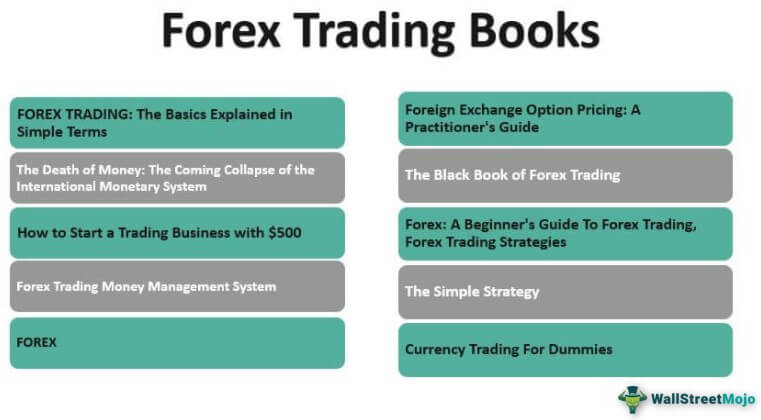

Top 16 Forex Trading Books [2025]

As technology and communication have advanced to unscaled heights, and no boundaries exist between countries, foreign exchange has become an inseparable part of the economy today. We provide a heads-up to the top best forex trading books. Below is the list of such books: -

- FOREX TRADING: The Basics Explained in Simple Terms ( Get this book )

- The Death of Money: The Coming Collapse of the International Monetary System ( Get this book )

- How to Start a Trading Business with $500 ( Get this book )

- Forex Trading Money Management System ( Get this book )

- FOREX: Using Fundamental Analysis & Fundamental Trading Techniques to maximize your Gains ( Get this book )

- Foreign Exchange Option Pricing: A Practitioner’s Guide ( Get this book )

- The Black Book of Forex Trading ( Get this book )

- Forex: A Beginner’s Guide To Forex Trading, Forex Trading Strategies ( Get this book )

- The Simple Strategy ( Get this book )

- Currency Trading For Dummies ( Get this book )

- Day Trading and Swing Trading the Currency Market: Technical and Fundamental Strategies to Profit from Market Moves ( Get this book )

- Currency Forecasting: Methods and Models for Predicting Exchange Rate Movements ( Get this book )

- Forex The Holy Grail ( Get this book )

- A Three Dimensional Approach To Forex Trading ( Get this book )

- The Sensible Guide to Forex: Safer, Smarter Ways to Serve and Prosper from the Start ( Get this book )

- The 10 Essentials of Forex Trading: The Rules for Turning Trading Patterns Into Profit ( Get this book )

#1 - FOREX TRADING: The Basics Explained in Simple Terms

by Jim Brown

Key Takeaways

It is of great use for those who have started trading Foreign exchange and require appropriate guidance, given the abundance of information on the internet. It is a good book for gaining an understanding of the very basics. The author has also mentioned one of his Trading systems and the indicators without any further associated costs.

The essential concepts and principles have been covered directly and in simple language. Examples that traders encounter in daily work have also been highlighted for the readers to have a practical understanding.

#2 - The Death of Money: The Coming Collapse of the International Monetary System

by James Richards

Key Takeaways

The US dollar has been the centerpiece of the world economy since World War II, and its performance can have a ripple effect on the financial condition of other countries around the globe. This book is a fast-paced look at the financial future, considering the greed of the financiers, the incompetence of the central bank, and the dangers of over-reliance on the US dollar as the Reserve currency.

The 2008 Global Financial crisis has haunted the US economy, and the FED is paying the price for helping the bankers. It is forced to print money to create inflation to offset the deflationary effects of the debt overhang from the banking crisis. The Government's borrowing ability is required to come as a savior to Wall Street. The drawbacks of devaluation due to excess printing and reducing the intrinsic value have also been extensively mentioned. The author has made two assumptions for arriving at the given theories:

- The recession of 2007-08 has been structural, and the Central banks have been using the wrong tools, assuming it is a cyclical situation.

- Gold is the only 'true money.'

This book has sufficiently supported neither of the assumptions. However, it is in simple language, and one can expand their financial understanding by linking basic financial knowledge and the prevailing economic situation in the world.

#3 - How to Start a Trading Business with $500

by Heiken Ashi Trader

Key Takeaways

Most new traders who start their businesses need more means of raising capital. This top Forex trading book highlights how one can become a full-time trader with limited capital, including private traders. It provides step-by-step guidance on approaching trading business with a capital of as low as $500. However, this foreign exchange trading book will not highlight how to expand the business rapidly to a large target, say $100,000. Some of the other important components of the book are:

- How should one acquire and smoothly implement good trading habits?

- How to be a disciplined trader?

- Social trading

- Communication skills with a broker

- How to be a professional trader?

- Maximize returns from the available $500 and make it feel like a very large amount

- Trading activities for a hedge fund

#4 - Forex Trading Money Management System

by Don Guy

Key Takeaways

This book contains a simple theory provided by the author, which reverses the FOREX market movement with a simplified money management system and aids in maximizing profits. The book's cover highlights this difference, which shows the performance of the market with and without the system.

It is popularly called 'Roulette Trader Money Management', which implements reverse engineering to magnify profits while simultaneously reducing drawdown in most scenarios. The author once visited a Casino in Las Vegas, where he lost $2,000 while playing Russian roulette. To counter the same, it established this system to 'Crush Financial Markets like a Professional Gambler.' This system can be automated and can be used manually, as well.

Post developing the system, the author returned to Las Vegas with $20 and turned it into a profit of $500 in 1 hour, which it locked in from the automatic profit locking mechanism. The same gets applicable in financial markets as well. The cover page will highlight how the profit is almost four times greater, and the maximum drawdown is only about one-third the size.

#5 - FOREX: Using Fundamental Analysis & Fundamental Trading Techniques to maximize your Gains

by Dave Matias

Key Takeaways

This edition will focus on the importance of fundamental analysis in the movement of the FX markets. Fundamental analysis is the base of trading and a primary driver of FX flows and also provides one with practical knowledge and understanding, which is unique. Moreover, the market is volatile and sensitive to micro and macro releases. Hence, making use of such fundamental analysis is of high importance.

Though one should pay attention to technical analysis, one needs to keep a blend of both these analyses. Therefore, this book will highlight the following aspects:

- Myths of fundamental trading

- How can macro and micro events influence the market?

- Currencies and bonds

- Usage of practical examples and use of models in fundamental trading

- Global market flows and other important trading concepts

- Trade and capital flow concerning the FX market.

#6 - Foreign Exchange Option Pricing: A Practitioner's Guide

by Iain J. Clark

Key Takeaways

This publication covers all the aspects of FOREX options from the point of view of a finance practitioner. It contains all the essential information that a trader or quantitative analyst must possess while working in a bank or a hedge fund. In addition, it covers the theoretical mathematics aspect and the comprehensive coverage of implementation, pricing, and calibration.

The content develops with inputs from traders and real-life examples. It also will introduce the more commonly requested products from the FX options trading desks along with various models capturing the risk characteristics essential for accurate pricing of the products. Another aspect covered is the numerical methods required for calibrating these models, a crucial component in practice but often neglected. Robust treatment is given to the following features:

- Specific market conventions for FX volatility management.

- Adjustment for settlement and delayed options delivery.

- Pricing of vanilla and barrier options contract under volatile conditions.

- Three-factor long-dated FX model.

- Numerical calibration techniques for all the models under consideration.

- Adopting variable approaches for strongly path-dependent options using either partial differential equations or Monte Carlo simulation.

This guide is essential to FOREX options in the context of the real-life marketplace, connecting the mathematically robust theory with live practical scenarios.

#7 - The Black Book of Forex Trading

by Paul Langer

Key Takeaways

The contents of this edition are crafted after multiple years of testing and getting fingers burnt in the volatility of the financial market. Of course, one can follow the success stories of those who have made it big in the financial world, but few will understand the skills and swiftness one learns after going through failure, and this book highlights the same.

This book targets beginners to intermediate traders who are still struggling to make it big in the trading world and can be equipped with harsh tactics to handle complex situations. It will cover the three main areas in Forex trading:

- How to construct a solid winning strategy adhering to personal lifestyles and requirements?

- Ways to optimize and maximize gains without taking unnecessary risks.

- Traders must take control of their emotions and biases while executing and follow a few simple steps while trading.

Certain other aspects which are covered are:

- Combatting struggling market scenarios

- Start earning money consistently

- Tactics to become a successful trader in 4 months

- Ensuring one can plan their financial freedom within the specified boundaries and limitations

- Gain sufficient confidence to trade with the appropriate knowledge and numbers in place.

The book's size is relatively small, but its knowledge is irreplaceable and adopted under complex situations for a long time.

#8 - Forex: A Beginner's Guide To Forex Trading, Forex Trading Strategies

by Matthew Maybury

Key Takeaways

It will focus on two broad areas: a beginner's guide to FOREX trading and the other best strategies for high profit and reduced risk.

The beginner's guide provides a blueprint to build a trading plan using Forex and how one can maximize their earnings. It will highlight the basic components of introducing the $2,000 billion forex market. This foreign exchange book enhances how an individual should strive to create a pool of money depending on their financial needs for certain events like marriage, retirement, etc. One can gain a profit margin of 70-90% following simple rules of the FOREX market.

The second aspect will focus on the Best Forex Trading Strategies for high profit and reduced risk. One can become an expert in FOREX by using several strategies to make a successful trader. Additionally, experienced traders can explore a strategy one must have yet to encounter before. Hence, if one is a reader to gain knowledge of foreign exchange or as a daily task, this book will teach the following:

- Basics of Forex Trading

- Determining and understanding Market Trend

- Strategies including Moving Averages, Price Action, Candlestick, Turtle, scalping, etc.

- Reducing the risk of loss

- Street smart tactics to survive choppy market conditions.

#9 - The Simple Strategy

by Markus Heitkoetter

Key Takeaways

This top Forex trading book is a powerful trend-following day trading strategy for futures, stocks, ETFs, and FOREX. The popularity has increased due to the following reasons:

- Clear Entry Rules are on specific indicators such as the MACD above the zero lines or not, and the entries are easy to identify and execute.

- Clear Exit Rules togive one a clear idea to exit the market when taking the position. This way, one can manage the quantum of risk to be assumed for the sizing of the positions and money management. One can also keep the trade on auto-pilot once the entry order fills, keeping the trade management to a minimum and thereby reducing costs.

- Taking advantage of Small Intra-day trends: Trading executes on beating a pulse, and one may only sometimes wait for the trading day to complete. This forex trading book will offer tips to tackle such situations as well.

- Sophisticated Trading Software is not required: A simple charting software with basic capabilities for plotting range bars, Bollinger Bands, MACD, and RSI. One is not required to purchase any proprietary indicators or expensive charting software.

#10 - Currency Trading For Dummies

by Kathleen Brooks

Key Takeaways

This user-friendly guide explains the functioning of a FOREX market and how one can benefit from the same. It offers an easy to follow introduction to the Global FOREX market, which explains the size, scope, players, and other major economic drivers that influence currency values and how to interpret the data and events in a channelized manner. In addition, one will explore various trading styles for constructing a concrete strategy and a game plan for execution. The areas to focus on are -

- Currency trading convention and its tools

- Providing an insider's look at key characteristics of established and successful currency traders.

- Understanding the importance of organization and preparation

- Offering guidance on the pitfalls of trading to be avoided and rules to manage various kinds of risks.

This best Forex trading book will go to the grass root levels for trading and will enhance the mechanics of trading on how the currencies are traded, pairing of currencies, understanding price quotes, how the global trading day flows, and so on. Subsequently, one can test their knowledge and intuition by getting a practice trading account with an online foreign brokerage before actually putting money in the real market.

#11 - Day Trading and Swing Trading the Currency Market:

Technical and Fundamental Strategies to Profit from Market Moves (Wiley Trading)Hardcover Import, 16 Dec 2008

by Kathy Lien (Author)

Book Review

- This best Forex book is a comprehensive work that outlines Forex trading for seasoned and amateur traders to identify and utilize hidden opportunities for day and swing traders.

- The author lays down the basic theoretical framework for Forex and discusses the evolution of the currency market over the years before moving on to effective trading techniques and strategies for forex traders.

- Readers would learn how to use several time-tested technical and fundamental trading strategies to their advantage and utilize them in specific market conditions.

- Some key areas covered include profiling a trading environment to apply specific indicators befitting this context. Traits unique to each major currency pair are discussed, including when they might be most active and what drives their price action.

- This work would also expose its readers to a wider spectrum of fundamental strategies involving news events, Intermarket relationships, interest rate differentials, and option volatilities, among other factors. Overall, complete work on Forex trading for amateur and professional day and swing traders.

- On the whole, complete work on Forex trading for amateur and professional day and swing traders.

Key Takeaways

- This book is a fairly detailed work that outlines the theory and practice of forex trading for the day and swing traders.

- What brings added value to the work is its emphasis on utilizing several proven techniques and fundamental trading strategies that one might apply suitably by profiling a trading environment.

- This a highly recommended read for the day and swing forex traders to acquire advanced knowledge and skills, which might help achieve better results.

#12 - Currency Forecasting:

Methods and Models for Predicting Exchange Rate Movements Hardcover Import, 1 Nov 1995

by Michael R. Rosenberg (Author)

Book Review

- This top Forex book is a classic on the currency market dynamics and how it can be understood and exploited to the advantage of Forex traders.

- Rosenberg combines technical and fundamental analysis with Forex macroeconomics to create a masterpiece that continues to be a valued knowledge resource on forex trading strategies a couple of decades after its publication.

- Considering the fast-changing dynamics of the currency market, it is a stunning achievement that this work continues to be of such relevance.

- Power-packed with useful information on dynamic currency analysis, the author dwells at length on the effect of interest rates and fiscal policies and utilizes concepts like a balance of trade and purchasing power parity to study the rise and fall of currencies. (all see Top 10 Economic Indicator to Watch)

- The author does an outstanding job of communicating the most complex aspects of forex trading to his readers in a concise volume of this kind.

Key Takeaway

- This best book on Forex is a veritable masterpiece on forecasting currency movements and trends based on a combination of technical and fundamental approaches with the microeconomics of forex trading.

- This work brings to light perspectives on studying the problem of currency price determination and retains its relevance more than two decades after its publication date.

- In short, it is a concise yet detailed exposition on the subject that could be of great use to professional currency traders in learning how to improve their techniques.

#13 - Forex The Holy Grail Kindle Edition

by SIMONE SIESTO (Author)

Book Review

- This book on forex is an attempt by the author to explore what could be the holy grail of currency trading by analyzing the leading financial analysis techniques employed in forex trading for their relative worth.

- One of the key points which emerge from the analysis is that merely technical indicators might not suffice to achieve consistent results nor steer one towards the ultimate concept of forex trading.

- Instead, the author describes 15 golden rules for success in forex trading while studying the moves of big players and how they can be followed with success.

- The readers would need not rely on age-old technical analysis indicators or go by the advice of experts and would be equipped with the right kind of methodology required to adopt a holistic approach and understand how the balance of powers works between currencies at any given point of time.

Key Takeaway

- This best book on forex explores several currency trading techniques in an effort to bring to light some hidden techniques and approaches to achieve a higher level of success in forex trading.

- Synthesizing various approaches, the author lays down 15 golden rules for success in forex trading.

- This would be of immense use in being able to look beyond the accepted truths of forex trading and recognize the true pulse of the market, thus providing the reader with the key to success.

#14 - A Three Dimensional Approach To Forex Trading

Kindle Edition

by Anna Coulling (Author)

Book Review

- The author does a brilliant job of expounding the basic framework of currency markets and presenting a clear and workable plan for traders to pursue.

- Readers will discover why the currency is the most complex of all financial markets as it controls the money flow and risk in quite a literal sense, thus making it the link between all the financial markets.

- The author explains the intricate web of intermarket relationships and how studying stock indexes, bond markets, and commodities can help find clues to the performance of currency markets as the movements in these markets almost invariably get reflected in currency markets.

- Novice and experienced traders can better anticipate market moves by studying these associated markets and innovatively utilizing analytical techniques. The author has laid stress on

- The author has stressed the use of relational fundamental and technical analysis to unravel the inner workings of currency markets and trade with a higher level of efficacy.

Key Takeaway

- This book is a complete treatise on currency markets, which reveals its workings and how this market holds the key to understanding the financial world better.

- The author makes it clear how the currency markets control money flow and risk in the financial world, and by studying other markets, including stocks, bonds, equities, and commodities, one could understand currency markets at a rather subtle level.

- Instead of relying on fundamental or technical analysis or any one of their specific techniques, the author advocates using relational fundamental and technical analysis for much better results.

- A recommended read for inexperienced as well as seasoned currency traders to enhance their understanding and expand their arsenal of trading techniques.

#15 - The Sensible Guide to Forex:

Safer, Smarter Ways to Survive and Prosper from the Start (Wiley Trading) Hardcover Import, 2 Oct 2012

by Cliff Wachtel (Author)

Book Review

- It is the best Forex book for risk-averse traders who would not like their portfolios to devalued as leading currencies continue to lose their value.

- The author outlines an approach that would help long-term investors effectively reduce risk and the complexity often associated with Forex trading while taking less time for execution and achieving desired results.

- Forex traders with a view of long-term investment would learn how to effectively hedge currency risk by creating diversified portfolios in terms of currency exposure and asset class.

- It would help consolidate higher capital gains and income while lowering the level of risk. This work would introduce traders to advanced trading tools, including Forex binary options and social trading accounts, which can greatly help improve trading performance.

- The author stresses that irrespective of how other markets are faring, currency markets can always present interesting opportunities to exploit with careful planning and execution of balanced investment strategies developed specifically for currency markets.

Key Takeaway

- It is a compendium of useful information on long-term investment strategies for currency traders, which is considered a grey area considering the fluid nature of currency markets.

- This work analyzes the very fluid nature of Forex and how one can utilize it to the advantage of traders and a strategy adhered to, which minimizes risk and improves chances of returns in the long term.

- Excellent strategies and methods for hedging currency risk are discussed, which would help create low-maintenance and high-performance portfolios for traders.

- A highly recommended read for long-term currency traders.

#16 - The 10 Essentials of Forex Trading:

The Rules for Turning Trading Patterns Into Profit Hardcover

by Jared Martinez (Author)

Book Review

- It is a practical guide to using effective trading tools and techniques for currency markets and ensuring positive returns with minimal risk.

- The author presents 10 essentials to succeed at forex trading for novice and experienced traders and shows how to combine these techniques effectively.

- One can use charting methods to identify underlying trading patterns and make smart moves for higher profits.

- Some important areas covered in this work include a detailed analysis of support and resistance levels, creating consistent entry and exit strategies, using Japanese Candlesticks to identify market rhythms, and using Fibonacci efficiently.

- Sideway market movements and also discusses how to benefit from these.

Key Takeaway

- This best Forex book is a straight-to-the-point practical guide for Forex traders looking for useful techniques they can understand and apply with little effort to achieve desired results.

- Some of the techniques covered are charting methods and how one can effectively use them for trading patterns for profit.

- Japanese Candlestick charting is also a useful tool for currency trading, along with the use of Fibonacci, which has some unique applications in trading.

- Overall, a must-read for practical currency traders of any level of experience and knowledge.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com