Table Of Contents

What Is a Tear Sheet?

A Tear Sheet also referred to as a fact sheet, displays the information and summary about the company to its prospective investors to make informed investment decisions. It usually consists of the stock price, market capitalization, shares outstanding with the company, beta of a stock, etc.

Venture capitalists create company tear sheets to ascertain the company’s portfolio and send it to their partners to consider an investment or a monthly, quarterly, or yearly performance of an investment. This terminology arises from the old school practice of stock brokers would tear a sheet from their notepad to give a stock recommendation to their clients.

Table of contents

Tear Sheet Explained

A tear sheet is a brief summary of the portfolio or the financial overview of the company. It helps keep complete track of their investment and stay updated with their portfolio companies.

It was initially used by stock brokers to give a stock recommendation to their clients about a prospective company. In the modern day, they are no longer torn out of a notepad. In fact, they are sent to clients or partners in an electronic format.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

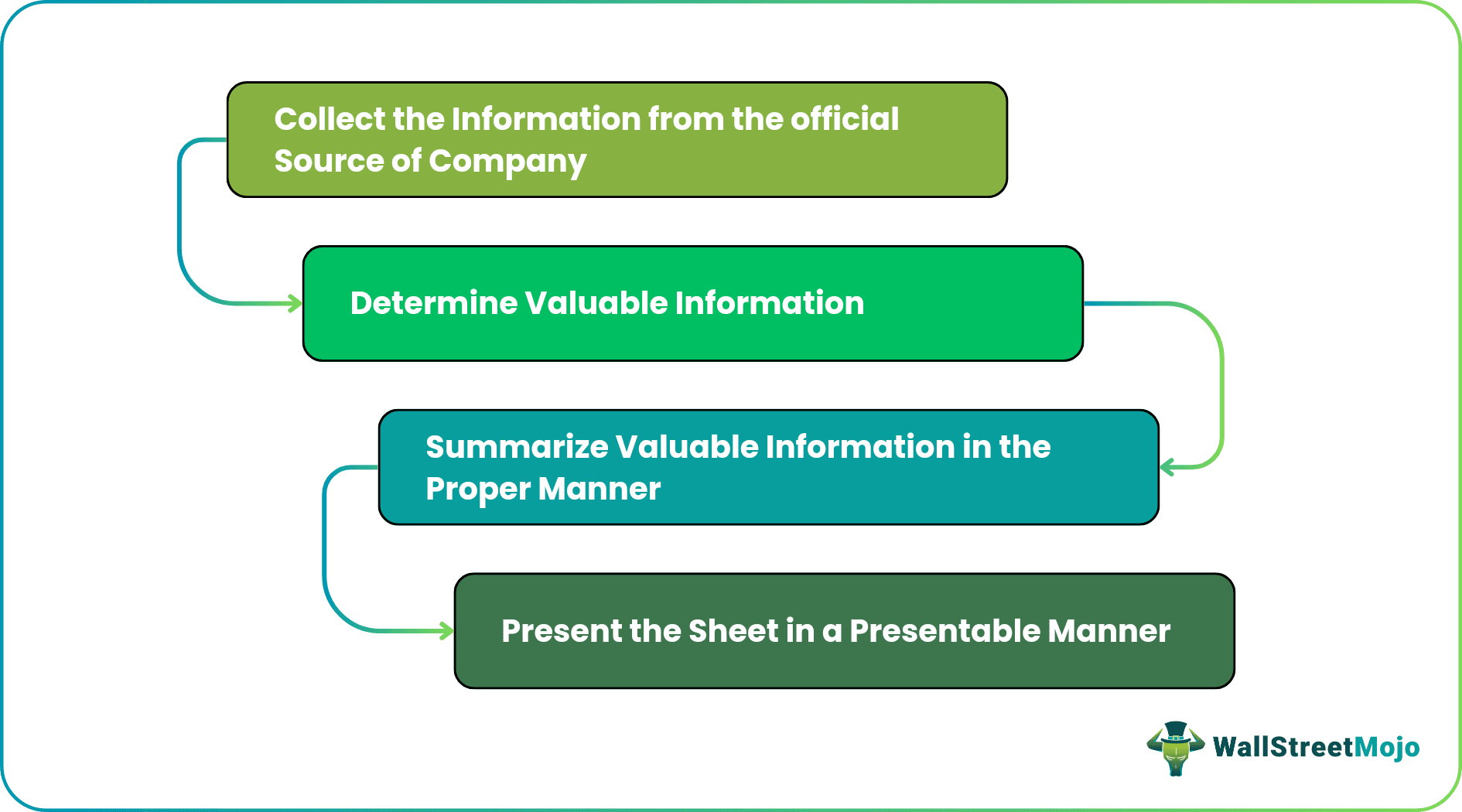

How to Prepare?

It can be prepared differently by different organizations as per their requirements or their company’s portfolio some of the guidelines on preparation are as mentioned below to add up to be a tear sheet sample –

Collect the information from the official Source of the Company

For making the sheets, the source of information should be vital and carry proof. i.e., the information and figures should be official to give the correct information to the clients.

Determine the Valuable Information

After collecting the information, the preparer should determine the valuable information known to the investors due to the nature and importance of data from an investment point of view.

Summarize the Valuable Information in the Proper Manner

After collecting the valuable information, the information should be summarized properly, so that the reader can understand to make him or capable of making the investment decisions.

Present the Sheet in a Presentable Manner

After summarizing the information, the sheet should be presented properly and understandably. The information should be clear enough that it does not create confusion.

Example

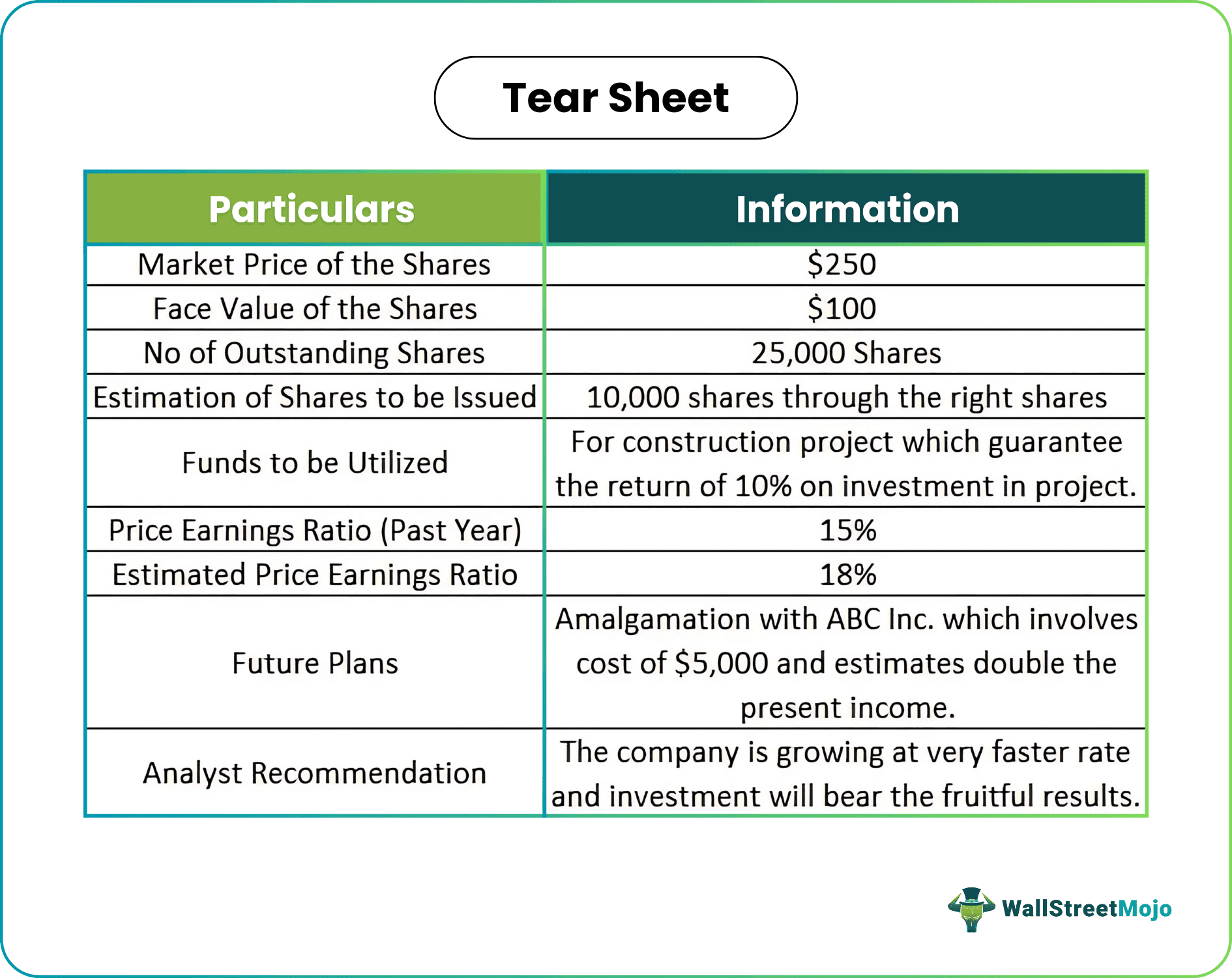

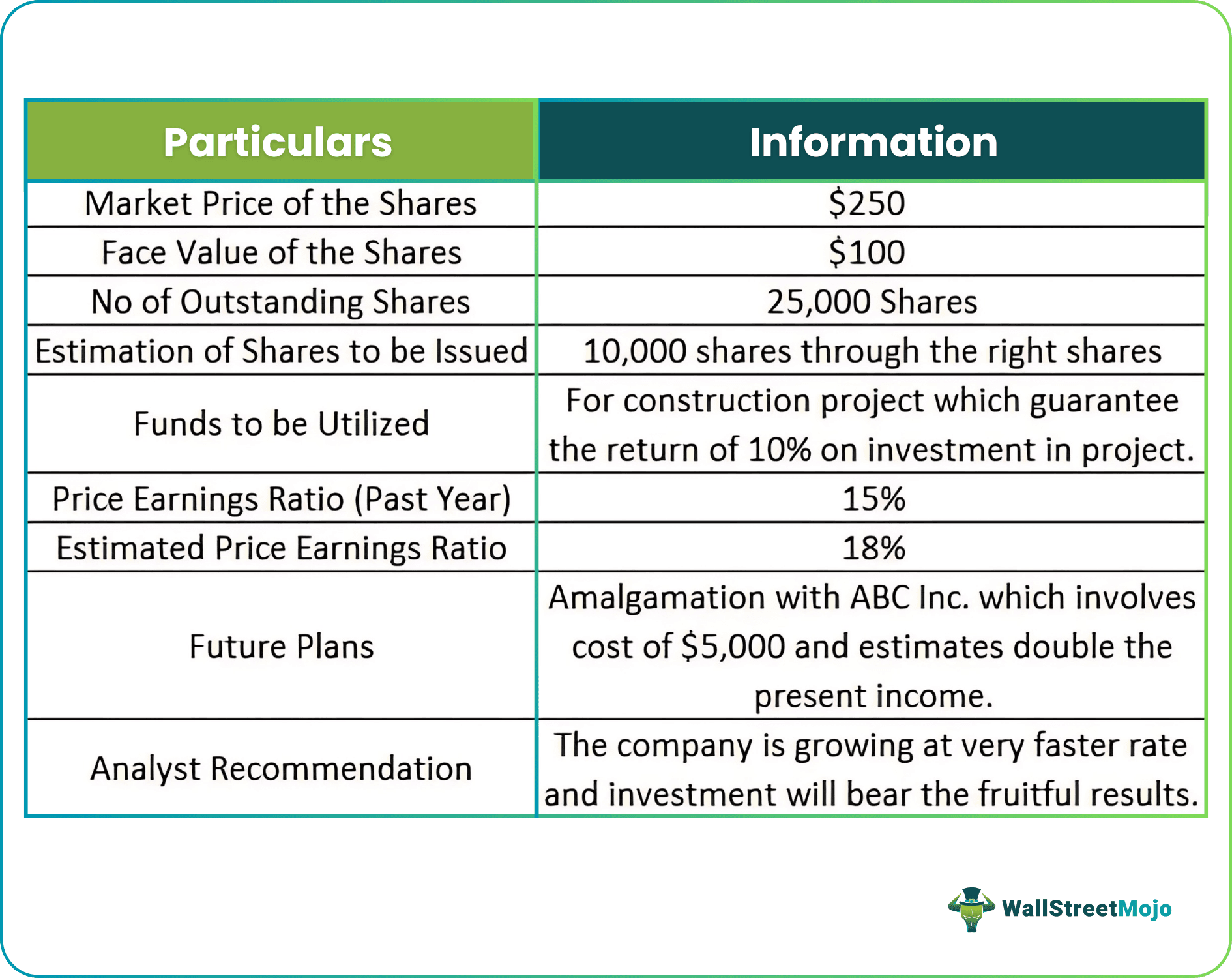

An example of a Tear Sheet about the security and investment details of XYZ Inc. is as under –

Components

The following are the contents of a company tear sheet–

Basic Financial Information

Tearsheet should contain the basic financial information like price of shares, the number of shares outstanding, face value, week’s high and low market price, social services initiated by the company, market beta and beta of stock, etc. so that the investor can get the complete and unambiguous information and make the correct decision about the investment.

Estimates and Future Prospects

The Tearsheet shall also contain the forecast of the future information to determine the future benefits to the investor and guides about the correct investment decision.

Important Ratios

The tearsheet also contains information about the important ratios like profit to sales ratio, price earning ratio, stock turnover ratio, liquidity ratio, etc., compared to the previous years’ ratio so that the investor should know whether the company is growing or not.

Analyst Recommendation

It also contains the analyst's recommendation about the company's performance and the suggestions of the analyst on investment in the company.

Sales Details by the Region

The test sheet also contains the sales data region-wise to evaluate future sales estimation and growth.

Stock Details

The test sheet also contains the stock details and processes to evaluate the money blocked in the stock.

Price Details

The sheet also shows the price details about the company and the average price of the last 200 days to be displayed.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Recommended Articles

This has been a guide to what is a Tear Sheet. Here we explain its example, components, and a step-by-step guide on how to prepare it. You may learn more about financing from the following articles –