Table of contents

What Are Box IPO Risk Factors?

The Box IPO Risk Factors explain the process and the decision involved in going public through the issue of Initial Public Offer (IPO). Box is a provider of cloud storage facilities that helps manage data in a secure and durable manner and makes them accessible over the internet.

On 24th March 2014, Online storage company Box filed for an IPO and unveiled its plans to raise US$250 million. The company is in a race to build the largest cloud storage platform, and it competes with larger companies like Google Inc and its rival, Dropbox.

Box IPO Risk Factors Explained

This article will explain in detail the various risk factors that were involved in the IPO of the cloud storage entity Box, in 2015. After the decision to cancel the idea of going public in 2014, its founders finally decided to go ahead with the process and make its place in the financial market. This IPO happened to be the first one from the US technology sector during that year.

Box, which is based in Redwood City, California, has been a pioneer in developing and selling tools for content management and file-sharing, which are totally cloud-based and can be used by corporates. The company was founded by Aaron Lavie and Dylan Smith in 2005. Initially experimenting with retail consumers, the founders decided to explore the demand for their products in the corporate sector.

It managed to get quite a good amount of funding from different sources since the business easily got the attention of millions of users, and the revenue multiplied exponentially. Its demand and revenue levels made it easy for the company to get funds. Finally, it decided to raise funds through a public offer and turned into a public company on January 23, 2015, on the New York Stock Exchange.

Through the offer, Box successfully raised $175 million, with plans to use the money in various areas of the business, including marketing and sales, product upgradation and development, growth and expansion, etc. This would lead to an increase in its financial stability and flexibility.

However, investors should note at this point that even though the company recorded an impressive revenue level, it faced a loss in its after-tax figures amounting to $121.5 million. Even the stock market was in a fluctuating mode every day during that year, showing high volatility and increasing pressure on the IPO process and expectations. In this article, we will study the different grey areas that an investor could have possibly noticed in the company’s financials and overall performance, which would lead to a not-so-positive outlook regarding the IPO process.

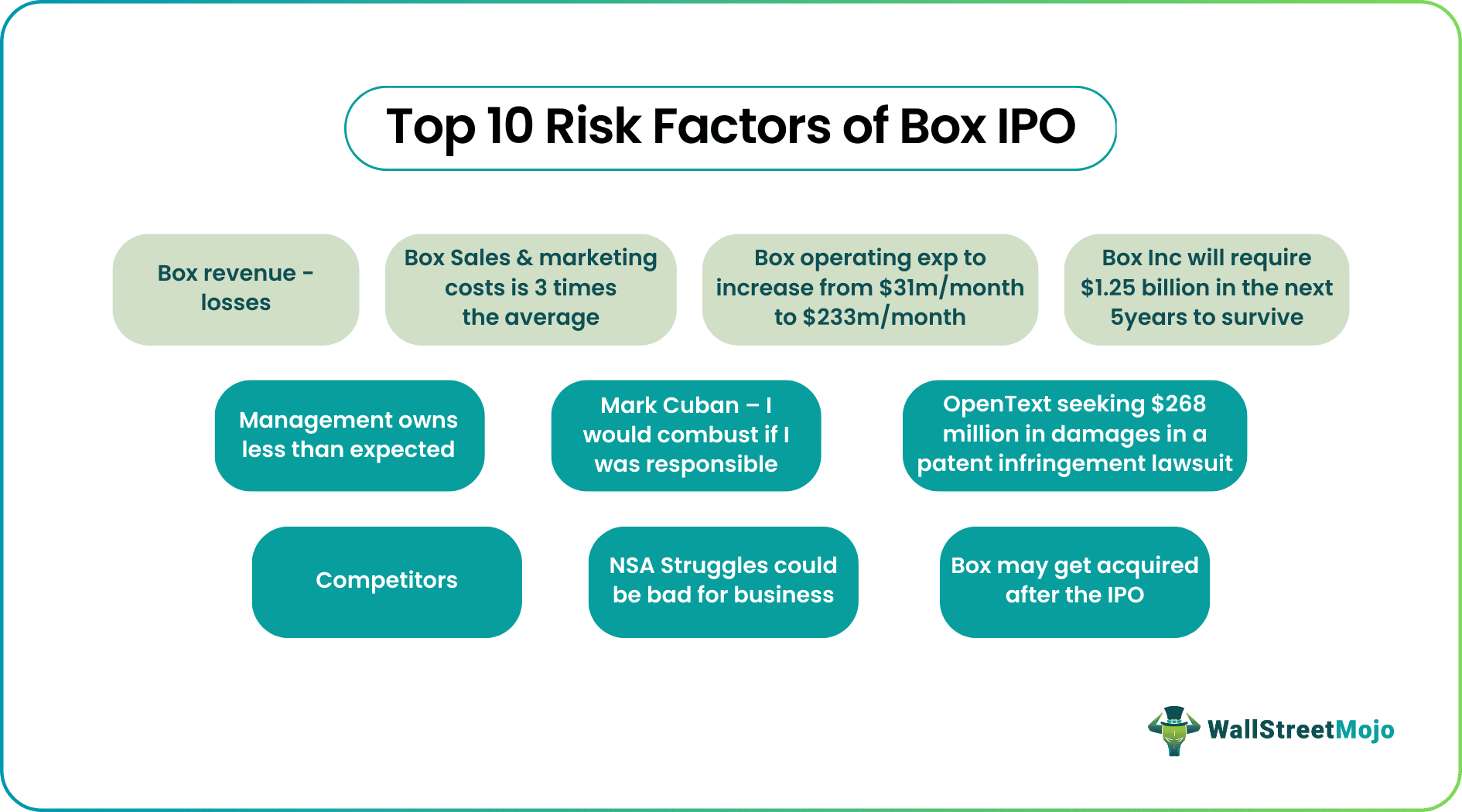

Top 10 Risk Factors

I quickly browsed through Box S1 Filing, and when I was hoping to see a Cool Blue Box, it turned out to be a diffused “Black Box.” I also prepared a quick and dirty Box Financial Model to assess the gravity of the situation further and realized that Box Financials were full of horror stories.

The risk Factor also mentioned in the Prospectus of Box Inc scares me even further.

We do not expect to be profitable for the foreseeable future

If you are planning to invest in Box, you may also want to read Box IPO – To Buy or Not to Buy?

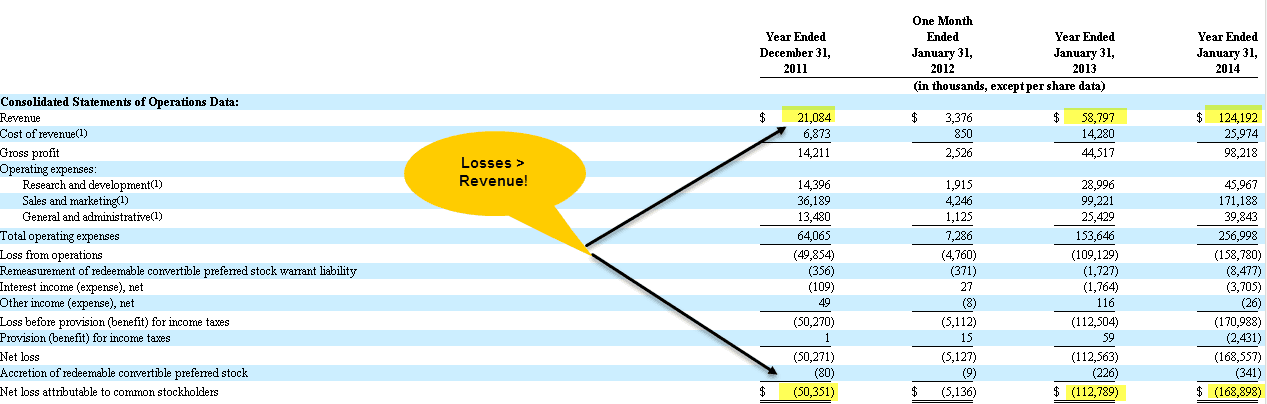

#1 OMG – Box Revenue <<< Losses!

- Box’s top line growth trend of more than 100% each year, which I believe is very impressive. However, the bottom line is in a real mess. I initially thought it was a typo, but realized soon that Box revenues were significantly less than losses.

- Revenue of $124 million vs. Net Loss of $168 million looks a bit scary.

- Further adding to the woes, Box has an accumulated deficit of $361 million.

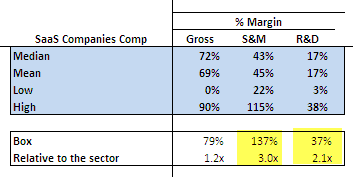

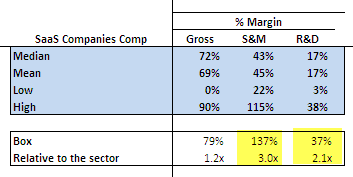

#2 Box Sales & Marketing Costs is three times the average

- The highest cost is the Sales and Marketing costs, which at $171 million, grew by nearly 73% y-o-y.

- Box has maintained an aggressive pace of expanding into several vertical industries, and it is unlikely to come by significantly over the next couple of years.

- The average Sales & Marketing (S&M) costs are approx. 45% of Revenue for the SaaS companies.

- However, Box’s S&M costs are 137% of Revenue, representing three times the SaaS companies (this makes me nervous!)

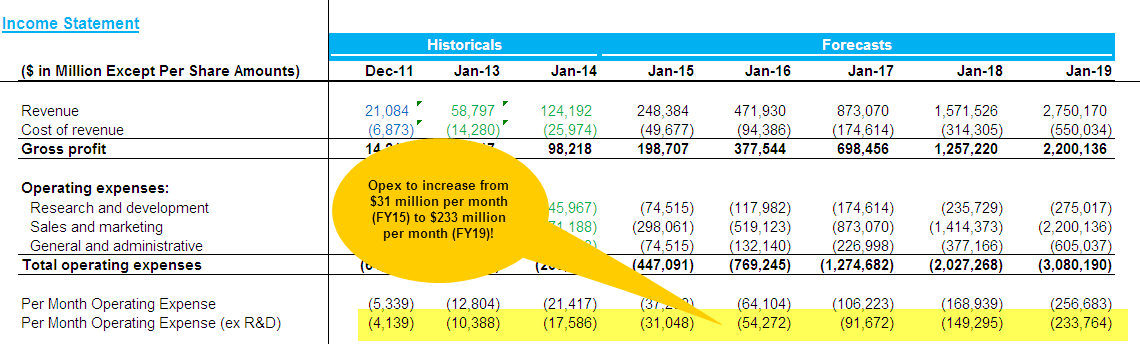

#3 – Box operating exp to increase from $31m/month to $233m/month (yes, it is per month!)

- The company recorded operating expenses of $257 million in FY2014, which is approximately $21.5 million per month.

- Even if we remove the R&D expenses, the per month expenditure will be $17.5 million per month.

- Also, note that operating expenses disproportionately increase every year, and it increases from $31 million per month in FY2015 to $233 million per month in FY2019!

Want to become a Ratio Analysis Pro, then have a look at this step by step detailed Ratio analysis case study in Excel

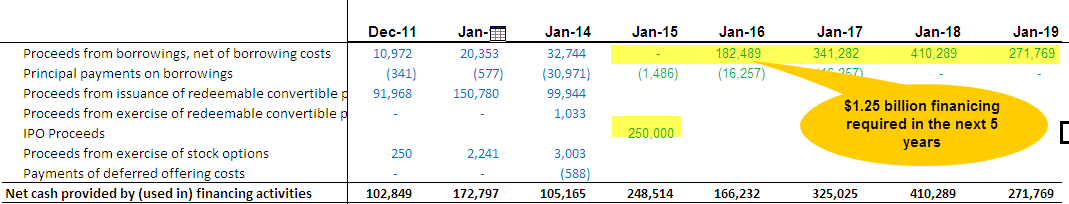

#4 – Box Inc will require $1.25 billion in the next five years to survive

Box Inc will require $1.25 billion in the next five years to survive

- Box had only $108 million in cash and cash equivalents, and this was due to late year-end funding of $100 million. It looks like Box received this funding in just a nick of time!

- It can be seen from the Box Financial Model that $250 million would last a little less than a year at its current cash burn rate. You can learn more about Enterprise Valuations of the Box here.

- I note in Box Inc Financial model template that they would require another $1 billion if they wish to “survive” for the next five years!

- I have assumed that they would raise debt; however, private investments can also be a reasonable option to look at.

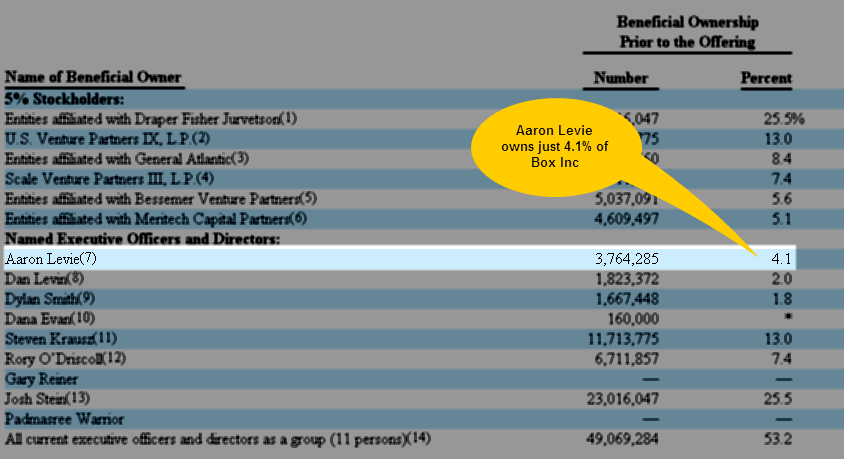

#5 – Management Owns Less than Expected

- Aaron Levie owns only 4.1% of Box Inc (vesting portion); however, if additional grants that he got are included, his stake is closer to 6%. With such a small stake in Box, the founder’s interest and the company’s interest may not be aligned. To put things into perspective, you may note that post-Facebook IPO, Mark Zuckerberg owned 22% of Facebook.

#6 – Mark Cuban – I would combust if I were responsible…

Mark Cuban, the billionaire investor, and entrepreneur, was one of the first angel investors in 2005. However, a change in strategy by the company led him to sell his stake in about a year. He may have missed the gains that his investment would have made. However, Cuban seems unperturbed and warns investors with his tweet on 25th March 2014.

I wish @BoxHQ the best but I would combust if 8 years in I was responsible for $169mm in losses against less revs.I hope IPO gets them going

#7 – OpenText seeking $268 million in damages in a patent infringement lawsuit

On 30th March 2014, OpenText, Canada-based largest software company that distributes Enterprise Information Management software, filed a patent infringement suit against Box asserting that Box infringes 200 claims across 12 patents in 3 different patent families. Open Text is seeking preliminary and permanent injunctions halting the sale of Box’s products, as well as damages exceeding $268 million. Compare this number with $250 million Box Inc is raising through IPO!

#8 – Competitors

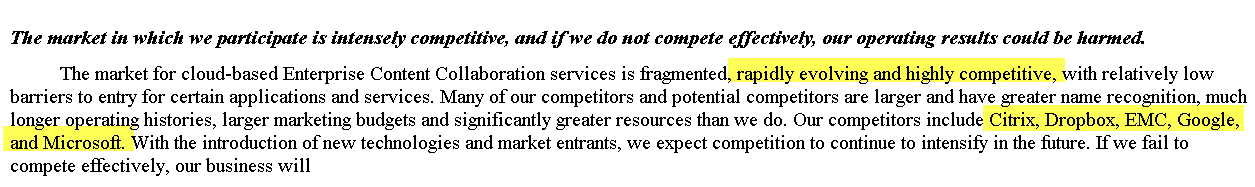

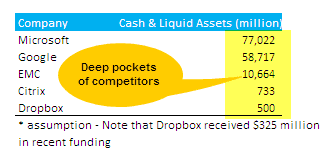

The market for cloud-based Enterprise Content Collaboration is competitive and fragmented. Though this segment is rapidly evolving, Box Inc acknowledged Citrix, Dropbox, EMC, Google, and Microsoft as competitors.

A look at the competitor’s balance sheet provides a glimpse of how deep-pocketed these companies are and how competitive the business environment may get going forward.

#9 – NSA Struggles could be bad for business

- National Security Agency (NSA) intelligence gathering tactics may scare international businesses from working with US-based technology companies.

- Essentially when the core business lies on data sharing and collaboration, it becomes even more problematic as data security becomes a question mark for an international firm.

- Aaron Levie suggested that if this occurs, then as a cloud provider, they have to build a business country by country with entirely different operations and facilities and services.

- Levis acknowledged that this would curtail the ability to go international, and Box Inc may lose out on an opportunity in the growing cloud market.

#10 – Box may get acquired after the IPO

The Box needs to raise around $1.25 billion in the next five years. IPO of 250 million would contribute only 20% of the overall fund requirement. However, the company may have to arrange for funds to the extent of $1 billion. Either they can look for private funding or raising debt. Another option that cannot be denied is that Competitors with deep pockets may look at acquiring Box Inc. Box may have to oblige going forward as they may look for aggressive growth and consolidation beyond their core capabilities.

Thus, the above details give us a wide view of the possibility of the IPO going wrong and how it would affect the working of the company along with its growth. Its huge loss amount was due to exorbitant burning of cash for the purpose of sales and marketing, giving the superficial idea of its ability to reach out and advertise its products using big spending amount, whereas the reality was that the spending ate up its profits. Even though it happened to be the fastest growth SaaS business during that year, there were enough reason to be concerned. All that was required was faith of investors that Box will tide over all its negative points and continue to grow.

If we look at the current scenario of the company, despite its high revenue, it needs to catch up in profitability. Even though it can grab a more significant market share and grow, its share price needs to allow it to do so. Thus, it is losing its place in the competitive market. Profits of the company have fallen by 23% since its IPO, even though the S&P index has shot up by 70%.

Next Steps?

Anything I missed? Let me know what you think, your feedback by Leaving a Comment