Table Of Contents

What Is Taping Rule?

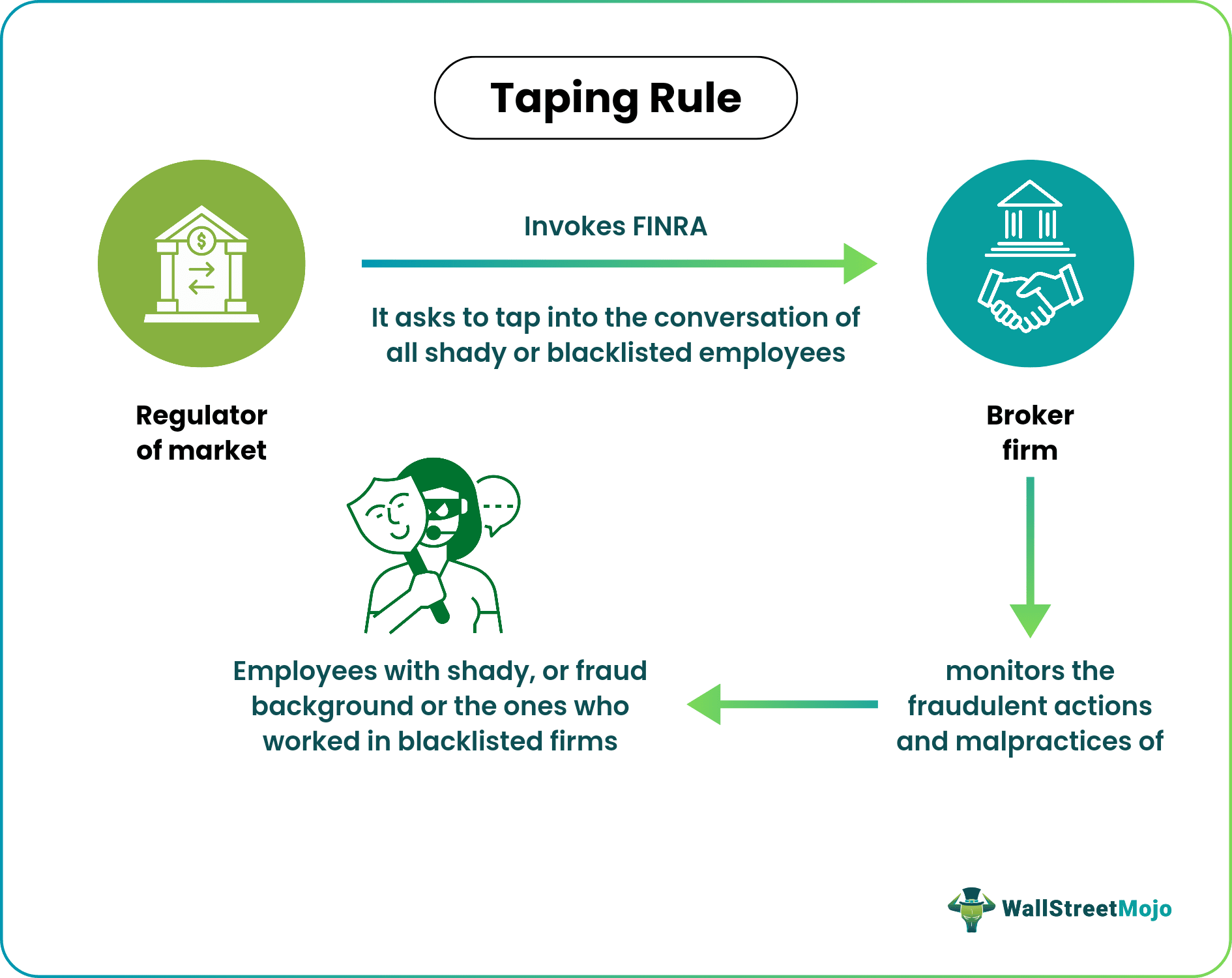

Taping rule or the Financial Industry Regulatory Authority (FINRA) Rule 3170 is a disciplinary measure whereby firms install taping systems for recording conversations of employees that have previously worked for blacklisted firms. They do it to monitor the fraudulent actions and malpractices of such employees while marketing or selling securities & financial products to the customers.

The taping rule helps to protect customers from any financial losses due to fraud and misinformation by firms and employees. The firms under FINRA are called FINRA taping rule firms. All the recorded conversations of the employees get stored for three years with quarterly reporting to FINRA.

Table of contents

- What Is Taping Rule?

- The taping rule is a disciplinary rule enforced by FINRA for making firms dealing in securities record conversations of staff with shady pasts and previously working in blacklisted employers.

- It safeguards the customers' interest and keeps the trading safe, fair, and fruitful to the investors.

- The rule has been in existence since 1998 but got implemented as a FINRA rule in 2014.

- If any firm has upto 40 percent employees from previous backlisted firms, they get covered as taping firms under the rule.

Taping Rule Explained

The taping rule refers to a disciplinary rule enforced by FINRA to record the telephonic conversation of all employees previously working with blacklisted companies that currently work in a firm in large numbers. In short, these rules provide surveillance to detect firms’ employees. In addition, depending on its size, firms install certain tapping systems to record conversations of registered representatives with past compliance or trouble regulatory records.

So, the firm that gets mandated to record the conversation is called the taping firm, and the rule is called the taping rule. Taping firms must ensure to put in place recording systems to record and store employee interactions with customers for a minimum of 3 years.

All those firms and all brokers dealing in trading securities must be self-registered with FINRA. The rule gets applicable to firms with large numbers of staff who had previously worked at:

- A broker firm with its registration revoked.

- A brokerage firm that got expelled for fraud or misinformation to customers.

- A firm that did not provide inadequate training and supervision to them.

- Firms that surpass a specific hiring employees percentage.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

History

The taping rule came into existence on 1st December 2014 when the United States Security and Exchange Commission (SEC) embedded it into the FINRA rulebook in place of the National Association of Security Dealers (NASD) rule. But the rule for taping conversations already exited on 17th August 1998 through an SEC amendment to the NASD Rule 3010. The amendment required the member firms to set up, implement, and sustain the procedure of recording the conversations of employees by taping firms because:

- SEC removed such firms from the trading bodies.

- Firms had revoked the registration of their brokers/dealers because of malpractices and fraudulent activities.

Subsequently, SEC inserted these rules into the FINRA Rule 3170 via NASD Notices to Members 98-52, 02-61, 05-46, and FINRA Regulatory Notice 14-10. These provisions also contain taping rule FINRA arbitration and taping rule FINRA advertising. As a result, in 2021, FINRA recognized six firms as disciplined firms.

Requirements of Taping Rule

The requirements for a firm to get listed under FINRA's are as follows:

- It depends on the size of the firm.

- The number of staff with shady pasts must be 20% (for a large firm) to 40% (for a small firm).

These firms get categorized as taping firms.

The taping firms are required to follow the below rules as provisioned in the FINRA rule:

- For three years, all taping firms must record all the conversations between registered staff, current customers, and potential customers.

- All the telecommunication regularly in usage for communicating between customers and staff

- Landlines, cell phones, emails, and other office-based and customer-related conversations by staff get to be recorded by the firms.

- Suppose the firm cannot implement or install the taping tool and software. In that case, it must ban all business-related communication by staff and permit only personal communications.

Example

Here is an example to understand the concept better:

If a broker firm hires 30 employees with expelled membership, then necessarily tapping rule will apply to existing and potential clients. Depending on the registration numbers, the firm will require a specific threshold to tape-record. For instance, the firm has 30 registered reps here so FINRA would implement the tapping rule.

It takes upto 60 days to begin taping if a firm passes the threshold. However, the number of days can come down to 30 if the firm reduces the disciplined reps' headcount.

So, if the firm passes the threshold on 1st July, it will have 30 days, i.e., till 31st July, to reduce the headcounts. Then, it will have to start tapping calls from 31st August (sixty days from 1st July) if it fails to reduce the headcounts.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

It is an organization that looks after the functioning of the securities market and protects the investors under the Financial Industry Regulatory Authority (FINRA). FINRA is a not-for-profit organization authorized by the U.S. government to supervise and control U.S. broker-dealers.

Since FINRA is a not-for-profit organization authorized by the U.S. government and not a government body, it does not have the power to send anyone to jail when they violate the taping rule.

Taping rules regulate the subjects like - funding portals, broker-dealers, and capital acquisition brokers. Broker-dealer's trade on behalf of customers just like capital acquisition brokers.

Anyone involved in any firm's securities trading business, like sales executives, directors, officers, partners, branch managers, and department supervisors, must be registered with FINRA.

Recommended Articles

This article has been a guide to What is Taping Rule. Here, we explain its history, requirements for a firm to get listed under FINRA, and an example. You can also go through our recommended articles on corporate finance –