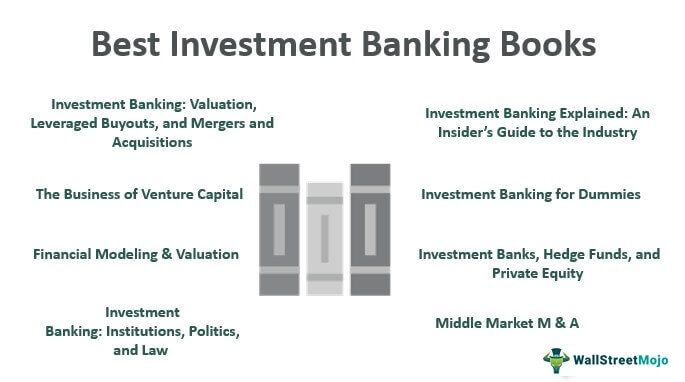

12 Best Investment Banking Books [2025]

Investment banking is a highly specialized field where financial entities known as investment banks assist private and public corporations issue equity and debt securities along with helping facilitate corporate restructuring, Mergers & Acquisitions (M&A), and an entire range of highly complex transactions. Below is the list of 12 best books on investment banking to read in 2025 –

- Investment Banking: Valuation, Leveraged Buyouts, and Mergers and Acquisitions ( Get this book )

- Investment Banking for Dummies ( Get this book )

- The Business of Venture Capital ( Get this book )

- Financial Modeling & Valuation: A Practical Guide to Investment Banking and Private Equity ( Get this book )

- Investment Banking Explained: An Insider’s Guide to the Industry ( Get this book )

- Investment Banks, Hedge Funds, and Private Equity ( Get this book )

- Middle Market M & A: Handbook for Investment Banking and Business Consulting ( Get this book )

- The Best Book On Goldman Sachs Investment Banking Jobs ( Get this book )

- Investment Banking: Institutions, Politics, and Law ( Get this book )

- The Best Book on Investment Banking Careers ( Get this book )

- The Accidental Investment Banker: Inside the Decade That Transformed Wall Street ( Get this book )

- The Business of Investment Banking ( Get this book )

Let us discuss each investment banking book in detail, along with its key takeaways and reviews.

#1 - Investment Banking: Valuation, Leveraged Buyouts, and Mergers and Acquisitions

By Joshua Rosenbaum & Joshua Pearl

Review:

A complete investment banking book that makes technical concepts highly accessible to the reader. While recognizing the critical nature of the role played by valuation analysis in investment banking and corporate finance, this book lays down a solid foundation to gain a deeper understanding of the general concepts, processes, and methodologies in the field of investment banking. The authors have adopted a detailed step-by-step approach while delineating primary valuation methodologies, usually employed for analyzing the viability of a corporate sale, M&As, and buyouts.

Key Takeaways

This book represents the gold standard in terms of a textbook manual on intricate aspects of investment banking with a thorough technical outlook. A must for finance professionals and others interested in acquiring an in-depth technical knowledge of investment banking and valuation analysis.

For further details on this investment banking textbook,

#2 - Investment Banking for Dummies

By Matthew Krantz & Robert Johnson

Review:

Excellent introductory book in investment banking that adopts an easy-to-understand approach while describing fundamental banking concepts and their application in the real world. Beginning with what investment banking stands for and its role in M&As, buyouts, and other critical corporate decisions, the authors go ahead to describe the role of investment bankers and how they make things happen. The entire focus is on helping develop an understanding of key banking concepts and practical aspects, including valuation of companies, issuance of bonds and stocks, and constructing a financial model that makes this work of immense practical value.

Best Takeaway

Hands-down one of the best beginner guides for investment banking that covers almost everything from its definition to core concepts and practices, making it an invaluable addition to the collection of every professional or layman interested in acquiring a broad-based understanding of the subject.

The topics discussed in this book may lead you to explore different avenues, like LBO modeling in the investment banking domain. If you want to develop a practical understanding of how to build an LBO model, this LBO Modeling Course can be extremely helpful.

#3 - The Business of Venture Capital

Insights from Leading Practitioners on the Art of Raising a Fund, Deal Structuring, Value Creation, and Exit Strategies –

By Mahendra Ramsinghani

Review:

Complete nuts and bolts guide on venture capital business. This book is written for anyone interested in learning the meticulous art of raising venture funds, structuring investments, value creation, and assessing exit pathways. Complete with enriching insights from leading experts in the field, this book is truly meant for the practitioner, detailing everything right from sourcing investment opportunities and conducting due diligence to negotiating investments. It makes for a perfect companion to anyone looking for a complete knowledge resource on venture capital business along with detailed opinions of industry leaders on the subject.

The best takeaway from this Best Investment Banking Book

One of the most complete and authentic guides on the subject, offering a comprehensive overview of the art and science of venture capital business. Especially useful for venture capital professionals.

#4 - Financial Modeling & Valuation: A Practical Guide to Investment Banking and Private Equity

By Paul Pignataro

Review:

A fairly thorough guide on doing accurate stock valuations with the help of financial modeling. To fulfill its objective, the author has taken pains to support the methodology with a full-length, practical illustration on the valuation of Wal-Mart by using financial modeling. Even a novice would have little trouble following the detailed instructions and creating a financial model for the valuation of a stock in a fairly balanced manner. It also discusses the concept of value in the context of a company and elaborates on the standard valuation techniques employed by professionals. Readers can also benefit from chapter-end questions, additional case studies, and other material available on the companion website.

Key Takeaways

A condensed manual on financial modeling lays down a set of clear instructions for students interested in learning financial modeling and stock valuation in all its practical aspects.

#5 - Investment Banking Explained: An Insider's Guide to the Industry

By Michael Fleuriet

Review:

The author offers a bird's eye view of the investment banking industry in this book and delves at length on how things work from an insider's perspective. Focusing on the roles of traders, brokers, relationship managers, hedge fund managers, and other industry intermediaries, the author provides a unique insight on the subject, which stands out for its practical value and relevance. Beginning with the very basics, including key industry terms, structures and strategies, the author gradually helps the reader become acquainted with more broad-based aspects, including operations of leading firms, changing perspectives on risk and ways of managing it along with the creation of international strategies in an increasingly complex and interconnected financial world.

Key Takeaways

An inside guide to investment banking, professional strategies, operations, risk management, and how things are shaping up in today's fast-changing global industry. An added plus is the focus on unique roles played by industry intermediaries and how things work out for them.

#6 - Investment Banks, Hedge Funds, and Private Equity

by David Stowell (Author)

Review:

This book offers an eye-opening revelation into the intricate web of relationships between investment banks, hedge funds, and private equity. The author discusses how in the wake of the 2007-09 global meltdown, these financial institutions are devising novel business strategies to survive and grow while focusing on their roles and the continual tussle to attract investor funds and expand their corporate power. The author talks at length about the need for capital and ways of sourcing capital, along with details of recent transactions in a structured manner. The impact of these institutions on the polity, corporations, and the financial world is another important focus of the work. Readers are provided with spreadsheets and each case to create their analytical frameworks to help develop their understanding further.

Key Takeaways

Focused on the workings of investment banks, hedge funds, and private equity in the aftermath of the 2007-09 global meltdown and a change of perspective on their part towards risk management and other key elements. A highly practical approach and inclusion of case studies and resources are relevant for students and professionals alike.

#7 - Middle Market M & A: Handbook for Investment Banking and Business Consulting

by Kenneth H. Marks (Author), Robert T. Slee (Author), Christian W. Blees (Author), Michael R. Nall (Author)

Review:

An essential reading companion for investment bankers, M&A advisors, wealth managers, and professionals working in the private capital market. Based on the body of knowledge of the Certified M&A Advisor (CM&AA) Program, this book offers information on every conceivable aspect of M&A deals, divestitures, and strategic transactions. The authors deal concisely with core subject areas related to private capital market deals and offer a complete solution for M&A business. This work also serves as an excellent guide to obtaining a FINRA Series 79 license.

Key Takeaways

A complete knowledge resource on the private capital market focuses on the complete life cycle of M&A transactions and their several complex aspects. Highly relevant for those looking to earn FINRA series 79 licenses.

#8 - The Best Book On Goldman Sachs Investment Banking Jobs

by Lisa Sun (Author)

Review:

Find out what it takes to build a high-flying career in investment banking with an internship at Goldman Sachs, one of the best financial industries globally. This work is complete with practical tips, strategies, and expert advice on everything from the application process for an internship, creating the perfect resume and cover letter, and finally preparing for the interview with test questions and more. A perfect guide for those looking to turn a valued internship with Goldman Sachs into a full-fledged career in investment banking.

Key Takeaways

A power-packed manual with practical tips and step-by-step instructions on every aspect of preparing for an investment banking internship and career. Learn how to nail the interview for a banking internship at Goldman Sachs. This quick read can help students understand the challenges and be better prepared to succeed.

#9 - Investment Banking: Institutions, Politics, and Law

by Alan D. Morrison (Author), William J. Wilhelm Jr. (Author)

Review:

This book attempts to provide a unique historical and legal perspective on the development of investment banking as we know it today while propounding a novel theory to explain the historical changes in this industry and its co-relationship with the state. Tracing the history of investment banking for the last three centuries, the authors brilliantly expound on the evolution of modern banking and the economic rationale. Authors also discuss with great clarity the massive restructuring of the investment banking industry in the last few decades and what it means for the future.

Key Takeaways

A must-read for anyone interested in acquiring an in-depth understanding of the history and evolution of investment banking. It offers invaluable information on the influences that have shaped the industry for past centuries and how recent industry changes will impact the course of future history.

#10 - The Best Book on Investment Banking Careers

by Donna Khalife (Author)

Review:

A veritable source of information on how to land an investment banking job and gear up for a high-flying career in this intensely competitive field. The author explains the basics of investment banking and various job roles in an easy-to-understand manner apart from what any prospective employer looks for in a candidate. Readers will learn how to write an effective resume and cover letter, find useful recruitment advice and tips to prepare for a high-profile investment banking job interview. In short, an excellent guide to a successful IB job hunt.

Key Takeaways

As the title aptly describes, this book indeed provides every bit of relevant info on how to get started with an investment banking career. Authors provide just the right kind of conceptual background for career-oriented information, making this work all the more useful for aspiring investment bankers.

#11 - The Accidental Investment Banker: Inside the Decade That Transformed Wall Street

by Jonathan A. Knee (Author)

Review:

This scintillating book is nothing less than an insider’s account of an investment banker living through the chills and thrills of the magnificent nineties. The author recounts how the dotcom bust at the turn of the century sent Wall Street into a tizzy and the power games and insider deals that went on behind the closed doors. An interesting read exposes how powerful human instincts of power, greed, and ambition influence the workings of Wall Street. A witty yet honest account that offers a revealing peek into the exciting world of high finance.

Key Takeaways

A humorous but gripping account of Wall Street from the eyes of an insider in an era when the internet bubble suddenly went bust. Anyone interested in discovering the human side of Wall Street would love this work for its witty yet honest narration.

#12 - The Business of Investment Banking

by K. Thomas Liaw (Author)

Review:

It is an all-encompassing work on investment banking as an industry that covers everything from underwriting M&As to the broader scope of investment banking in the renewed global context. This work is especially focused on the changed scenario for investment banks and institutions in the context of a highly interconnected global industry and how they must adapt to emerging markets' needs. The book is divided into four major sections dealing with the basics of investment banking, international capital markets, trading and risk management, and special topics that include the latest securities regulations, ethics, and major market trends.

The best takeaway from this Handbook on Investment banking

It offers a fairly detailed overview of investment banking operations and deals with how emerging markets are redefining investment banking in a global context. A must-read for investment banking students and those interested in learning how international capital markets are shaping up.

Recommended Articles

This article has guided the 12 Best Investment Banking Books to read in 2025. Here we discuss what these books propose, along with their review and best takeaways. You may also have a look at the following book's articles –

- Best Data Analytics Books

- Top 10 Financial Planning Books

- Best Data Science Books

- Best Personality Development Books

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com