Table Of Contents

What is the Total Return Index?

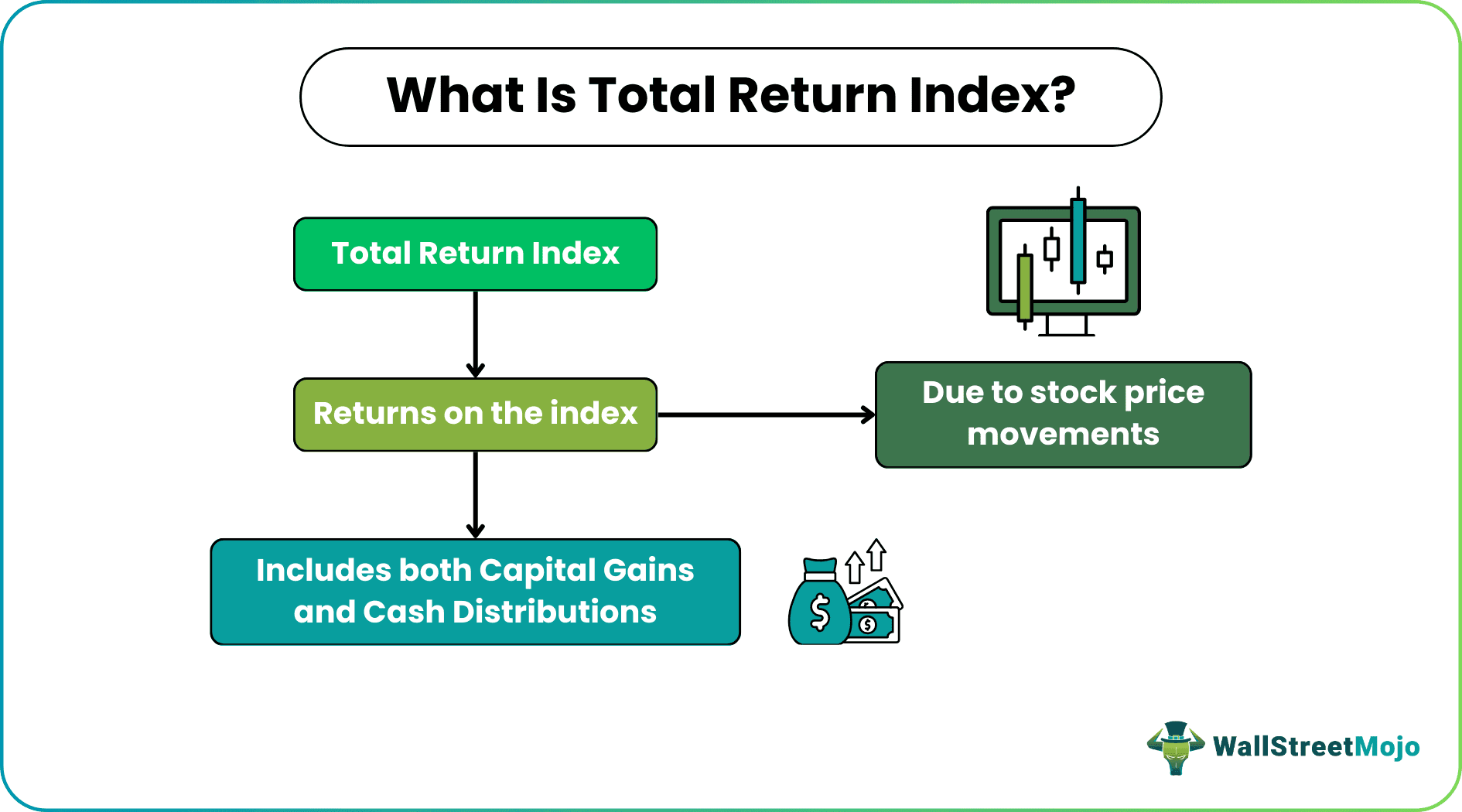

Total Return Index or TRI is a useful equity index benchmark to capture the returns from the movement of prices of the constituent stocks and the payout of its dividends. It is a very useful measure because it states what the investor is taking back or getting in return from the investment made. It also assumes dividends are reinvested.

The performance of the Total Return Index indicates how fruitful an investment into the company assets would prove to be for shareholders. This, in turn, helps them decide whether to invest in the equity shares of a particular firm or look for another option.

Table of contents

- What is the Total Return Index?

- The Total Return Index (TRI) measures equity index returns by factoring in changes in stock prices and dividend payouts. It gives investors a clear idea of their return on investment, assuming that any dividends received are reinvested.

- Calculating TRI involves computing the dividend per index point. Second, balancing the price return index; third, adjusting to a former day's TRI index level.

- Investors can now use TRI to benchmark mutual funds, which consider capital loss/gain and dividends received. PRI is the traditional approach that only looks at price changes.

Total Return Index Explained

The total return index is a useful benchmark for finding out the actual return generated for constituents of a stock or a mutual fund. It is the constituent of the return of an index, the paid dividends, and the dividends that are reinvested back into the index. It is a handy measure because it states what the investor is taking back or getting in return from the investment made.

The index assuming the dividends to be reinvested helps firms understand the amount of dividend they would not have to pay to the shareholders. Instead, the amount to be reinvested is considered as the retained earnings, which becomes the income that is generated by a company and used by it for further growth over a period.

In all major developed markets, all mutual funds these days are marked against the total return index, which was previously benchmarked against the price return index. Even in cases of equity funds, when it comes to the growth option of the fund, it’s mandatory to consider the dividend it generated but did not distribute from its underlying companies. Thus TRI comes into a bigger picture when the actual return from the equity fund is to be computed.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Formula

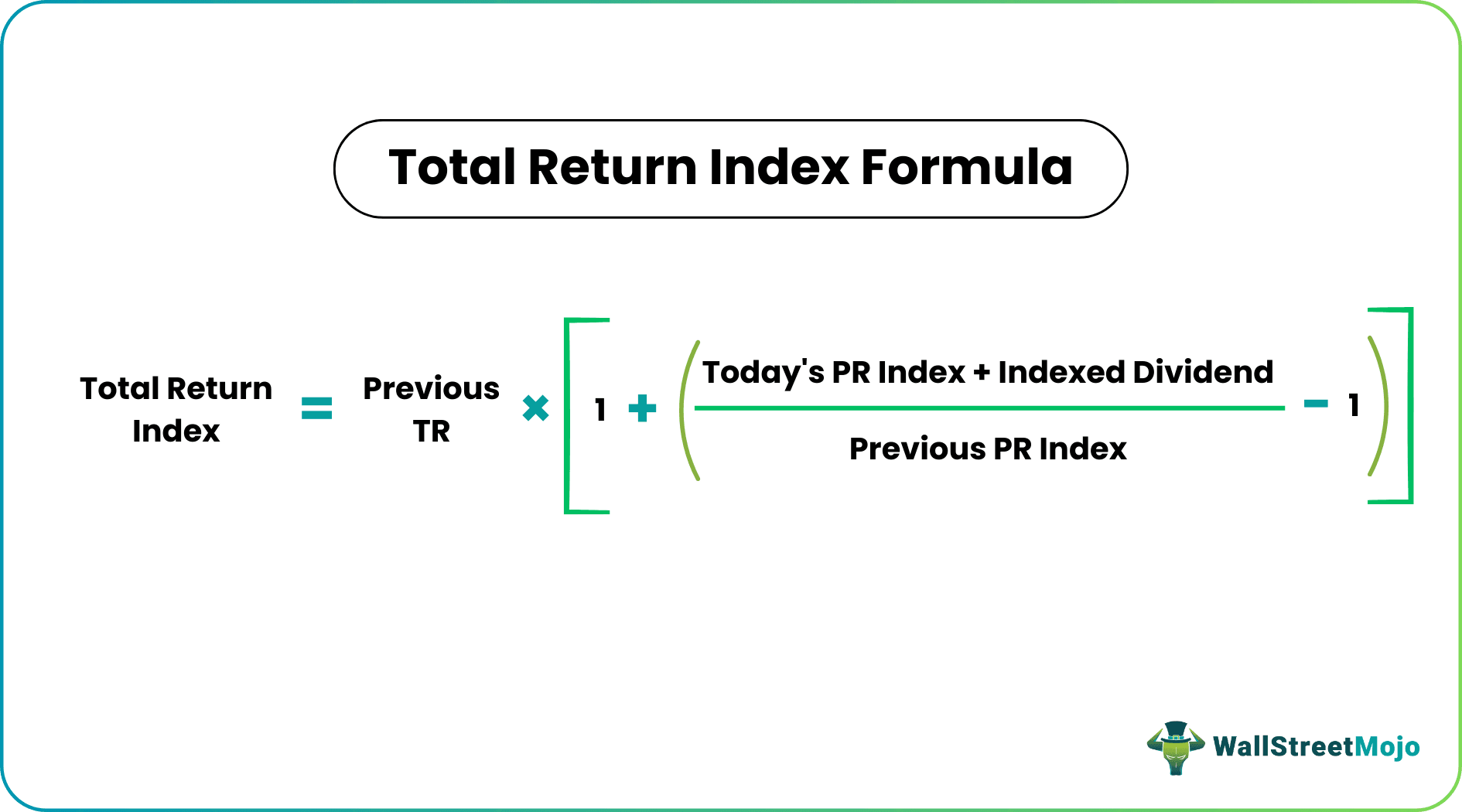

The Total Return Index formula is represented as below –

Total Return Index = Previous TR *

How To Calculate?

A total return index calculation can be from values of dollars, euros, or other currencies. The steps for calculation are as follows:

- To calculate the TRI first, we need to account for the dividend paid. The first step is to divide the dividends paid over time with the same divisor, which is used to calculate the points related to the index, or this is also called the base cap of the index. It gives us the value of the dividend paid out per point of the index, which is represented by the equation below:

Indexed dividend (Dt) = Dividend Paid out / Base Cap Index

- The second step is combining the dividend and price change index to adjust the price return index for the day. The below formula can be used to do so:

(Today’s PR Index +Indexed Dividend)/Previous PR Index

- Lastly, the total return index is calculated by applying the adjustments to the price return index to the total return index, which accounts for the full history of payment of dividends. This value is multiplied by the earlier day's TRI index. It can be represented as below:

Total Return Index = Previous TRI *

So, TRI calculation involves a three-step process: determining the dividend per index point, adjusting the price return index, and applying the adjustment to an earlier day's TRI index level.

Example

Let us consider an example to understand the total return index meaning and its calculation in a better way:

London Stock Exchange as a single unit stock, and we invest in it. This stock was purchased in the year 2000, and in 2001 a dividend of 0.02 GBP was issued for the stock. The stock price after the dividend was issued took it to 5 GBP. We can now imagine that whatever dividend was issued was utilized to purchase more of the stocks of LSE at the same price band of 5 GBP. Therefore we can now purchase 0.02/5 = 0.004 shares of LSE, which takes 1.004 shares. Thus TRI at this level can be calculated as 5*1.004= 5.02

In the second-year 2002, the stock issued a fresh dividend again where the share prices are supposed to be constant at 0.002 GBP. At present, we are the owners of 1.004 shares. The total dividend thus calculated is 1.004*0.02 = 0.002008 GBP. It is reinvested in the same stock whose current price is 5.2 GBP. Now the number of shares held will become 1.008. The TRI now will thus turn out to be 5.2 * 1.008 = 5.24

We need to do the same for every period. Therefore, at the end of the cumulative number of the period, we can easily plot a graph of the TRI level or calculate the required TRI for that period using the formula mentioned above, taking into account the previous period TRI and current TRI.

Impact

Total return index usage over the Price return index can broadly affect the long-term strategies of investors. It plays a crucial role in active investments in passive investments made. Taking an average count, it is seen that components of the index will earn around a 2 % dividend yearly. When we take the PRI approach, this return is not included in the comparison of mutual funds.

One good thing about TRI on mutual fund investors is that the money invested will no longer be locked behind inaccurate benchmarks. Thus, the return is minimized or understated by 2% annually in the PRI approach. With the TRI approach, investors will see that the index's performance has gone up by 2% by considering the TRI approach rather than taking into account the PRI approach.

Total Return Index vs Price Return Index

Total return index and price index are two terms that signify two different indices used for two distinct purposes. Given the significance that these indices hold in the market, it is important to understand the differences between them.

Let us have a look at a few differences between these indices mentioned below:

- The total return index includes both the movement of prices or the capital gain/loss and the dividend received from the security. In contrast, the price return index only considers the movement of a price or the capital gain/loss and not the dividend received.

- TRI gives a more realistic picture of the return from the stock as it includes all the constituents associated with it like price change, interest, and dividend. In contrast, PRI only details the movement of prices, which is not the real return from the stock.

- TRI is more of the latest approach as to how investors benchmark their mutual funds because it helps them to assess the fund in a better manner since the NAV of a mutual fund portrays not only the capital loss/gain in the portfolio but also the dividend received from the holdings in the portfolio. In contrast, PRI is more of the traditional approach where mutual funds benchmark against price changes only about the number of securities driving a mutual fund.

- TRI is more transparent, and the credibility of the stocks or funds has increased a lot. In contrast, PRI is more of a misleading scenario because it overstates the performance of a mutual fund, which attracts a lot of investors to invest in the specific fund without understanding the real scenario.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

One example of a total return index is the S&P 500 Total Return Index (SPTR). These indexes operate similarly to mutual funds, where cash payouts are automatically reinvested into the fund.

Investors look at various indexes to determine the returns on mutual funds when deciding whether to invest. One helpful benchmark is the Total Return Index (TRI), which captures the returns from both the movement of stock prices and their payouts of dividends.

A price return index only tracks the price changes (gains or losses) of the securities in the index. In contrast, a total return index considers other distributions like dividends, interest, and rights offerings that occurred during a specific period.