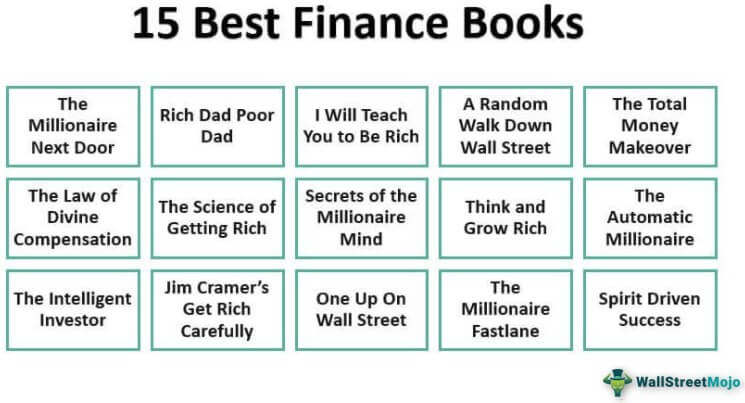

15 Best Finance Books [2025]

Simply reading the black-and-white text is not enough to get rich; thinking and implementing their thoughts is essential. We provide you with information on the 15 best finance books in 2025:

- The Millionaire Next Door ( Get this book )

- Rich Dad Poor Dad ( Get this book )

- I Will Teach You to Be Rich ( Get this book )

- A Random Walk Down Wall Street ( Get this book )

- The Total Money Makeover ( Get this book )

- The Law of Divine Compensation: On Work, Money, and Miracles ( Get this book )

- The Science of Getting Rich ( Get this book )

- Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth ( Get this book )

- Think and Grow Rich: Your Key to Financial Wealth and Power ( Get this book )

- The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich ( Get this book )

- The Intelligent Investor: A Book of Practical Counsel ( Get this book )

- Jim Cramer's Get Rich Carefully ( Get this book )

- One Up On Wall Street: How To Use What You Already Know To Make Money In The Market ( Get this book )

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime ( Get this book )

- Spirit Driven Success: Learn Time Tested Biblical Secrets to Create Wealth While Serving Others! ( Get this book )

Let us discuss each finance book in detail, along with its key takeaways and reviews.

#1 - The Millionaire Next Door

by Thomas J. Stanley

Introduction

The book intends to highlight the differences between the two distinct categories of American society – the massive accumulators of wealth and the accumulators of wealth.

Book review

This national bestseller featured on the New York Times Best Sellers list for a significant period owing to its mind-boggling subject matter. The book's author compares the people who pretend to be wealthy and those who are rich. In this book, the author conveys that to become wealthy, one should follow in the footsteps of really wealthy people. For instance, a significant finding of the book is that most rich people gather massive wealth by living well below their means. It is one of the reasons that these actual millionaires don't look like ones. In short, you don't need to look like a millionaire to be a millionaire.

Key Takeaways

- It teaches you some of the best financial habits practiced by wealthy people.

- It is an assortment of well-compiled data powered by a strong narrative.

#2 - Rich Dad Poor Dad

by Robert T. Kiyosaki

About the book

The book narrates the author's story of growing up with two contrasting characters – his father and his best friend's father. In addition, the author explains the difference between working for money and making money work for you.

Book review

This book is one of the top personal finance books of all time and has been translated into different languages in the last two decades. The best part of the book is that it presents financial concepts that a layperson can easily understand. For instance, the author states that 'Assets' are anything that puts money in your pocket even while you are not working, while 'Liabilities' are anything that takes money out of your pocket. In addition, the book uses many practical examples from the author's life to state how rich people think differently about money-making as compared to the poor section of society.

Key Takeaways

- It is a great introductory book for you if you are a beginner, as it can help you develop your financial intelligence.

- As far as wealth accumulation is concerned, it will motivate you to think differently and think out of the box.

From this book, you can get a basic idea of assets and liabilities. If you wish to enhance your knowledge further through examples, you can consider taking this Basic Accounting Certification Course.

#3 - I Will Teach You to Be Rich

by Ramit Sethi

About the book

This book teaches you various personal finance strategies and financial habits as part of a well-defined investment program that can help you set up a self-sustaining wealth growth.

Book review

If you are a newbie with low to moderate knowledge of personal finance, then this book is the Bible for you; whatever is explained in the book should be regarded as the gold standard. The book offers several essential tips, mainly focusing on the role of retirement investment funds (401k and Roth IRA) that can put your fiscal plan on autopilot mode. It doesn't use any fancy terms or suggest any crazy investment plans. Suppose you can follow the author's suggestions in a disciplined manner. In that case, you can successfully achieve the financial goal of paying out all your debts and setting up an investment strategy that grows your wealth automatically.

Key Takeaways

- It is a practical handbook that provides step-by-step guidance on managing your personal finance most efficiently.

- It is a great personal finance book for people in their early to mid-20s as it can help them develop healthy financial habits.

#4 - A Random Walk Down Wall Street

by Burton G. Malkiel

About the book

This book offers a broad overview of the securities markets, briefly touching upon its operations and the investors' behavior. It covers everything from stocks and much more.

Book review

In his rational way, the author presents many anecdotes, theories, historical facts, and statistical results to make a compelling argument for his finance strategies. However, many people disagree with some of his endorsements. For instance, the author believes in Efficient Market Theory (EMT), while many experts feel that EMT is irrelevant in the current market scenario. Nevertheless, the book provides beneficial investment strategies that can significantly benefit the long run. Some of the essential tips in the book revolve around the delusion of market timing and the benefits of more extended holding periods and diversification.

Key Takeaways

- The financial concepts are so well explained that even an average investor without advanced finance knowledge can also quickly grasp the concepts.

- It is a good launching pad for beginners new to the stock market.

#5 - The Total Money Makeover

by Dave Ramsey

About the book

The book imparts elementary financial literacy and preaches ways to live a debt-free life. It uses step-by-step guidance to instill financial discipline among the readers.

Book review

If you are struggling with your personal finance and drowning in credit card debt, it is high time you start reading this book. The author resorts to brutal honesty to point out the faults in our money management skills that we deliberately tend to ignore. The book's core idea is simple – sacrifice today for a better tomorrow. The author used his personal bankruptcy story to illustrate how he managed to turn around his financial position based on some restraints and responsible behavior. In short, the book provides step-by-step guidance on eliminating debt and living life within your means.

Key Takeaways

- It strongly advocates the idea of living life free of debt. Otherwise, we spend our lives as slaves to the lenders.

- By living within our means, we may quickly achieve a debt-free life.

#6 - The Law of Divine Compensation: On Work, Money, and Miracles

Author - Marianne Williamson

Introduction

The author is internationally acclaimed, a world-renowned teacher, and an inspirational thinker. She has also written books such as Return to Love, Healing The Soul of America, etc. So, yes, your guess is correct. We are talking about Marianne Williamson. In this finance book, she reveals spiritual principles that can help you overcome financial stress by unleashing the divine power in profusion.

Book Review

Marianne Williamson focuses on taking or driving your financial stress away by explaining the Law of Divine Compensation. She specifies that the universe resembles the handwriting of the almighty and hence is self-correcting and self-organizing. The universe plans to remove the lack from your circumstances by itself. Deactivating the law is only by having more and more faith in the facts of absence and the facts of the rules of this universe.

Key Takeaways

This finance book on work, money, and miracles explains that our thoughts create our financial reality. The author of this book clearly states that one cannot threaten anything real, and for that matter, nothing unreal exists.

#7 - The Science of Getting Rich (A Thrifty Book)

Author - Wallace Wattles

Introduction

The author gives the world the power of positive thinking. He was a real influence on several other authors, and without him, great books such as The Secret, The Law of Attraction, and the Law of Positive Thinking. This book is away from philosophical reasons and is based on practicality, and is mainly for men and women who would like to get rich before getting philosophical.

Book Review

Getting rich is an exact science. It has specific laws that monitor the process of achieving wealth. Several people that are men and women out there can do things in a certain way to get rich. This book resembles this fact and details becoming a rich person with positivity.

Key Takeaways

A man or woman who can read and understand this finance book can help them get rich, be it talented, blockheaded, intellectual, stupid, physically strong, or physically weak.

#8 - Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth

Author - T. Harv Eker

Introduction

There is an excellent line between wanting success and achieving it. The author explains the trick of going out there and achieving success or your financial success of becoming rich. It is normal to wonder why some people quickly get rich, whereas some struggle for bread and butter. The author answers this question for you.

Book Review

The author of this book can predict your financial future in 5 minutes. This finance book allows you to identify and revise your money blueprint, increase your money noticeably, and accumulate your wealth correctly. Well, the author applied these principles and went from Zero to a millionaire in only two and a half years, which means these principles are proven and tested.

Key Takeaways

The book gives you the root cause of success. It also can motivate the readers by its information to win.

#9 - Think and Grow Rich: Your Key to Financial Wealth and Power

Author - Napoleon Hill

Introduction

This bestseller has inspired several business people from the United States of America to empower themselves for success. The author has included more than just his success story and principles. He has also included success stories and regulations of the business people who have made successful real-world lessons. It is also acknowledged as one of the most excellent self-help books.

Book Review

You can gain valuable insights from this finance book by reading real-world lessons of not just the author but also other successful and influential US business people. It teaches you everything you need to know to empower yourself with financial success. It is a self-help book for every financial situation.

Key Takeaways

Your thoughts are the most powerful, as they are your best motivational factor. Conversion of these burning thoughts into wealthy richness can never be explained better by any other writer ever.

#10 - The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich

Author - David Bach

Introduction

After being asked a million times about the secret of being wealthy, the author finally wrote this book, yes, that's right, the captioned book. This finance book focuses on the story of an average American couple whose income never exceeded $55000 annually. As you go further, the story reveals the facts of becoming rich and its requirements.

Book Review

The author smartly and efficiently conveys the fact of becoming rich and ending rich quickly from the convenience of your home. Setting up a plan in an hour without having a budget, willpower, and the motive alone of making a lot of money can help you get there. He has given real-life examples for you to understand.

Key Takeaways

Look beyond your paycheck-to-paycheck system of payment. David Bach explains the actions of making financial life easy and fun.

#11 - The Intelligent Investor: A Book of Practical Counsel

Author - Benjamin Graham

Introduction

The timeless philosophy is value investing. It is one of the best books ever written for people investing in stocks. The concept of investing and growing differs for different people. The author offers sound and safe funding principles, which have worked for more than 40 years since the 1st edition was published.

Book Review

This finance book is a classic example of sound work offered for safe principles of investments. It is the best book in finance ever written for investors who like to invest in stocks, bonds, debentures, or anything related to the stock market. The best book you can ever read to make your investments a success.

Key Takeaways

This book helps prevent investors from making substantial errors in investing and helps them develop a long-term investment strategy making it comfortable for them later.

#12 - Jim Cramer's Get Rich Carefully

Author - James J. Cramer

Introduction

This finance book warns you of getting rich quickly, promises that can lead you to careless decisions, which, according to the author, can be a stepping stone to a poor house. So he does it differently, which is carefully or cautiously. Finally, putting in 35 years of his investment, the author brings to the captioned title.

Book Review

Using his knowledge of the stock market, the author wrote the book "Get Rich Carefully." 35 years of experience with his downfall and the success based on the losses and profits he made in his journey of profits are jotted down in his unique writing style. For him, it is a straightforward accumulation of wealth by turning your savings into long-lasting wealth.

Key Takeaways

Refrain from making reckless decisions with the promise of making you rich quickly. That is not the way. Instead, play it differently to think about lasting wealth; you do not want to make a poor's home.

#13 - One Up On Wall Street:

How To Use What You Already Know To Make Money In The Market

Author - Peter Lynch

Introduction

The author Mr. Lynch is a legendary mutual fund manager and has sold over a million copies of this finance book. He also states that the average investor has the advantage of investing in funds more than professionals and uses this to gain financial success. Investment opportunities are everywhere, from supermarkets to the workplace.

Book Review

The author confirms that an average investor can become a specialist in his field by picking up winning stocks effectively. All they need to do is take notice of the existing market, look for a potentially successful company, and grab the opportunity before the professional grabs it. Easy-to-follow directions are mentioned in this captioned book.

Key Takeaways

Ignore the ups and downs of the market and focus on the long-term returns to get a handsome reward for your investments. Your long-term should be anywhere between 5 to 15 years.

#14 - The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime

Author - MJ DeMarco

Introduction

He somehow does not believe in the slow lane, for it will get you to retire rich after 65. The slow lane only gives you restrictions rather than financial restrictions of all that you cannot do for yourself and your family. However, the fast lane is an alternative route to wealth that can fulfill your dreams today rather than when or after you grow old.

Book Review

This best finance book is a shortcut proved by mathematics to live rich today instead of dying rich tomorrow. So keep the financial gurus from brainwashing you and convince you to take the slow lane drill in the dream of dying rich in your head. Instead, switch your lane to the fast lane and live rich today by converting your dreams into reality.

Key Takeaways

Sacrificing all your dreams today to die rich is wrong. You have to live today, for you want to live rich instead of dying rich.

#15 - Spirit Driven Success:

Learn Time Tested Biblical Secrets to Create Wealth While Serving Others!

Author - Dani Johnson

Introduction

This best finance book is based on the author's experience of becoming a millionaire in a couple of years, not just a millionaire but a young millionaire and a successful businesswoman. But by applying her principles, the author has created success not just for herself but for thousands of others purely based on the ageless code.

Book Review

The author, a self-made multi-millionaire, quickly turns your financial life around. She is also one of the most successful coaches and has helped thousands of people achieve great results in their business and personal lives. In this finance book, she has used time-tested biblical secrets to gain financial success and spiritual keys that unlock the doors to true wealth. There is much to read about uncovering habits leading to poverty and financial struggle.

Key Takeaways

Enlightens and guides to true wealth. But unfortunately, the barrier to our economic success is our habits that lead us to poverty and financial struggle.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.