Table of Contents

What Is Thematic Investing?

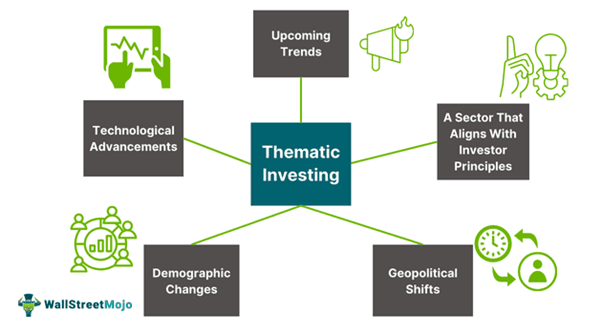

Thematic investing is an investment approach that invests in future trends and macroeconomic factors that might impact specific companies or businesses in general. It is a top-down approach that considers factors such as interest rates. In addition to macroeconomic factors, a thematic investing strategy also considers geopolitical and technological trends. These trends have the potential to change industries and revolutionize their use.

It is considered similar to sector investing. However, thematic funds tend to cover a broader range of sectors and companies that are aligned with the fund's theme. For instance, if a healthcare-themed fund is curated, pharmaceutical companies, nursing homes, surgical material manufacturers, and health insurance companies can be grouped under the same fund.

Key Takeaways

- Thematic investing refers to a strategy that allows investors to park their funds in stocks or companies under a specific theme. This theme could be upcoming trends, technological developments, or geopolitical or demographic shifts.

- It allows investors to enhance the diversification in their portfolios and experience the financial gains of entering an investment early.

- Multiple sub-categories can be clubbed under a single theme. For instance, EVs, automobile companies, battery manufacturers, and companies providing wiring solutions can be under a single theme.

- It is vital to understand that if the themes do not perform as expected, the losses can also be significant. Therefore, investors must throw caution to the wind.

How Does Thematic Investing Work?

Thematic investing is an investment style that significantly influences future trends. It heavily relies on research concerning technological, macroeconomic, and geopolitical trends and their impact on businesses in general and specific companies.

Multiple short—and long-term trends shape an industry or a company's performance at any given point. Therefore, in the last few years, Exchange Traded Funds (ETFs) have been a relatively compelling way to invest in thematic investing.

If investors want to invest independently by eliminating another company or manager managing their funds, they can do so based on their beliefs and principles. For instance, for an environmental-conscious investor, investing in the Electric Vehicle (EV) sector could not only fulfill their investment goals but also help them stay in line with their principles.

One of the significant benefits of thematic investing ETFs is that they have a concentrated number of stocks per fund. This is precisely the opposite of mutual funds, where a fund can have anywhere between 50-80 stocks and focuses on diversification.

Different ETFs or thematic investing funds invest in a specific sector or index. For instance, SPY has the S&P500 as its underlying index, FINX invests in fintech companies, and ICLN gives investors exposure to renewable energy companies.

Investors can choose a group of stocks or an ETF that not only has a clear plan for years into the future but also aligns with their investment philosophy and principles.

Targeted Themes

Targeted themes can arise from factors such as demographics, technological advancement, or socioeconomic shifts. A few of the most popular targeted themes are:

- Artificial Intelligence: AI and machine learning have been significant areas of interest for businesses and investors alike. In the post-pandemic world, ML and AI have shown clear signs of being an undeniable force in the near future.

- Electronic Vehicles: With rising concerns around global carbon footprint and rising fuel prices, Electric Vehicles have been a fantastic solution. They have not only been an efficient way to reduce pollution but are also considered easy on the pocket in the long run.

- Blockchain: Blockchain and cryptocurrencies gained popularity during and after the pandemic. The decentralized way of conducting transactions has been met with mixed feelings. However, one thing remains certain: both crypto and blockchain technology are here to stay, and investors have shown their trust in them.

- Demographic Changes: Demographic changes also play a significant role in shaping the trends and investments in a particular region. For instance, India is said to have one of the youngest populations in the world. As a result, the sub-continent has experienced a hike in investors showing interest in their market.

- Renewable Energy: With concerns over using fossil fuels and the pollution associated with them at an all-time high, renewable energy has attracted more interest than ever. In the near future, solar and wind energy have clear prospects of playing crucial roles in fulfilling daily needs globally. Thus, sustainable thematic investing has also gained popularity.

How To Build A Thematic Portfolio?

The steps to build an efficient thematic strategy are:

- Themes & Categories: The foremost step is to find themes that align with the investor's beliefs or principles. These can also be innovative themes that are gaining popularity among the masses, themes that are already gaining popularity, or themes that show massive potential in the future.

- Research: Conducting due diligence on different themes and benchmarking them is a vital step in the process. Benchmarking against other assets gives investors a clear idea of the investment's viability.

- Decision: Based on the first two steps, investors can ascertain the themes that they are keen on investing. Now, depending on their investing sum and risk appetite, they can decide if they want to invest directly in stocks with the theme of investing through an ETF or mutual fund.

- Rebalancing: It is common practice to rebalance portfolios at regular intervals to balance risks and maximize returns. Rebalancing is even more necessary when introducing a new theme. Once the portfolio is rebalanced, it is optimized for the current market scenario.

Examples

Now that the theoretical aspects of sustainable thematic investing are established, it is time to address its practical applicability. The examples below illustrate the concept's real-life application.

Example #1

Ricky is a nature enthusiast who prefers to track his carbon footprint. Therefore, his family and close circle of friends regularly carpool, limit air travel, and cycle to work.

On Ricky’s 30th birthday celebration, he and his friends decided to invest in Electric Vehicles and related sectors such as wiring and batter-making companies. They believed that this sector was not only on the verge of exploding but also aligned with their principles.

Example #2

BlackRock is one of the most significant investment companies in the United States and the world. With over $10.4 trillion in assets under management (AUM), it understands trends better than most firms.

According to them, five trends have the potential to revolutionize how the world operates: Artificial Intelligence, economic competition and geopolitical changes, fintech, the aging population, and the shift to low-carbon economies.

Pros And Cons

Just like most concepts or approaches, both ends of the spectrum are very much in play with the thematic investing strategy. The pros and cons of this form of investing are discussed below:

Pros

- Early identification of trends allows investors to enter the stock early and experience significant gains.

- Investors benefit from the stock's transition from being found to becoming mainstream as the market adjusts itself to one or more of these trends.

- It is an investment methodology that enhances portfolio diversification by removing factors such as geographic exposure and market cap constraints.

- It provides investors with the opportunity to invest in companies or sectors that align with their beliefs and principles.

- Aligning with ethical and moral commitment boosts investor satisfaction and helps them develop a stronger bond with their investing strategy.

Cons

- Thematic investing is innately more volatile due to its concentration on a specific stock or sector. This can become an apparent headache for investors, especially if the sector is cyclical.

- These investments indeed give massive returns if these themes succeed. On the contrary, losses are also significant if they do not perform as expected.

- Entering into trends too early has a significant risk of the theme being short-lived, resulting in losses.

- Timing the market is always a challenge. It is more accurate in this case as it can never be ascertained when the market completely accepts a new theme and when maturity level is attained. Therefore, entry and exit points are even more challenging to figure out.

Thematic Investing vs Impact Investing vs Sector Investing

The distinctions between thematic investing ETFs, impact investing, and sector investing are:

Thematic Investing

- It focuses on personal values, ideas, and upcoming trends in the market.

- This form of investing allows investors to invest in different sectors within a theme, enhancing the diversification of their portfolios.

- It is a future-focused investing strategy that looks to enter new themes or ideologies early and maximize the profits or gains when these themes mature.

- However, the timing of the market and the innate volatility in these investments are undeniable. Hence, investors must conduct their due diligence before investing.

Impact Investing

- Impact investing is a way of experiencing financial gain while making a significant positive impact on the environment and society.

- These investments must have a measurable impact.

- These investments not only focus on profitable stocks or sectors but also ensure that these sectors or stocks have a positive impact on society.

- Sustainable agriculture, affordable housing, and gender equality are typical examples of the same.

Sector Investing

- Sector investing refers to investing in one or more sectors of the market. It can be due to aligned principles of the investors or just a profitable venture to experience financial gains.

- These investment strategies help investors experience targeted growth and diversify their portfolios.

- It is also a fantastic way to manage the risks of a concentrated portfolio.

- Energy, materials, healthcare, consumer discretionary, and utilities can be examples of sector investing.