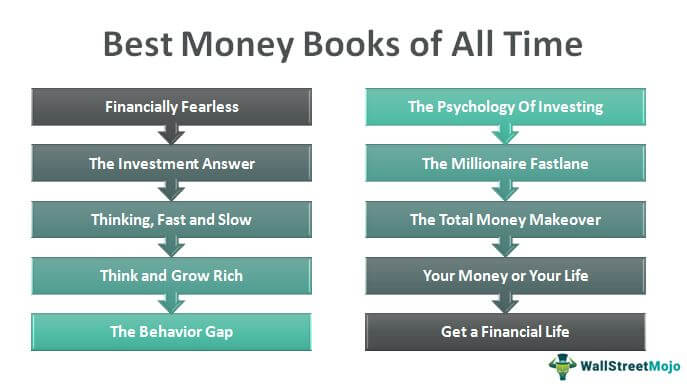

10 Best Money Books [2025]

We have a selection of the best money books on managing personal finances and overcoming debts and liabilities. Most importantly, the behavior patterns and psychology behind finance and investing. Below is the list of such money management books to read in 2025:

- Financially Fearless: The LearnVest Program For Taking Control Of Your Money ( Get this book )

- The Investment Answer ( Get this book )

- Thinking, Fast and Slow ( Get this book )

- Think and Grow Rich ( Get this book )

- The Behavior Gap: Simple Ways To Stop Doing Dumb Things With Money ( Get this book )

- The Psychology Of Investing ( Get this book )

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime! ( Get this book )

- The Total Money Makeover ( Get this book )

- Your Money or Your Life ( Get this book )

- Get a Financial Life ( Get this book )

Let us discuss each Money making books in detail, along with its key takeaways and reviews.

#1 - Financially Fearless: The LearnVest Program For Taking Control Of Your Money

by Alexa Von Tobel

Book Summary

Authored by the founder and CEO of LearnVest, a financial planning firm, this best money book offers a valuable and accessible guide for readers willing to make the most of their savings and investments. What makes this work stand out from most other books on this subject is the practical relevance that comes with every bit of advice by the author. It's all about creating a customized financial plan in keeping with individual needs, which can quickly adapt to one's everyday existence. The only drawback is that some of the advice may come across as pretty essential and not relevant to all ages and sections of society. Still, to begin with, the author does not claim it to be an all-encompassing treatise in that sense. On the whole, a work of convenient value is targeted at the online generation, who believes in taking control of their financial lives for better or worse.

Key Takeaways

It is a practical beginner's book on money for go-getters who would instead implement a specific piece of advice they can relate to instead of relying on complex theoretical concepts that are difficult to comprehend and implement. Some of the stuff is pretty basic, but it works for what it's worth and is an excellent place to start for any beginner—a must-read for the current generation, which takes pride in its financial independence.

#2 - The Investment Answer

by Daniel Goldie and Gordon Murray

Book Summary

This book about money management is an attempt by the author to drive home the simple truth that investing is an integral part of any personal financial planning. Keeping in mind how an average person might want to avoid being bothered with complex stuff on investing, this work offers simple and beneficial guiding principles on where to invest. The author addresses some of the oft-repeated questions related to investing, including whether it would be best to seek professional advice or invest on one's own, the correct proportion of funds for investing in stocks, bonds, and cash, and the right time for buying and selling assets. It is a highly recommended work on essential investment advice for beginners.

Key Takeaways

It is a pinpointed book on money for first-time investors on navigating the complex world of investment choices and confidently making the right decisions. The author adopts an unhurried approach, which leaves enough space to address the most fundamental questions like the relevance or lack of it in seeking professional assistance for investment decisions. In totality, an ideal companion for beginners to the world of investment.

#3 - Thinking, Fast and Slow

by Daniel Kahneman

Book Summary

The author, a Nobel-Award winning behavioral economist, takes the readers on a journey of understanding the thought process and its intricacies. He argues that there are two fundamental types of thought systems: intuitive, emotional, and more or less spontaneous, with little time to think or reason. The second thought system is relatively slow and reasoning-based, driven by logic. If we carefully balance our more intuitive thoughts with reasoning-based slow ones, potentially fewer logical errors would be committed, increasing the chances of success in any sphere, be it work, finance, or personal life. With the role our psychology and thought process plays in financial decisions, this could be the most critical work on succeeding in finance without discussing any financial concept. It is a highly recommended money management book for anyone willing to grasp the basics of the psychology of investing and finance.

Key Takeaways

Did you ever take a moment to think about how you think? If not, then this is the time. Here is a book on money that analyzes how we think, the types of thought processes, and how they shape our decisions in every aspect of life, including finance. It is a commendable book on money for anyone willing to understand the underlying thought processes behind our actions and how to improve them to make better decisions. (also, look at Behavioural Economics)

#4 - Think and Grow Rich

by Napoleon Hill

Book Summary

A cult-classic book on money in its own right, this work shares the insights gained by the author after interviewing more than 500 successful people on what they did right. There is a lot of helpful advice on creating a successful financial plan early in life and implementing it in the following years to attain good financial success and security. There has been a lot of financial advice on getting rich with good financial habits and investment strategies, but this one is more rooted in the ground with a long-term plan to create wealth with higher chances of success. Excellent work on wealth creation for everyone, especially the young, who can invest the time and resources available in a workable plan for the longer term.

Key Takeaways

It is a highly acclaimed best-money book on building long-term wealth with step-wise practical long-term planning. The author shares the wisdom gained by interviewing more than 500 wealthy people and chalks out a six-step plan to get rich based on how much money you have and how much you hope to have in a certain amount of time. It is a must-read book about money for everyone looking for an effective wealth creation plan that requires more effort in planning than resources to succeed.

#5 - The Behavior Gap: Simple Ways To Stop Doing Dumb Things With Money

by Carl Richards

Book Summary

Most books on money focus on what to do right, but few, if ever, address what you might be doing wrong. This top money book focuses on the common mistakes committed by people while spending, investing, or making other financial decisions. The author argues that a study of behavior can help improve upon these mistakes, which tend to recur and affect our financial lives adversely. Utilizing simple, at times humorous situations, the author presents his view on how people tend to do things like buying stuff with no real utility or spending more because others are. He stresses that taking control of financial behavior can profoundly impact our finances and offers valuable suggestions on how to do it. A recommended work to help understand how behavior affects our financial choices and how to improve it for the better.

Key Takeaways

Unlike usual works on finance, this work focuses on mistakes committed by people due to specific behavior patterns. It could include spending more than needed or buying useless stuff; the list is endless, but the author argues that it is possible to make better financial decisions by introducing some well-thought changes in our behavior. A light and beneficial read for anyone who wishes to understand how behavior affects our financial decisions

#6 - The Psychology Of Investing

by John Nofsinger

Book Summary

Usually, people think that it takes time, planning, and money to invest in making more money. This top money book challenges the notion that financial planning is enough to succeed, as the author argues that behavior and psychological outlook do shape our financial decisions to a great extent. Therefore, it is necessary to understand how we think to make the right choices and ensure that our psychology assists us instead of creating obstacles in our path. It is what this book about money making helps you to do, analyze, and identify your psychological pitfalls and overcome them with concerted effort.

Key Takeaways

It is a masterpiece that offers fascinating insights into financial choices from a psychological perspective. If you thought your behavior and habits do not have a significant role in your financial situation, you could be very wrong. This work would help you discover and deal with your psychological issues better—a valuable introductory work on behavioral finance that offers practical value to readers

#7 - The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime!

byM.J. DeMarco

Book Summary

In this offbeat money book, the author argues that conventional long-term wealth creation plans lack practical value and rarely, if ever, could help one get rich. Instead, he presents a unique approach to make the most of market volatility and capitalize on the opportunities at your disposal to make wealth in the short term and live your dream. He suggests that planning for retirement, everyday financial savings, mutual fund investments, and tax planning should be distinct from wealth creation. It is an exciting and helpful read on how to make money quickly instead of living by the policy of living on less in hopes of a better future.

Key Takeaways

Challenging conventional wisdom, the author argues that tax planning, mutual fund investments, spendthrift lifestyle, and retirement planning do not lead to wealth creation. Then, going one step ahead, he chalks out a plan for the readers to study and implement that helps capitalize on the volatility of financial markets to make substantial profits—a must-read book about money for those looking for get-rich-quick strategies that yield results.

#8 - The Total Money Makeover

by Dave Ramsey

Book Summary

A New York Times bestseller, this masterly work from Dave Ramsey can help you turn things around with its helpful advice on managing your resources, paying off your debts, and beginning your journey to financial prosperity. Millions have praised this work for the insights offered on money management, presented in the form of seven easy-to-follow steps that the average reader can implement without much effort. Along with providing the financial guidance, the author also busts several myths that can harm an individual's financial health. As a result, it is a perfect introduction to financial management for the average reader, along with helpful information on creating an emergency and retirement fund for a secure financial future.

Key Takeaways

It is a highly acclaimed book on money on personal financial management, which offers relevant information on how to manage debts effectively and plan to realize one's financial goals with simple and practical steps. The author has presented a seven-step plan for anyone willing to change their fortunes for the better with the help of time-tested financial principles—an ideal companion for anyone willing to lead to stress-free financial existence.

#9 - Your Money or Your Life

by Vicki Dominguez, Joe Robin

Book Summary

This book is a rather unusual book on money on personal finance and sheds a rare light on the concept of value for money or making value-based financial choices, be it spending or anything else. The author argues that contrary to popular perception, you don't need to be wealthy to lead a financially happy existence. Instead of the money you spend helping build experiences that bring value to your life; then they might be worth it. The reader can embark on a journey of not only improving the quality of their financial decisions and working towards a debt-free existence but would also be able to look at their lifestyle choices and money from a value-driven perspective imbibing the concepts presented in this work. If you want to improve your understanding of how money choices shape your life instead of merely tips on financial management, then this is the ideal choice.

Key Takeaways

Sharing his hard-earned financial wisdom, this author offers a novel perspective on money and its role in our lives. Instead of simply presenting a plan to spend less and save more, this work discusses how certain expenses and things can be meaningful for the experiences they afford. An off-the-beaten-path approach to money management focused on enhancing your understanding of money decisions and how they influence your life.

#10 - Get a Financial Life

by Beth Kobliner

Book Summary

This book is more of a manual on financial stuff and equips you with updated information on managing your finances smarter. Knowing your health insurance, student loan debt, and other things inside out would help you get on your way to getting your financial affairs in control. That is what this work is intended for. On the road to financial independence, the valuable advice of this author will help you navigate the speed bumps with ease and get one step closer to realizing your goals.

Key Takeaways

It is an updated and relevant book on money, getting out of debt, managing health insurance, mortgage, and much more, leading you to financial freedom. Learn how to save, invest, and borrow more thoughtfully and avoid getting caught up in common financial traps people fall into for better knowledge.