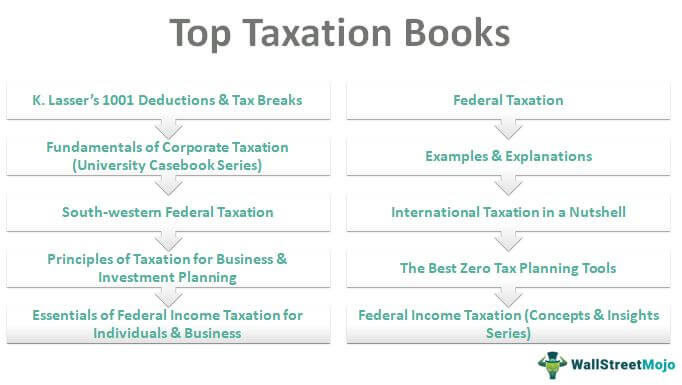

List of Top 15 Tax Books [Updated 2025]

No matter who you are, a financial consultant, a human resource professional, an entrepreneur, or a fresher, you need to know taxation. Taxation books will help you learn tax in-depth. Only some of the books are always relevant irrespective of the years of publication. Below is the list of such top tax books:

- Tax-Free Wealth ( Get this book )

- How to Pay Zero Taxes ( Get this book )

- J.K. Lasser’s Small Business Taxes 2021 ( Get this book )

- Taxes Made Simple ( Get this book )

- 475 Tax Deductions for Businesses and Self-Employed Individuals ( Get this book )

- K. Lasser’s 1001 Deductions and Tax Breaks: Your Complete Guide to Everything Deductible ( Get this book )

- Fundamentals of Corporate Taxation (University Casebook Series) ( Get this book )

- Essentials of Federal Income Taxation for Individuals and Business ( Get this book )

- South-western Federal Taxation: Individual Income Taxes ( Get this book )

- Principles of Taxation for Business and Investment Planning ( Get this book )

- Examples & Explanations: Corporate Taxation ( Get this book )

- International Taxation in a Nutshell ( Get this book )

- Federal Taxation: Basic Principles ( Get this book )

- Federal Income Taxation (Concepts and Insights Series) ( Get this book )

- The Best Zero Tax Planning Tools ( Get this book )

Let us discuss each taxation book in detail, along with its key takeaways and reviews.

#1 – Tax-Free Wealth

by Tom Wheelwright

About the book

This book will tell you how the tax laws in your country work and how you can use them for your benefit. In addition, it explains various tax planning concepts that one can use to reduce tax liability.

Book review

This book offers you an outside-the-box tax book. The author is very passionate about tax laws and has a penchant for using them to your advantage. Consequently, he provides a high-level overview of the various tax considerations and techniques you can employ to seize the available tax benefits, such as special tax treatment for real estate spending. He also touches upon and explains various technical concepts with good examples, such as depreciation, estate planning, etc. The only shortcoming of the book is that it has a lot of details that would apply to you only if you own a corporation. Nevertheless, there is no doubt that this book will boost your tax planning strategies and help you accumulate more wealth.

Key takeaways

- It is a fascinating book with exciting tips and ideas that will otherwise take many years to gather.

- It can help you build wealth by finding ways to cut down your taxes.

#2 – How to Pay Zero Taxes

by Jeff A. Schnepper

About the book

This book predates the Internal Revenue Service (IRS) sanctioned deductions, credits, shelters, and exemptions that taxpayers can use for tax savings.

Book review

The author starts the book with a powerful statement that every year, you may be paying far more than you should due to a lack of knowledge of available tax deductions. He states that you shouldn’t pay the IRS even a penny more than what the law mandates. As such, the books offer comprehensive coverage of deductions that no other tax book does. It includes deductions related to child care & elder care, job-hunting expenses, moving expenses, investment expenses, mortgages and points, and 401(k)s. Besides the current status of the tax rules, it also provides a historical account of the tax deductions and credits. Overall, it provides in-depth knowledge about the tax code in a way that is easy to read and apply.

Key takeaways

- It is exciting, informative, and a must-read if you file taxes.

- It covers all the tax breaks available in the current tax code.

#3 – J.K. Lasser’s Small Business Taxes 2021

by Barbara Weltman

About the book

This book will help you legally limit your tax liabilities by making the most of the tax deductions and credits. It covers all available tax relief and explains how you can claim them.

Book review

In this book, the author uses a straightforward and easy-to-read writing style. The book covers the newest tax laws, IRS rulings, available write-offs, related court decisions, etc., in great detail that can help you build tax planning strategies to support running a tax-smart business. In other words, it focuses on the strategies that can help you leverage the currently available tax deductions and credits to shield business income while maximizing the other aspects of small business taxes. It is a practical guide that shows you how your actions today will impact your business’s bottom line tomorrow from a tax perspective.

Key takeaways

- It can help you optimize your tax savings and minimize your audit exposure.

- It will help you with the tax filing process for 2020 and assist you in tax planning for 2021.

- It offers you the most relevant information as it is updated every year.

#4 – Taxes Made Simple

by Mike Piper

About the book

This book explains the most complex and essential tax matters in the simplest of ways. While it covers the basics of deductions, credits and retirement contributions, it avoids getting too detailed and academic.

Book review

The book’s most striking feature is its size – short, and no playing around. The author does an excellent job of breaking down complex concepts into simple, reader-friendly units. However, he avoids getting too much into the details of the deductions and credits. In addition, it gives a to-the-point answer to most of the questions. This book is a must for people who want to learn about filing taxes. However, it is to be noted that it won’t turn you into a specialist as it doesn’t provide advanced knowledge about any of the topics. In short, if you are a newbie, it can be a great introduction to the world of taxes.

Key takeaways

- It should be the first read for people who need more clarification with taxes.

- The simple vernacular makes it easy to understand for the readers.

- It can help you understand the language of your tax advisor, but it can’t become a substitute for professional help.

#5 – 475 Tax Deductions for Businesses and Self-Employed Individuals

by Bernard B. Kamoroff

About the book

This book discusses a broad spectrum of business tax topics including the various expense categories.

Book review

The book guides you through the tax filing process with regard to tax deductions and credits. The author states that it is your duty as a taxpayer to do your essential homework on the available tax deductions to present a list of applicable deductions to the CPA for further processing. The fundamental idea is that if you don’t claim the deductions, you just don’t get it. Therefore, this book can be a good starting point for you if you need to know what a tax deduction or credit is. The explanation is straightforward, to the point, and easy to understand. The layout is also relatively simple and easy to navigate.

Key takeaways

- It is best suited for beginners, while advanced students might get little out of it.

- If not entirely, you should take primary responsibility for your tax filing.

#6 – K. Lasser’s 1001 Deductions and Tax Breaks: Your Complete Guide to Everything Deductible

by Barbara Weltman

Giving away all your money in taxes is a foolish thing to do. So why not read this best taxation book instead?

Book Review

As the title suggests, you would get everything you need about taxes in this book. From you and your family, your home, your car, your job or business, even casualty and theft losses or insurance, you would know everything and how to save money and the deductions available under these heads. The book is very well organized so that you will find a particular deduction for your situation. And it’s just 480 pages long.

Key Takeaways

- This book should be used by everybody who would like to save on taxes in 2016-17.

- It will help you understand the why of taxation and where you can save taxes.

- The information available in this book would be immediately applicable. So you don’t need to go to any tax consultant to find out where you would get deductions in taxes.

#7 – Fundamentals of Corporate Taxation (University Casebook Series)

by Stephen Schwartz & Daniel Lathrope

It is used as a textbook in university classes. You can avail of all its benefits just by purchasing it.

Book Review

Please don’t go by its words. The words of this edition are more lucid than you would like them to be. But it’s not about the words that make the book count. It’s the information provided in it. Many people who read this book have mentioned that it has worked as an advisor in all their taxation issues. Moreover, this book has given you cases from which the examples are shown. Cases help students understand a scenario better than anything else.

Key Takeaways

- This publication is 756 pages long and includes everything you need about corporate taxation.

- This book will help you understand the cases along with the fundamentals.

#8 – Essentials of Federal Income Taxation for Individuals and Business

by Linda M. Johnson

If you are bothered by the harsh language of taxation, pick this book up. It’s lucid, easy to read, and will guide you to take control of your taxes.

Book Review

People who have gone through this book have mentioned that if you read this book from cover to cover, you would be able to file your tax return and understand tax as if you have years of training in the subject. The fundamental reason behind this is that it covers everything relevant for you as an individual and for businesses.

Key Takeaways

- If you are looking for a book for your college education in taxes, this is the book you should pick up.

- This book will help you learn taxation like a student and will guide you to understand every part of federal taxation.

#9 – South-western Federal Taxation: Individual Income Taxes

by William H. Hoffman, James C. Young, William A. Raabe, David M. Maloney & Annette Nellen

We all know that tax is boring. But if you read this book, you will find out why tax could be attractive.

Book Review

This book is handy for those who want to understand federal taxes for individual purposes. If you want to avoid hiring a tax consultant to file your return, you can read this book yourself. Else, you can also help others and how they can manage their returns by reading this book. It is a good book, but sometimes, you may feel bogged down under the heap of information. Just learn slowly, and you will enjoy the material.

Key Takeaways

- It is very much useful for individual taxation. So, if you need to know individual income taxes in-depth, read this book.

- One can rent this book if you are in college, and you can return the book whenever you are done with the semester.

#10 – Principles of Taxation for Business and Investment Planning

by Sally Jones & Shelley Rhoades-Catanach

This book is handy for people more interested in business and investment planning. Have a look at the review and the best takeaways to know more.

Book Review

Most people feel that taxation is boring because only a few books can concentrate on all the fundamentals in a summarized form. But in this book, you would get all the summary of tax fundamentals, which will help your understanding and application. Moreover, it is written in very lucid language, and the chapters are short.

Key Takeaways

- Two opposites are organized here correctly. The first taxation is dry. It will be easier for usual readers if you have short chapters. The second taxation needs readers to go in-depth. And with explanation, the subject would make sense. This publication has correctly done both of these things.

- It can be used as a primary textbook in college.

#11 – Examples & Explanations: Corporate Taxation

by Cheryl D. Block

If you are searching for a book on taxation for dummies, this is the one that will fit the bill.

Book Review

This book has been read and revered by many students at the university. They have mentioned that it has helped them learn taxation in a new way. This edition on taxation is crisp and to the point. It is an excellent substitute for any thick corporate tax book you would like to read. Moreover, it has included several case studies so students can relate to their learning. Tax students and law students can benefit significantly from this book.

Key Takeaways

- The best part of this book is its diagrams. They are very informative and help a student revise the concepts well.

- You would not only learn concepts from this book; instead, you would also be able to apply the concepts in real life.

- You can also use many examples to crystallize your understanding.

#12 – International Taxation in a Nutshell

by Richard Doernberg

This book would be a great addition to your taxation library. Look at the review and best takeaways to know more about the book.

Book Review

It has not only helped many students to learn international taxation but also helped them in tax planning. And the students who have read this book hail from college students to professionals of different backgrounds. Moreover, it is a straightforward read and a great law supplement if you are studying law. Finally, if you are struggling with international taxation, it would also help you as a great reference book and help you prepare for your exam.

Key Takeaways

- If you are involved in any business, you must understand the cross-border flow of taxation. And this book will help you do that.

- This book will not only help students understand the concepts, but it will also help them with straightforward exams.

- This book is comparatively very cheap if you compare the value with the price.

#13 – Federal Taxation: Basic Principles

by Ephraim P. Smith, Philip J Harmelink & James R. Hasselback

This edition is written so that learners will significantly benefit from the approach.

Book Review

If you are a student of finance or law, you would know how frustrating it becomes when studying taxation. Most of the books are overly technical and written, so a student can’t digest even the parts of the books. But this book is the exception. It is designed in such a way that you can digest the whole book in a short time. In addition, you would learn most of the tax codes you need to learn because this book has explained the tax codes in a very logical manner. And the whole book is organized according to a flow chart, which will help you understand chapter after chapter without missing out on anything in between.

Key Takeaways

- It is beneficial for students who are complete beginners. If you need to learn about taxation, this book will help you understand taxes from a fundamental level. Even with the aid of this book, you would be able to learn tax filing.

- Once you buy this book, one will provide you with a free tax code, which will help you understand the fundamentals of tax codes very well.

- The book is written in a very lucid manner, and the chapters are very well organized.

#14 – Federal Income Taxation (Concepts and Insights Series)

by Marvin Chirelstein & Lawrence Zelenak

It is a perfect guide for students who want to make their mark in the examination. Read the review and best takeaways to know more.

Book Review

Why do students struggle with tax laws? Because few books can explain the tax laws well (meaning in length with examples). As this publication is designed for students, it will help you lucidly learn the fundamental tax laws. Students who have read this book have mentioned that if you want to read one single book on this subject, make it this book. It has lucidly explained everything. However, it is not wordy and doesn’t deviate from the topics while describing.

Key Takeaways

- This edition is reasonably priced. Suppose you compare the value it provides. The price will seem low. You can rent this book as a supplement to your current textbook.

- As mentioned, it is most helpful for finance, law, or taxation students.

#15 – The Best Zero Tax Planning Tools

How to Maximize Tax-Efficient Lifetime Income, Transfers to Heirs, and Gifts to Favorite Charities

by Tim Voorhees

This book is different in scope. As a result, it’s beneficial for those who want to maximize income.

Book Review

This book is written for a single purpose. That’s why it can’t be called a textbook. It is written to teach you the secret of passing on wealth and preserving it. If you read this, you will ensure that the next generation can enjoy the wealth you have created for them. And it is straightforward to read. You would be able to read this book in a few hours (just 133 pages book).

Key Takeaways

- This book is valuable without any flowery language and serves one single purpose helping you preserve and pass on your wealth to the next generation.

- Even professionals who are tax planners can use this book to help their high-net-worth clients.