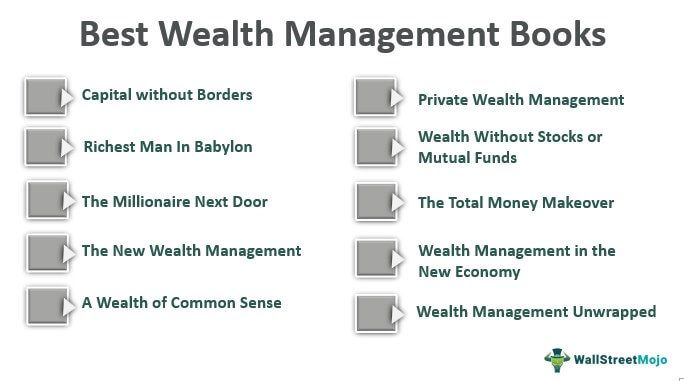

List of Top 10 Best Wealth Management Books [2025]

Wealth management is a carefully practised art and science, which not only helps understand the underlying concepts of wealth creation but also deals with efficient management of resources. Below is the list of top 10 books on wealth management -

- Capital without Borders: Wealth Managers and the One Percent ( Get this book )

- Richest Man In Babylon ( Get this book )

- The Millionaire Next Door: The Surprising Secrets of America's Wealthy ( Get this book )

- The New Wealth Management ( Get this book )

- A Wealth of Common Sense ( Get this book )

- Private Wealth Management ( Get this book )

- Wealth Without Stocks or Mutual Funds ( Get this book )

- Wealth Management Unwrapped ( Get this book )

- The Total Money Makeover( Get this book )

- Wealth Management in the New Economy ( Get this book )

Let us discuss each of the wealth management books in detail along with its key takeaways and reviews.

#1 - Capital without Borders: Wealth Managers and the One Percent

by Brooke Harrington (Author)

Book Summary

This top wealth management book details the strategies and tactics adopted by high-profile wealth managers to help the super-rich protect their wealth. It is nothing less than an attempt to unravel the secret world of wealth where the sole objective is to find out ways and means of shielding wealth worth billions of dollars from taxation laws and any other legal entanglements. Usually, this wealth, not always amassed by the best methods, is kept safe in foreign tax havens away from local laws or stashed away in offshore banks or shell corporations or trusts are created for the purpose. The author spent nearly eight years researching this subject, and the level of her research shows in this work while detailing how meticulously these professionals execute their job to ensure that their high-net-worth clients remain untroubled by any sort of legal obligations. This work is also a reminder of the fact that there exists this one percent of humanity, which commands most of the wealth in the world, which inevitably leads to global inequality.

Key Takeaways from this Best Wealth Management Book

A specialized wealth management book offers insight into the shadowy world of vast capital flows into tax havens

Also, look at the CWM Exam Guide

#2 - Richest Man In Babylon

by George S Clason (Author)

Book Summary

This top wealth management book is virtually a collection of fairy tales on finance but ones that carry weight in the real world by helping acquire a fundamental understanding of how and why one must save, invest and grow wealth. Written way back in the 1920s, this work remains just as relevant today, relating age-old truths of universal significance for financial management and wealth creation for almost anyone. Interestingly, this work has inspired many other similar ones and what makes it unique is the simplicity of language and the context provided, in which some simple folk in the ancient city of Babylon struggles to find his footing in the world. You can also hope to secure your financial future by applying the simple truths presented through Babylonian parables in this work.

Key Takeaways from this Best Wealth Management Book

A collection of age-old tales set in ancient Babylon that teach modern-day investors and consumers to value money, learn to save, invest, and be a master of their own destiny. It matters little whether the tales are true or not; the messages conveyed are crystal clear, and if you are fascinated by storybooks, this one might well become your favorite. Composed in the 1920s, this work retains its relevance, value, and message to date and can help modern investors become aware of their power and realize the simple mistakes they might be committing while making financial choices.

#3 - The Millionaire Next Door: The Surprising Secrets of America's Wealthy

by Stanley Thomas (Author)

Book Summary

This best wealth management book is all about how to build wealth in America, focusing on stories of ordinary people who went on to enter the elite Millionaire club with nothing much except for their hard work and perseverance to show. Everyone might acknowledge that hard work is a must for success, but in the current context, it acquires quite a different meaning, as the author shows with painstaking research how in most of the cases, it is not inheritance, education, or even intelligence which matters most, rather a persevering approach does. Layer by layer, he successfully peels away the myth of some magic formula as case after case brings out the very same facts that it is the saving habits, the ability to consistently make efforts and at times even living below one's means which might hold the key to being a millionaire more than anything else. An excellent read for anyone who is willing to face the facts and adopt an approach to building wealth, which has worked consistently for people.

Key Takeaways from this Top Wealth Management Book

A New York Times best-seller on how a bunch of average individuals went on to become millionaires solely based on their hard work, dedication, and perseverance. He busts several myths along the way to demonstrate how even inheritance of intelligence may not be the most important factor in wealth creation. Instead, this work brings the focus to consistent saving habits and how they might help build wealth in the most unexpected of ways. A unique work on growing rich, which reaffirms the importance of keeping your feet on the ground all along the way.

#4 - The New Wealth Management:

The Financial Advisor's Guide to Managing and Investing Client Assets

by Harold Evensky (Author), Stephen M. Horan (Author), Thomas R. Robinson (Author), Roger Ibbotson (Foreword)

Book Summary

A definitive guide on modern wealth management techniques and what it takes to maximize the growth of clients' assets while managing the element of risk efficiently. What sets apart this work is that it addresses the issue of managing multiple-client assets, which are dealt with at length in most other works on portfolio and asset management. The author specifically deals with the problem of optimal asset allocation, which holds a central place in the current approach to wealth management. Part of the CFA Investment Series, this acclaimed work retains much of its original text from the 1997 edition along with a good amount of updated information on wealth management tools and techniques which have greater relevance today. On the whole, excellent work on the novel approach to wealth management and how to achieve optimal asset allocation for multiple clients.

Key Takeaways from this Top Wealth Management Book

An invaluable work on managing private wealth, especially dealing with multiple-client assets, working to protect and grow the wealth efficiently. Part of the CFA Investment Series, this work stands apart for its treatment of the subject and for providing insights on optimal asset allocation, which goes beyond the average approach. A complete guide on how to deal with the many challenges of private wealth management in the new economic era.

#5 - A Wealth of Common Sense:

Why Simplicity Trumps Complexity in Any Investment Plan (Bloomberg)

by Ben Carlson (Author)

Book Summary

An excellent book on wealth management for smart investing brings out the power of simplicity by helping create an investment strategy that works without becoming dependent on complex tools and techniques. The author starts with the premise that the stock market might be complex, and the dynamics of market volatility might give the impression that a simple approach might never work well enough, but in fact, the exact opposite is true. He proposes that most of the complex strategies adopted for investing in the stock market and wealth management are based on noise and short-term factors which have but little say in the long term view. Instead, he suggests that it's much better to have a long term view and plan and focus on select factors that truly matter to be able to make better and more informed decisions. If you also wish to learn and experiment with a well-defined and simple framework of investment and wealth management, this work could make a valuable addition to your collection.

Key Takeaways from this Best Book on Wealth Management

A novel look at what really makes an investment plan successful. The author argues that it is the simplicity of the plan, which matters most, contrary to popular perception. He builds his argument beautifully by pointing out how most of the complex factors often paraded as crucial any investment plan is market noise or things which matter at their most in the short-term. Interesting and highly useful work for investors to learn and grow their skills and capabilities to realize their true potential in the markets.

#6 - Private Wealth Management:

The Complete Reference for the Personal Financial Planner

By G. Victor Hallman, Jerry Rosenbloom

Book Summary

A complete wealth management book for a modern private wealth manager, which details all the aspects of financial planning and provides a solid theoretical and practical foundation for professionals to work upon. This work addresses most of the critical issues, including setting up financial objectives and the creation of a custom investment and wealth management strategy suitable for a particular client in terms of investing in equities and fixed-income securities along with income and retirement planning. The current updated ninth edition of the work offers the latest information on the tax legislation, a number of economic benefits, and investment products along with several legislative changes in recent times. A complete treatise on private wealth management lays down the groundwork for professionals and offers information on the latest legislative reforms as well.

Key Takeaways from this Top book on Wealth Management

This best wealth management book for the private wealth manager discusses how to develop and implement personalized investment and wealth management strategies for any client. A prized possession for any practitioner to learn the nuances of managing private wealth efficiently.

#7 - Wealth Without Stocks or Mutual Funds

by John Jamieson (Author), Randy Glasbergen (Artist)

Book Summary

This top wealth management book deals with alternative methods of wealth creation that do not rely on conventional options, including stocks or mutual funds. The authors delve at length on how to explore the potential of real estate as a means of income generation, which can rival the returns of any other traditional forms of investment. Usually, real estate is seen as more of a passive investment, which can yield only a relatively low income in the short term, but in this work, the author brings out little known techniques for utilizing turnkey real estate investment solutions. They also discuss alternative ways of building wealth, repayment of debts, and tips to keep in mind while banking.

Key Takeaways from this Best Wealth Management Book

This best book on wealth management represents a bold and original attempt to present real estate as an alternative to stocks and mutual funds as a viable source of income. Usually, people consider real estate as a fixed asset with but little prospect of any good returns in the short-term. However, the authors have put in considerable effort in this work to demonstrate how little-known solutions can be used for wealth generation from real estate. Apart from this, the work also offers a number of useful tips on banking, repayment of debts, and other aspects of financial planning.

#8 - Wealth Management Unwrapped

by Charlotte B. Beyer (Author)

Book Summary

This is a unique wealth management book in the sense that it intends to empower the reader by helping him or her make wise financial decisions. The author provides an ample amount of information for readers to be able to choose their own financial advisors and realize that ultimately they are themselves responsible for their finances. Investors can learn what questions to ask financial advisors before utilizing their services, and more importantly, discover what kind of investors they are. This would help them make a better choice of financial services they might need or adopt suitable investment strategies as a do-it-yourself investor.

Key Takeaways from this Top Wealth Management Book

An excellent do-it-yourself guide for investors to acquire a greater understanding of managing finances and how they should go about choosing a competent financial advisor. This work would help readers become better investors and understand their responsibility as investors. A must-read for anyone willing to learn a few tips and tricks on investing with care.

#9 - The Total Money Makeover:

Classic Edition: A Proven Plan for Financial Fitness

by Dave Ramsey (Author)

Book Summary

A practical guide on money management that offers a novel outlook on how to lead a debt-free, financially independent existence. The author provides useful information on how to create an emergency fund, fight off all kinds of liabilities with a streamlined approach to money management. He also busts a number of money myths that keep people from realizing their financial potential. Adopting more of a straightforward approach, he addresses several financial issues, including liabilities, explains how to keep track of their financial progress, and finally regains control of their financial lives.

Key Takeaways from this Wealth Management Book

A one-stop solution for managing any and all kinds of liabilities and leading a stress-free financial existence. The author offers a number of useful money management tips and dispels several money myths to help readers gain a more realistic understanding of the subject. A recommended read for every investor.

Also, have a look at - Finance for Non-Finance Training

#10 - Wealth Management in the New Economy:

Investor Strategies for Growing, Protecting and Transferring Wealth

by Norbert M. Mindel (Author), Sarah E. Sleight (Author)

Book Summary

This top book on wealth management offers a complete overview of wealth management tools and techniques for professional wealth managers as well as avid investors. The author explains a number of key concepts related to wealth creation, risk management, and asset protection, along with their application for the benefit of the readers. He goes on to discuss finer aspects of portfolio management and how it can be used to manage the element of market risk rather elegantly. Excellent work for wealth managers and investors willing to defeat market volatility to protect and grow wealth in the modern economy.

Key Takeaways from this Wealth Management Book

A guide to smart investing can help deal with market volatility and offers useful information on wealth creation, risk management, asset protection, and portfolio management for professionals as well as investors. A highly recommended read for anyone planning to protect and grow wealth in the modern money markets without any fear.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com