Table of Contents

Tax Filing Meaning

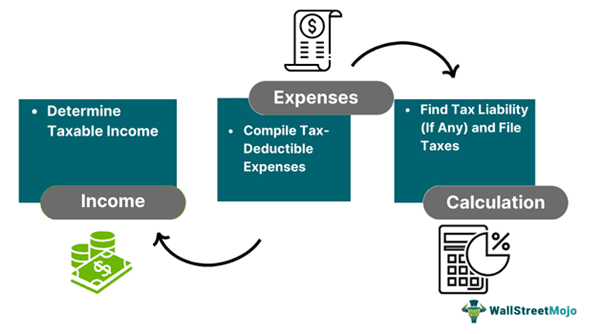

Tax filing is the process of disclosing a taxpayer’s income, expenses, and other financial information to calculate and gauge the tax liability or the amount of tax refund they are eligible for. In the modern day, the filing process can be done online through the Internal Revenue System (IRS) e-filing portal.

It is important to note that individuals above a threshold are only required to perform income tax filing. A few common forms that taxpayers in the United States have to fill and attach to their filing are 1040, 1040A, 1040EZ, 1120, 1120S, and 1065. It is essential to file taxes within the given timeframe to avoid interests and penalties.

Key Takeaways

- Tax filing refers to the process of determining an individual's or entity's taxable income and tax-deductible expenses for a financial year.

- The process helps taxpayers fulfill their tax obligation by helping them understand their tax liability, if any, or the refund they are eligible for.

- Essentially, the process allows taxpayers to fulfill their obligations by declaring their income and paying taxes to the government.

- The tax filing process must be completed within the IRS's stipulated time frame. Otherwise, it can attract penalties and interest.

Tax Filing Explained

Tax filing is the process of individuals and businesses putting their financial information and income forth to the Internal Revenue System (IRS). Tax filing is to be done every year within a stipulated period as directed by the IRS. The tax filing process makes sure that taxpayers disclose their deductions, earnings, credit, and other financial information accurately to gauge their tax liability or refund.

There are different eligibility criteria for different taxpayers. For instance, taxpayers who are single need to file a tax return only if their gross income is above $13,850. However, if a married couple decides to file their taxes separately, they are required to do so if their gross income is above $5. Therefore, taxpayers must stay on top of the moderation through the official IRS website.

It is often said that filing is not a one-time-a-year process. Taxpayers must document their income, expenditures, and tax deductions, if any, throughout the year. As a result, their tax filing is a breeze at the end of the year as they do not have to find details and statements for different transactions.

The filing is not just a financial obligation to the government but also gives taxpayers an opportunity to make use of their credits and rebates whenever applicable. Therefore, compliance with tax norms and regulations is a non-negotiable for long-term financial growth.

Requirements

Before even preparing to file taxes, taxpayers must ensure that their gross income is above the IRS threshold. The threshold for different types of taxpayers is available on the official IRS website.

Once the filing requirement is over, taxpayers must be able to fulfill the following requirements. After filing, they must get their tax filing number for future reference. The requirements are:

- Forms that determine the income earned by the taxpayer within the year. These documents include W-2 forms from employers and forms 1099 and 1099-INT that indicate interest and other earnings statements.

- All receipts for tax-deductible expenses within the year. These include mortgage interest, charitable donations, medical expenses, state and local taxes, business expenses, and any other tax-deductible expenses for itemized returns.

- All taxpayers are required to choose a filing status. Whether they are single or married but filing separately, married and filing jointly, or filing as dependents significantly affects the thresholds and tax liability.

- After these formalities, taxpayers are also required to choose whether to file a return with an itemized deduction or a standard deduction.

- They are required to fulfill all these formalities within a stipulated period to file taxes without attracting penalties or interest.

Examples

Now that the basic outline of the income tax filing process is out of the way, it is time to touch upon the theoretical knowledge's practical applicability. The examples below help with understanding the process's real-life application.

Example #1

Stephen and Stephanie got married in 2023 at the ages of 32 and 35, respectively. They were diligent with their accounts and recorded every income and expenditure without fail. Stephen worked as a librarian, and Stephanie was a freelance writer. That year, their joint gross income was $25,500.

When the time to file taxes arrived, they decided to file jointly. Since they are married and filing jointly, and both partners are under the age of 65, they were not required to file taxes. The threshold or limit for married couples filing jointly is $27,700 and above in annual gross income.

Example #2

A seasoned IRS agent was indicted for filing false tax returns for several years. The employee was found guilty on three counts of failing false tax returns and another three counts of doing so as a U.S. employee. She was arrested, and criminal charges were filed against her.

As a result, she faced a three-year prison tenure and was directed to pay $100,000 as a file for her crime. A U.S. sentencing commission said that in the fiscal year 2022 alone, approximately 61,000 such cases were reported.

Late Tax Filing Penalty

Taxpayers who fail to pay their taxes within the due date, which is usually around April 15, are subject to fines and penalties. The penalty is decided upon the due date and not the extended due date that the IRS provides. Therefore, the penalty calculation depends on the period of failure to file taxes. The penalties could be 5% of the tax liability for each month or part of a month where the return is late, which shall not exceed 25% of the taxes owed.

Additionally, an interest rate might also be levied on the penalties. If a taxpayer fails to pay their penalty for an extended period, they shall also be liable to pay interest on the penalty amount.

How To Extend?

Taxpayers can use the IRS's online tax filing portal to fill out a free form to file an automatic extension for filing taxes. Filling out the form gives taxpayers breathing space until October 15 to file their taxes. However, if October 15 happens to be a legal holiday or weekend, the extension is valid until the next business day.

It is important to note that to get an extension, taxpayers must first approximate their tax liability and pay any amount due to ensure their extension is accepted.

An important point to note in this regard is that taxpayers in disaster areas or war zones need not file for an extension. They shall be granted an extended period by the IRS.

Joint Vs Separate Tax Filing

The distinctions between joint and separate income tax filing are discussed below.

Joint Filing

- Married couples decide to file their taxes as a singular file, usually referred to as married filing jointly.

- It gives them an increased level of eligibility for tax credits.

- Most often, filing jointly gives couples a larger standard deduction.

- It gives couples an opportunity to take advantage of higher tax break thresholds such as IRA contributions.

Separate Filing

- Married couples can file their taxes separately. This option has its own set of thresholds and procedures.

- Filing separately can help if one of the spouses has significant deduction eligibility due to high healthcare-related expenses.

- It can significantly reduce a spouse's student loan payment, especially if they are on an income-driven repayment program.

- It is helpful in most cases for couples with a huge income disparity.

Tax Filing Vs Tax Return

Income tax filing and tax returns are terms that are often used interchangeably. However, their meanings and implications are quite different. The differences are:

Tax Filing

- It refers to a broader process of ensuring that a taxpayer fulfills their tax obligations as an entity or as an individual to the IRS.

- The process involves various factors, such as finding the taxpayer’s taxable income, calculating tax liability, and attaching necessary documentation.

- It is the whole process that involves preparing, submitting, and completing tax-related information to relevant authorities in accordance with the country’s tax laws.

Tax Return

- Tax return documents are an official declaration that a taxpayer is eligible for a refund of the tax paid.

- It is a specific document or a set of documents that are submitted to tax authorities. It includes statements that determine the income, credits, deductions, and other financial information within a particular tax period, usually a financial year.

- It includes forms such as Form 1040 and Form 1120. These forms and the refund mark the end of a yearly tax filing process.