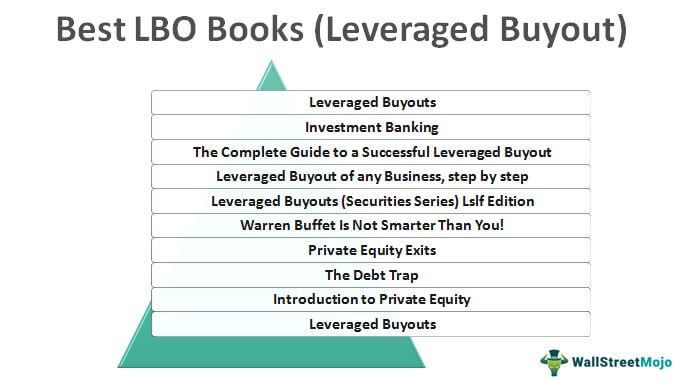

List of Top 10 Best LBO Books [2025]

Below are the best LBO books to learn more about the leveraged buyout.

- Leveraged Buyouts ( Get this book )

- Investment Banking ( Get this book )

- The Complete Guide to a Successful Leveraged Buyout ( Get this book )

- Leveraged Buyout of any Business, step by step ( Get this book )

- Leveraged Buyouts (Securities Series) Lslf Edition ( Get this book )

- Warren Buffet Is Not Smarter Than You! ( Get this book )

- Private Equity Exits ( Get this book )

- The Debt Trap ( Get this book )

- Introduction to Private Equity ( Get this book )

- Leveraged Buyouts ( Get this book )

Let us discuss each LBO book in detail, along with its key takeaways and reviews.

#1 - Leveraged Buyouts

A Practical Guide to Investment Banking and Private Equity (Wiley Finance)

by- Paul Pignataro

Introduction

To understand the ever-changing Private equity market, you need to know the industry. The author has skillfully and informatively shown how to identify and invest in a private equity company. The author takes you through the process of analysis behind making private equity profitable. This book includes information giving leveraged buyout overviews.

Book Summary

This best LBO book includes very informative LBO models and valuable case studies, primarily real-life case studies. In addition, the author is an expert in finance and the CEO and founder of the New York School of Finance. Hence, it can deeply explain the analysis of identifying a private company along with accounting and creating value theories of LBO concepts and mechanisms.

Best Takeaway from this Best LBO book

This book is the best option in LBO, for the author brings you all his experience and knowledge expertly. This book is a practical guide to investment for you. The author has explained how fast and differently the industry has grown in the last 20 years. This book allows you to learn from the past.

#2 - Investment Banking

Valuation, Leveraged Buyouts, and Mergers and Acquisitions May 28, 2013 –

by- Joshua Rosenbaum, Joshua Pearl, Joshua Harris, & 1 more

Introduction

Again the author talks about creating a technical finance base in the changing finance industry as understanding it is crucial, and understanding the base is impossible. The authors are experts in the fields of finance and private equity. Hence, they can help you and provide you with the tools of finance to help you succeed in this industry.

Book Summary

This best LBO book focuses on the primary valuation methodology now used on Wall Street. Hence, this book is very authoritative and accessible. He has used methodology and LBO analysis to know the value of private and public companies. This book also helps you make LBO, IPO, restructuring, and investment decisions. In addition, the authors have given step-by-step how-to approach methods.

Best Takeaway from this Best LBO book

The authors also give you the importance of ethical analysis, which is based on the same database, which is trusted. They have included various datasets and excellent banking tools to help you understand and analyze the subject.

#3 - The Complete Guide to a Successful Leveraged Buyout

by- Allen Michel and Israel Shaked

Introduction

LBO brings new jargon and different issues, and a stunning step into finance. Making yourself private is making profits for yourself and taking control of the company’s future. LBO structuring and implementation is the 1st step towards a fantastic industry experience. This story is put across very well by the authors in this book.

Book Summary

This best LBO book successfully explores the managerial, financial, and market deliberations confirming LBO's success and failures. In addition, they have given several classic real-life LBO examples to clarify and give a great explanation of how to identify the keys to the factors responsible for the success of a successful LBO. It doesn't just end here; the book is a detailed explanation of the entire subject.

Best Takeaway from this Top LBO book

This book is famous for its informative area on the LBOs and critical factors that help the readers determine the main ingredients of a leveraged buyout. They also explain the process of evaluating LBOs and confirm whether they are acceptable. It is also full of real LOB example stories.

#4 - Leveraged Buyout of any Business, step by step

by--- Sterling Cooper

Introduction

This best LBO book is a step-by-step guide to help you buy any business for yourself and your co-workers. He has used his principles to participate in several valuations, appreciations, acquisitions, and financing. The book focuses on the fundamental structuring of LBO for acquisition, helping the reader understand and achieve purchase success.

Book Summary

This book has simple formulas to follow. It is an effortless and step-by-step guide to acquiring the business you wish to own, you have knowledge about, or you work a process that the author underlines through a dairy that is to be written daily and will guide you towards progress.

Best Takeaway from this Top LBO book

The author has made this book easy to follow and has taken the help of various steps towards success. The information comes from an author with huge experience in buyouts who has been a part of over 3,200 acquisitions. And these buyouts have been on small organizations and huge businesses.

#5 - Leveraged Buyouts (Securities Series) Lslf Edition

by--- Joseph A. Bartlett, Peter L. Korn Jr, David J. Mittelstadt, Cathy L. Reese

Introduction

This top LBO book answers all your questions related to LBO. The authors have made sure to explain each leverage buyout transaction in-depth; he makes the concept sound rational and straightforward. Therefore, this book can help you save time, providing a reasonable solution for these transactions. Once you get solutions, you can quickly draft the best document for your LBO transaction.

Book Summary

This book is a solid recommendation for students appearing for M&A, securities, and corporate collections, as it is an all-inclusive review of LBO. It explains the advantages of the present financial system, tax structure, regulatory issues, corporate governance, and other legal issues. It includes everything from easy transactions to huge LBO deals and some sophisticated deals.

Best Takeaway from this Best LBO book

This book gives examples of simple equity letters of commitment to notes to senior subordinates’ indenture. In addition, the author has given you solutions for all transactions, be it mezzanine financing, negotiation of a break-up-free transaction, or minimizing client taxable events.

#6 - Warren Buffet Is Not Smarter Than You!:

You can buy any business in a leveraged buyout, step-by-step guide, and become a millionaire in 365 days.

by--- Sterling Cooper

Introduction

A fundamental introduction to LBO transactions and their understanding is given in this book. The author has very smartly explained the subject in a step-by-step method. This method makes understanding the subject very easy and exciting. He ensures he adds his principles as he is highly experienced with the concept. Moreover, the author himself has been involved in thousands of LBO transactions.

Book Summary

Cooper makes sure he allows every new and inexperienced buyer to look for such a transaction, find one, and complete the transaction step by step. He emphasizes step-by-step because he believes bankers love organized work as they have the money and want to fund the transactions. So, his first step here is understanding his principles.

Best Takeaway from this Best LBO book

This top LBO book allows you to buy a business, which means almost any business is outside your hands. His positivity is the best in the entire book as he says that acquiring anything is not impossible. There are real-life examples that you will surely enjoy reading.

#7 - Private Equity Exits

Divestment Process Management for Leveraged Buyouts Softcover reprint of hardcover 1st ed. 2007 Edition

by--- Stefan Povaly

Introduction

The equity market has grown crazily in the last two decades. Hence, this period has been the most focused time for research of financial researchers. The most important for research is the term private equity in companies. The returns of private equity have constantly huddled to actual quantitative research because the companies usually need to publicize their private equity return results.

Book Summary

The author has summarized the subject in various topics: fundraising, the relationship between acquired companies and private equity providers, a contract between investors and private equity funds, performance measures along with value creation and valuation, and the list continues. In addition, the characteristics of private equity and its structure are detailed.

Best Takeaway from this Top LBO book

This LBO book is focused on the LBO transaction in the recent development of the private equity industry, taking into account various industry trends and situations and the huge and adding competition to this industry.

#8 - The Debt Trap

How leverage impacts private-equity performance

by--- Sebastien Canderle

Introduction

Debt commitments of huge organizations start piling up when the companies are generally unable to cope with market corrections. This book is about the screen mentality and techniques used as a shortcut that impacts the return of portfolio assets and investment returns. Whether you are a student, investor, or business manager, this book is fascinating and authoritative.

Book Summary

This top LBO book has 14 business stories that can also be named as in-depth case studies that show how one can maximize value in an LBO transaction. These 14 business names are big headline-grabbing names, and their changes for the better with the LBO transactions and how these private companies are now financed and managed. He has a solution and a story for every industry.

Best Takeaway from this Top LBO book

The author has broken the usual asset class methods and given you relatable examples. He has made investing in private equity simple by opening doors for future investment for the audiences and readers of this book.

#9 - Introduction to Private Equity

Venture, Growth, LBO and Turn-Around Capital 2nd Edition

by--- Cyril Demaria

Introduction

The author has given more than just an update, which provides a balanced perspective on the challenging effects of corporate governance on the industry, evolving sectors of this industry, and the perspectives drawn by the same, followed by major financial crises.

Book Summary

This top LBO book covers the entire private equity industry, including the recent developments in the industry. It covers the organizations of private equity, functions, and management or governance, a detailed explanation of different segments in the industry, mainly LBO, growth capital, venture capital, distress debt, fund of funds, turn-around capital, and much more than just this much. He has also included the following:

- Information on how a private business is valued.

- The processing of the transactions.

- The issues related to due diligence.

- Everything that needs to be considered.

Best Takeaway from this LBO book

Demaria offers a framework to see and understand this industry's future development. He has created a critically grounded guide to help you through these transactions with the help of real-life and practical experience.

#10 - Leveraged Buyouts:

A Practical Introductory Guide to LBOs

by--- Pilger, David (2012)

Introduction

LBO being a controversial and innovative transaction, requires prudent judgment. Getting the equation between the debt load and the coming companies' forthcoming performance is demanding and challenging. This book lays a foundation for understanding the subject and can be very helpful in making decisions.

Book Summary

This LBO book is loaded with principles of leveraged buyouts and using the LBO models in the industry through various organizations. It will help you go through the purpose of LBO, the risks involved, its advantages, its outcome, the main and the most typical players of LBO, instruction on building an LBO in excel in a step-by-step format, etc. This book is just the perfect guide for all finance students.

Best Takeaway from this LBO book

This LBO book can help you understand the basic principles and techniques under LBO analysis. In addition, the author has given models in the book, as the models can help the reader better understand the subject.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com