Table Of Contents

What Is A Tax Deed?

A tax deed is a legal document that transfers absolute title in the ownership of any property like land, building, vehicle, or any other movable or immovable property from the owner to government authorities due to non-payment of taxes due (like property tax) by the taxpayer generally undertaken with the motive of collecting delinquent taxes.

Tax deed sales transfer the ownership of the property to the highest bidder in the auction, thereby recovering the property tax that has been outstanding for long. Property tax is the tax levied on the real estate property one owns.

Tax Deed Explained

Tax deed is a formal document that transfers the right over a property from one individual or entity to another through an auction. This auction is conducted when the original owner fails to pay the required property tax. The government authorities, in the event of default in paying these taxes, conduct the tax deed auction to find the highest bidder to be transferred the property ownership rights to.

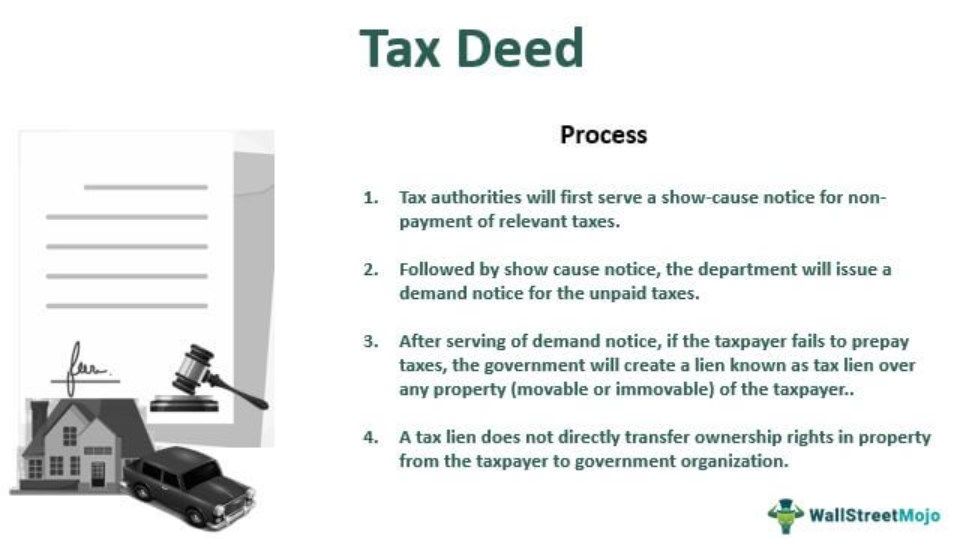

Every taxpayer has to pay taxes and duties levied by the government on time as and when they fall due. However, sometimes due to various reasons, for example, under financial distress conditions, the taxpayer may not be able to comply with the prevailing tax laws and repay required taxes as and when required. Under such circumstances, tax authorities will first serve a show-cause notice for non-payment of relevant taxes.

Followed by show cause notice, the department issues a demand notice for the unpaid taxes. Even after serving demand notice, if the taxpayer fails to prepay taxes, the government conducts an auction for property (movable or immovable) of the taxpayer. The highest bidder gets the ownership rights and becomes the purchaser of the tax deed property.

The amount generated helps the authorities recover the delinquent taxes. The taxes collected as property tax are used to finance projects, including the development and improvement of water and sewer systems, construction of roads, initiating educations schemes and programs, etc. In the process, however, the owner is free to clear all outstanding tax dues before the issuance of the tax deed to retain the owrnership rights over the property.

Tax deed sale is nothing different than selling any seized property generally via auction sale mode of tax defaulter under a legal document that transfers ownership of a property from the tax defaulter to the prospective buyer to recover unpaid taxes.

How To Buy/Invest?

Whenever a taxpayer defaults in payment of property taxes on time, countries create a tax lien, seize the property, and ultimately sell the property to recover delinquent taxes. Generally, countries sell the property through auction mode. Property is sold at a value lower than the normal valuation and attracts a large investor. Anyone interested in buying property via tax deed may attend the auction and place bids according to their potential.

The highest bidder gets the allotment of property subject to payment of the bid amount within 72 hours of the auction. Once after getting an allotment, the owner's sole description is to either keep the property for sale in the future or immediately realize cash.

Tax deed investing becomes active when the application for the same is made to the tax collector’s office. As soon as the application is submitted, the property becomes open for public action. The participants bid for the property and the one who puts forth the highest bid gains the ownership rights.

Example

Let us consider the following example to understand the concept and check how it works:

Mr. Mark didn’t clear his income tax liability of $ 1,00,00 for 2018. The income tax department had served notice for payment of the tax liabilities. Even then, Mr. Mark didn’t clear his tax dues. Now the tax department will create a lien over any asset of Mr. Mark, say, for example, against his house property. Even after the creation of the tax lien, if Mr. Mark didn’t clear his tax dues, the department would seize it and ultimately sell the property against the tax deed document. If the property realizes $ 1,50,000 from sale proceeds, the department will recover its $1,00,000 and surrender $ 50,000 to Mr. Mark. Since the motive is to recover tax dues, any excess amount will be repaid to the property owner.

Risks

Investing in tax deed sales, undoubtedly, offers individuals a chance to own a property through auctions. However, it comes with certain risks as well as the same time. Let us check out the risks associated with buying the tax deed sales:

- The property in question is likely to have financial obligations, including mortgages, liens, etc., on it, which could thereby make the new owners own the debts of the original owner as well.

- If the market fluctuation is unfavorable, it may affect the price of the property negatively, thereby turning the deal into a not-so-profitable one for the new purchasers.

- The lack of legalities might lead to legal issues at a later stage for the new owners.

- Plus, the property purchased might not be in a sound condition, which may make the new property owners to invest in the improvement of the property as well.

Tax Deed vs Tax Lien

Tax Deed and Tax lien are the terms that are widely used in the context of real estate and they are often used synonymously, which is inappropriate. Hence, it is important to have a look at the difference between both the terms. Let us have a look at the differences below:

- Tax Lien is a charge created against a taxpayer’s property against non-payment of taxes and duties on time. This charge does not transfer the right of ownership from the tax defaulter to tax authorities or any other person. On the other hand, a tax deed is a document that transfers the ownership of any property from the owner to government authorities due to non-payment of taxes due.

- Tax lien creates a charge/ right on any amount or economic benefit realized from sale proceeds. The tax lien is similar to a mortgage and is simply a public record of debt that restricts the owner from selling or creating a charge on a property unless debts are repaid. On the contrary, tax deed sale is the process that allows the government authorities and original owners to put the property for auction to be purchased by someone else.