Advanced Technical Analysis Course!!

Master Advanced Technical Analysis Like a Pro | Learn Charting, Indicators & Trading Strategies with Demonstration | Exclusive Bonuses Worth $500+!FLASH SALE!

Claim Your 60% + 20% OFF

FLASH SALE is here, and your chance to upskill has never been better.

💰 Get 60% +20% off (WSM20)

📈 Master financial modeling skills with expert-led training.

🕒 Learn anytime, anywhere, and boost your career prospects without breaking the bank.

🔥 Hurry - this FLASH SALE is live for a limited time only.

HIGHLIGHTS

Highlights Of The Course

Master Advanced Technical Analysis

Master Advanced Technical Analysis : Learn chart patterns, indicators, market sentiment & moreDesigned for Traders Seeking an Edge

Designed for Traders Seeking an Edge : Develop expertise in techniques to identify market trendsLearn What Sets Successful Traders Apart

Learn What Sets Successful Traders Apart : Join thousands of learnersPractical, Strategy-Based Learning

Practical, Strategy-Based Learning : Apply real-world trading concepts with hands-on analysisEssential Skills for Profitable Trading

Essential Skills for Profitable Trading : Build a strong foundation for trading with advanced strategiesCertification to Boost Your Resume & Credibility

Certification to Boost Your Resume & Credibility : Enhance your career prospectsAdvanced Technical Analysis Course Preview

Sample Videos

HURRY UP!

Unlock Premium Course Benefits Worth $500+!

Live Case Studies & Real Market Analysis

Live Case Studies & Real Market Analysis : Apply technical analysis concepts to real scenariosComplete Charting & Price Action Mastery

Complete Charting & Price Action Mastery : Learn how to analyze price movementsAdvanced Indicators & Oscillators

Advanced Indicators & Oscillators : Master RSI, MACD, Bollinger Bands, moving average, etc.Fibonacci & Harmonic Pattern Strategies

Fibonacci & Harmonic Pattern Strategies : Identify market turning points with advanced techniquesMarket Sentiment & Volume Analysis

Market Sentiment & Volume Analysis : Learn how to interpret trading volume & sentiment indicatorsProfessional Trading Strategies

Professional Trading Strategies : Apply proven techniques in equity, forex & derivativesRisk Management & Trade Execution

Risk Management & Trade Execution : Build a disciplined approach to risk management & executionSKILLS COVERED

What Will You Learn?

BENEFITS AND FEATURES

Benefits & Features Of The Course

There are some of the top-tier career benefits available to those who choose this course.

#1 - Expertise:

Learn technical analysis online with our course and equip you with an added advantage over other traders during trading sessions.

#2 - Skills Development:

With this advanced technical analysis course. Enhance your ability to analyze, forecast, and interpret market data and upgrade your trading to the next level with this advanced technical analysis course. The practical approach of this course helps build confidence concerning your financial knowledge regarding the stock market and securities.

#3 - Practical Application:

With the help of various examples provided on TradingView, witness a practical application of the concept in the markets. You also get familiar with the popular indicators and chart patterns that can help predict price movements!

#4 - Career Opportunities:

You could soon get a promotion or a hike after your employer learns about the completion of an Advanced Technical Analyst course.

#5 - Support:

If any doubt arises with regard to this course, individuals can contact our course support team without any hesitation by writing an email to support@wallstreetmojo.com. In addition to seeking assistance via email, you can take the help of chat support available on our platform to get all your queries resolved.

QUICK FACTS

Industry Trend

PROGRAM OVERVIEW

Course Description

As Warren Buffet popularly states, “Risk comes from not knowing what you are doing.” It is akin to being ignorant and blindly following the crowd. But the impact is then visible in your stocks and portfolio. Analyzing risk and reading market sentiments is crucial as well. Additionally, there is definitely a way to pick the right stocks and, most importantly, profitable stocks for the long term at the right time!

With our extensive and comprehensive course on Advanced Technical Analysis Course, explore the different indicators inclusive of technical analysis basics and ways to use and develop trading strategies for different securities as well.

Learn in detail about advanced technical analysis as we delve into the different indicators, candlesticks, and chart patterns, learning to apply them in different market situations. Likewise, with the help of the different live examples explained on the TradingView platform, learn how traders can react to certain market sentiments as well.

Also, gain insights into trading volume and application of different technical analysis tools to determine the future trend of stocks. Furthermore, get a clear idea regarding industry trends and tips from our highly experienced instructors.

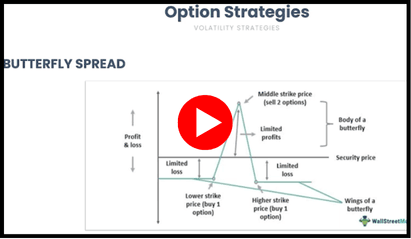

Discover the different momentum indicators and fundamentals of price action as well. With that, you will also understand the development of trading strategies and working of derivatives securities like options and futures. However, these benefits do not end here.

ROLES FOR FINANCE

Careers With Technical Analysis Skills

#1 - Technical Analyst:

A technical analyst is a professional analyzing the financial (like stock markets) markets and determining the current and future prices of securities. They are mostly hired by well-known companies like JPMorgan Chase, Oracle, Cerner, Accenture, Dell Technologies, ADP, and similar others. For the job role offered, the analyst receives around $79,018 and $98,193 annually.

#2 - Financial Advisor:

A financial advisor is a person or a business that gives financial advice on one’s portfolio investments. A technical analysis certification helps one to develop the expertise to assist their clients with money management and profit-making decisions.

These individuals earn an average salary of $93,069 annually. Although financial advisors often have their own consultancy firms, there are some major companies like BlackRock, Vanguard, Fidelity, State Street Global Advisors, and J.P. Morgan Asset Management that hire financial advisors.

#3 - Portfolio Manager:

As the name suggests, the portfolio manager is a financial expert handling portfolios of different clients. Since they hold expertise in financial markets, these managers understand clients’ investment objectives and try to give maximum returns with minimized risk.

Such professionals either work individually or as a part of investment banks, mutual fund companies, insurance companies, or equity firms. Some of the large investment banks like Goldman Sachs, Wells Fargo, JPMorgan Chase and others provide a higher salary of $142,030 annually to them.

#4 - Financial Risk Manager:

As a financial risk manager, they are responsible for forecasting trends occurring in the market and their impact on the organization. They analyze the company’s financial position and suggest strategies to mitigate risk. They are mostly hired by PWC, Amazon, Deloitte, Credit Suisse, PayPal, HSBC, and others.

Generally, the salary prospects range between $120,372 and $163,279 on an annual basis.

#5- Equity Research Analyst:

These analysts are primarily concerned with the stock markets. The equity research analysts analyze financial information along with the different trends of the different organizations and industries and then give an opinion in their equity research report based on the analysis conducted.

In short, they give verdicts to clients on their investment decisions. Some of the popular hiring companies include Goldman Sachs, MorningStar, Barclays, and CRISIL. They earn around $76,997 per year plus some additional benefits.

#6 - Traders:

A stock market trader is an individual who trades in the financial markets daily to earn profits by exploiting the opportunities present in the market. These traders purchase and sell securities within the same day in an attempt to earn profits either in the same trading session or later on.

In normal circumstances, these traders may have a fluctuating remuneration based on their profits. However, with more years of experience, it ranges between $79,310 and $126,030 on average.

WHAT WILL YOU GAIN IN THIS COURSE?

Course Curriculum

TradingView Walkthrough

Review of Basics of Technical Analysis

Advanced Technical Analysis Fundamentals

Indicators & Oscillators

CERTIFICATION

Earn A Certificate On Completion Of This Course

WHAT SHOULD YOU KNOW?

Prerequisites For Advanced Technical Analysis Course

Our Technical Analysis Advanced Course does have some minor requirements that one should meet.

There are some prerequisites for Advanced Technical Analysis training courses does bring some pr

- Familiarity with stock markets, market data, and company-related information

- Good, stable internet connection

- Access to trading platforms like TradingView

WHO ARE ELIGIBLE TO LEARN?

Who Should Attend The Advanced Technical Analysis Course?

Got questions?

Still have a question? Get in Touch with our Experts