Table Of Contents

What is the Taxable Income Formula?

The taxable income formula calculates the total income tax under the income tax. For the person, the formula is easy. It is calculated by deducting the exemptions and deductions as allowed in income tax from the total income earned. For businesses, it is calculated by deducting all the expenses and deductions from the total revenue and other income earned.

In simple terms, it refers to the amount of income earned by an individual or an organization that eventually creates a potential tax liability. The formula for taxable income for an individual is a very simple prima facie, and the calculation is done by subtracting all the expenses that are tax exempted and all the applicable deductions from the total gross income.

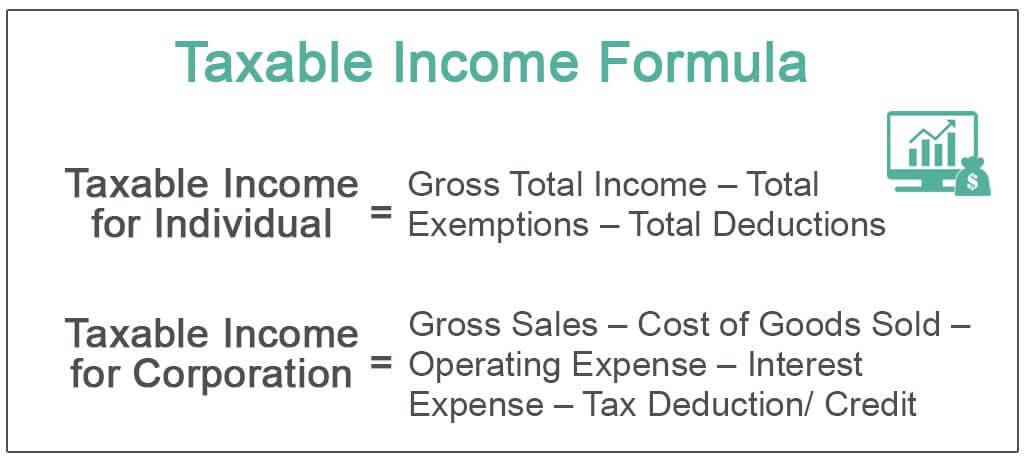

For an individual, it is represented as,

Taxable Income Formula = Gross Total Income – Total Exemptions – Total Deductions

On the other hand, the calculation of a corporation's taxable income is done by deducting the cost of goods sold, operating expenses and interest paid on debts from the company's gross sales. Additionally, adjustment for a tax deduction or credit is made to arrive at the final income.

For Corporate, it is represented as,

Taxable Income Formula = Gross Sales - Cost of Goods Sold - Operating Expense - Interest Expense - Tax Deduction/ Credit.

Explanation

The taxable income formula for an individual can be derived by using the following four steps:

Firstly, determine the total gross income of the individual. Gross total income includes all sources of income like wage/ salary, rental income from property, capital gains from the asset sale, income from other business interests, etc.

Next, determine the total exemptions availed by the individual. Different types of tax-exemption may include charities, humanitarian aids, educational materials, etc. The list may vary depending on the reporting country.

Next, determine the total deductions applicable to the individual's income. Different types of tax deductions may include interest on a student loan, interest on a home loan, medical expenses, etc. This list may also vary depending on the reporting country.

- Finally, the taxable income formula is calculated by total exemptions and deductions from the individual's total gross income, as shown below.

Taxable Earning = Gross total income – Total exemptions – Total deductions

The taxable income formula for an organization can be derived by using the following five steps:

Step 1: Firstly, gross sales have to be confirmed by the sales department.

Step 2: Next, the cost of goods sold is determined by the accounts department.

Step 3: Next, the operating expense is also calculated from the accounts department.

Step 4: Next, the interest paid is calculated based on the rate of interest charged and the company's outstanding debt.

Interest expense = Rate of interest * Debt

Step 5: Next, figure out all the tax deductions and credits applicable to the company.

Step 6: Finally, the calculation of the taxable income equation is done by deducting the cost of goods sold, operating expenses, and interest paid on debts from the gross sales of the company, as shown below.

Taxable Earning = Gross sales - Cost of goods sold - Operating expense - Interest expense - Tax deduction/ credit

Examples of Taxable Income Formula (with Excel Template)

Let’s see some simple to advance examples of the Taxable Income Formula to understand it better.

Example #1

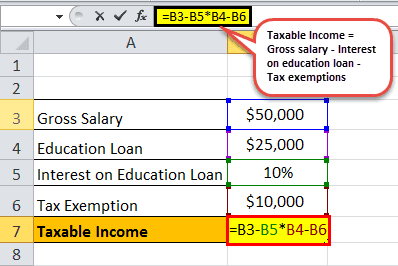

Let us take David's example to understand the taxable income tax calculation. He is entitled to a gross salary of $50,000 annually and pays 6% interest on his son's education loan of $25,000. He is also eligible for a tax exemption of $10,000.

Below is data for the calculation of David’s Taxable Earnings.

Therefore, David’s Taxable Income can be calculated as,

Taxable Earning = Gross salary – Interest on education loan – Tax exemptions

= $50,000 – 10% * $25,000 - $10,000

= $37,500

Therefore, David’s taxable Earning is $37,500.

Example #2

Let us take the real-life example of Apple Inc.'s annual report for 2016, 2017, and 2018. The table gives a snapshot of the detailed calculation of taxable income for the years 2016, 2017, and 2018. The following information is available:

The below table shows data for the calculation of taxable earnings of Apple Inc.'s annual report for the years 2016, 2017, and 2018.

The taxable Income of Apple Inc.'s annual report for the year 2016 can be calculated as,

Taxable Earning= Net sales – Research and development expense – Selling, general and administrative expense – Interest expense + Non-operating income

= $215,639 - $131,376 - $10,045 - $14,194 - $1,456 + $2,804

Taxable Earnings = $61,372

Therefore, the taxable earnings of Apple Inc. stood at $61,372 Mn for the year 2016.

The Taxable Earning of Apple Inc.'s annual report for the year 2017 can be calculated as,

Taxable Earning = Net sales - Research and development expense – Selling, general and administrative expense – Interest expense + Non-operating income

= $229,234 - $141,048 - $11,581 - $15,261 - $2,323 + $5,068

= $64,089

The Taxable Earning of Apple Inc.'s annual report for the year 2018 can be calculated as follows,

Taxable Earning = Net sales - Research and development expense - Selling, general and administrative expense - Interest expense + Non-operating income

= $265,595 - $163,756 - $14,236 - $16,705 - $3,240 + $5,245

= $72,903

Revenue vs Income Explained in Video

Relevance and Uses

For an individual, it is important to understand taxable income because it is more than just the salary earned at the job. If one receives any compensation, it will likely be considered under taxable income. Some of the uncommon examples of income included under taxable earnings are debt liability forgiven by the lender or creditor, lottery winnings, payments made for jury duty, gifts, unemployment benefits offered by the government, strike benefits, and even embezzled money.

The amount of taxes to be paid by an individual is lowered by tax credits, while the tax deductions and exemptions lower the individual's taxable earnings. In the US accounting terminology, the items that qualify as "taxable income" are defined in the Internal Revenue Code Section 63. In contrast, the sources identified as "gross income" are defined in Section 61 of the Internal Revenue Code.

For a company, taxable earning is the earning before taxation after all the business expenses have been recognized and the adjustments have been made. The understanding aids the preparation and filing of the business' tax return.