Table Of Contents

What Is Time Series Decomposition?

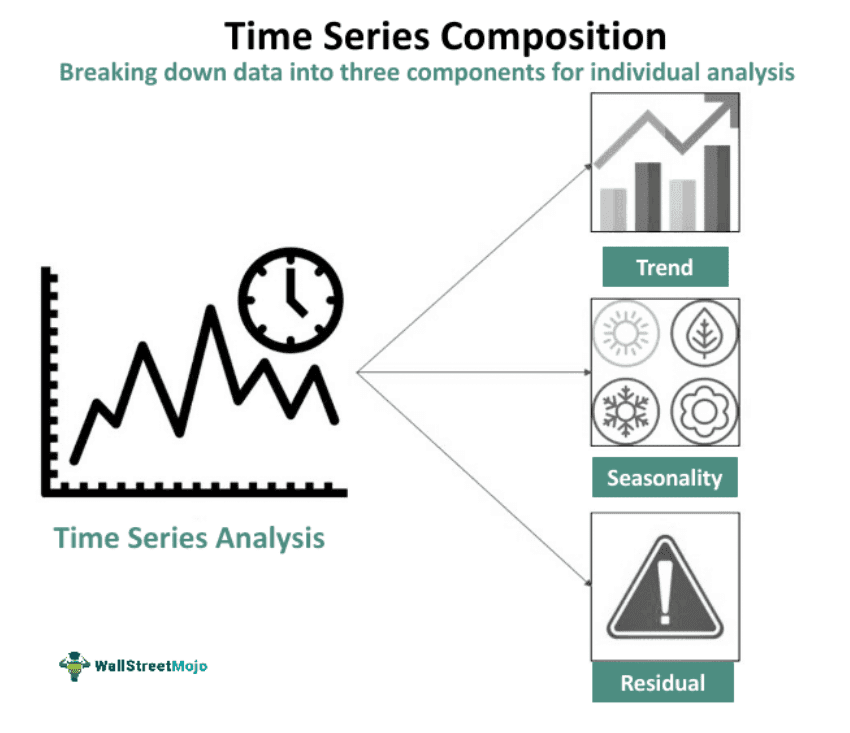

Time Series Decomposition refers to a statistical phenomenon employed to analyze time-based data by breaking it down into distinct components such as trend, seasonality, and residuals. It is a powerful method that facilitates the prediction of underlying patterns and the forecasting and modeling of future strategies.

This technique helps one to identify and separate the different types of variations that are present in a time series.

Interpreting these components collectively helps in understanding the historical trends, seasonal patterns, and noise within the time series data. The additive and multiplicative decomposition methods allow analysts to model the underlying patterns within a time series data set, distinguishing between long-term trends, repeating seasonal patterns, and random fluctuations, forecasting future values, identifying anomalies, and making data-driven decisions in various fields.

Key Takeaways

- Time series decomposition is a statistical measure that gauges the underlying patterns by separating the data into different components, including trend, seasonality, and noise.

- It is a valuable tool that allows businesses and researchers to make more informed decisions and predictions by understanding and analyzing structured time series data.

- Its effectiveness depends on the underlying pattern's regularity and complexity, outliers, and other external factors in the data.

- Some of the common types include Classical, Moving Average, STL, SEATS, and SSA Decomposition.

Time Series Decomposition Explained

Time series decomposition is a valuable technique used in various real-world applications to analyze and understand underlying patterns and trends within a dataset. In businesses, it facilitates demand forecasting for inventory management, predicting delivery times, and improving overall supply chain efficiency and production planning.

Even the retailers employ such methods to interpret sales data, identify seasonal patterns, and plan marketing and promotional activities accordingly. Moreover, analysts use decomposition to identify patterns in stock prices, currency exchange rates, and other financial metrics, aiding in investment decisions and risk management. It's a crucial tool for economists, analyzing economic indicators like Gross Domestic Product (GDP), inflation rates, and unemployment to study trends and make policy recommendations.

Marketers and social media analysts also apply time series decomposition forecasting to analyze user engagement, follower counts, and content trends on social media platforms, helping in crafting effective marketing strategies.

It is even used for energy consumption forecasting, climate and weather analysis, and healthcare planning. It serves as an effective technique due to its ability to segregate raw data into different components for better time-driven data analysis. It further enables anomaly detection, data visualization, and efficient forecasting of time series.

Limitations

However, there are limitations to this technique.

Its practical use depends on certain assumptions about the components, which can be compromised by changing dynamics and external factors.

A single extreme data point can distort the trend, leading to inaccurate decomposition and affecting the reliability of the components.

Standard decomposition methods may not accurately capture seasonal patterns if they are irregular or change over time.

For irregular or noisy data, decomposition may not offer meaningful insights, and alternative techniques might be more suitable.

Moreover, selecting appropriate parameter values, like the length of the seasonal period, in some decomposition methods can lead to accurate results.

Components

By breaking down a time series into the following components, analysts can gain valuable insights into the underlying patterns, enabling more accurate forecasts and predictions:

- Trend: This represents the long-term movement or general direction in which the data is increasing, decreasing, or stable over time. Trends can be upward, downward, or stable, and understanding them helps in identifying the overall trajectory of the data.

- Seasonality: Seasonality refers to the recurring pattern or fluctuations in the data that happen at regular intervals, such as daily, monthly, or yearly cycles. These patterns can be influenced by factors such as weather, holidays, or cultural events. Recognizing seasonal patterns is crucial for making predictions and understanding cyclic behaviors in the data.

- Residuals (Noise): Residuals are the remaining random variations or irregularities in the data once the trend and seasonal components have been extracted. They represent the noise or unpredictability in the time series and are valuable for assessing the overall variability in the data.

Types of Time Series Decomposition

- Additive Decomposition: It assumes that the time series is a sum of its components:

Time Series = Trend + Seasonality + Residual

It is best suited when seasonal fluctuations remain constant in magnitude over time, like the monthly temperature data with seasonal changes.

- Multiplicative Decomposition: The time series in multiplicative decomposition is expressed as the product of its components.

Time Series = Trend × Seasonality × Residual

Classical Decomposition: It breaks down a time series into three main components: trend, seasonality, and residual, assuming that the data can be expressed as an additive or multiplicative combination of these components.

- Moving Average (MA) Decomposition: In MA decomposition, the moving average is employed to assess the trend component of the time series. Hence, the original series is divided by the estimated trend to obtain the seasonally adjusted series.

- STL Decomposition: Seasonal and Trend decomposition using Loess is a robust method that facilitates time series decomposition in Python into seasonal, trend, and residual components using a process involving local regression (Loess). It is beneficial for handling nonlinear trends and irregular seasonal patterns.

- Singular Spectrum Analysis (SSA): It is a non-parametric spectral decomposition method that decomposes a time series into a sum of oscillatory components and noise. It is helpful for analyzing nonlinear and non-stationary time series data.

- SEATS Decomposition: Seasonal Extraction in ARIMA Time Series is a seasonal adjustment method that uses an Autoregressive Integrated Moving Average (ARIMA) model to evaluate the seasonal and trend components of a time series.

Formula

The concept involves breaking down a time series into its fundamental components: trend, seasonality, and noise (or residual). The formula for mathematical calculation of the Time Series Value at Time t (Yt) using the time series decomposition is as follows:

Methods include:

- Additive decomposition presents the time series as the sum of its components, and

- Multiplicative decomposition, which represents it as the product of its components.

Standard techniques used for the concept include moving averages, exponential smoothing, and Fourier analysis. By decomposing a time series, analysts can enhance their predictive abilities, identify trends, and comprehend the fundamental patterns present in the data.

Examples

Let us understand the use of decomposition techniques for time series analysis through the following examples.

Example #1

A raincoat manufacturing company estimates its sales increase for production planning based on the past ten years sales data during the rainy season. If the sales of raincoats show a consistent annual increase, such as a fixed amount of 1500 units, the manufacturer would opt for an additive model.

On the other hand, if the sales increase by a percentage value, like 15% every year, a multiplicative model would be suitable for analyzing the sales pattern. It is important to note that, in both cases, the data is expected to exhibit a seasonal pattern.

The choice between an additive and multiplicative model depends on whether the seasonality is best represented as a fixed amount added to the trend (additive) or as a percentage of the trend (multiplicative).

Example #2

Consider a set of monthly stock price data as follows:

| Month | Stock Price ($) |

|---|---|

| January 2020 | 100 |

| February 2020 | 110 |

| March 2020 | 120 |

| Total | 330 |

The overall average is $120, and the moving average for January over the last five years is $105.

Employing a 3-month moving average to smooth out fluctuations and identify the trend:

- Calculate the average for each quarter (3 months):

- Calculating the seasonal index for January:

- Calculating Detrended and Deseasonalized Series for January 2020:

100−114.29 = −14.29

Thus, for January 2020, the time series analysis shows an expected fall of $14.29 in stock prices.