Table Of Contents

What Is Tax Write-Off?

A Tax Write-Off is the amount of money that can be claimed by a person, company, or any tax-paying entity as a legitimate reduction from their taxable income. When this happens, the tax liability gets minimized. It is a tax avoidance provision that can help companies save a lot of money on their annual tax imposition.

Tax evasion is contradictory to it, as this practice involves illegally not reporting income. The Internal Revenue Service (IRS) of the United States allows companies to write off business costs and only taxes them on generated revenue not reinvested.

Key Takeaways

- Tax write-off reduces the taxable income of individuals, corporations, and entities by allowing them to show claimable expenses.

- The common types of tax write-offs are standard, medical, donation, student loans, mortgage interest, self-employed, IRA, and HSA contributions.

- In the US, the IRS is the leading tax authority, with a series of sections and laws that allow write-offs. This may differ in different nations.

- To receive tax benefits from the government, it is wise to use tax deductions or write-offs during annual tax filing.

How Does Tax Write-Off Work?

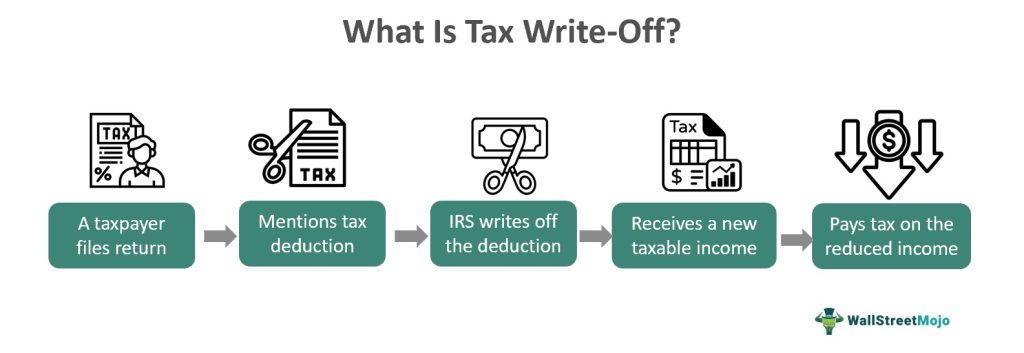

A tax write-off is an IRS tax avoidance provision that lets people, corporations, and other entities subtract a certain amount or percentage from their taxable income to arrive at a new reduced income on which they have imposed federal taxes. Taxpayers can directly minimize the amount of tax they have to pay, saving them a significant amount of money. Individuals and companies can request various forms and mention all applicable itemized deductions and expenses during tax return filing.

Big corporations, startup companies, small businesses, and self-employed individuals frequently claim business tax write-offs because they apply to all of us. The IRS does not tax an entity for its operational costs and expenses; instead, it only taxes based on the entity's revenue. Apart from that, the IRS offers individuals standard deductions and separate ones for student loans, household responsibilities, mortgage interests, donations, and medical and dental expenses. It also allows them to claim a tax deduction. Each of these claims has different rules, limits, and percentage brackets.

Every taxpayer must know about these tax deductions because the IRS only holds the authority to check and analyze the deductions mentioned above. If a taxpayer or company does not mention or employs tax write-off, they will have to pay the income tax based on their gross taxable income.

Common Tax Write-Offs

The list of common write-offs is as follows:

- Standard Deduction - The very first is the standard deduction, in which the IRS presents a certain amount to subtract from the taxable income. Once a person claims it on their yearly tax return, it reduces the income amount and, hence, the liability. Every year it gets updated and adjusted for inflation and other factors.

For 2024, single and married taxpayers filing separately are given a $14,600 standard deduction. On the contrary, married joint tax return filers can deduct $29,200, whereas the heads of household can decrease their income by $21,900.

- Student Loan Interest - The IRS allows individuals to deduct a certain amount from the interest paid on qualified student loans. The maximum amount that can be claimed for 2023 and 2024 is $2,500, irrespective of how much an individual has paid in interest.

- Donation Write-Offs - When a person donates to specific charities, they can claim it as a deduction from their taxable income. It can be claimed as itemized deductions on IRS Schedule A Form 1040. As a result, the adjusted gross income (AGI) cannot exceed 60% for this deduction.

- Mortgage Interest - Homeowners observe this type of deduction as a tax incentive. They can deduct the mortgage interest from their taxable income. As a result, the Tax Cuts and Jobs Act brought a significant change in the individual income tax by reducing the mortgage deduction limit and limiting how much a homeowner can subtract from their taxable income.

- Medical Expenses - Individuals can deduct their medical expenses from their taxable income according to IRS provisions. Most of the time, much of people's income goes into paying medical bills. Thus, it helps people minimize their tax liability. For 2024, an individual can only deduct medical expenses that exceed 7.5% of their AGI.

- State Taxes Paid - If an individual has already paid state taxes, they can claim them to reduce their taxable income while filing a tax return.

- Self-Employed Business Expenses - When a person operates a self-employed business, the IRS allows them a certain amount of tax write-off as they are necessary expenses related to running a business. Thus, the IRS lets individuals reduce up to 50% of their total self-employment tax on their tax return filing.

- Traditional IRA Contributions - When an individual writes off contributions they make to a traditional IRA scheme. It depends on the modified adjusted gross income (MAGI) if it is $77,000 or less, a total deduction of $7,000, and $8,000 if the person is 50 or older. But if the MAGI lies between $77,000 and 87,000, there is a partial deduction, and if it's above $87,000, then there is no deduction.

- Property Taxes - This follows the Tax Cuts and Jobs Acts to claim deductible state and local income taxes. The limit is capped at $10,000 for it and will last until 2025.

- Health Savings Account Contribution - If a person is qualified to contribute to the HSA, they can claim a tax deduction in their annual tax return filing. Again, the limits for this keep changing every year.

Examples

Below are two examples related to the concept:

Example #1

Suppose Philip is a single man earning $45,000 annually. He lies in the tax slab range of $11,601 to $47,150, which imposes a 12% income tax. It means Philip will pay 12% of $45,000, which is $5,400, to the IRS.

But recently, upon doing research, Philip came across the standard tax deduction offered by the IRS. The prevailing tax laws allow him a $14,600 deduction, making him happy. Now, when filing the tax return, Philip mentions the standard deduction as an itemized deduction and claims a standard deduction.

It now reduces Philip's taxable income to 45,000 – 14,600 = $30,400.

With this new taxable income, the annual tax rate remains the same at 12%, which minimizes the tax liability.

12% of $30,400 = $3,648

Earlier, Philip was paying $5,400 to the IRS with the standard deduction. Now, he is paying $3,648. Hence, this is how tax write-offs help save money.

Example #2

The second example comes from a Forbes article, which explains some of the utilities and in-depth knowledge that highlights the tax write-offs for YouTubers. YouTube channels can be treated as businesses. You can claim tax deductions for the camera, video editing software, props, audio equipment, lighting, etc. As a business owner, a YouTuber has multiple write-off options.

The article further gives an example of a YouTube channel that reviews watches. The channel owner was coaching people and educating them about global luxury watches like Rado and Rolex and their applications and features. The person documented each piece of paperwork and claimed that the nature of his business was to share information. The IRS made a watch deduction for their business.

Benefits

The benefits of the concept are as follows:

- This write-off helps reduce taxable income; it is applicable to everyone, from individuals to companies, and is of different types.

- The IRS established a legitimate tax avoidance provision, not an instance of tax evasion.

- The IRS exempts companies from being taxed on business costs, as the IRS believes that they should only be taxed on their revenue.

- For individuals, it also includes several claimable expenses that they can show to reduce their taxable income, eventually decreasing their tax liability.

- With the reduction in taxable income, the tax liability also declines. Therefore, a write-off's most significant benefit is saving a lot of money.