Table Of Contents

What Is Take or Pay?

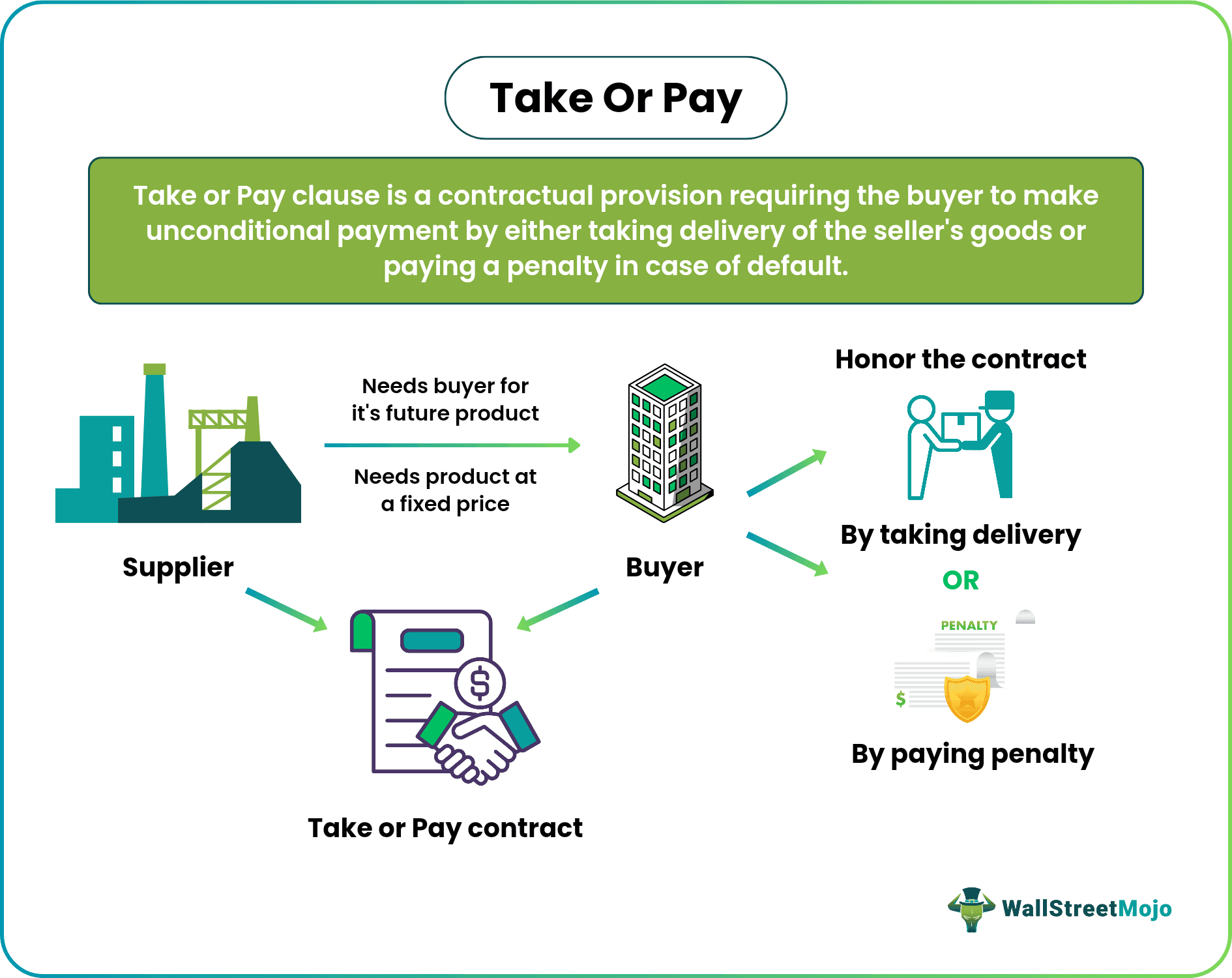

The take or pay (TOP) is a contractual clause requiring the buyer to take the delivery of a specific amount of goods or services from the seller or pay a fine if they do not. Thus, it protects the seller against potential losses if the buyer refuses to complete the purchase by a particular date.

A TOP clause in supply agreements is common in energy industries, including oil, natural gas, mineral, and coal, seeking significant investment. It is also called the kill clause. The contract is normally signed before the companies start oil, natural gas, minerals, or coal exploration. Therefore, it is a type of offtake agreement.

Key Takeaways

- The take or pay clause is a contractual provision requiring the buyer to make an unconditional payment to the seller.

- The buyer must either take delivery of the seller’s goods or pay the penalty in case of default.

- It is widely prevalent in the energy sector and capital-intensive projects.

- The clause enables buyers and sellers to share the risk associated with long term contracts.

- The TOP agreement is beneficial to both sellers as well as the buyer. However, it provides greater security to the sellers.

- The force majeure clause, price clause, and review clause allows renegotiation of the TOP agreement.

Take or Pay Explained

The take or pay is a contractual provision protecting the seller’s interests if the buyer refuses to honor the contract. Thus, under a TOP contract, the buyer is subject to a fine on failure to take the delivery from the seller.

Moreover, the TOP clause derives its name from the terms of the contract that state:

- Take the delivery, or

- Pay for not taking the delivery

The main objective of incorporating the TOP provision in the contract is to ensure that the seller does not have to bear the related expenses in the event of a change of mind by the buyer. However, the TOP provision cannot be invoked when there are issues on the seller’s side. But the parties to the contract can renegotiate under the force majeure clause, price clause, and review clause.

In the US, the natural gas contracts in the 1960s widely applied the TOP provision to benefit the producers and pipeline management companies. During the industrial crisis in the 1980s, the TOP clauses led to the renegotiation of contracts and legal disputes. However, the courts in the US continue to accept it as a valid contractual clause.

Working of the Take or Pay Clause

The take or pay clause is usually part of contracts in the mining and energy sector. This is because companies (sellers) have to incur huge costs for extracting resources and hence, need a guaranteed buyer for their future production to reduce the risk involved. These companies have to depend on loans to meet their capital needs most of the time.

Since the funding requirements are huge, the bank (lender) needs assurance of a credible buyer. Therefore, under these situations, the seller goes to a company (buyer) that will purchase its product continuously over a period of twenty to thirty years.

The buyer will assess the proposal and, if found beneficial, may agree to include a take or pay clause in its agreement. The take or pay provision protects the seller's interest by imposing a penalty on the buyer on default.

With a secured future stream of revenue from the buyer as per the TOP clause, the bank offers a working capital loan for the project. Hence, the seller starts the energy exploration project on receiving the loan.

However, the seller invokes the TOP clause if the buyer fails to honor the contract by not buying the products or only buying a part of the product on a specified date. As per the clause, the seller gets the penalty or part payment as per the terms of the contract.

TOP Benefits

TOP benefits both the seller and the buyer alike by allowing sharing of each other's risks. On the one hand, it reduces the seller's risk of any capital loss on future production. On the other hand, it limits the buyer's risk by ensuring an assured supply of specified goods at a stipulated price and date. The buyer can also negotiate a lower price for sharing the seller's risk.

#1 - Seller

The seller is assured of:

- Huge capital investment from lenders

- Relief from price fluctuation

- Guaranteed buyer of output

- No issues of losses

- Unconditional payment from buyers

- Freedom to sell its product to anyone in cases of refusal by the buyer

#2 - Buyer

The buyer:

- Gets the desired product

- Obtains the product at a fixed rate as per the agreement

- Acquires immunity from price fluctuations in the market

- Eliminates competitors

- Has the option to end the TOP contract by paying the penalty and buying the same product at a lower price from another seller

TOP Risks

The TOP contracts have long-term validity, so the conditions in the future may change drastically. For instance, political realignment like BREXIT, pandemics like coronavirus, a natural catastrophe like Tsunami or earthquakes, or management changes may happen in the future.

In such circumstances, the TOP contract may no longer remain beneficial to one of the parties or both parties involved. Therefore, they terminate the agreement. Moreover, the parties may renegotiate the TOP clause to suit both of them. Hence, the TOP contract includes certain conditions to facilitate renegotiation of the terms of the contracts.

Renegotiation of TOP Contract

A major feature of the TOP contract is its reviewing nature. Parties to contact can renegotiate under the following special condition:

- Force majeure clause (Act of God) – The intervention of natural disasters or calamities like a Tsunami or coronavirus makes it difficult for both the parties to maintain and uphold their obligations as per the agreement.

- Price clause (Escalation clause) – This clause is inserted to safeguard the interest of both the buyer and seller in case of highly unpredictable fluctuations of the product's market price.

- Review clause (Renegotiation) – This clause contains the terms and conditions for timings of regular review of the long-term TOP agreement by the parties involved.

Examples

Let us look at some take or pay contract examples to understand the concept in a better manner.

Example #1

Let’s assume an oil exploration company SAUD Enterprises, in Saudi Arabia, has found a new spot containing 1,000,000 barrels (bbl) of oil. However, it does not have enough capital to start and run the oil exploration project on its own. So, it will be seeking banks and other financiers to help get the working capital. But the lenders will finance the project if it could ensure that:

- Its oil will have a buyer for the long term.

- Its oil will generate enough revenue to cover the loan liability.

In such a situation, SAUD will enter into an agreement with the take or pay clause with an American oil buyer, NYE Oil & petroleum Co. for a period of 30 years and at a rate of $50 per barrel of oil.

The SAUD presents this TOP agreement to the lenders for funding its capital requirement. Financers will fund its oil exploration project based on this agreement.

As per the TOP clause in the contract, SAUD will have to deliver oil to NYE at $50 per barrel for the next 30 years at stipulated time intervals. However, if NYE refuses to honor the TOP agreement or does not buy the agreed amount of oil, it will have to pay the pre-decided penalty of 70% of the agreed cost of oil as per the agreement.

Thus, SAUD Enterprises will benefit from sharing its risk related to oil extraction with NYE. In addition, NYE Oil & petroleum Co. will get an assured supply of oil at a pre-determined rate without price fluctuation.

Example #2

Suppose an iron ore mining company FERRO Inc. in California, has the license to extract iron ore in Nevada in the US. However, the mining activity will require huge capital to finance its project, from initiation to selling iron ore to steel-producing companies like STEELE Inc.

FERRO needs an assured buyer and working capital for the project. Therefore, it scouts for financiers and lenders to fund the mining project. Moreover, the financiers and lenders ask for the project's feasibility, the buyer of the iron ore, and a regular revenue stream to cover the loan liability.

In such a scenario, FERRO enters into a TOP contract with STEELE to get an easy assurance of finance from its lenders or financiers. Thus, as soon as the TOP contract is executed, STEELE will have to provide the payment at regular intervals for 30 years as per the contract.

FERRO Inc. will get the desired capital, buyer, and regular source of income to carry on its project. In case of default by the buyer STEELE, FERRO can get a pre-determined cost to be paid and sell the iron ore to another company at a higher cost.

STEELE Inc. will get the iron ore for the long term without any risk of price fluctuation in the future and a competitive edge over its rivals in the steel manufacturing sector.