Table of Contents

Tax Settlement Meaning

Tax settlement refers to the agreement between the IRS or any state tax authority and a taxpayer to resolve a tax debt for less than what is actually owed. It is vital to note that the IRS does not have a formal settlement program. However, they have a few alternative resolutions that help taxpayers with a reduced settlement of their tax debt.

Tax settlement payments allow the resolution of disputes in an efficient manner. Therefore, expensive litigation costs can be avoided, and manageable settlement plans can be negotiated with the tax authorities. However, these agreements need guidance from an expert to understand the complicated details of the system thoroughly. There is also a risk of the terms being unfavorable to the individual.

Key Takeaways

- Tax settlements or Offers in Compromise let taxpayers pay their tax debt for less than the actual amount they owe.

- However, they have to provide relevant documentation to prove their poor financial situation.

- The taxpayers can attach all the documents, fill out Form 656 and Form 433, and propose a settlement with the IRS. The IRS shall review and respond.

- Both parties agree to a certain amount that can be settled, either as a lump sum payment or as a periodic payment.

- If the taxpayer does not pay according to the agreed terms, additional interest and penalties might be levied.

How Do IRS Tax Settlements Work?

IRS settlements, also commonly referred to as offers in compromise (OIC), are avenues that allow taxpayers to resolve tax liabilities pending against them for a lesser value than they actually owe. The taxpayer submits an OIC form to the Internal Revenue Service (IRS) stating their financial difficulties. The form and their declaration are attested with relevant documentation such as income statements, expenses ledger, assets, and other outstanding debts.

Once the IRS receives any such requests, they thoroughly go through the financial situation of the taxpayer. Upon review, the IRS may or may not agree to resolve the liability for a lesser amount. In a scenario where a lower amount is agreed upon, the amount is calculated based on reasonable collection potential (RCP). This system not only calculated the value of the taxpayer's assets but also their ability to pay.

Since the taxpayer is in a dire financial situation, the IRS also allows the option of paying through a periodic payment plan if they cannot pay the agreed amount in lump sum. However, it is vital to understand that if the individual or organization in question fails to meet their obligation even after trimmed liabilities and flexible payment plans, the IRS revokes the agreement, and total tax debt is levied again. Moreover, additional interest and penalties are also added to the final figure.

While these provisions or room for understanding seem an excellent addition, it is critical to note that not all taxpayers might qualify to benefit from them. Additionally, the whole application and settlement procedure is complex. It might require the help of a Certified Public Accountant (CPA) or an enrolled agent for the settlement processes and other tax settlement services.

Types of Tax Settlement

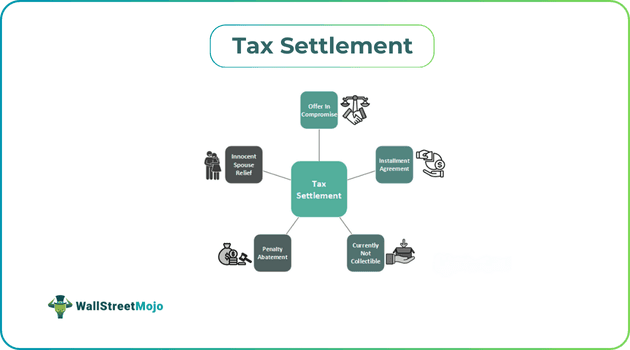

The different types of tax settlements are mentioned below.

- Installment Agreement: An installment agreement is more or less like an EMI where taxpayers can settle their unpaid taxes over a pre-determined period. In simple terms, the amount can be paid in installments, which are monthly payments arrived at using a tax settlement calculator. However, the taxpayer might be liable to penalties and interest as well. Moreover, the IRS might activate a federal tax lien to ensure their interests are safeguarded.

- Offer in Compromise (OIC): This form of settlement is when the IRS conducts its due diligence and finds that the entity in question cannot pay the owed amount in full. As a result, a lesser amount is negotiated and settled.

- Currently Not Collectible (CNC): In some situations, the taxpayer might need to be in a condition to settle their tax debt. Therefore, the IRS might conduct a thorough check to verify their situation and tag them as "CNC." While the pending tax amount will not be collected, the penalties and interests shall keep accruing in this case.

- Penalty Abatement: A taxpayer who has defaulted on their tax payment can apply for a reduction if they have a reasonable and unavoidable reason for missing their obligations. These reasons could be natural disasters, death in the family, severe sickness, or meeting with an accident. The taxpayer needs to provide proof of their situation and settle their unpaid tax obligations.

- Innocent Spouse Relief: For married couples filing jointly, there might be situations where they remain ignorant of any possible tax frauds or errors made by their spouse in their tax filing. The innocent partner must prove that they did not have any knowledge about the omittance. If proven innocent, they shall not be held responsible for the tax bill.

How To Negotiate An IRS Tax Settlement?

While the benefits of tax settlement payments are apparent through the discussion above, only some qualify for the same. Nevertheless, even qualified entities might need professional support to negotiate with the IRS. The points below explain how to do that.

- First things first, the taxpayer must assess their eligibility by evaluating their income, assets, expenses, liabilities, and overall financial situation.

- If they qualify, gathering all relevant documents is essential to prove their financial circumstances. These documents can include bank statements, income statements, asset valuations, and tax returns.

- Once the documents are gathered, taxpayers must fill out Form 656 for an offer in compromise attached with Form 433 (433A for individuals and 433B for business entities) to give the IRS a complete financial disclosure.

- After submitting the forms along with the documents, taxpayers must calculate a reasonable sum as the settlement amount. At this stage of the process, it might be a good idea to consult with a professional even if the taxpayer is negotiating on their own with the IRS,

- When the proposed sum is put forth to the IRS, taxpayers typically have to pay a $205 application fee. However, the fee is waived off if they are eligible for a low-income waiver. Additionally, the taxpayer must pay either a lump sum or the first installment in the case of a periodic payment plan.

- The IRS shall review the application and the proposed amount based on the taxpayer's financial standpoint. Hearing from the IRS might take months. After the review, the IRS either agrees to the terms or have slightly different terms communicated.

- The taxpayer can further prove their financial hardship with relevant documents and negotiate better terms with the IRS.

- As and when the IRS accepts the offer, the taxpayer must comply without fail.

Examples

Understanding any concept is easier with real-life scenarios and practical applications in the mix. The examples below are an attempt towards just that.

Example #1

Glenn, a small importer, experienced severe difficulties due to a war between Russia and Ukraine. Owing to supply chain disruptions and a slowdown in production, his business in the United States was affected adversely.

At the end of the year, his tax liability amounted to $40,000. He was in no situation to settle that big an amount. Therefore, he applied to the IRS's offer in compromise or OIC. He attached all necessary documents and also filled out Form 656 and 433A.

Glenn proposed a settlement amount of $10,000. Along with the application, John also made his initial payment and is awaiting approval from the IRS. After reviewing the case thoroughly, the IRS accepted Glenn's offer and agreed to a periodic payment plan.

Example #2

Caterpillar Inc. is one of the world's biggest machine manufacturers. The company settled with the IRS with respect to the tax disputes right from 2007 to 2016. In 2017, US agents even raided the company's headquarters to find the links to this case.

After much deliberation, the IRS and Caterpillar Inc. have decided to end the tax dispute with a $740 million settlement. Moreover, the manufacturing giant does not have to pay any interest or penalties for lapsing their obligations or stretching the dispute for almost a decade.

How Do Tax Settlements Affect Taxes?

Tax settlement payments are significant sources of relief for individuals or businesses under financial stress. When the IRS accepts an offer to receive a lesser amount than the actual tax liability, it allows legal entities to manage their already tight finances more efficiently.

However, it is vital to note that the amount forgiven by the IRS could be considered taxable income in some cases. Therefore, the revised amount proposed to the IRS must be arrived at after considering this possibility. In some other cases, the amount forgiven is not taxable and, thereby, can be reduced from the gross income.

One crucial point to understand is that the taxpayer must be punctual with their payments after the agreement is mutually agreed by both parties. Otherwise, extra penalties and interest may be levied on every installment or lump sum paid after the due date. These additional penalties might beat the purpose of going through such a tedious process to negotiate the tax liability.

Benefits

Even though we have discussed the advantages of tax settlement services in bits and pieces throughout the article, the points below concisely specify their benefits.

- The fundamental benefit of these settlements is that taxpayers can settle for an amount significantly less than their actual amount owed. Therefore, their already tight finances can be managed efficiently after the tax amount is freed up.

- When an individual or a business does not pay their tax obligation and does not approach the IRS about the reasons for their failure to pay, there are severe consequences. By applying for tax settlements, taxpayers free themselves from seizures, levies, and penalties.

- By opting for these forms of settlements, taxpayers can safeguard their assets and income from being seized.

- Taxpayers can pay their tax liabilities in installments. Therefore, it gives them the time and freedom to manage their finances.

- These forms of settlements save taxpayers from their employers holding back a certain amount while disbursing their salaries. It is referred to as wage garnishments. OIC taxpayers are saved from such drastic steps.