Table Of Contents

What Is Take Rate?

A take rate in business refers to the commission or fee charged by third-party platforms or marketplaces for their services. It is usually collected as a percentage of the gross merchandise value (GMV) generated by a particular business on that platform or through a third party.

The metric is crucial in the services industry, especially with the rampant adoption of online shopping. It can be seen in three areas: e-commerce marketplaces, payment providers, and service marketplaces. Depending on the service provider, the rate can be fixed or fixed plus variable.

Key Takeaways

- A take rate meaning refers to the amount collected by third-party service providers from the seller as a commission for facilitating transactions between the buyers and sellers.

- The parameter helps the service providers generate income at a pre-determined and agreed-upon rate to keep the business running and continue offering services.

- Three types of service providers take a cut from the sellers of products and services - eCommerce marketplaces, payment providers, and service marketplaces.

- Some examples include Etsy, Uber, American Express, Shopify, etc.

Take Rate Explained

Take rate is a formal term for 'take a cut.' Before explaining the concept, let us understand the background. Businesses follow many options to sell their products. New companies with less investment sell on third-party websites like Amazon, eBay, etc.

When these platforms help generate sales, they expect a portion of the revenue to facilitate the transaction. Apart from serving as a platform linking the buyer and the seller, the websites provide payment services, advertise for the client, and offer reverse logistic services.

Three different platforms charge these fees:

- eCommerce: These marketplaces facilitate transactions, thus reducing businesses' need to maintain a separate website or app. Examples include Amazon, eBay, etc.

- Payment providers: Online shopping has been expedited to a great extent through online payment services. Payment gateways, e-wallets, etc., charge a fee for this. Examples include PayPal, Visa, etc.

- Service platforms: These marketplaces bring together customers and service providers. They collect a commission for acting as a link. Examples include Uber, Airbnb, etc.

The amount that a platform collects as commission depends entirely on its business and revenue model. It varies from website to website and relies on the nature of the service offered.

Some marketplaces collect a fixed rate, whereas others collect fixed and variable components. For example, the Airbnb take rate is 3% of the revenue from hosts. They also collect a 14% fee from guests, which is not usually considered the take rate (since the metric only applies to sellers).

Another example is that of Amazon. According to the eCommerce Marketplace, the seller has to pay two components – first, $0.99 per unit sold—and secondly, an 8-15% referral fee on the gross merchandise value.

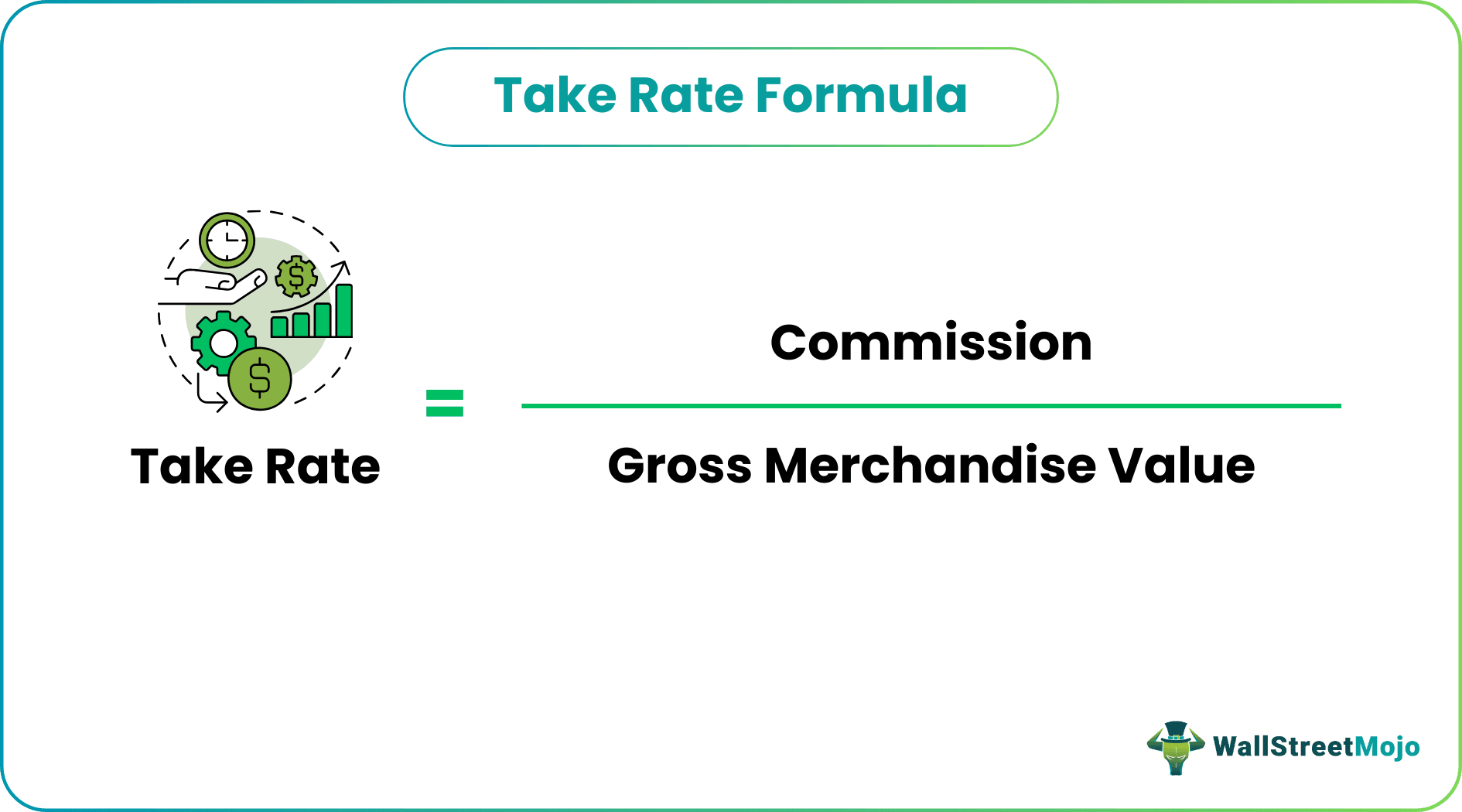

Formula

Take rate calculation involves the following formula given below:

The gross merchandise value or GMV is the business' total sales facilitated through that particular platform or service provider.

Note: Though the take rate formula is given here, more often, the formula is used differently. Instead, the rate is specified, and the commission is calculated as a percentage of the GMV. Lt us refer to the examples in the next section for a more precise understanding.

Calculation Example

Let us study the example to understand the concept more clearly.

As already discussed, Airbnb charges a service fee of 3% to hosts. Suppose Ryan is a host who charges Paul $500 for a day's stay at his house. Here, the GMV from this particular transaction is $500. Ryan would have to pay a fee of $15 (3%) from the amount Paul pays him.

Take another example of Amazon. Leonard sells 30 pairs of shoes at $200 each. His revenue is $6000. He is charged a referral fee of 10%.

Commission charged by Amazon: ($0.99 x 30) + ($6000 x 10%)

= $629.7

How To Determine?

Organizations or merchants should assess the following factors to determine the take rate.

- The costs paid by users, for example, listing fees, subscription fees, etc.

- Take rates that industry peers charge

- The competitive landscape

- Margins and operational costs so that the fee can ensure profitability while supporting future growth

- The size and frequency of transactions taking place on the platform

- The value derived by users from the platform

Factors Impacting Take Rate

Some of the key factors that impact the take rate charged by an organization are as follows:

- The type of products and services provided by a company

- Chargebacks resulting from fees a merchant must pay back and penalties

- The number of transactions processed by a merchant

- Merchants’ risk exposure

- Payment gateway charges

- Merchant Category Codes or MCCs

- Currency exchange rates (in the case of international transactions)

- Incentives, discounts, and other promotional offers

How To Increase Take Rate?

Merchants can raise their take rate by using the following strategies:

- Improving product offerings

- Acting on customer feedback

- Tracking and adapting to strategies used by competitors

- Optimizing marketing campaigns

- Making technological investments for process automation

- Leveraging analytics to track performance

- Improving the efficiency of the delivery system

- Introducing better payment methods

- Providing loyalty and reward programs

Individuals should keep in mind that the main objective is not the maximization of this fee. This is because a higher fee can lead to reduced transaction volume. Instead, the goal should be to charge a sustainable rate that can result in a strategic advantage.

Importance

Marketplace take rates are an essential source of revenue for most companies. Lt us consider Amazon. It brings together buyers and sellers. It employs almost a million and a half people around the globe. The income from referral and affiliate marketing enables platforms like Amazon to charge a fee for their services and their role in commerce.

Now, there is a general conception that higher take rates are reasonable. A higher commission indicates that the platform can generate higher sales for the seller. But before a seller is ready to pay a higher commission, they should verify if the platform is worth it. Otherwise, giving up a portion of profits for less-than-expected sales will be a loss for the seller.

Due to these platforms and payment providers' competition, they are forced to charge lower rates. A typical example in this regard is eBay. The company charged higher commissions, due to which sellers started opting for newer marketplaces with lower fees, like Etsy.

Also, when a payment provider takes a cut, they receive a partial commission. For example, if a seller gets payments through PayPal, but the buyer uses a credit or debit card, a portion of the commission amount collected would be paid to payment networks like Visa, Mastercard, etc.

This fee is a crucial element for financial analysts who carry out financial modeling, as this is one of the metrics they may use to forecast future financial figures. If you are not sure how to build a financial model, consider enrolling in this Financial Modeling 2-Day Bootcamp to develop the required knowledge. The instructor of the program uses a practical approach to make sure you know all the steps involved in the process.