Table Of Contents

Formula to Calculate Tax Shield (Depreciation & Interest)

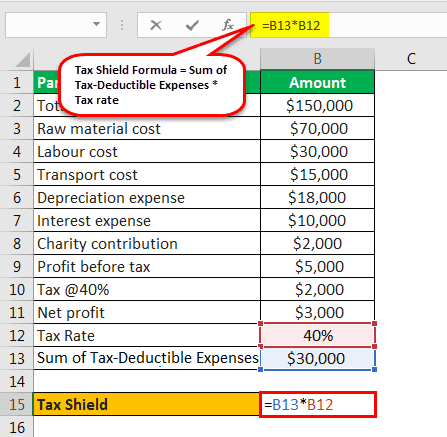

The term "Tax Shield" refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed to the government. The formula for tax shields is very simple, and it is calculated by first adding the different tax-deductible expenses and then multiplying the result by the tax rate.

Mathematically, it is represented as,

Tax Shield formula = Sum of Tax-Deductible Expenses * Tax rate.

Although tax shield can be claimed for a charitable contribution, medical expenditure, etc., it is primarily used for interest and depreciation expenses in a company. Therefore, the tax shield can be specifically represented as tax-deductible expenses.

The calculation of interest tax shield can be obtained by multiplying average debt, cost of debt and and tax rate as shown below,

Interest Tax Shield Formula = Average debt * Cost of debt * Tax rate.

The calculation of depreciation tax shield can be obtained by depreciation expense and tax rate as shown below,

Depreciation Tax Shield Formula = Depreciation expense * Tax rate

Calculation of Tax Shield (Step by Step)

The tax shield can be calculated by using the following steps:

- Firstly, gather all the tax-deductible expenses, such as interest expense, depreciation expense, charitable contribution, medical expenditure, etc., from a company's income statement. Add all such expenses to derive the sum of all the tax-deductible expenses.

- Next, the tax rate that applies to the company is determined, depending on the jurisdiction.

- Finally, the tax shield is calculated by multiplying the sum of tax-deductible expenses and the applicable tax rate, as shown above.

Video Explanation of Tax Shield

Examples

Example #1

Let us consider an example of a company XYZ Ltd, which is in the business of manufacturing synthetic rubber. As per the recent income statement of XYZ Ltd for the financial year ended on March 31, 2018, the following information is available. But, first, do the calculation of Tax Shield enjoyed by the company.

Based on the information, do the calculation of the tax shield enjoyed by the company.

The following is the Sum of Tax-deductible Expenses,

Therefore, the calculation of Tax Shield is as follows,

- Tax Shield Formula= ($10,000 + $18,000 + $2,000) * 40%

The Tax Shield will be -

Tax Shield= $12,000

Therefore, XYZ Ltd enjoyed a Tax shield of $12,000 during FY2018.

Example #2

Let us take the example of another company, PQR Ltd., which is planning to purchase equipment worth $30,000 payable in 3 equal yearly installments, and the interest is chargeable at 10%. The company can also acquire the equipment on lease rental basis for $15,000 per annum, payable at the end of each year for three years. The original cost of the equipment would be depreciated at 33.3% on the straight-line method. The applicable tax rate is 35%. Determine which option is more viable for the company. Purchase of Equipment on Debt or Purchase of Equipment on Lease.

1st option (Purchase of Equipment on Debt)

Annual repayment=Equipment price * Interest rate * /

= $30,000 * 10% * ÷ = $12,063

Cash Outflow in Year 1 = Annual repayment – Depreciation tax shield – Interest tax shield

= $12,063 - $30,000 * 33.3% * 35% - $30,000 * 10% * 35% = $7,513

Cash outflow in year 2 = $12,063 - $30,000 * 33.3% * 35% - ($30,000 - $12,063 + $3,000) * 10% * 35%

= $7,831

Cash outflow in year 3 = $12,063 - $30,000 * 33.3% * 35% - ($20,937 - $12,063 + $2,094) * 10% * 35%

= $8,180

PV of cost of acquisition @10% = $7,513 / (1+10%) + $7,831 / (1+10%)2 + $8,180 / (1+10%)3

= $19,447

2nd option (Purchase of Equipment on Lease)

Yearly cash outflow after tax shield = $15,000 * (1 – 35%) <<since lease rental is the only tax deductible expense, no depreciation due to lease and no interest as no debt>>

= $9,750

PV of cost of acquisition @10% = $9,750 / (1+10%) + $9,750 / (1+10%)2 + $9,750 / (1+10%)3

= $24,247

Therefore, the 1st option is better since it offers a lower cost of acquisition.

Relevance and Use

The tax shield is a very important aspect of corporate accounting since it is the amount a company can save on income tax payments by using various deductible expenses. These savings eventually add to the Company's bottom line. The higher the savings from the tax shield, the higher the company's cash profit. The extent of tax shield varies from nation to nation, and their benefits also vary based on the overall tax rate.