Table of Contents

Tax Residency Meaning

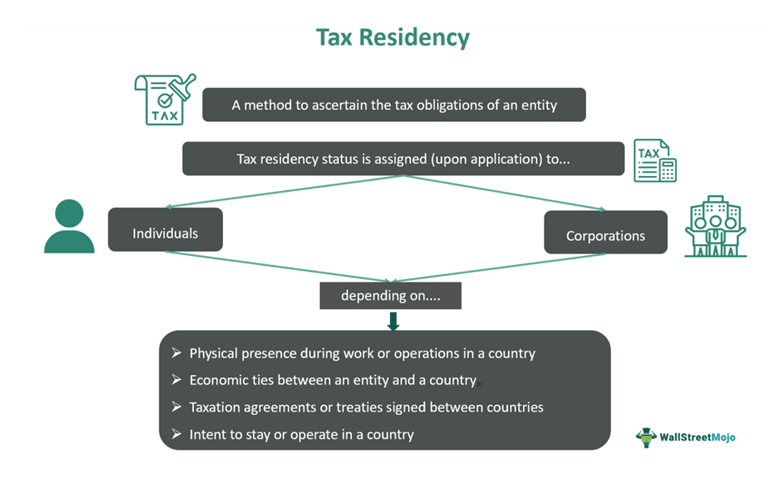

Tax Residency refers to the status that countries assign to entities (individuals and companies) working or operating in their jurisdiction to determine their tax liability. Tax authorities determine the tax rules that apply to entities and accordingly assign them the tax resident status, which means they become liable to pay taxes in said countries.

Countries worldwide have defined laws to ensure such individuals and companies are correctly identified and made responsible for tax payments upon living, working, and operating in a given region. These rules are based on the duration for which an entity works or operates in a specific country, citizenship, domicile, and economic ties. Hence, they may change from one country to another.

Key Takeaways

- Tax residency is a way to determine where entities are liable to pay taxes based on their place of work, domicile, time spent in a specific country, citizenship, and economic ties.

- Whether they are regarded as a tax resident is determined by how long they have lived in a specific location, in addition to other aspects like citizenship, domicile, economic connections, etc.

- In the US, if an individual holds a green card or meets the Substantial Presence Test, they are considered a tax resident. The tax rules determine whether an individual or corporation has complied with the taxation laws pertaining to their income.

- Double taxation, which occurs when income is subject to taxes in multiple jurisdictions, can be prevented through tax residency. To avoid double taxation and simplify international taxation, several countries have established tax agreements and treaties.

Tax Residency Explained

Tax residency refers to assessing an individual's or a company's legal tax status in a specific country. Since international taxation is complex, this demands careful consideration and planning before an individual can be hired, or a company can set up operations in a region other than its home country.

It is a key concern for Human Resources professionals since it specifies the regulations that state how much tax employees living and working abroad must pay. Companies operating in foreign lands are also required to comply with the relevant region’s taxation guidelines. Non-compliance with tax rules may lead to financial or legal repercussions or both.

Each country has rules regarding tax residency. Generally, tax departments consider how long an individual has been physically present in a country, where their primary house or office is, and what kind of financial connections they have in a given region. Additionally, intent to stay is also taken into account, where matters of residency and citizenship are evaluated. Economic ties that define if an entity has other means or sources of income are also considered while making tax residency decisions. It also gives importance to whether a Double Taxation Avoidance Agreement (DTAA) or any other tax treaty exists between two countries.

A Tax Residency Certificate (TRC), issued by tax departments, is a document that mentions and confirms an entity’s tax residency status in a given country. The process to apply for and secure this certificate typically varies from nation to nation. Usually, it involves filling out an application and submitting supporting documentation to verify details like an individual's place of residence or income.

For employees, a TRC can be advantageous. It suggests that they receive rebates, exemptions, or other advantages outlined in tax agreements between their nation of residence and the country in which they are earning money.

How To Determine?

Every nation has regulations that govern who is considered a tax resident. To put it simply, a tax resident is a person who, regardless of where their money is earned, is subject to the tax laws of the nation in which they live.

A person's residency status in the US determines their tax liability. Like US citizens, resident entities must disclose their earnings and pay taxes on their worldwide income. Nonresidents are required to file an annual tax return and submit Form 8843 by the deadline, even if they do not have any income. They pay taxes only on their US income.

There are two primary ways to become a tax resident in the US. The first is the Green Card Test, which determines if a person is automatically considered a tax resident if they are granted a green card, which permits them to reside in the country permanently.

The second way is through the Substantial Presence Test. It looks at the total number of days they have spent in the US over three years. If an individual has been in the US for at least 31 days in the current year and a certain amount in the two years just before that, they might be considered a tax resident.

The determination of a person's status as a tax resident varies by nation. It usually depends on where an individual resides for the longest amount of time over a given length of time. This period of time could be as brief as two months, or it usually lasts for about six months, or 183 days in a row. Being a tax resident, regardless of how a nation defines residency, basically implies that an individual must pay taxes in that nation on all of their income, whether it is earned domestically or abroad.

For US tax residency, the Internal Revenue Service (IRS) applies a somewhat complicated way to determine if someone passes its substantial presence criteria so that an individual becomes liable for US taxes. This requires the person to:

Be physically present for at least 31 days in the current year.

Clock in 183 days across a three-year period, which includes the current year and the two years preceding it. The 183-day count is not simple. It is a combination of:

- Every day they spent in the United States in a given year

- One-third of the days from the previous year and one-sixth from the year before that

Form 6166 is issued by the US Department of Treasury to validate an individual or corporation’s residency status to enable eligible individuals and entities to claim tax treaties and other relevant benefits in foreign jurisdictions. Form 6166 is issued upon correctly filing Form 8802, which is the Application for United States Residency Certification.

https://www.irs.gov/individuals/international-taxpayers/form-6166-certification-of-us-tax-residency

Examples

Let us study some tax residency examples to decode the concept further.

Example #1

Suppose United Kingdom citizen Mary accepted a job in the United States. She received a fantastic job opportunity from StarLight Inc., a US company, and decided to take it up. Although she was excited about the work, she knew there may be consequences if she is declared a tax resident of the United States. She already pays taxes under UK tax residency through citizenship.

In Mary’s case, the Substantial Presence Test was used by US tax authorities to assess whether Mary should be considered a tax resident. She may be deemed a tax resident if, over three years, including the current one and the two previous ones, she spent more than 183 days in the United States. Mary decided to consult a tax lawyer to ensure she did not violate any rules, which could otherwise result in penalties or legal action.

Keeping this guideline in mind, Mary kept count of her days in the United States. If she was physically present for at least 31 days in the current year, and her cumulative number of days over the previous three years met the substantial presence criteria, Mary would be subject to US taxes on her global income.

This illustrates the importance of tax residency, which is more than just the nation in which an individual lives; it also considers the amount of time they spend in a country, which can have an essential effect on their tax liabilities.

Example #2

A November 2023 update on a previously published news report about the renowned singer Shakira’s alleged tax fraud brings to light the importance of compliance with taxation laws, particularly when income sources originate from various regions or geographies.

Allegations of tax fraud had emerged and were being investigated, as the popular singer was asked to present her case in cases of tax evasion to the tune of $16 million across 2012, 2013, and 2014. While the case was settled later and the singer did not face any severe repercussions, it drew people’s attention to a few crucial issues regarding international taxation.

A prominent aspect discussed in this case was how to establish an individual’s residence status for the purpose of taxes. For instance, the duration of her stay in Spain was evaluated, as Spain deems a person to be a tax resident if they have spent 183 days or more in the country. In this case, Shakira was said to have spent 200 days there.

This illustrates why it is important to have a tax resident status through certification in relevant countries when an individual earns money from various sources across different geographies.

Importance

We know that when an individual or company is assigned this status, it proves beneficial in terms of ensuring compliance and avoiding penalties or legal hassles. In this section, let us study the importance of tax residency.

- Tax benefits and deductions: One of the primary reasons for determining tax residence is the ability to benefit from tax benefits and deductions that are normally granted to a country's residents. These advantages can include lower tax rates, exemptions, credits, and deductions, which may drastically decrease the overall tax burden.

- Double taxation avoidance: Tax residency helps avoid double taxation, which happens when income is taxed in more than one country/jurisdiction. Several nations have entered tax agreements and signed treaties to prevent double taxation while offering reassurance to residents about the income earned overseas.

- Facilitates compliance: Individuals and corporations find it easier to comply with several nations' extensive tax rules and regulations due to tax residency. This includes filing tax forms, declaring income and assets, and complying with other tax duties unique to each jurisdiction.

- Ensures reporting uniformity: Once an individual or corporation’s residency status is clear, they can follow uniform methods while reporting income, expenses, assets, and other tax-related items relevant across various jurisdictions.

Overall, recognizing and determining tax residency outlines the right tax duties while providing access to a variety of benefits and facilitating cross-border or international tax compliance.