Table Of Contents

Take-Home Pay Definition

Take-Home Pay refers to the net amount paid to the employees after the deduction of contributions like retirement account contributions, premium on insurance, social security and Medicare contributions, benefits and taxes from the Gross Pay.

This amount, after deducting all the above, is the one that an employee will receive and is listed on the paycheck. Due to the above deductions, the amount that the employee finally gets is significantly different and lower than the gross pay, which is before these deductions. During loan applications for large amounts, very often, this net payment is considered for the purpose of credit rating.

Take-Home Pay Explained

The term take-home pay refers to the amount that an employee of an organization receives in hand after the employer deducts all items like insurance premiums, social security, retirement benefits, taxes, and so on from the gross pay and then gives the resultant amount to the employee through a paycheck.

The deductions in a take-home pay monthly can be in any form, mandatory or voluntary, that reduces the gross pay of the employee for the month. But this is the amount that they take home to manage their daily expenses, make investments, and save the rest for future requirements.

Thus, this amount is the one that can be attributed to a particular pay period. Apart from the deductions mentioned above, there can also be some deductions that have been explicitly ordered by the court, like alimony or child support, any cost related to uniform upkeep, etc. But these items are rare.

This amount is a very good benchmark to evaluate the credit or loan repayment capacity of an individual. Apart from all other internal and external factors that a lender will consider before lending money, this pay is the first item for consideration to decide whether the borrower will be able to return the loan amount in the future.

Employees try to negotiate this amount of take home pay monthly and get the highest possible pay during the hiring process. It is beneficial for them because this increases their pay in hand, resulting in more savings and investments. It is also suitable for the company since the employee is satisfied and will contribute their best with loyalty and integrity. It is an excellent method to ensure talent is retained with the highest productivity and performance.

How To Calculate?

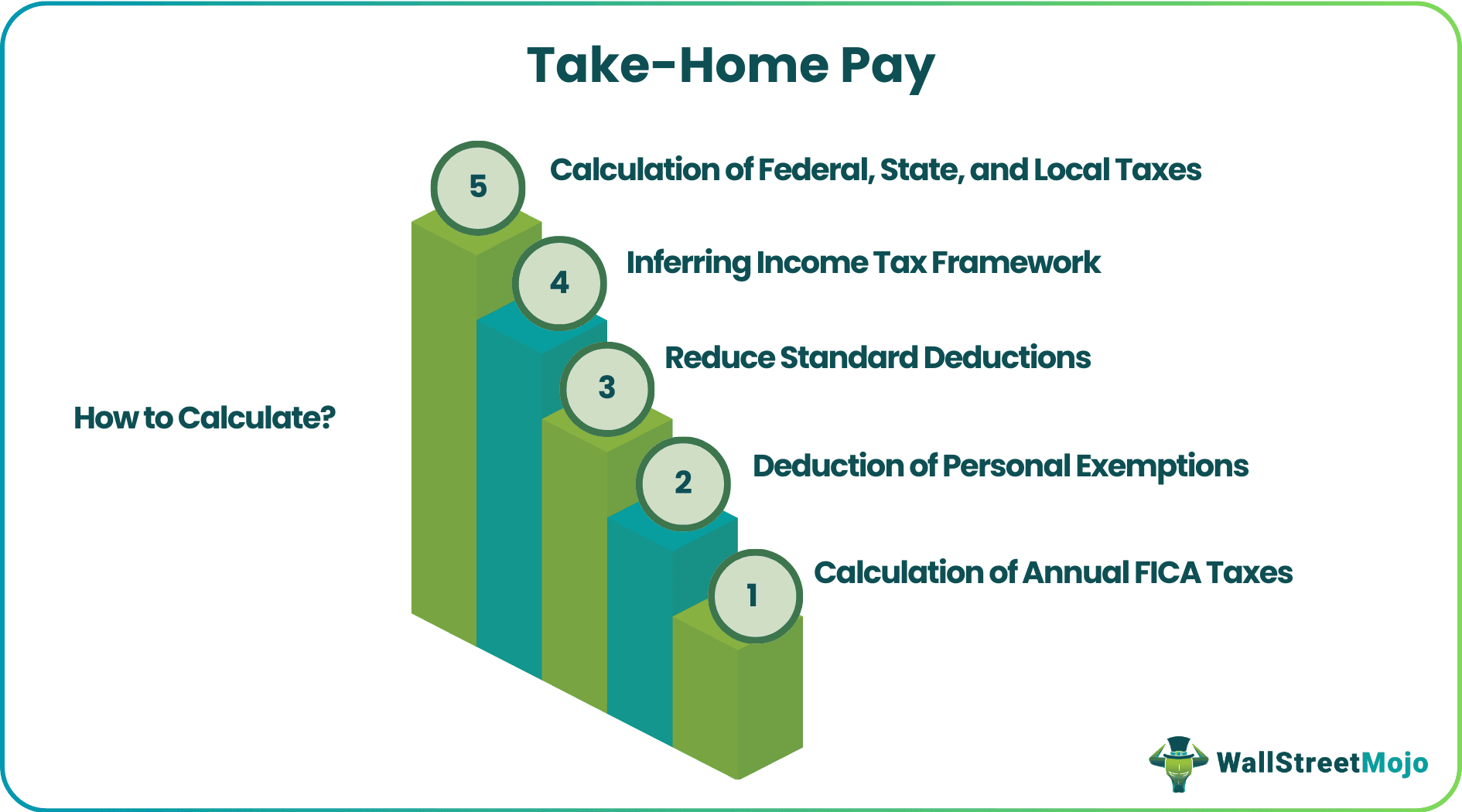

For calculating take-home pay, the following strides need to be followed-

- Calculation of Annual FICA Taxes: Contribution to Social Security and Medicare is your FICA taxes. These taxes are reduced from gross pay as a deduction. Any person generating income in the U.S. gets a deduction of a flat rate, which increases or decreases based on inflation. This flat rate of deduction allowed on gross pay in 2020 is 7.65% up to earnings of $137,700. Thus, we can deduct this percentage of deduction from the gross pay before entering into further calculation.

- Deduction of Personal Exemptions: IRS provides you with the right to deduct personal exemptions before providing for further calculation of income tax. This rate of the deduction varies on year to year basis. To account for accurate computation, you need to acknowledge the current rate deductions applicable. Deduce current rate of deduction with whatsoever your gross income is for the said year.

- Reduce Standard Deductions: The standard deduction is allowed based on the tax filing status of the person like married, single, etc. Also, it varies every year. To know the deduction rate applied current year, you can refer to the IRS website before reducing such amount from gross pay.

- Inferring Income Tax Framework: After subtracting personal exemptions and standard deductions, you can indicate taxable income. This taxable income will determine your federal and state taxes. To acknowledge the tax bracket in which you fall, you can visit the websites of the government.

- Calculation of Federal, State, and Local Taxes: Depending upon the tax bracket you fall in, federal, state, and even some other local taxes may apply. Federal taxes also relies on the tax filing status you possess.

After subtracting, income tax, FICA deductions, and other deductions as illustrated above from your gross income, the rest is take-home pay.

We often use various types of calculators available online for the purpose of calculating take-home pay after tax. They will include all necessary deductions slots where we need to enter the respective amount and get the final take-home salary. However, these deductions will vary based on the jurisdiction where the company is operating or where the employee is working from.

Example

Let us understand the concept of take-home pay after tax with the help of a suitable example as given below:

Nisha who has been filing the tax return in the status of single agreed for a job offer at a specific designation in a company. They are appointing her at $15 per hour having a total work of 35 hours per week. She had taken health protection and pays a premium of $40 a week, this payment is exempted in income tax withholding and also under FICA. With the other details provided below, calculate her take-home pay?

Solution

- Gross pay for the week = $15 x 35 hrs = $525

- Now, subtract deductions of health insurance premiums from gross wages.

=$525-$40

= $485

- After deducting the above figures, we will calculate FICA taxes from the above-deducted figure-

FICA taxes = 7.65% x $485 =$37.10

- Federal income tax is provided as per filing status, since, Nisha is within the single bracket with zero claims, $63 per week is the federal tax.

- Nisha lives in Arizona, where employees can decide their desired percentage to go towards state income tax. So, let us suppose she chose 2.5%. Hence,

State Income Tax = $485 x 2.5% = $12.13

- Since local income tax does not apply to all the states, we can suppose here that no local tax is to be paid.

Now, let us calculate the take-home pay -

Take-Home Pay = Gross Pay - Deductions (FICA, federal, states, other local taxes, and health insurance premiums)

- =$525- $40 -$37.10 -$63 -$12.13 -$0

- =$372.77 per week

Hence, in the above example, net pay is $372.77.

How To Maximize The Take-Home Pay?

There are certain ways by which you can maximise your take-home pay. We have mentioned some of them below:

- Keep an eye on your Withholdings: This is a quick and common way to maximise your home pay as you must consider the amount you should pay to the taxman before making the payment. W-4 is a form which each employee uses to fill while starting for a job. You can claim more and more personal exemptions so that taxes reduce proportionately.

- Monitor your Payroll Deductions: If you are a healthier person and always consider a routine medical check-up, then you can look for an insurance provider who would take a lesser premium. It will increase your home pay to a certain amount.

- Overtime Work: If your working organisation has a provision to pay for overtime, then you can work extra to receive extra.

- Request for Increment: Most of the organisation reviews the performances of the employee from time to time and then provide for salary increment. So if you work harder, then you may get an increase in your earning.

- Look for a Side Job: If your office doesn't pay for overtime or not allowing increment, then you may look for a side job so that you will get a higher take-home pay.

- Education – Education plays an extremely important role in increasing this amount. An educated person, who has the skill, expertise and knowledge to meet the requirements of a job or industry standards will have a far better chance of getting a higher take-home salary than their counterpart who does not have such skills.

- Research – It is necessary to de research on the topic which an employee is working on and understand the current needs, requirements and most importantly the trends that are being followed in terms of skills, client choices or market demand. This will help them to present themselves as better candidates who have the eligibility to get a good compensation after deductions and prove to be an asset for the company.

- Experience – Every candidate should strive for identifying opportunity and gaining relevant experience. This will not only make their portfolio attractive but also compel employers to hire them at a better take-home pay because these candidates have diverse knowledge that may prove to be useful for the business.

- Reviews- The annual performance reviews play an important role because if candidates are able to perform well and employers give positive feedback, there is every chance of a good hike in the take-home salary. Commitment, integrity, honesty, willingness to learn, and flexibility are some criteria that employers often look for during performance reviews.

Thus, the above points are some factors that contribute towards maximization of the this amount which not only helps the candidate or the company alone, but also contribute towards the overall development of the society and standard of living of people.