Table Of Contents

What Is Thin Capitalization?

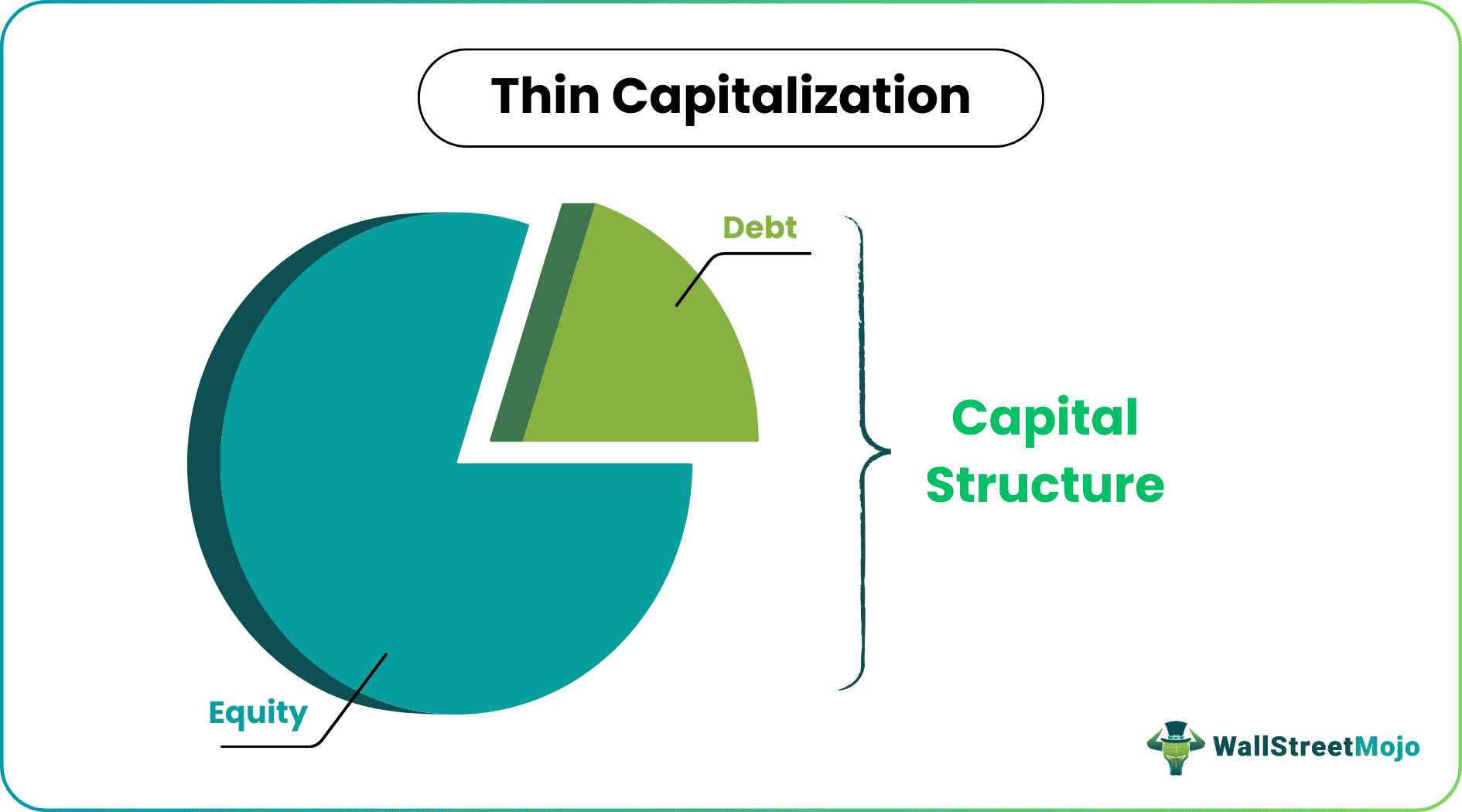

Thin capitalization is a tax term that refers to a situation in which a company has a high level of debt and relatively low equity. The concept aims to portray a company with a financial structure heavily skewed towards debt financing instead of equity financing.

The essence of thin capitalization is to limit the interest expense a company can claim as a deduction for tax purposes. This limitation typically takes the form of a debt-to-equity ratio, which sets a maximum threshold for the level of debt financing that a company can have relative to its equity. If a company exceeds this threshold, its interest expense will be disallowed or subject to certain restrictions, resulting in a higher tax liability.

Key Takeaways

- Thin capitalization refers to a highly leveraged capital structure where a company's debt exceeds its equity.

- US companies with a debt-to-equity ratio greater than 1.5:1 or 60% are considered thinly capitalized.

- Companies operating in countries with high tax rates often use thin capitalization to avoid taxes by claiming interest deductions from their taxable income.

- Multinational companies use debt financing to shift profits to their affiliates in other countries, resulting in high-interest income.

Thin Capitalization Explained

Thin capitalization refers to a capital structure where a company raises a significant portion of its capital through debt financing instead of equity financing. This makes such companies highly leveraged and reliant on external sources of capital rather than internal capital. As a result, some companies may have a debt-to-equity ratio as high as 3:1, which indicates a high-risk position.

Since interest on loans is deductible from a business's taxable income, while dividends have no such relaxation, multinational corporations (MNCs) often seek such an imbalanced capital structure under a debt-shifting strategy to avoid taxation. In this strategy, the parent company extends loans to its subsidiaries with high tax rates in other countries, shifting their profits and minimizing taxes.

Rules

Thin capitalization rules are an effective tool for preventing tax base erosion and profit shifting, as they discourage companies from using debt financing solely for tax reasons. The rules prevent multinational corporations from using excessive debt to shift profits to low-tax countries and minimize their tax liability in higher-tax jurisdictions. Thin capitalization rules ensure that companies are financed in a way that reflects their economic substance rather than tax avoidance objectives.

The importance of thin capitalization lies in its ability to prevent multinational corporations from artificially shifting profits to low-tax jurisdictions. By limiting the tax benefits of excessive debt financing, thin capitalization rules help companies pay their fair share of taxes in the countries where they operate. Thin capitalization rules are widely used worldwide and important to many countries tax systems. In practice, thin capitalization rules can be complex and difficult to enforce, and they require careful design and implementation to avoid unintended consequences.

As companies have been using thin capitalization for tax avoidance, tax authorities in various countries have introduced thin capitalization rules (TCRs) to discourage such practices. These rules limit tax deductions for interest on loans up to a certain debt level. There are two different ways to apply the TCRs, as discussed below:

- The "Arm's Length" Principle: Under this principle, there is a maximum debt amount beyond which companies cannot claim interest payment deductions from taxable income.

- The "Ratio" Approach: This approach sets a maximum interest amount allowed for a tax deduction based on the ratio of interest to another variable.

How To Calculate?

To determine if a company is thinly capitalized, the financial leverage position of the business entity needs to be evaluated. If the debt-to-equity ratio is more than 1.5:1, the company is considered thinly capitalized. The debt-to-equity ratio of a company can be calculated using the following formula:

Debt-to-Equity Ratio = Total Liabilities / Total Shareholders' Equity

The IRS examines whether a company is an affiliate of a large multinational corporation and if the parent company is highly leveraging it. If so, it could be a profit shifting by the parent company to its affiliate to save the latter from high tax liability.

Examples

Let us now understand this concept with the help of the following examples:

Example #1

Let's say Company Soylent Corp. is a multinational corporation that operates in two countries, Country X and Country Y. It has a subsidiary in Country X and a subsidiary in Country Y. It's subsidiary in Country X has borrowed a significant amount of money from Company Soylent Corp. subsidiary in Country Y.

If the company Soylent's subsidiary in Country X has a high level of debt relative to its equity, it could be considered thinly capitalized. This means that the subsidiary uses excessive debt financing to shift profits to Country Y, where the tax rate is lower, and minimize its tax liability in Country X, where the tax rate is higher.

To prevent this tax avoidance, Country X may introduce thin capitalization rules that limit the tax deductions for interest on loans up to a certain debt level. This would make it less attractive for Company A's subsidiary in Country X to rely heavily on debt financing. Instead, it would need to consider using more equity financing to fund its operations in Country X.

Example #2

Large multinational companies use tax havens and thin capitalization to avoid paying taxes. Such companies use a high level of debt to finance operations in high-tax countries and then shift profits to low-tax countries where the debt can be offset against profits. This practice has become a contentious issue as governments struggle to balance their budgets and face public pressure to ensure that large companies pay their fair share of taxes.

According to Her Majesty's Revenue and Customs (HMRC), the amount of tax being investigated from large businesses about transfer pricing and thin capitalization increased from £680 million at the end of March 2011 to £1 billion by July 31, 2012. This suggests that more and more large businesses are scrutinized for their tax practices and that authorities are focusing on transfer pricing and thin capitalization to ensure that companies pay their fair share of taxes on debt financing and encourages them to consider using more equity financing to fund their operations.