Table Of Contents

What is Tax Burden?

The tax burden measures increased tax liability imposed on individuals, companies, and other entities. It is the difference in tax paid by producers and consumers. The difference is expressed as the tax burden ratio.

In free markets, the weight of taxation depends on the elasticity of supply and demand. In most cases, the tax liability ultimately falls on the consumers—in the form of higher product prices. Taxation is the primary source of revenue for the government.

Key Takeaways

- Tax burden refers to the indirect responsibility of paying taxes irrespective of the legal taxpayer. That is, the producer directly submits taxes to the government. Even so, the burden falls on the consumer.

- Both individuals and businesses apply strategies to reduce tax liabilities. Businesses regulate aspects of operations to achieve this

- Economists criticize tax incidence for its complexity and apply other models to calculate tax burden.

Tax Load Explained

The term tax burden refers to citizens’ responsibility to pay taxes. It is closely linked to the elasticity of market supply and demand. Ultimately the burden falls on corporations. Apparently, businesses are more likely to pay taxes.

Some economists suggest that businesses earn from consumers—the amount businesses pay the government is not at the cost of profits—it is retrieved from the customer only. Therefore, commodity price is closely linked with taxation.

But taxes have their own importance. Taxation is the primary source of revenue for the government. Since taxes control the final price of a commodity, they indirectly control supply and demand. The consumer often pays a higher price, and the seller does not increase profits; the government intervenes in the form of increased taxes.

The burden depends on the nature of demand or supply—whether they are elastic or inelastic. Depending on elasticity, the tax liability shifts toward the consumer or the seller. Tax incidence fluctuates between a perfectly inelastic supply and a perfectly elastic demand.

In economics, tax incidence is a term used to describe how taxes are distributed between buyers and sellers. The weight of taxes can fall more on individuals or organizations depending on the unique circumstances around the product. The difference between the initial tax incidence and the final burden is called tax shifting. Policies that increase the price elasticity of supply compared to demand can raise the weight of tax on consumers.

Let us assume that a shopkeeper buys a beverage for $9 from a supplier. In addition, the shopkeeper pays a $2 tax on the transaction. The shopkeeper decides on a $3 profit margin and sells it for $14. Consumers visit the shop and purchase the beverage for $14. In this scenario, the tax obligation to pay the government was on the shopkeeper, but tax liability was shifted to the consumer as soon as they paid the final price for the beverage because the final price included the tax as well.

A similar scenario can be seen in Canada; 43% of the average family income goes towards tax contributions. And more than 36% is spent on essentials and necessities. This highlights that food, housing, and utilities take up a major percentage of a citizen's income in Canada. Also, Canadian citizens are experiencing an excess tax burden (compared to other countries).

Tax Burden Ratio Formula

The tax burden formula is as follows.

Tax Burden = Net income / Pre-tax income

For calculating the burden on consumers, the following formula is used:

Here,

- Ed = demand elasticity

- Es = supply elasticity

Now, the producer or supplier tax incidence formula is expressed as follows:

Again,

- Ed = demand elasticity

- Es = supply elasticity

Calculation Example

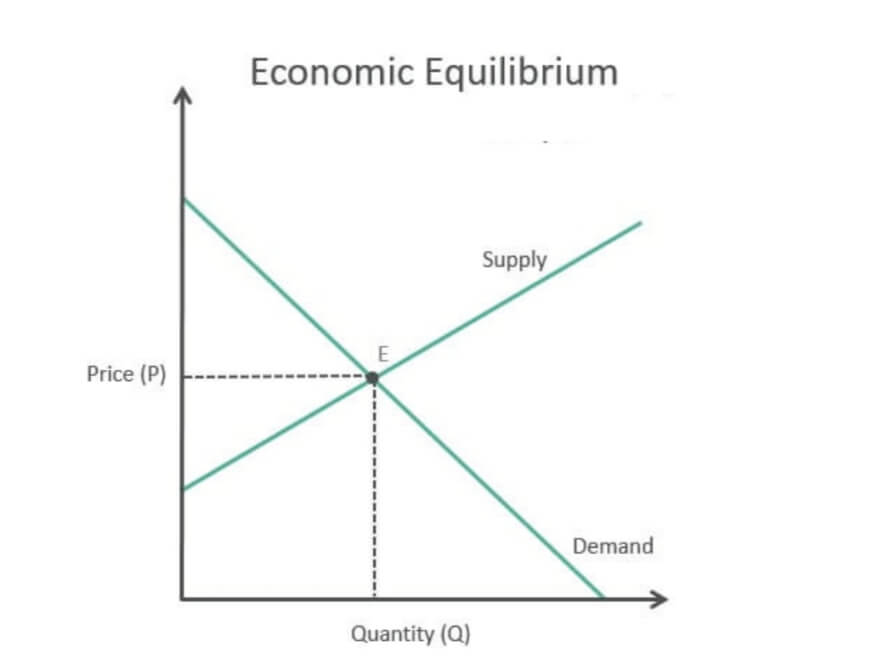

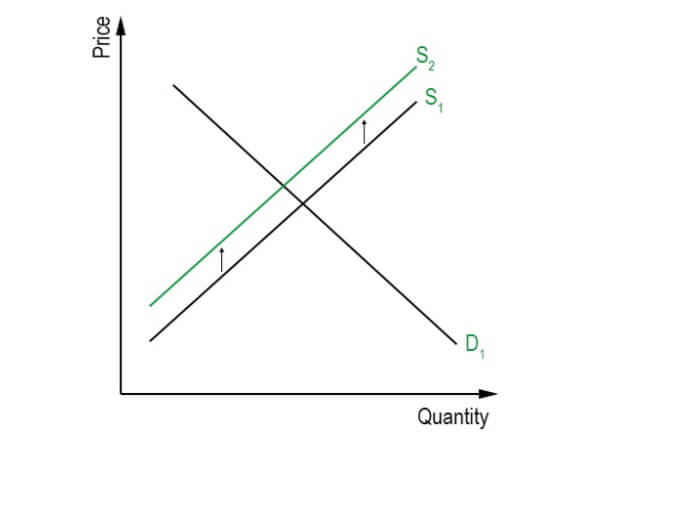

When a graph with quantity (x-axis) and price (y-axis) represents demand and supply curves, the curves intersect at a point. This point of intersection is known as the equilibrium point.

Let us assume that a company sold nine pens at $3 (before introducing sales tax). Later, the government announced a sales tax of $4—the supply curve shifted upwards, bringing a new equilibrium point of seven pens at $9.

Before taxation, the supplier received $3. After taxation, the consumer pays $9. After paying taxes to the government, the seller takes home $5 for every pen. The difference between the consumer-paying price and the seller's after-tax receiving price is $4. Here, the tax load heavily slants towards the consumer who is paying the sales tax (indirectly).

Now let us apply the tax burden formula to the given values:

Tax Burden = Net income / Pre-tax income

= 9/3

= 3

Thus, the tax burden ratio is 3.

For ease, users can make use of tax burden calculators or sales tax calculators available online.

Tax Burden vs. Tax Incidence

- The tax burden is the immediate impact of the tax. In contrast, tax incidence is the final burden of the tax.

- The former is borne by tax-paying citizens; the latter shows the distribution of tax liability among consumers, producers, sellers, and other market participants.

- The former is direct, a statutory liability. The latter can be shifted towards the consumer.