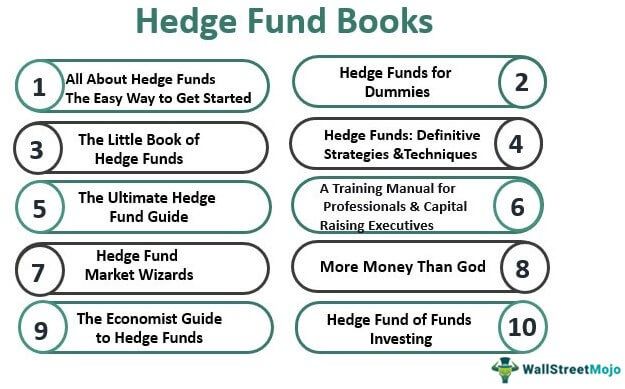

10 Best Hedge Fund Books [2025]

Books may seem old school, but still, they serve the purpose of soaking in the essential concepts in any area you want to master. If you are interested in hedge funds and can see yourself building career blocks, you may consider these 10 Best hedge fund manager books to read in 2025 that will aid you in learning hedge fund comprehensively.

- All About Hedge Funds: The Easy Way to Get Started ( Get this book )

- Hedge Funds for Dummies ( Get this book )

- The Little Book of Hedge Funds ( Get this book )

- Hedge Funds: Definitive Strategies and Techniques (Wiley Finance) ( Get this book )

- The Ultimate Hedge Fund Guide: How to Form and Manage a Successful Hedge Fund ( Get this book )

- The Hedge Fund Book ( Get this book )

- Hedge Fund Market Wizards ( Get this book )

- More Money Than God ( Get this book )

- The Economist Guide to Hedge Funds ( Get this book )

- Hedge Fund of Funds Investing: An Investor's Guide ( Get this book )

These books are well-researched, and the authors have used many practical examples while writing these books. We are sequencing these books according to an order that you would find useful and can follow the same if you wish to:

Without much ado, let's dive in and see in brief the best ten hedge fund manager books.

#1 - All About Hedge Funds: The Easy Way to Get Started

by Robert A. Jaeger

If you are new to hedge funds, we strongly recommend that you start with this book. This book gives a comprehensive overview of the industry, which will help you see the big picture. Let's look at the review and the best takeaways from the book.

Book Review

The book about hedge fund begins with a broad overview of market theories giving specifics about efficient markets, merits & demerits of random walk theory, diversification theory, and more. After that, this book will talk about investment tools available to hedge funds, such as long and short on share prices and volatility. You will also learn how to run a fund and its intricate details regarding operational, financial, and legal information.

Best Takeaway

This book is particularly useful for beginners. If you're one of those who are just starting in hedge funds, this book will act as a nice primer for you. The questions that are given are easy to understand, and there are many basic concepts lucidly provided, which will help you build your foundational knowledge in hedge funds. But don't think that it's too basic. It will also introduce you to portfolio theories, which will be useful in your profession later on. Put a great book to start your journey in hedge funds.

#2 - Hedge Funds for Dummies

by Ann C. Logue

Dummies series of books are the best if you want to learn anything new. This book will also help you understand hedge funds in detail. Let's have a glance at the review and the best takeaways of the book.

Book Review

From the title, this book may seem a little dull, but once you start reading this book, you would understand that this book doesn't only cover basics but also consists of a good overview of hedge funds. Most of the books which are written on hedge funds are either by academicians or practitioners. But this book takes a balanced approach between the two, which helps people understand the hedge fund more rationally. If you want to find the primary answers on hedge funds and would like to begin by a book, this book will surely fit the bill (except the previous book we recommended).

Best Takeaway

- You would be able to do due diligence on your hedge fund.

- You would learn to set up your hedge fund strategy with ease.

- You will get to know about your tax liability.

- You will also learn legislation affecting hedge funds.

- Moreover, you will also get to know how you can avoid the mistakes of failed hedge funds.

- Finally, you will learn to calculate return and risk, evaluate your performance, and analyze hedge funds.

#3 - The Little Book of Hedge Funds

by Anthony Scaramucci

Wiley Finance books are known for their quality and standard of production. This book is no exception. You will find jewels in this book. Let's find out about the review and the best takeaways of the book.

Book Review

This book is as little as to fit into your back pocket. But don't judge the book by its size. It's a great book if you are not particularly fond of Wall Street mumbo jumbo. This book talks about the history of hedge funds and the evolution so you would get a lot of back-stories to remember. The author has also included several segments on interviews with industry giants, due diligence questionnaires, which make this book unique. It's not particularly useful for people looking for charts, spread-sheets, or algorithms, but it's written for everyone who wants to understand hedge funds.

Best Takeaways

- This book is for everybody, especially those who would like to understand hedge funds and its strategies in a funny way. The author explains that the future of hedge funds is in providing transparency to attract more investors.

- It will also bust a few myths about hedge funds.

- It will also talk about various financial instruments like short selling, hedging, and leverage.

- Moreover, it will also talk about how the hedge funds evolved and why investors need to be aware of the evolution.

#4 - Hedge Funds: Definitive Strategies and Techniques (Wiley Finance)

by IMCA

This is an all-in-one book on hedge funds and their strategies. In this book, you will learn the trade secrets and will be able to apply whatever you learn. Let's get to the meat of the book.

Book Review

This book is a conglomeration of ten separate chapters which are written by industry experts. Treat each chapter as a small book in itself. From various hedge fund strategies to evaluating performance, from understanding convertible arbitrage, fixed-income arbitrage to risk management of hedge funds, this book will go in great detail. This book is not for the layman; instead, it's particularly useful for finance professionals.

Best Takeaway from this Book

- This book is created by IMCA (Investment Management Consultants Association), which means that the final product is the brainchild of so many experienced professionals who have spent years in the hedge fund industry.

- This book is much more in-depth and offers practical insights for people who know the industry.

- Each chapter talks about the pros and cons of the particular category and clarifies critical issues that connect the missing links in the hedge fund industry.

#5 - The Ultimate Hedge Fund Guide: How to Form and Manage a Successful Hedge Fund

by Frank Nagy

This textbook is for you if you would like to form and manage a successful hedge fund step by step. Let's see the review and the best takeaways of the book.

Book Review

Imagine you are a beginner in a hedge fund, and you would like to form and manage your hedge fund. This hedge fund book will show you how to do that. This guide will include core topics like how you would choose your auditor, administrator, and attorney, how you would market your fund while maintaining appropriate compliance, what documents you need to offer, and more. It will give you a completely different perspective on hedge funds.

Best Takeaway from this Book

This book is useful for those who are thinking of setting up their hedge funds and their investment strategies It includes an entire gamut of information regarding legal issues and framework, making things easier for the readers. The most important reason for which this book is considered a rare gem is because of its approach and scope of topics included in it.

#6 - The Hedge Fund Book

A Training Manual for Professionals and Capital-Raising Executives (Wiley Finance)

by Richard C. Wilson

This book is another, much more comprehensive guide on setting up and managing hedge funds. This is another Wiley Finance book, and once you start reading it, you will understand the value of it. Let's get to the review and the best takeaways of the book.

Book Review

This advanced book is very useful for people who have some knowledge in hedge funds and would like to operate, raise capital, and invest in hedge funds. What makes this book stand out is its case study approach. Most people learn best when they are given a practical example and explained the theory in regards to the real-life example. You will also learn to analyze funds within different phases of life cycles and investment processes.

Best Takeaway

- You will learn everything about this industry in a case study format.

- This book is written by an authority who is the head of one of the largest hedge fund groups with more than 30,000 members.

- You will understand the value of situation analyses and would be able to test your knowledge in each section.

- This book is required to read in CHP (Certified Hedge Fund Professional) Designation.

#7 - Hedge Fund Market Wizards:

How Winning Traders Win

by Jack D. Schwager

This is a completely different book that you usually find in the market on hedge funds. This is of 549 pages and covers a lot of back-stories of hedge fund traders.

Book Review

How would you learn best? You will know best when the industry experts in a field tell you their secrets of success, and you apply them in your own life or business. Treat this book in the same light as this book is a comprehensive guide containing several interviews with traders and many lessons on hedge fund trading. But this book is not for the newbies, so if you want to pick up this book, read some books on hedge funds beforehand to understand the basic concepts.

Best Takeaway from this Book

- You will get 15 interviews with hedge fund traders who will frankly share their secrets of success and reasons for failures.

- You will also learn 40 critical lessons if you're interested in hedge fund trading.

- You will also get to know many behind the scenes stories which are rarely covered by any hedge fund book.

#8 - More Money Than God:

Hedge Funds and the Making of the New Elite

by Sebastian Mallaby

This book will entice you if you're particularly interested in the history of hedge funds. Let's have a look at the review and best takeaways of the book.

Book Review

This book has taken a different approach to explain hedge funds and its managers. If you read this book, you will find why hedge funds manager better risk than any banks and other financial institutions and the evolution of hedge funds in the earlier years. From the 1960s to 2007 & 2009, this book talks a lot about behind the scene stories and why beating the market is not impossible anymore.

Best Takeaway from this Book

- People who have read this top book have recommended among the top 10 books they have ever read on finance. And they mentioned that it's a must-read for people involved in the financial industry by any means.

- As you read along with the book, you will find a chord that connects today's hedge fund market with when it got started in 1950-60 by Alfred Winslow Jones.

#9 - The Economist Guide to Hedge Funds

What They are, What They Do, Their Risks, Their Advantages

by Philip Cogan

This is another in-depth study of hedge funds. Have a look at the review and the best takeaways.

Book Review

Hedge fund managers are now called "masters of the universe" because they earn more than anyone can imagine. And the best of the best earn more than the average financial manager can ever think of. The author has bridged the gap between a layman and a potential hedge fund manager (if you ever imagine yourself to be soon). You will get to know every tiny aspect of the hedge fund clearly and concisely. In a word, this book is un-put-down-able.

Best Takeaway from this Book

- The author writes the Buttonwood column for The Economist so that you can be assured about the end product.

- There are six chapters in the book which will cover hedge fund taxonomy, the players, funds-of-funds, hedge fund regulation, hedge funds: for and against, and the future of hedge funds. Most people have heard about hedge funds, but very few know what hedge fund is and how it is operated. You will find your answers here.

#10 - Hedge Fund of Funds Investing: An Investor's Guide

by Joseph G. Nicholas

This is another un-put-down-able book on hedge funds and their investment strategies. Have a look at the review and the best takeaways.

Book Review

Hedge funds have earned a bad name as "unsafe" investments. However, investors face significant challenges while investing in hedge funds. In this book, industry expert Joseph G. Nicholas talks about how these funds operate, the benefits, the risks, and the criteria needed to be used and due diligence required to select appropriate funds. If you want to invest in hedge funds, this is your go-to-guide without a tinge of doubt.

Best Takeaway

- This is the most comprehensive guide on hedge funds for investors.

- The author wrote in a case-study approach, which will make even a layman understand the hedge fund investments.

- The author's historical analysis will enable a strong interest in hedge fund investments and make people go beyond "unsafe investments."

Recommended Articles

- Hedge Fund Jobs

- Finance Books

- Top Best Venture Capital Books

- Investment Banking Books

- Best Stock Trading Books

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com