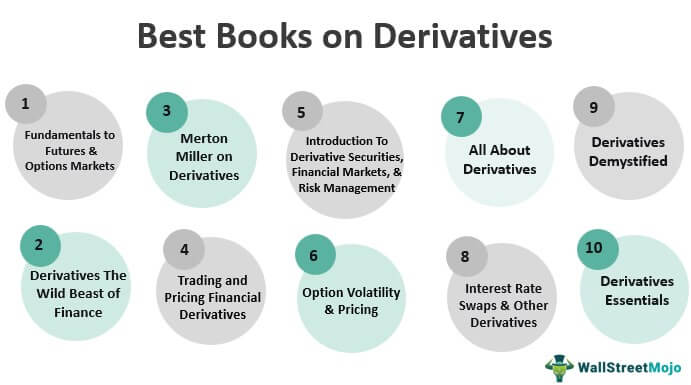

List of Top 10 Best Derivatives Books [2025]

Derivatives are financial instruments whose value depends on underlying assets such as stocks, bonds, and other traditional securities. Below is the list of top books on derivatives:

- John Hull’s – Fundamentals of Futures and Options Market ( Get this book )

- Derivatives The Wild Beast of Finance ( Get this book )

- Merton Miller on Derivatives ( Get this book )

- Trading and Pricing Financial Derivatives ( Get this book )

- Introduction To Derivative Securities, Financial Markets, And Risk Management ( Get this book )

- Option Volatility & Pricing ( Get this book )

- All About Derivatives (All About Series) ( Get this book )

- Interest Rate Swaps and Other Derivatives ( Get this book )

- Derivatives Demystified ( Get this book )

- Derivatives Essentials ( Get this book )

Let us discuss each derivative book in detail, along with its key takeaways and reviews.

#1 - Fundamentals of Futures and Options Market

by John Hull (Author)

Book Review

- This best book on derivatives introduces finance students and the novice to the basic principles underlying derivatives. Then, it sets readers on the path to understanding more complex aspects of this specialized class of financial instruments.

- Most introductory works of this nature require a detailed understanding and mastery of mathematical concepts for evaluating and analyzing derivatives. However, this work is designed specifically for readers with little mathematical background to make the subject much more accessible.

- Some key areas covered in this work include the presentation of swaps, day count conventions discussions, scenario analysis, and value-at-risk, among others.

- Entry-level professionals, laypeople, and students would find this work valuable in acquiring a fundamental knowledge of futures, options, and other derivatives.

Best Takeaway from this Best Derivatives book

- Preparatory work on futures and options markets would help readers understand derivatives, including their evaluation and analysis.

- Usually, detailed knowledge of relevant mathematical concepts is necessary for understanding the complex nature of derivative instruments. However, this work skillfully presents the concepts for those with little mathematical understanding.

- It enhances the value of this work as an introductory guide to derivatives markets.

- A highly acclaimed work on the fundamentals of derivatives for students and seasoned professionals.

#2 - Derivatives The Wild Beast of Finance

A Path to Effective Globalisation? 1st Edition by Alfred Steinherr (Author)

Book Review

- This top derivatives book attempts to portray derivatives markets in their true global perspective and analyze their impact on the future of the financial world.

- First published in 1998, this work carried predictions about the implications of the then prevailing conditions in derivatives markets on global financial markets, and his foresight proved correct.

- His fundamental fear was related to the lack of adequate risk assessment and management in the derivatives markets and how it could destabilize the financial markets.

- Indeed, the risk value has slowly been realized in the global context for the past decades and is of great value to the involved corporations and investors.

- What makes the current edition special is that the author has taken special care to enhance the work's readability and reassessed current market conditions for interested readers.

- An eye-opening read for those versed in the concepts and principles that drive the derivatives markets and the element of risk in these and other financial markets.

Best Takeaway from this Top derivatives book

- Significant work on the future of risk management in derivatives markets and what it means for the rest of the financial world.

- The author brings his erudition to work while explaining some of the most complex concepts related to derivatives and their functioning while analyzing the derivatives market without invoking many technical details.

- In the current edition, he shares his thoughts on how derivatives markets and the element of risk might shape the future of the global economy.

- This a highly recommended read for professionals and erudite readers interested in financial issues with wide-ranging implications.

#3 - Merton Miller on Derivatives

by Merton H. Miller (Author)

Book Review

- This best derivatives book is a collection of essays by Nobel laureate Merton Miller, which addresses several critical issues related to derivatives.

- For a long time, the industry has viewed derivatives with skepticism and is often treated as a mystery. Still, Miller does an excellent job of demystifying derivatives for his readers with a flair.

- He offers a rare and critical insight into the exciting world of derivatives, which has revolutionized the financial world and brings out the real value of derivatives' ineffective financial risk management and price discovery.

- He offers an objective evaluation of financial disasters, including Procter & Gamble, Orange County, and Barings Bank, for which derivatives are usually held responsible.

- He argues against derivatives being perceived as fraught with risks and how they have been of great help in hedging against risk. If anything, the 'derivatives revolution' has made managing risk much easier.

- In short, an eye-opening treatise on much-misunderstood derivatives and how they have proved to be a beneficial instrument instead of a malignant one.

Best Takeaway from this Best book on Derivatives

- A masterful work on derivatives, essentially featuring a collection of essays by Nobel laureate Merton Miller, dispels several common myths and misconceptions about this unique class of financial instruments.

- Miller has analyzed several financial disasters as well thought to have been caused by derivatives and demonstrates how derivatives have instead helped manage financial risk better.

- He presents a strong case for the derivatives revolution, having helped improve financial risk management by helping hedge against financial risk.

- This a highly recommended read on derivatives for professionals, amateurs, and anyone with an academic interest in derivatives.

#4 - Trading and Pricing Financial Derivatives

A Guide to Futures, Options, and Swaps

by Patrick Boyle and Jesse McDougall

The book will introduce you to derivatives, such as futures, options, and swaps. It is a handy book on derivatives trading used as a textbook for undergraduate and graduate courses.

Book Review

Although this book was published and used as a textbook at the University of London, England, it is equally suitable for both beginners and those with intermediate knowledge. The best part about this book is that it doesn't require advanced mathematical knowledge as it attempts to explain each concept as clearly as possible. The authors have used their years of experience in the financial markets, as investment bankers and hedge fund managers, making the book very informative yet easy to understand. One should recommend this book to everyone interested in derivatives.

Best takeaway from this book

- It is suitable for both beginners and people with intermediate knowledge of derivatives.

- It can serve as a good starting point for candidates who want to pursue the career of a quantitative analyst.

- It is a straightforward and well-structured book that explains all financial derivative concepts with the help of great examples.

#5 - Introduction To Derivative Securities, Financial Markets, And Risk Management

by Robert A. Jarrow, Arkadev Chatterjea

As the name suggests, this book introduces you to various derivatives, financial markets, and risk management concepts.

Book Review

This book is quite different (in a pleasant way) from the others available in the market owing to the simplicity of the explanations provided. You will find a great mix of theory and practical aspects of derivatives trading, backed by meticulous examples referencing relevant case studies. It is highly inspired by what happens in the financial markets. If you are an instructor or tutor, the book can greatly help you. It comes with worked-out solutions to problem sets and illustrative slides, which will significantly reduce your prep time without compromising students' learning experience.

Best takeaway from this book

- The level of Mathematics used is suitable for lower-division college students.

- The supplementary materials provided can greatly help the tutors who use them as course textbooks.

- The illustrations used in the book are closely related to the real markets.

#6 - Option Volatility & Pricing

Advanced Trading Strategies and Techniques

by Sheldon Natenberg

The book discusses the basics of option theory and explains how one can use it for identifying trading opportunities. It also covers a wide variety of advanced option trading strategies.

Book Review

This book is one of the most extensively read on options trading worldwide. It captures recent developments, focuses on volatility, and discusses market-appropriate option trading strategies. The book is written in clear and easy-to-understand language as it focuses on the key concepts of options trading. In addition, it is highly theoretical and is full of graphs and charts, which can be very useful for graduate students. In short, it demonstrates how you should approach the market and the options trading strategies from the perspective of a professional trader.

Best takeaway from this book

- It is one of the most informative books that concisely covers all aspects of options trading.

- It is well-written and appropriately explains how volatility affects pricing and trading options.

- It is not suitable for rookie options traders but is a must-read for intermediate-level options traders.

#7 - All About Derivatives (All about series)

Paperback – November 16, 2010 by Michael Durbin (Author)

Book Review

- This best derivatives book is an excellent introductory work on derivatives that presents the fundamental concepts related to derivatives with a rare degree of clarity using an uncomplicated approach for the benefit of the readers.

- This work covers a lot of groundwork on various derivatives contracts, including forwards, futures, swaps, and options, along with critical concepts such as cost of carrying, settlement, valuation, and payoff.

- The author also provides information on pricing methods and the mathematics employed for determining fair value. Other topics include several hedging strategies one can utilize to manage various risks.

- This work makes complex concepts on derivatives highly accessible to the readers. In addition, it helps them acquire knowledge of basic tools and techniques for trading and hedging with derivatives to manage risks better.

Best Takeaway from this best book on Derivatives

- A concise introduction to derivatives, including information on the types of derivative contracts available and techniques for trading and hedging in this unique class of financial instruments with a high degree of success.

- One of the best things about this work is the clarity with which complex concepts are explained, which makes this work a useful guide for any beginner.

- A must-read for students, professionals as well as professional traders.

#8 - Interest Rate Swaps and Other Derivatives

(Columbia Business School Publishing) Hardcover – August 28, 2012, by Howard Corb (Author)

Book Review

- This top derivatives book focuses on developing an understanding of interest rate swaps and other derivatives and attempts to bring out their real significance as efficient risk management tools.

- These derivative instruments have also explored trading opportunities that might otherwise be available in the market.

- The author presents some basic concepts related to interest rate swaps and records how several derivatives trace their evolution to them.

- It is a commendable effort to present some complex ideas related to derivatives in a conversational style, which makes it an ideal textbook for students. Furthermore, he dwells on financial structuring, which helps understand derivatives and can also help deconstruct derivatives and analyze them effectively.

- This work covers several common applications of derivative trading strategies, the necessary mathematics, and the useful variables employed. It is outstanding work for students and laypeople to help acquire a basic understanding of derivatives.

Best Takeaway from this best derivatives book

- A focused guide on interest rate swaps and other derivatives offers useful information on these derivatives and common trading strategies for derivatives and their applications.

- The author explains how traders can take advantage of unique trading opportunities in the derivatives market, which might be difficult to locate in conventional markets, and how to make the most of them.

- A highly conversational style adopted by the author makes the readers feel at home with relatively complex concepts.

- A commendable read meant to double up as a textbook for students and a reference work for professionals.

#9 - Derivatives Demystified

A Step-by-Step Guide to Forwards, Futures, Swaps, and Options- Kindle Edition by Andrew M. Chisholm (Author)

Book Review

- This ingenious volume in the Wiley Finance series presents a stepwise introduction to key derivative products and how one can utilize them for risk management and efficient trading.

- Without letting readers get entangled with the mathematics usually involved in any discussion on derivatives, the author helps them understand that despite numerous applications of derivatives, there are only a few basic building blocks, including forwards, futures, swaps, and options.

- He demonstrates how one can apply these building blocks to different markets to tackle risk-related issues and trading problems.

- In the current edition, details of the use and misuse of derivatives in the 2008 credit crisis are also included, along with an additional chapter dedicated to regulating and controlling derivatives, commodity derivatives, credit derivatives, and other products.

- A complete treatise on the inside out of derivatives meant for amateurs, students, professionals, and academically-oriented readers.

Best Takeaway from this top derivatives book

- An indispensable guide to understanding derivatives without getting stuck in complex mathematical concepts.

- Basic derivatives and their utility are explained in detail, along with their application in different markets to take advantage of unique trading and hedging opportunities.

- The author also discusses the critical role of derivatives in the 2008 credit crisis before focusing on the regulatory framework for derivatives, which plays a crucial role in shaping the future of the derivatives market.

- In short, a power-packed guide on derivatives and their applications for students and seasoned professionals.

#10 - Derivatives Essentials

An Introduction to Forwards, Futures, Options and Swaps (Wiley Finance) by Aron Gottesman

Book Review

- Living up to its title, this best book on derivatives focuses on the essentials of derivatives. It provides information of great practical utility on trading terms and conventions, pricing methodologies, and derivative instruments' valuation.

- Practical trading strategies and techniques are provided for types of derivatives, including forwards, futures, swaps, options, and other products.

- This work is to help readers become acquainted with the fundamentals of derivatives while including the bare essentials of mathematics and laying greater stress on practical applications of these concepts instead.

- It is structured to help develop a greater understanding of the 'behavior' of various derivative instruments. It invests an individual with the power to make informed decisions and devise novel trading strategies personalized to their specific needs and preferences.

- Trading strategies and techniques are illustrated with the help of practical examples to help readers develop a practical understanding and confidence in their abilities to trade in derivatives.

Best Takeaway from this top book on derivatives

- A straightforward, practical guide covers the theory and practice of derivatives trading and hedging while creating a deeper understanding of the products to help readers make more informed decisions.

- An uncluttered approach is adopted to keep things as simple as possible and explain the fundamentals and their application without getting caught up in the mathematics involved.

- These things make it a highly accessible work for anyone interested in developing a broad-based understanding of the subject.

- In short, a well-structured guide to trade in derivatives with a more intimate understanding of each derivative product offers a unique advantage to the reader.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com