Table of contents

What Is George Soros On Finance?

George Soros on finance is an essential topic of discussion due to his immense skill and knowledge in the financial market and many exciting and informative books that he has written in this field. He is a businessman of Hungarian-American origin and also an active philanthropist by nature.

He is a fund manager by profession who has spent a lot of time in the company of experienced investors and learned the nitty-gritty of the financial market in detail. He is famous for his ability to forecast the market direction, take leveraged trades on short-term movements of various financial products, and book profits. His books give a lot of valuable insight into his trading strategies.

George Soros On Finance Explained

George Soros on finance can be considered as an important topic of discussion because of the invaluable contribution of Geore Soros in the field of finance and financial market through his profession as a manager of hedge funds and his writing.

He is a Hungarian-American investor who is a billionaire and also a philanthropist, supporting and donating money to productive causes. He is the founder of the organization named Open Society Foundation which works towards supporting human rights, social equality, democracy and other social reforms on a global level.

He gained a lot of attention in the financial market due to his unique speculative ways of taking trades for short term and gaining success from fluctuations in prices of various types of financial products like currency, commodities, derivatives, stocks, bonds, etc.

George Soros has gained a lot of admirers and followers over the years due to his unique working style and ideas. But many critics have pointed out certain negative aspects of his work and its influence on politics and trading. He is skilled in identifying in which direction the market movement may take place for the short term. He also studies each financial product on which he plans to trade and its participants. and them makes his decision.

He calls his trading philosophy reflexivity. This method is against the typical idea of equilibrium in the market, where all investors have all the information and that information are already factored into the product prices. Each of his books explain in detail about his strategies and ideas that are not only interesting to read but also very informative. Let us dive into them directly, as given below.

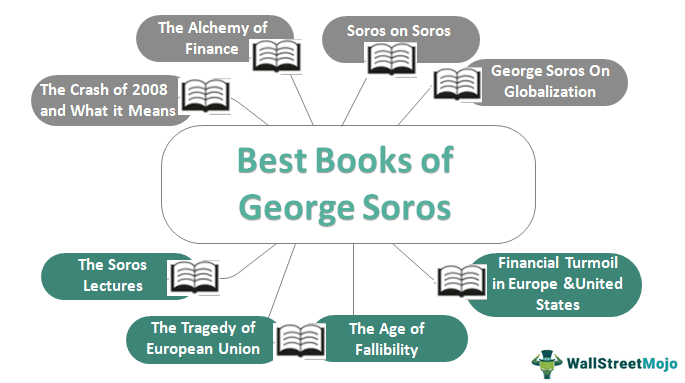

8 Best Books Of George Soros [Updated 2025]

George Soros is an established Hungarian-American investor who has witnessed decades of changes in the Global Economy. Before starting his hedge fund business, he commenced his career by taking various jobs in England as a Merchant banker. It was his success in this area that he further expanded his career as an author and philanthropist. Some of the best books of George Soros to read in 2025 are:

- The Alchemy of Finance ( Get this book )

- Soros on Soros: Staying Ahead of the Curve ( Get this book )

- The Crash of 2008 and What it Means: The New Paradigm for Financial Markets ( Get this book )

- George Soros On Globalization ( Get this book )

- Financial Turmoil in Europe and the United States ( Get this book )

- The Age of Fallibility: Consequences of the War on Terror ( Get this book )

- The Tragedy of the European Union ( Get this book )

- The Soros Lectures: At the Central European University ( Get this book )

Let us discuss each of the George Soros books in detail and its key takeaways and reviews.

#1 – The Alchemy Of Finance

This book is regarded as one of the most influential books of George Soros on finance and economics. It is recommended for:

- Fund Managers

- Serious Traders and Investors

- Policymakers

- Economists

- Banking Professionals

Key Takeaways

This book clearly describes his understanding of the world and markets through the “Theory of Reflexivity” and how his decision-making skills in trading operations always have an underlying belief about the potential outcome of events. In addition, non-technical methods are used to forecast the dynamic interplay and market participants. Some of the other exciting analyses are:

- Conglomerate Boom of the 1960s

- REIT boom

- Abolition of Gold standard and its ramifications

- International debt and the cycle of lending using the Eurodollar market

#2 – Soros On Soros - Staying Ahead Of The Curve

This book by George Soros is an interview-style narrative with some of the established names in the financial world. There is a beautiful connection between Personal experiences, political analysis, and moral reflection to offer a complete picture of the global markets.

Key Takeaways

Quantum Fund describes the investment theories and strategies that have made Soros a “Superstar among money managers,” a fascinating story of the highly successful Soros Fund Management and its $12 billion flagships. The book also offers fresh insights into some of the most established victories and losses, including the $1 billion made up against the British pound and the fortune he lost while making Speculations on the Yen. There is also a take on the Devaluation of the Peso and International currency fluctuations.

#3 – The Crash Of 2008 And What It Means: The New Paradigm For Financial Markets

Through his vast experience, George Soros has given a detailed description of the origin of the 2008 Financial Crisis. The theory of Reflexivity argues the actions taken by a market for marketability to understand the situation.

Key Takeaways

The book argues the importance of market regulation and the equality of information. These have been supported by a detailed history of actions for several past U.S. crashes.

The final chapters provide recommendations of what the Global financial authorities should do to rectify the crash and steps undertaken in collaboration with other hedge fund managers.

#4 – George Soros On Globalization

This book by George Soro highlights various complex issues and situations plagued by globalization and is broken down into granular levels for readers to understand more. Many institutions have failed to keep pace with the growing economy, and a new dimension is offered for bringing the economy back on track.

Key Takeaway

Soros has successfully expressed some thoughtful advice on dealing with financial aid to underdeveloped nations and conditions to be enforced by countries such as the U.S. and Great Britain and the role of the IMF and World Bank. But, the book has focused on a capitalistic view, not a socialist one.

#5 – Financial Turmoil In Europe And The United States

This book by George Soros takes the readers on a journey of real-time economic policy work and experimentation. The current financial situation is based on more than economic forces but various policies pursued/not pursued by global leaders.

Key Takeaways

Specific to the 2008-09 financial crisis, Soros explores the domestic and international policy choices which could have prevented the implosion of Fannie Mae and Freddie Mac. Some of the other highlights of this book are:

- Deploying measures to stem global contagion from the sub-prime crisis

- Alternative options for offering financial aid to the less developed nations

- Vitality on assisting the underdeveloped countries

- Structural problems of the European Economic Management

#6 – The Age Of Fallibility: Consequences Of The War On Terror

Through this essay, Soros expresses his core views, i.e., Democracy, Human rights, and Open Society, and his differences with President George Bush, against whom he was in the 2003-04 elections.

Key Takeaways

It is insightful into human fallibility that has been destroying the legislative processes. The political fallout of this intentional path is at hand, such as Bush’s polarization of Muslim factions and how he could have held the Arab world accountable with the developed nations helping them.

While Bush’s rhetoric may have caused substantial damage, Soros sinks into quasi-conspiracy and sinister theories instead of recognizing actions for what they probably are, i.e., brutal actions based on imperfect information in an uncertain world in the aftermath of 09/11.

#7 – The Tragedy Of The European Union

The European Union has collapsed massively in the last decade, and if the downslide is not stopped, the member states may soon turn rivals. It will cause global turmoil through severe political and economic consequences.

Key Takeaways

George Soros has offered vigorous commentaries on how the Euro crisis was not due to the Integration of nations but a result of avoidable mistakes in politics, economics, and finance. He also stressed that there was excessive faith in the self-regulation of financial markets, which inspired flawed institutional structures calling out various reforms.

However, Soros maintained faith in the European Union as a model of an open society, which is a testament to his vision of a productive and peaceful Europe.

#8 – The Soros Lectures: At The Central European University

This book by George Soros is a consolidation of 5 lectures that one delivered at the Central University of Budapest. The reflexivity hypothesis is laid out, giving specific examples resulting in collective, subconscious creation and reinforcement of our realities. In addition, these lectures highlight a collection of practical and philosophical reflections.

Key Takeaways

The book includes:

- The first two lectures were specific to the general theory of Reflexivity and its application to the financial markets. However, good highlights are also made to the various financial crises with his reasoning for the occurrence of such distressing situations.

- The third and fourth lecture offers a detailed understanding of the concept of an open society through the philanthropic views of George Soros and the potential conflicts which can arise between an open society and Capitalism.

- The final lecture focuses on the futuristic view, closely examining China’s increasing political and economic role in the future.

Readers of the above books will be able to easily identify the fact that George Soros believes that market participants influence the market movements through their irrational behavior leading to rise and fall of prices. He takes account of the market movements at global level to assess the impact of his trades. He tries to identify opportunities that will drive the entire market toward following him because he has the capacity and confidence to speculate in huge amount and small governments are not able to withstand the effect.