Table Of Contents

Tax Wedge Definition

A tax wedge can be defined as an underlying difference between pre-tax (gross income) and post-tax (after-tax income) wages. It is used to understand the financial implications of a tax burden imposed on a particular product or service. This is why it yields income for the governments but simultaneously leverages the level of inefficiencies in a financial market.

Explanation

Tax Wedge can be learned as an existing difference or gap between demand and supply price. This difference between the demand and supply curve is created as a result of the tax being imposed on a financial market. It takes place because the demand price borne by the customers already comprises the taxes, whereas the supply price received by the suppliers doesn’t comprise these taxes. As a result of the standard demand and supply curve, i.e., the negative and positive slope, the tax implications are levied upon both the customers and the suppliers. Levying taxes on a financial market can result in inefficiencies and create a gap between the demand and supply prices.

Formula to Calculate Tax Wedge

The calculation formula is as follows:

Where,

- Before-tax wedges refer to the wages the employee has earned before any deduction in the form of the taxes from it.

- After-tax wages refer to wages the employee has earned after deducting the taxes as applicable to him.

The other formula used for the calculation of tax wedge on labor is as follows:

Where,

- Average Total Labor Costs = Employee Wage Earnings + Employer Social Insurance and Payroll Taxes

- Net Take – Home pay = Employee Wage Earnings – Income and Social Insurance Taxes + Cash Transfers

How to Calculate the Tax Wedge?

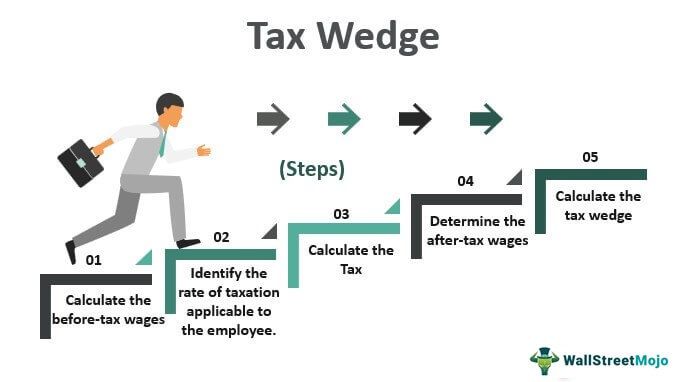

Following are the steps that can be used to calculate for an employee earning the wages:

- Calculate the Before-Tax Wages

Firstly, calculate the before-tax wages which are earned by the employee during the period under consideration.

- Identify the Slab of the Tax Rate

After that, identify the tax rate slab, which applies to the employee as per the federal and the state tax bracket of income, i.e., identify the rate of taxation applicable to the employee.

- Calculate the tax

Calculate the tax the employee must pay to the state and federal government by multiplying the tax rate with the gross wages. The tax to be paid is the tax wedge, which measures the amount the government receives from taxing its labor force.

- Determine the after-tax wages

Determine the after-tax wages of the person by deducting the tax calculated in step 3 from the gross income.

- Calculate the tax wedge

Calculate the tax wedge by deducting the after-tax wages calculated in step 4 from the before-tax wages as determined in step 1.

Example

For example, Bill earned $200,000 as a salary in 2018. He is entitled to pay a 20 % federal tax and 10 % state and local tax on his salary earned in 2018. This means that he paid $40,000 ($200,000 * 20 %) as federal taxes and $20,000 ($200,000 * 10 %) as state and local taxes. Therefore, Bill is left with a remaining salary of $140,000 ($200,000 – $40,000 – $20,000) after paying federal, state, and local taxes. If there is a rise in federal, state, and local tax rates from 20 % to 30 % and 10 % to 15 %, respectively, Bill will be left with $110,000 only.

- ($200,000 * 30 %) = $60,000 (federal taxes)

- ($200,000 * 15 %) = $30,000 (state and local taxes)

- Salary after taxes = $90,000 ($200,000 - $60,000 - $30,000)

During this sudden hike in taxes, Bill and other employees might not find it convenient to work as an employee and they might start looking for better modes of earning their bread and butter.

Importance

The importance is enumerated and discussed as follows-

- It is highly useful in calculating the percentage of inefficiencies caused in the market due to the sales tax.

- It can be used to evaluate the total tax burden on labor and employment for any country.

- It enables a better assessment of the economic impact of employee and employer social insurance contributions often neglected in the wider tax segment.

- It helps generate government income while leveraging inefficiencies in the financial market.

- The greater the rate of tax wedge, the higher the possibility for the same to be present in an informal sector instead of the formal sector.

- In an informal setup, a change in tax wedge might have a minimal impact on the overall employment while having a larger impact on wages.

Conclusion

The tax wedge is merely a difference between gross income and net income once the taxes are deducted. In a progressive tax mechanism, It might increase on a marginal basis with the rise in income. It might also be used to calculate the overall percentage of market inefficiencies introduced as a result of sales taxes. The inefficiencies caused in the financial market due to the tax wedge might enable the customer to pay slightly more. The supplier or the manufacturer receives a lower amount for the goods or services in comparison to the amount that they were usually paying/receiving before the implications of taxes as a result of greater equilibrium prices that the customers pay and a lower number of equilibrium quantities that the suppliers or manufacturers sell.