Table of Contents

What Is Tax Expenditure?

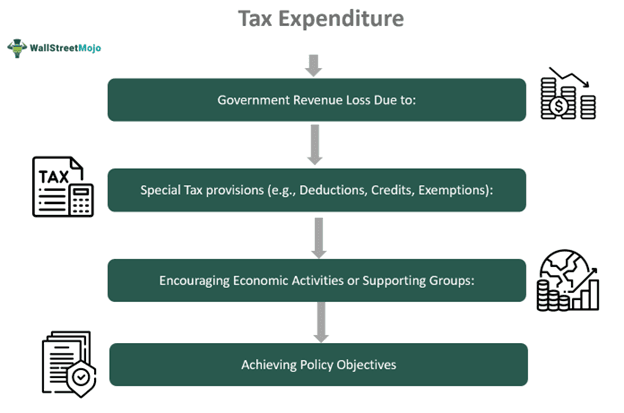

Tax expenditures are deviations from the regular tax rules that reduce taxes for individuals or businesses. Their aim is to provide incentives or benefits to taxpayers in form of exemptions, deductions, credits, or special rates, which eventually leads to revenue losses for the government.

It is a valuable tool for governments, offering incentives to citizens and businesses. However, their impact on budgets remains less transparent than regular expenditures, and it favors specific interest groups. Civil society organizations play a crucial role in monitoring, evaluating, and advocating for accountability in tax expenditure policies.

Key Takeaways

- Tax expenditure refers to government revenue foregone due to preferential tax treatment, such as deductions, credits, or exemptions, designed to incentivize certain activities or groups.

- Tax expenditure analysis involves assessing the fiscal impact and effectiveness of various tax provisions that result in forgone government revenue.

- It evaluates the economic and social objectives of tax policies, determining their efficiency, equity, and overall impact on public finances.

- Tax expenditures provide tax breaks through deductions, credits, or exemptions, reducing tax liability for individuals or businesses.

- In contrast, direct subsidies involve the government providing financial support directly to recipients through grants, loans, or payments.

Tax Expenditure Explained

Tax expenditures refers to money/revenue funds that the federal government loses because of special rules in tax laws. These rules let people or businesses avoid paying some taxes or get special credits or lower tax rates. They are seen as alternatives to other ways the government might achieve its goals, like spending money or making regulations.

These expenditures are evaluated based on their deviation from the "normal" tax code. According to the U.S. Treasury, they represent revenue losses resulting from provisions in federal tax laws that offer special exclusions, exemptions, deductions, credits, preferential tax rates, or deferral of tax liability.

Understanding tax expenditures can be difficult at times because it involves figuring out what is different from the regular tax rules. For example, while things like child tax credits are counted as tax expenditures, common deductions like the standard one that lowers tax bills aren't. This can confuse taxpayers.

They serve us with different purposes, like encouraging certain activities or changes in behavior. They're also used to slowly change the tax system. This step-by-step method Also, there have been changes to international tax rules to support a territorial tax system.

Examples

Let us look at the tax expenditure examples to understand the concept better-

Example #1

In a hypothetical scenario, let's say the government introduces a tax expenditure to encourage small businesses to invest in employee training programs. Under this provision, businesses that allocate funds for employee skill development may be eligible for a tax deduction or credit. This tax incentive aims to enhance workforce productivity, promote job growth, and stimulate economic competitiveness. However, implementing and monitoring this tax expenditure requires clear guidelines to define eligible training expenses and ensure that businesses genuinely invest in employee development rather than exploiting the tax benefit for other purposes.

Example #2

Over the past decade, there has been a growing focus on economic issues and tax collection by the Federal Board of Revenue (FBR), largely due to the efforts of diligent journalists in English-language newspapers. While this increased scrutiny holds the potential to foster a financially responsible government and empower voters to make informed choices, there is a risk of distorted information circulating through mainstream and social media. Criticisms often arise due to misunderstandings or insufficient context provided by FBR, the government, and economists regarding tax expenditure data.

For instance, the recent uproar over the significant tax exemptions granted to the elite, as revealed in the Tax Expenditure report published by FBR, illustrates this point. The report, released online in June 2023, indicated a substantial increase in tax exemptions compared to the previous fiscal year. However, critics failed to acknowledge that the data covered only three months of the current government's tenure. Furthermore, the report highlighted that Pakistan's tax expenditure estimate for FY2021-22, at 3.36% of GDP, is below the global average, with countries like the U.S. and Australia allocating much higher percentages of GDP to tax expenditure.

While social media discussions and media reports may fuel perceptions of favoritism towards the elite, it's essential to assess tax expenditure with a broader perspective. Tax expenditure serves multiple purposes beyond revenue maximization, including achieving economic and social objectives. Exemptions and concessions are often aimed at promoting economic growth, alleviating the tax burden on certain sectors, and advancing social welfare goals. For example, exemptions on essential items like medicines and food products primarily benefit the general public rather than the elite.

Additionally, tax credits and exemptions on investments aim to incentivize economic activities and stimulate industrial growth, benefiting the broader economy. Criticisms of tax expenditure should consider whether these exemptions align with socio-economic objectives and benefit the broader population. While improvements in transparency and accountability are necessary, attributing ulterior motives to tax expenditure decisions may overlook the complex factors involved in shaping fiscal policy.

Impact

- Tax expenditures, akin to direct expenditures, impact fiscal budget balance by reducing tax revenue, thereby affecting the overall budget deficit or surplus.

- They are funded from the tax base and lack periodic budgetary appropriation, leading to uncontrolled growth and potentially jeopardizing fiscal balance and sustainability.

- Tax expenditure programs receive higher budget priority than direct expenditure programs, regardless of whether they are aimed at national defense or social welfare.

- The effectiveness and efficiency of public resource allocation can be compromised by overlapping or conflicting tax expenditure programs, outdated provisions, and lack of coordination with direct expenditure programs.

- Tax expenditures add complexity to the tax system, burdening tax administration and providing opportunities for abusive tax practices such as evasion and avoidance.

- Loose financial discipline and scrutiny over tax expenditures can lead to abuse by government officials and legislators for personal gain or to benefit favored interests, undermining spending efficiency and fiscal accountability.

Tax Expenditure vs Direct Subsidies

The differences between the tax expenditure and direct subsidies is as follows -

| Tax Expenditure | Direct Subsidies |

|---|---|

| Tax expenditure involves providing financial benefits indirectly through the tax system by granting exemptions, deductions, credits, or preferential tax treatment to certain groups or activities. | Direct subsidies involve providing financial assistance directly to specific groups or individuals in the form of cash grants, interest-free loans, or other tangible benefits. |

| Tax expenditures have less direct targeting as they are applied broadly to certain categories of taxpayers or economic activities defined by tax laws. | Direct subsidies can be targeted more directly to specific groups or activities based on eligibility criteria set by the government. |