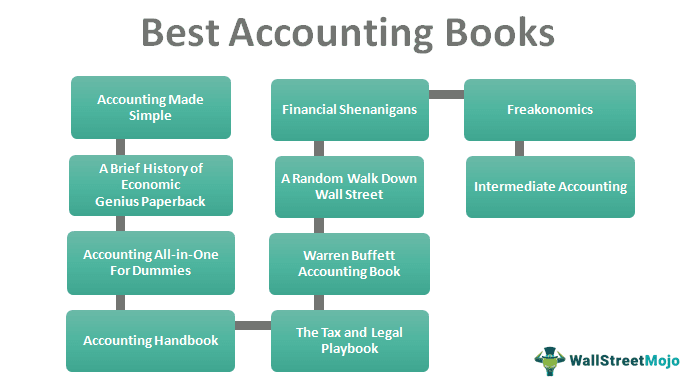

List of Best Accounting Books [2025]

Accounting books are the different books having information about accounting, types of accounting, ways to do accounting, and the other related concepts. Below is the list of such books on accounting that you must read in 2025 –

- Accounting Made Simple: Accounting Explained in 100 Pages or Less ( Get this book )

- A Brief History of Economic Genius Paperback ( Get this book )

- Accounting All-in-One For Dummies ( Get this book )

- Accounting Handbook (Barron's Accounting Handbook) ( Get this book )

- The Tax and Legal Playbook: Game-Changing Solutions to Your Small ( Get this book )

- Warren Buffett Accounting Book: Reading Financial Statements for Value Investing Buffett Book Edition ( Get this book )

- A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing ( Get this book )

- Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports ( Get this book )

- Freakonomics: A Rogue Economist Explores the Hidden Side of Everything Paperback ( Get this book )

- Intermediate Accounting ( Get this book )

Let us discuss each accounting book in detail, along with its key takeaways and reviews.

#1 - Accounting Made Simple - Accounting Explained in 100 Pages or Less

by Mike Piper

The first baby step into the accounting world needs to be cautiously tread, considering you do not want to run away with fright with the in-depth details and heavy terminology. This accounting book by Piper keeps things straight and simple with practical and simple examples that help elucidate the concepts without the unnecessary jargon of the technicalities. The basic concepts of topics like Accounting Equation and their significance, reading and preparing financial statements, calculation, and interpretation of several different financial ratios, and the concepts and assumptions behind Generally Accepted Accounting Principles (GAAP) are explained sufficiently concisely. The accounting textbook is a quick read for the early beginners gripping them till the end and helping the novice refresh their concepts

#2 - A Brief History of Economic Genius Paperback

by Paul Strathern

History puts many off to sleep…zzzz and imagine if it is the history of numbers and theories, but we vouch that this accounting book won't make you fall off to sleep until you have read the last page of the book. Strathern writes history as if it is a piece of a lively picture. He uncovers the definite progression of mathematics and economic theory, from double-entry booking keeping to the discovery of standard deviation and the various applications of probability theory. Theories have been synchronized as a piece of beautiful music taking from Adam Smith and Hume; to the French Optimists and British Pessimists: Saint-Simon and Owen; Marx and Hegel; Pareto; Veblen; Schumpeter, Keynes, John Nash and finally back to von Neumann. Strathern condenses the broad history of the mathematical influence of every economist on the other, thereby shaping each of their theories by arriving at one another's conclusion. The author does a great job of putting this boring information in an interesting format and thereby providing a deep understanding of the subject through the men of history.

#3 - Accounting All-in-One For Dummies

by Kenneth Boyd (Author), Lita Epstein (Author), Mark P. Holtzman (Author), Frimette Kass-Shraibman (Author), Maire Loughran (Author), Vijay S. Sampath (Author), John A. Tracy (Author), Tage C. Tracy (Author), Jill Gilbert Welytok (Author)

A one-stop solution for all the problems is the easiest answer to many of our issues. How about solving all your accounting problems in one go? Accounting All-in-one for Dummies is the right reference in this regard. The book provides a speed cruise of all accounting topics, from the basics of debits and credits to more complex issues like amortization and regulation. The text is written and a very easy read. The book also covers ways to report on financial statements, make savvy business decisions, audit, and detect financial fraud. All this is made easy with simple examples and small business scenarios. This accounting textbook is a good investment for the future by any accounting professional, M.B.A. student, or small business for a quick reference.

Besides books, individuals can take the help of this Basic Accounting Certification Course to develop detailed knowledge of accounting fundamentals. The self-paced program provides a practical understanding of financial statements, assets, liabilities, and other key concepts via real-world examples.

#4 - Accounting Handbook (Barron's Accounting Handbook)

by Jae K. Shim Ph.D. (Author), Joel G. Siegel Ph.D. CPA (Author), Nick Dauber MS CPA (Author), Anique A. Qureshi Ph.D. CPA (Author)

When you have a book written by so many C.P.A. holders, it is worth checking out for the sheer generosity of the task completed by them. But this book is worth treasuring, considering the innumerable requirements that it meets in accounting. The authors have very carefully penned down the details of financial accounting and painstakingly described every element of financial statements with details on financial reporting requirements and compliance and U.S.U.S. GAAP (Generally Accepted Accounting Principles) and IFRS International Financial Reporting Standards. Chapters are also dedicated to covering cost management and tax forms and their preparation. This book is an extensive A-to-Z dictionary of accounting terms, short-entry definitions of everything from Abacus to Z score.

#5 - The Tax and Legal Playbook: Game-Changing Solutions to Your Small

by Mark J. Kohler

Accounting is so tough and combines it with tax, a cocktail of two dangerous subjects. But Kohler handles both accounting and tax issues funny, throwing the seriousness completely out of the window. Small business owners often get so dogged by the complexities of the legal entities that they often miss out on their product, spelling doom for them in the long run. Kohler, an expert on the matter of accounting and tax, delivers outstanding content to help people save their time and money. The book answers legal questions by baring open the naked truth allowing you to make better decisions to protect your assets. Kohler does a great job by providing real-life examples, ultimately taking out the fear of the commoner from the idea of tax and accounting as a complex world of bizarre and intimidating instructions. The book is a great guide for tax planning and tax-saving strategies. With every page you unfold, this accounting book will make you wiser and equipped to handle the difficult situations of tax saving and planning. Read this informative book to raise your tax I.Q.I.Q. Quotient.

#6 - Warren Buffett Accounting Book: Reading Financial Statements for Value Investing Buffett Book Edition

by Stig Brodersen (Author), Preston Pysh (Author)

Accounting is incomplete without the musing of investing. The complex terms and heavy financial concepts can put off anybody, but this book will put you through the entire nitty-gritty of investing without the usual boredom. The book aims to enlighten investing professionals who have just set their foot in this industry. It is a treasure trove, as the book is to the point in explaining the requirements to analyze financial statements. There is no beating around the bush or unnecessary examples that will bog you down. It's a textbook on investing that every fresher should invest in for his successful career in this profession. The authors have done an excellent job in providing a perfect link to the various financial statements' various metrics and explain thoroughly why certain metrics are used and what they represent in real-world terms. It is great learning to analyze companies and when to buy and sell the stock.

#7 - A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing

by Burton G. Malkiel (Author)

A book by a Princeton economist is sure to make heads turn, and if it is the celebrated Burton Malkiel, students cannot resist the inclination to grab a copy of his book. Written in 1973, this book is an established guide for all fresher, novice, or entrepreneurs. Written in a simple and engaging style, this book packs the idea of indexing in the stock market's risk-taking and unpredictable world. The book advises lucidly and does a great job of combining the stock market funds' theoretical and practical. The eleventh edition of the book adds fresh material on exchange-traded funds and investment opportunities in emerging markets, a brand-new chapter on "smart beta" funds, the newest marketing gimmick of the investment management industry, and a new supplement that tackles the increasingly complex world of derivatives. This book is a great source of fundamentals and is recommended for anybody looking for advice on managing his money.

#8 - Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports

by Howard Schilit (Author), Jeremy Perler (Author)

The book's name itself is enough to ignite your curiosity and go through it. It almost sounds like a detective story, and no wonder Business Week awards them the title "from the Sherlock Holmes of Accounting." The book is an investment for financial professionals and laypeople to understand the gimmicks played by master head company makers to trick the investors. It is the Bible of detecting accounting frauds, allowing you to assimilate information on the tricks played by corporate bigwigs, exposing the deceptive levels of accounting involved, and preparing you to be ready to detect such frauds early on to avoid financial losses in the future. This financial accounting book equips you to deal with

- Earnings Manipulation Shenanigans: Learn the latest tricks companies use to exaggerate revenue and earnings.

- Cash Flow Shenanigans: Discover new techniques devised by management that allow it to manipulate cash flow as easily as earnings.

- Key Metrics Shenanigans: See how companies use misleading "key" metrics to fool investors about their financial performance.

The authors shed light on all the informative details by revealing the global market's most shocking frauds and financial miscreants.

#10 - Intermediate Accounting

by Donald E. Kieso (Author), Jerry J. Weygandt (Author), Terry D. Warfield (Author)

An excellent reference for established accountants, the author invariably handles every accounting topic as a teaching lesson rather than a gospel being imparted for learning. Kieso very efficiently dwells on simple accounting programs like Excel, G.L.S., and other computerized accounting software, giving them a strong background in the tools needed in the accounting profession. Intermediate Accounting is the perfect guide to providing the tools needed to understand what GAAP is and how it is applied in practice. The text also includes a new way of looking at GAAP, Convergence of U.S.U.S. GAAP and IFRS, and the Fair Value Movement. The core of Kelso's value statement continues to be authoritativeness and preparation for the profession (C.P.A. exam). The book on accounting and finance provides tips and example problems and shows you how to break them down step by step. It is a comprehensive guide and a must-have for every accounting student.

The above summarizes the top ten accounting books that we think are a great treasure trove of knowledge. Of course, students' and professionals' opinions can vary because each individual has their favorites, and there are countless books on accounting, so delve into each personally to enrich your knowledge. Consider spending time with these! All the best in your reading.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com