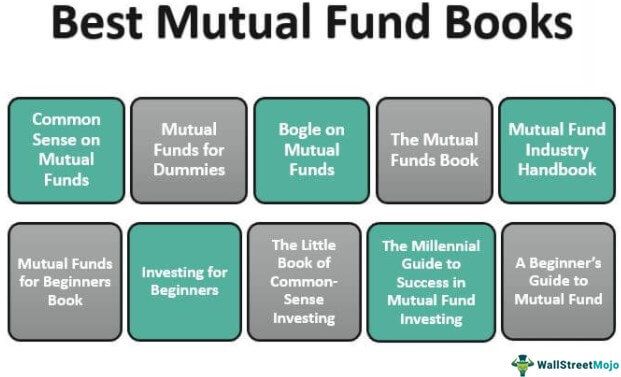

10 Best Mutual Funds Books [2025]

Any individual or a firm willing to invest in mutual funds must have a thorough knowledge of mutual funds and the global financial markets in general. Below is the list of top 10 books on mutual funds -

- Common Sense on Mutual Funds ( Get this book )

- Mutual Funds for Dummies ( Get this book )

- Bogle on Mutual Funds ( Get this book )

- The Mutual Funds Book ( Get this book )

- Mutual Fund Industry Handbook ( Get this book )

- Mutual Funds for Beginners Book (The Investing Series 3) ( Get this book )

- Investing for Beginners ( Get this book )

- The Little Book of Common Sense Investing ( Get this book )

- The Millennial Guide to Success in Mutual Fund Investing ( Get this book )

- A Beginner's Guide to Mutual Fund ( Get this book )

Let us discuss each of the mutual fund investing books in detail along with its key takeaways and reviews.

Now, without too much clarification, let's get going.

#1 - Common Sense on Mutual Funds

New Imperatives for the Intelligent Investor

By John C. Bogle and David F. Swensen

This dependable resource identifies the basics of mutual fund investments in the existing tough market conditions while offering excellent advice towards developing a superior investment portfolio.

Book Review

This best mutual fund book is crafted, keeping novice readers in mind who either possess no knowledge about mutual fund investments or only have little know-how on such investments. This is the very first book that many mutual funds investors must go through prior to intelligent investing in these types of financial instruments. The writing style is extremely accessible and straightforward, with an impressive display of common sense and simplicity, which explains the benefits of a highly diversified investment portfolio.

Key Takeaways

- Crafted by well-known mutual fund industry expert John C. Bogle

- Illustrates the eternal basics of investments that are applicable to all kinds of markets

- Digs down the regulatory and structural alterations across the global mutual fund's industry.

#2 - Mutual Funds for Dummies

Positioning Investment Portfolio for Growth

By Eric Tyson

The much-needed resource for healthy investing. This top mutual fund book is written in fairly simple English language for the emerging investors to clearly understand the basic concepts of the mutual fund industry while preparing them to take over the challenge of investing strategically in the mutual fund's space and delivering sustainable long-term profits.

Book Review

You wish to pick the right stocks for investment in a plethora of stocks, this book is definitely for you, and trust me, you would never wish to start new investments before reading the book if you go through it just once. The book contains a number of latest mutual fund investment advice and in-depth help from the investment pioneer or the author that maximizes your success chances and prevents you from falling into wrong investment traps.

Key Takeaways

- It provides quick, easy, and superior support for picking the top mutual funds along with impressive help being provided in maintaining and assembling one's portfolio while uniquely evaluating fund's performance

- It illustrates a detailed explanation of exchange-traded securities and an in-depth explanation of tax laws impacting the fund investments

- This best mutual fund book also determines the process of evaluating various fund-investing techniques.

#3 - Bogle on Mutual Funds:

New Perspectives for the Intelligent Investor (Wiley Investment Classics)

A Detailed Analysis of Mutual Fund Investments

By John C. Bogle

This best book on Mutual Funds ought to be on your study table with every investor aspiring to read the whole mutual fund investment concepts present in the book. A book by mutual fund investments behemoth, Bogle is bound to attract even the top investment experts apart from the investment beginners through its well-designed cover page, a detailed index, and a range of examples covering a number of industries.

Book Review

The classic mutual fund investment book is intelligently designed to redefine the concepts of mutual fund investing. This scripture provides an opportunity for its reader to become a pioneer in mutual fund investments and strategically determine and select the top-performing mutual fund investments to be included in an investor's portfolio. The author provides well-structured guidance on the investment misconceptions and the reality about such investment opportunities coupled with the layers of perseverance and persistence that resulted in this outstanding product. The keen reader would easily pick the differences among balanced funds, money market, bond, common stock, and why any submissively managed index security is an attractive investment compared to security controlled by a party making calculated moves on particular funds, segments, and the overall economy. The author discloses the reality behind selfishness, the average performance, and the advertising while highlighting the most common errors several investors generally make.

Key Takeaways

- Evaluates both the risks and returns of investments across mutual funds

- Study the technique for choosing among the four fundamental fund types

- Select a low-cost, highly reliable investment strategy

- Distinguish between actual and misleading false advertisements, and look out for downsides

Grab a copy of this mind-boggling work on mutual fund theory and investments that illustrates the right technique for investments in these funds with an expert outlook of this industry leader.

#4 - The Mutual Funds Book:

How to Invest in Mutual Funds & Earn High Rates of Returns Safely

The sure shot mutual fund investment strategy

By Alan Northcott

A refresher of mutual funds concepts with a keen focus on providing investment advice that contains minimal risk and high returns. Mutual funds are expected to provide benefits of diversification coupled with expert management. This top mutual fund book gives a detailed explanation of both the benefits and drawbacks of mutual fund investments coupled with the risks associated with such financial instruments.

Book Review

Anyone who needs to get to the fundamentals of mutual fund investments must consider going through this book at least once, and I am sure the reader wouldn't get disappointed. These funds aren't insured or guaranteed by any government institution or FDIC. Regardless of your purchasing the mutual funds from any nationalized bank, one may lose money while investing across mutual funds. Further, there are over 10,000 mutual funds for making investment decisions. The primary reason for any investor making investments in mutual funds is that there's only limited risk associated with such investments and hence, limited returns. Since the investor's corpus in these funds is strategically distributed to enhance diversification to minimize risk and maximize returns.

Key Takeaways

- A stepwise explanation of achieving profitability through investments with minimal risk and maximized returns

- The reader gets to know about the types of mutual funds that generate healthy returns at low risk

- A comparison of risks in other types of investments with mutual funds investment risks.

- Providing both the correct and incorrect techniques of investments in addition to their respective results along with the strategy for asset allocation, making, and activating one's account online. Also, it provides the method of determining when to sell any security and the way of converting such opportunities into cash.

#5 - Mutual Fund Industry Handbook:

A Comprehensive Guide for Investment Professionals

A Bible for Making Professional Mutual Fund Investments

By Lee Gremillion

This best mutual fund book provides notable and extensive knowledge as well as information about the mutual fund, their types to each and every industry contributor, business school candidates, college students, and all other participants having a keen interest in the mutual fund's industry. Further, the book also illustrates the intricacies of the remarkable industry in an easier form.

The interested investors are usually attracted by the element that these funds provide regulatory protection, significant investment alternatives, convenience, liquidity, simple diversification, and professional management. The popular mutual fund industry handbook covers all these concepts and targets on the varied functions accomplished in daily operations across the global mutual fund industry.

Book Review

The handbook on the mutual fund industry can be considered a thorough study of the topic that is bound to attract novice as well as expert investment professionals. This book provides an in-depth analysis of all the major and minor mutual fund investment techniques that are believed to inculcate interest in the readers while encouraging them to strategically invest in these financial instruments by taking all sorts of investing precautions.

Key Takeaways

- This top mutual fund book depicts detailed roles being played by transfer agents, distributors, custodial banks, custodial accounts, investment advisors, fund managers, and several other external service providers.

- Different fund types are employed by the Lipper, Morningstar, and the Investment Company Institute.

- Implements structures-level loads, back-end loads, or front-end loads.

- Back-office operations that include reporting, accounting, custody, and settlement.

- Analysis of front-office operations such as purchasing and selling.

A final reference for the global mutual fund industry can be obtained through this book.

#6 - Mutual Funds for Beginners Book (The Investing Series 3)

Investment Know-how for Novice Investors in the Mutual Funds Industry

By John Border

Markey D highly endorses this top mutual fund book for gaining a quick hold over the mutual fund concepts. Similarly, Cyrus V describes the book's author has done a commendable job of fragmenting the core topics into simpler to grasp divisions in order to enable anyone to quickly understand the toughest mutual fund concepts. Further, Derrick M, who is a well-known author and prepares personal finance blogs, writings, and mutual funds investing scriptures too endorse this book.

Book Review

Just a beginner investor usually seeks investment knowledge in easy language that can be quickly grasped and develops confidence among the investor to start their investment trials. Therefore, if someone is searching for a scripture targeted towards novice mutual fund investors, this is it. The search ends here with this book containing the concepts of investing in the global stock markets with no need to pick the stock oneself. Mutual Funds are also considered to be safer heavens compared to the equity investments that contain greater risks.

Key Takeaways

- Inside this book, one can find the technique of opening a new mutual fund account

- Key factors impacting the mutual fund investments and major techniques while making mutual fund investments

- Implementing clever financial decisions

- Mutual fund principles and many more

This top book on a mutual fund is written in simple English language which is easy to comprehend while covering every fundamental topic for getting you started.

#7 - Investing for Beginners:

A Beginner's Guide on how to make money by Investing in Stocks and Mutual Funds

A General Reminder of Mutual Fund Basics

By Ryan Smith

A proven technique for making money through strategic investments in mutual funds and stocks.

Book Review

This best mutual fund book provides investors with solid concepts about investing intelligently into stocks and mutual funds. A new investor can grab a copy of this scripture to learn about the basics of investing in the stock market and mutual funds.

Key Takeaways

- Easily explains the long-term investment technique

- Provides know-how of portfolio diversification

- Quick earning from various investments

- The technique for earning money through stock dividends

- Explains the significance of the market index

- Illustrates details on mutual funds

- Describes mutual funds analysis

#8 - The Little Book of Common Sense Investing:

The Only Way to Guarantee Your Fair Share of Stock Market Returns

Just a refresher of mutual fund investment concepts

By John C. Bogle

A guaranteed method of achieving industry-leading stock market returns.

Book Review

This scripture can be treated as a shortcut for getting some common sense in mutual funds and stock investment.

Key Takeaways

- All big and minor investors are advised to go through this book

- A simple way of getting only minor knowledge on stock investments and surely not for highly experienced stock investors

#9 - The Millennial Guide to Success in Mutual Fund Investing:

Key Things You Need To Know When Investing in Mutual Funds

A definitive guide for mutual funds investment

By Jeremy Kho

Provides stepwise information about stock and mutual fund investments starting right from the basics

Book Review

Mutual funds investment requires core knowledge about the stock market, and one can trust this book to provide the same.

Key Takeaways

- Any investor willing to learn favorable ways of achieving significant saving, earning additional income, and retirement planning needs to have this book

- The stepwise technique for analysis of an array of high and low returns generating investment options

#10 - A Beginner's Guide to Mutual Fund:

Everything to Know to Start Investing in Mutual Funds

A complete analysis of the overall investment process in mutual funds and stocks

By Ross Cameron

This book is again just for the beginners, and I do not suggest it for stock investment enthusiasts

Book Review

Novice investors with no knowledge about either a mutual fund or other stock investment must have a copy of this book on the desk.

Key Takeaways

- Prior to approaching any investment advisor or any bank, a novice investor must grasp some basic knowledge about investments through this book

- Provides tricks for avoiding costly funds and the actual cost of such funds

Recommended Articles

AMAZON ASSOCIATE DISCLOSURE

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com