Table Of Contents

What is Terminal Cash Flow?

Terminal Cash Flow is the final cash flow (i.e., Net of cash inflow & cash outflow) at the end of the project. It includes after-tax cash flow from disposing of all the equipment related to the project and recoupment of working capital. The terminal cash flow equation is the final cash flow at the end of the project. It consists of cash flow from asset disposal & working capital recoupment.

For any company who uses the capital budgeting approach to estimate the overall figure of an ongoing project or a project which company management is planning to undertake, they give the more clear understanding about earnings of the project to the company management, which help management initially to decide whether to accept or reject a project.

Terminal Cash Flow Explained

Terminal cash flow is a critical concept in financial modeling, representing the net cash flow that a project generates at the conclusion of its forecast period. It is essentially the net cash inflow or outflow resulting from the final phase of a project or investment. This phase often marks the end of explicit cash flow projections and is particularly relevant in discounted cash flow (DCF) analyses.

In financial modeling, the terminal cash flow is typically composed of two main components: the final year's free cash flow and the terminal value. The final year's free cash flow represents the cash generated or utilized by the project in its last forecasted year. On the other hand, the terminal value captures the present value of the project's expected future cash flows beyond the explicit forecast period.

This is the last amount of cash left with the company after the project is terminated; all assets related to the project are disposed of; the working capital is recovered. Considering this cash flow in estimating earnings give company management a more accurate figure to decide whether to accept or reject the project.

Understanding and accurately estimating terminal cash flow calculation is crucial for determining the overall value of a project or investment.

Formula

The terminal cash flow equation can be calculated by using the below formula:

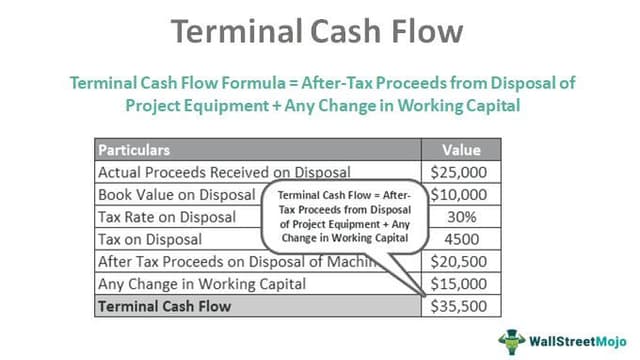

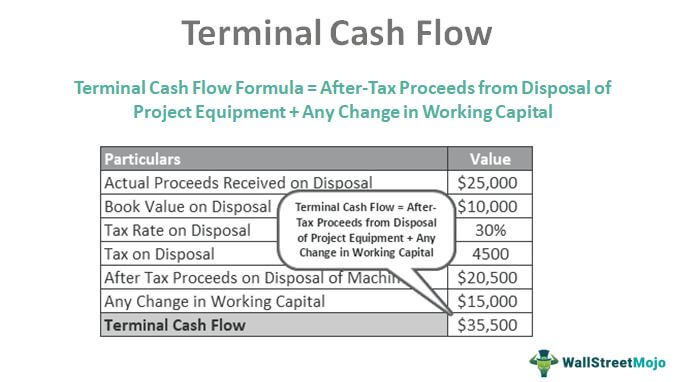

Terminal Cash Flow Formula = After-Tax Proceeds from Disposal of Project Equipment + Any Change in Working Capital

Example

Now that we understand the basics of the concept, let us also understand the practicality of the concept of terminal cash flow calculation through the example below.

Redtech, a manufacturing company, is considering a new project to manufacture a recyclable product that is made of paper. To begin with this manufacturing process, Redtech has to install a new machine, which is expected to have 5 years of economic life. After that, this machine should become obsolete and be replaced by a newer technology machine. The initial investment required for this machine is $100,000.

The machine is to be depreciated on a straight-line method basis over the life of the machine with excepted salvage value at the end of the project is $10,000. The tax rate applicable to gain/loss on disposal of the asset is 30%. Working capital recoupment is $ 15,000. Redtech management forecast that at the end of the project, this machine can be disposed of for $25,000. Calculate the terminal cash flow.

To calculate the terminal value, the following are the key components:

- Initial Investment required: $ 100,000.

- Working capital recoupment: $ 15,000.

- The tax rate on disposal: 30%.

- Salvage Value: $ 10,000.

As you saw in the question that at the end of the project, management expects cash proceeds on disposal is $25,000, which is higher than the book value of the machine at the end of the project by $15,000 ($25,000 - $10,000).

Solution:

Calculation of terminal cash flow will be -

- Actual Proceeds Received on Disposal = $25,000.

- Tax on Disposal = ($25,000 - $10,000) * 30%

- Tax on Disposal =$4,500.

- After Tax Proceeds on Disposal of Machine = ($25,000 - &4,500) = $20,500.

- Any Change in Working Capital = $ 15,000.

- Terminal Cash Flow = $20,500 + $15,000 = $35,500

Cash Flow - Video Explanation

Advantages

Let us understand the advantages of terminal cash flow equations through the points below.

- Company management can decide more precisely whether to accept or reject the project.

- Including terminal cash flow gives an accurate figure to analysts while estimating the value of the project.

- Terminal cash flow allows for the evaluation of a project's sustainability and financial performance beyond the explicit forecast period, providing insights into its long-term viability.

- Incorporating terminal cash flow in financial modeling ensures a more comprehensive project valuation by considering both the final year's free cash flow and the terminal value. This holistic approach accounts for the project's entire lifecycle.

- By extending the analysis beyond the explicit forecast period, terminal cash flow helps in identifying and mitigating risks associated with uncertainties in the project's future cash flows. This is particularly valuable for risk-sensitive industries.

- Terminal cash flow assists in making informed investment decisions by offering a clearer picture of the project's potential returns, aiding stakeholders in understanding the overall financial impact of the investment.

- In discounted cash flow (DCF) analyses, terminal cash flow is essential for calculating the terminal value, which, when discounted back to present value, contributes significantly to the overall valuation of the project.

- Including terminal cash flow aligns financial modeling with strategic planning, helping organizations make decisions that align with long-term goals and objectives.

Disadvantages

Despite the various advantages, there are a few factors that prove to be a hassle. Let us understand the disadvantages of terminal cash flow calculation through the points below.

- Incorrect forecasting of the disposable value of the asset at the end of the project.

- Sometimes actual life of the projects or equipment differs from the assumption made by management initially.

- Terminal cash flow is mostly used for the project only with a finite life.

- The terminal cash flow concept assumes a perpetual growth rate, implying that the project's cash flows will continue indefinitely. This assumption might not hold true in reality, particularly for projects with a finite lifespan or those subject to changing market conditions.

- While terminal cash flow focuses on the long term, it might overlook short-term dynamics and uncertainties that could significantly impact the project's financial performance in the initial years.

- Forecasting cash flows over an extended period is challenging, and the accuracy of the terminal cash flow depends heavily on the ability to make reliable predictions about future economic conditions and market trends.

- Changes in discount rates over time can affect the present value of terminal cash flow, introducing variability and making it challenging to precisely determine the project's overall value.