Table Of Contents

What is the Total Return Formula?

The term “Total Return” refers to the sum of the difference between the opening and closing value of all the assets over a particular period of time and the returns thereon. To put it simply, the changes in opening and closing values of assets plus the number of returns earned thereof is the Total Return of the entity over a period of time.

The total return calculation is generally done to check the percentage total return formula we earn on the investments made during the particular period. Every single penny has its own opportunity cost, which means that if the money was not invested in one opportunity, then it will earn some other income such as interest income if deposited if every investor wants to maximize the return on their investments by optimally using the available funds.

The Total Return can be calculated using two methods –

- By taking the difference of closing value and opening value plus returns therefrom.

- By adding the returns to their respective investments and then taking the difference between the opening and closing values.

In this article, we will focus on the Total Return Formula, which is expressed as the difference between the opening and closing date values plus the number of incomes earned therefrom.

Key Takeaways

- The Total Return Formula is a calculation used to measure an investment's overall performance, considering both capital appreciation (or depreciation) and income generated by the asset.

- The formula for calculating total return is Total Return = (Ending Value - Beginning Value + Dividends or Interest) / Beginning Value * 100.

- Total return provides a comprehensive view of an investment's performance because it considers all sources of returns, including price changes and income generated through dividends, interest, or other distributions.

- Total return is expressed as a percentage, allowing for easy comparison across different investments or asset classes.

Explanation of the Total Return Formula

The total return equation can be derived by using the following steps:

- Firstly, determine the opening or invested value of total assets, which is the sum of all the investments purchased or the value of the investment at the start of the selected interval.

- Then, determine the closing or present value of total assets, which is the sum of all the investments purchased or the value of the investment at the end of the selected interval.

- Then, take the sum of earnings from such investments or assets during the selected interval.

- Finally, the amount of Total Return is expressed as the difference between the total of the opening and closing value of assets plus earnings made therefrom during the selected interval.

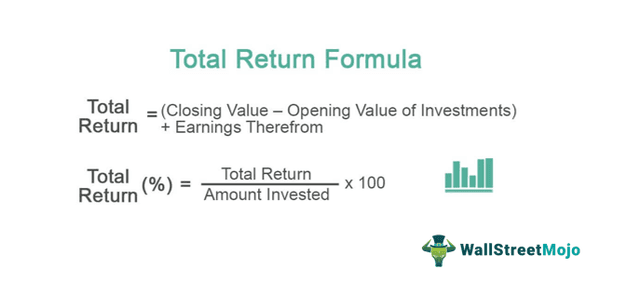

Total Return = (Closing Value – Opening Value) of Investments + Earnings therefrom

- Finally, to calculate the percentage total return formula, we have to divide it with the amount invested or opening value thereafter multiplied with 100.

% of Total Return = Total Return/ Amount Invested * 100

Examples of Total Return Formula

Let’s see some simple to advanced practical examples of the total return equation to understand it better.

Total Return Formula - Example #1

Suppose Mr. A has invested a sum of $100,000 in the 9% debentures of XYZ Inc. on 01.04.2019, and the value of invested money on the closing date is $150,000. The period of investment is 90 days. During the said period, the company has paid the due interest on their debentures.

Given,

- Amount invested on date 01.04.2019 = $100,000

- Value of Investment on closing date = $150,000

- Period of Investment = 90 days

Calculation of Amount Interest Earned

Amount of Interest Earned = Principal Amount * Number of days/365 * Rate of Interest/100

- =($100,000*90)/365*(9/100)

- Amount of Interest Earned =$2219

Now, Total Return can be calculated by using the above Formula as,

- = ($150,000-$100,000)+$2219

The total return will be -

- Total Return = $52219

Calculation of percentage (%) Total Return

- =$52219/$100000*100%

Percentage (%) Total Return will be -

- = $52219/100000 * 100

- = 52.22%

Total Return Formula - Example #2

Suppose Mr. A has invested a sum of $100,000 in the 9% debentures of XYZ Inc. on 01.04.2019, purchased 1000 shares of PQR Ltd @ 500/- per share, and has made a fixed deposit of $250,000 earning interest @ 10% p.a. for a period of 6 months. The value of invested money on maturity date is:

- The value per share of PQR Ltd is $ 700

- Value of 9% Debentures is $ 90,000.

Now for calculation of Total Return and % of Total Return, the following steps are to be taken:

Given,

- Amount invested on date 01.04.2019 = $100,000 + $(1000*500) + $250,000

= $850,000

- Value of Investment after 6 months = $90,000 + $(1000*700) + $250,000

= $1,040,000

Amount of Interest Earned on Fixed Deposits and Debentures

Calculation of the Amount of Interest Earned on Debentures

Amount of Interest Earned on Debentures in 6 Months = Principal Amount * Number of months/12 * Rate of Interest/100

- =100,000 * 6/12 * 9/100

- =4500

Calculation of the Amount of Interest Earned on Fixed Deposits

Amount of Interest Earned on Fixed Deposits in 6 Months = Principal Amount * Number of months/12 * Rate of Interest/100

- =250,000 * 6/12 * 10/100

- =12,500

Now, Total Return can be calculated by using the above Formula as,

=(1040000.00-850000.00)+17000.00

The total return will be -

- Total Return = 207000.00

Calculation of percentage (%) Total Return

- =207000.00/850000.00*100%

Percentage (%) Total Return will be -

- = 24.35%

Relevance and Uses

By timely calculating the total return equation on investments, we could plan the time of redemption of money invested. Sometimes we have liquid funds to be invested for a short span of time then for calculating the total return of the entity in which we are planning to invest the money, the concept of Total Return comes into the picture.

For example, ABC Ltd is a company whose share at present is trading at $50 per share, and three months ago, the shares were trading at $45 per share then; by applying the above concept, we got a value of 44.44% as the total return. It helps us in making the right decision by considering the history of the entity.