Table of Contents

Tax-Exempt Organization Meaning

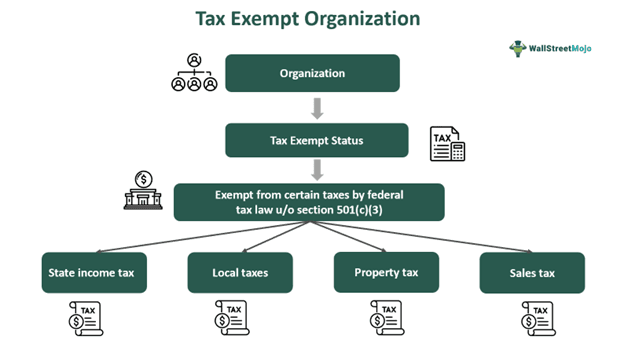

Tax-exempt organizations are officially recognized by the IRS and exempt from paying the federal income tax. This designation aims to support organizations dedicated to charitable, educational, religious, or other beneficial purposes by alleviating their financial burdens.

Tax-exempt status enables eligible groups to save on federal, state, and local taxes, allowing them to allocate more resources toward their objectives. Additionally, it opens doors to grants, government aid, services, and postage rates. Donors are inclined to support these organizations due to tax redemption for their contributions.

Key Takeaways

- A tax-exempt organization is one that is not required to pay certain taxes, typically federal income tax, due to its charitable, religious, educational, or other designated purposes.

- Tax-exempt status saves money and enhances credibility for organizations, attracting donors with tax-deductible contributions.

- However, it also includes complex compliance requirements, limits on political activities, and meticulous record-keeping, demanding ongoing administrative effort and potential regulatory scrutiny.

- Tax-exempt organizations include charities, religious groups, educational institutions, healthcare providers, social welfare organizations, and more.

- They are recognized by the IRS for their charitable, religious, scientific, educational, or other specified purposes, allowing them to be exempt from certain taxes.

Tax-Exempt Organization Explained

Tax-exempt organizations, such as charities, represent a diverse spectrum of entities spanning different fields like arts, education, health, and beyond. They are categorized by the National Taxonomy of Exempt Entities, a system the IRS utilizes to classify these organizations. This classification aids in identifying the specific purposes and activities of each group, facilitating regulatory oversight and public understanding.

Among these groups, those meeting the criteria outlined in Section 501(c)(3) of the Internal Revenue Code enjoy exemption from federal income tax. This designation is reserved for organizations engaged in charitable, educational, religious, scientific, or literary endeavors. By alleviating the tax burden, these entities can allocate more resources towards advancing their respective missions, benefitting society.

Furthermore, donors are incentivized to support these tax-exempt organizations as their contributions are typically tax-deductible. This encourages philanthropy and reinforces these organizations' vital role in addressing societal needs, fostering innovation, and promoting positive social change.

Types

Various types of tax-exempt organizations exist under the Internal Revenue Code Section 501(c)(3). These include charitable organizations focused on religious, educational, scientific, or literary purposes.

- Charitable Organizations: Organizations set up exclusively for charitable, religious, scientific, educational, or other specified purposes can qualify for tax exemption under Internal Revenue Code Section 501(c)(3).

- Churches and Religious Organizations: Churches and religious groups, like many other charitable organizations, can be exempt from federal income tax under Section 501(c)(3).

- Private Foundations: Any organization meeting the criteria for tax-exempt status under Section 501(c)(3) is deemed a private foundation unless it meets exceptions outlined in Section 509(a). These foundations usually rely on a single major funding source and primarily distribute grants to other charitable organizations or individuals.

- Political Organizations: Political entities subject to Section 527 are organized primarily to accept contributions or make expenditures for political purposes.

- Other Nonprofits: Various organizations meeting specific requirements may qualify for exemption under subsections other than 501(c)(3), such as social welfare groups, civic leagues, social clubs, labor unions, and business leagues.

Examples

Let us look at the tax-exempt organization examples to understand the concept better-

Example #1

John is deeply committed to addressing food insecurity in his community and has decided to establish a nonprofit organization focused on providing meals to those in need. After meeting the requirements outlined by the Internal Revenue Code, John's organization is granted tax-exempt status by the government.

This designation relieves John's nonprofit from paying federal income tax, allowing him to channel funds toward purchasing food supplies, operating meal distribution programs, and expanding outreach efforts. As a tax-exempt organization, John's nonprofit can maximize its impact in alleviating hunger and supporting vulnerable individuals and families in his community.

Example #2

In 2023, around 1.85 million organizations exempt from taxes were registered with the Internal Revenue Service. These groups made up about 5.6 percent of the US economy in 2022. Roughly 35 percent of these registered nonprofits have to submit annual returns, while others with lower revenues file simpler forms. Some organizations, like churches, don't have to file annually. Private foundations must file a specific form.

Being tax-exempt means these organizations don't have to pay federal taxes on income from their assets and activities, except for certain types of income. States usually follow federal rules, often exempting charities from property and sales taxes. Sometimes, charities can also issue tax-exempt bonds.

Pros and Cons

There are various pros and cons of tax-exempt organizations discussed below-

Pros of tax-exempt organizations are as follows-

- Tax Savings: Unlike for-profit businesses, these organizations are exempt from federal income tax on earnings related to their nonprofit activities. This means they can allocate more funds towards their mission instead of paying taxes.

- State Tax Exemptions: Many states also offer tax benefits to tax-exempt organizations, including exemptions from sales tax, state income tax, and property tax. This further reduces the financial burden on nonprofits, allowing them to stretch their budgets further.

- Tax-Deductible Donations: Donors who contribute to tax-exempt organizations can typically deduct their donations from their taxable income. This incentive encourages individuals and businesses to support nonprofits financially, increasing their ability to raise funds for their cause.

- Access to Funding Opportunities: Nonprofits with tax-exempt status may have access to grants, subsidies, and other funding forms specifically earmarked for charitable organizations. These funding sources may not be available to for-profit businesses, providing nonprofits with additional resources to carry out their programs and initiatives.

The cons of tax exempt organizations are as follows-

- Burdensome Reporting Requirements: Nonprofits are required to keep detailed records and regularly report to the IRS. This includes filing annual tax returns disclosing their financial activities, gross receipts, and expenditures. Failure to comply with these reporting obligations can result in the loss of tax-exempt status.

- Loss of Flexibility: Some organizations may find the flexibility of for-profit entities more appealing. For-profit businesses offer the potential for personal financial gain, which may not be available to tax-exempt organizations. Additionally, some organizations may choose to forego incorporation altogether to avoid the regulatory requirements associated with tax-exempt status.

- Exclusion of Smaller Organizations: Many smaller organizations may not qualify for or benefit from tax-exempt status due to the costs and administrative burdens involved. As a result, they may not be able to enjoy the advantages afforded to larger nonprofits.

- Strategic Considerations: Each organization must carefully weigh the pros and cons of tax-exempt status based on its unique goals and values. While tax-exempt status offers financial advantages and enhanced credibility, it also entails compliance responsibilities and limitations that may not align with every organization's objectives