Table Of Contents

Texas CPA Exam

Texas CPA (Certified Public Accountant) License is a statutory title granted to qualified accountants to pursue the profession in the U.S. jurisdiction. Texas has specific standards with regard to exam, experience, and other requirements to successfully acquire the CPA license.

The Lone Star State does not have any provision for issuing the CPA Certificate on qualifying the CPA Exam. Instead, the Texas State Board of Public Accounting (TSBPA) directly grants the CPA License on meeting all the stipulated specifications.

Note that Texas is a part of the International Examination Program. In other words, candidates applying through Texas can take the exam at international locations.

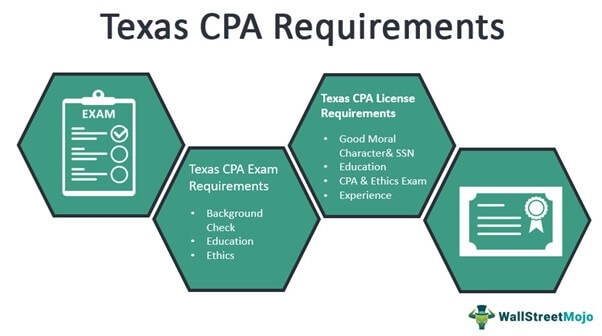

The following table outlines the Texas CPA exam and license requirements.

| Particulars | Texas CPA Exam Requirements | Texas CPA License Requirements |

| Minimum Age | None | None |

| Social Security Number (SSN) | - | Required |

| U.S. Citizenship | Not required | Not required |

| Texas Residency | Not required | Not required |

| Background check for criminal history | Required | Required |

| Education | 150 semester hours | 150 semester hours |

| Exam | Apply for and take all exam sections within 18 months | Pass all exam sections with at least 75 points in each within 18 months |

| Ethics | 3-semester-hour Board-approved ethics course | Pass the Texas Rules of Professional Conduct exam |

| Experience | - | 1 year of full-time non-routine accounting work experience |

Contents

Texas CPA License Requirements

Texas CPA Exam Requirements

The CPA Exam evaluates an aspirant’s knowledge of a wide variety of accounting and finance topics. The American Institute of Certified Public Accountants (AICPA) collaborates with the National Association of State Boards of Public Accountancy (NASBA) to administer the exam.

The Uniform CPA Exam is a string of computer-driven tests comprising four exam sections. The exam provides the liberty to take the test in any sequence at any time during the year. However, you must clear all sections within the rolling 18 months period. Each CPA exam section has a passing score of 75 on a scale of 0-99.

The exam constitutes three question types, namely, multiple-choice questions (MCQs), task-based simulations (TBSs), and written communication tasks (WCTs).

| CPA Exam Sections | Format | Time | Passing Score | |||

| Testlets | MCQs | TBSs | WCTs | |||

| Auditing & Attestation (AUD) | 5 | 72 | 8 | - | 4-hour | 75 Points |

| Business Environment & Concepts (BEC) | 5 | 62 | 4 | 3 | 4-hour | 75 Points |

| Financial Accounting & Reporting (FAR) | 5 | 66 | 8 | - | 4-hour | 75 Points |

| Regulation (REG) | 5 | 76 | 8 | - | 4-hour | 75 Points |

Eligibility Requirements

General Prerequisites

Submit your electronic fingerprints for background verification. The background check is performed from the criminal history files of the following agencies:

- Federal Bureau of Investigation (FBI)

- Texas Department of Public Safety (DPS)

Educational Prerequisites

Hold at least a bachelor’s degree from a board-approved U.S. institution or an equivalent degree from an institution in another country.

Complete 150 semester hours with:

- At least 30 semester hours of upper-level accounting courses, including

- 2 hours of accounting or tax research and analysis

- At least 24 semester hours of upper-level business courses, including

- 2 hours of accounting or business communications

Know that academic internships are acceptable only to fulfill the 30-semester hour requirement. After meeting the necessary education requisites, submit the Application of Intent to TSBPA.

Ethics Requirement for CPA Exam

You must complete a three-semester hour ethics course preceding the approval of your Application of Intent form. Note that the ethics course must be state board-approved.

Fees

You must pay the application fees to the TSBPA and the examination fees to NASBA. Both the Application of Intent and the Eligibility Application fees are non-refundable.

Remember that the Eligibility Application fee is valid for 90 days after the state board establishes the applicant’s exam eligibility. So, pay the exam fees to NASBA within that period.

| Particulars | Examination Fees | First-time Applicant Fees |

| Fee for the Application of Intent | - | $20 |

| Eligibility Application Fees | - | $15 |

| Exam sections | - | - |

| AUD | $226.15 | - |

| BEC | $226.15 | - |

| FAR | $226.15 | - |

| REG | $226.15 | $904.6 |

| Total Fees | $904.6 | $924.6 |

Required Documents

Submit the following documents to TSBPA.

| Documents | Submission Authority |

| Official Transcript(s) | You |

| Testing Accommodations Request Form | You |

| International Evaluation Summary (with international transcripts) | Board-approved Evaluation Provider |

Examination Process

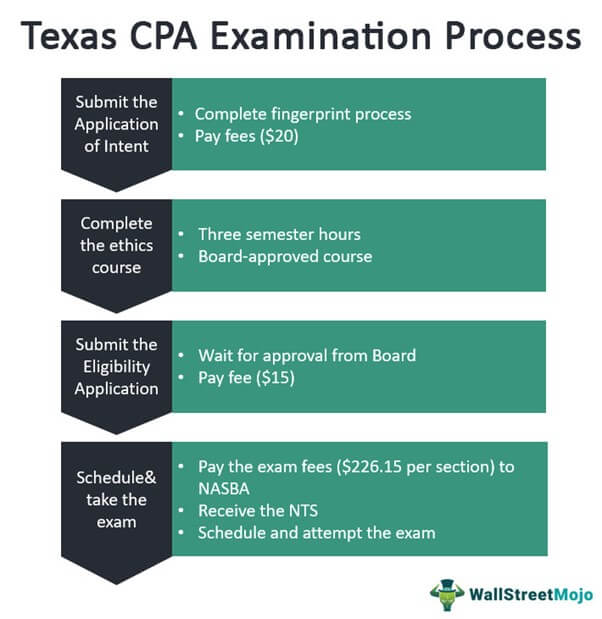

Start the application process by submitting the Application of Intent form along with the fee ($20) to TSBPA. In the meantime, ensure to complete the fingerprints process and the specified ethics course.

Note that the Application to Intent is used to check an applicant's education for compliance with the state rules. Remember to take the exam within two years after applying to the board. Or else the application expires, and you will have to submit a new application.

Once your Application of Intent is approved, complete the TSBPA online Eligibility Application and submit the necessary fee ($15). Note that information from your application may be shared with the NASBA for determining your eligibility.

After your eligibility is established, the board informs NASBA of the same. Then you can pay the exam fees through the NASBA Payment Coupon within 90 days from your application approval date.

Thereafter, you may receive your Notice-to-schedule (NTS). Using the NTS, you must schedule and take the eligible exam sections within 90 days from your application approval date.

Texas CPA License Requirements

To become a Texas CPA, candidates must:

- Obtain at least 150 semester hours of education

- Qualify for the CPA Exam

- Pass background check

- Attain one year of relevant work experience

- Pass the board-recognized ethics exam

- Gain a valid Social Security Number (SSN)

Texas CPA licensure applicants need not meet any minimum age, U.S. citizenship, or residency requisite. On meeting all the stipulations, you must submit the licensure application, documents, and fees to the Texas state board. Besides, you must also take the oath to office.

Education Requirements

The first step to Texas CPA licensure requires you to obtain a minimum of 150 semester hours along with a bachelor’s degree. Further details are mentioned in the Eligibility Requirements section.

Exam Requirements

Candidates must pass all four Uniform CPA Exam sections with a minimum of 75 points in each. In addition, ensure to conclude the test within the rolling 18-month period. For more information, please check the Texas Exam Requirements section.

Experience Requirements

You must also complete one year of non-routine accounting work experience under the direct supervision of an active CPA. Work experience may be part-time or full-time.

- Full-time employment – Minimum 12 months (at least 40 hours per week)

- Part-time employment – Minimum 2000 hours (minimum 20 hours per week) gained within two consecutive years

Furthermore, submit the work experience form along with the licensure application.

Ethics Requirements

Once you pass the CPA Exam, ensure to complete a board-recognized four-credit ethics course on the Texas Rules of Professional Conduct. Thereafter, you must take up the open-book exam that is emailed to you. The passing score on the exam is 85%.

Continuing Professional Education (CPE)

All Texas CPAs must obtain 120 CPE credit hours over the three-year reporting period. Furthermore, enroll only for CPE programs from sponsors registered with the state board.

CPE credits for CPA from non-registered sponsors must be submitted on an appropriate form, citing the reason for claiming the credit and the benefit to the licensee. Remember not to claim more than fifty percent of the CPE hours from non-registered sponsors during the three-year reporting period.

Here lie all the details.

| Particulars | Details | ||

| Renewal Date of License | Last day of your birth month (every year) | ||

| Reporting Period for CPE | Credit expires on the last day of your birth month (triennially) | ||

| General CPE Requirement | 120 hours every three years (minimum 20 hours per year) | ||

| Ethics Requirement | 4 hours every 2 years from board-registered providers | ||

| Credit Limitations | Instruction (advanced level) | Maximum 20 hours | |

| Nano Learning | Maximum 50% in 3 years | ||

| The passing grade is 100% | |||

| Non-technical Courses | Maximum 50% in 3 years | ||

| Other Certifications | Maximum 50% in 3 years for successful completion of certification programs | ||

| Published Materials | Maximum 10 hours annually | ||

| Fields of Study | Limitations on specific subject areas | ||

| Credit Calculation | Instruction | CPE credit = 3 times presentation | |

| Partial Credit | minimum of 1 full credit (50 minutes) initially and then 1/5 increments (10 minutes) or 1/2 increments (25 minutes) | ||

| University/College | 1 semester hour = 15 CPE hours | ||

| 1 quarter hour = 10 CPE hours | |||

| Other State Policies | CPE Reciprocity | Principal place of business with CPE Requirements | Meet state-specific CPE Requirements |

| Principal place of business without CPE Requirements | Meet Texas CPE Requirements |

Once you complete all the Texas CPA journey phases, you may start looking for a suitable job in the state. The educational requirements for taking the CPA Exam and licensure are the same. Hence, you need not stress about earning additional hours for licensure.

Currently, the state boasts of housing 49 Fortune 500 companies with exclusive demand for high-paying CPA jobs. Needlessly, the U.S. province is a land of golden opportunities for aspiring CPAs. So, brace yourselves and complete all the exam and license requirements to earn the coveted Texas CPA License.

Texas Exam Information & Resources

1. Texas State Board of Public Accountancy (https://www.tsbpa.texas.gov/)

505 E. Huntland Drive, Suite 380

Austin, TX 78752–3757

Phone: 512-305-7800

Fax: 512-305-7854

2. Texas Society of CPAs (https://www.tx.cpa/)

- 14651 Dallas Parkway, Suite 700

Dallas, TX 75254

Phone: 800-428-0272 & 972-687-8500

Fax: 972-687-8646

- 3305 Northland, Suite 406

Austin, TX 78731-4490

Phone: 877-592-0526 & 512-445-0044

3. NASBA (https://nasba.org/)

150 Fourth Ave. North

Suite 700

Nashville, TN 37219-2417

Tel: 615-880-4200

Fax: 615-880-4290

4. AICPA (https://www.aicpa.org/)

220 Leigh Farm Road

Durham, NC 27707-8110

Fax: 800.362.5066

Phone: 888.777.7077

Recommended Articles

This article is a guide to Texas CPA Exam & License Requirements. We discuss all Texas CPA requirements for a Texas CPA license, such as eligibility, fees, etc. You may also have a look at the below articles to compare CPA with other examinations –