Table Of Contents

Examples of T-Account

The following T-account examples provide an outline of the most common T-accounts. It is impossible to provide a complete set of examples that address every variation in every situation since there are hundreds of such T-accounts. The visual presentation of journal entries, which are recorded in the general ledger account, is known as the T-Account. It is called the T-account because bookkeeping entries are shown in a way that resembles the shape of the alphabet T. It depicts credits graphically on the right side and debits on the left side. Each example of the T-account states the topic, the relevant reasons, and additional comments as needed.

Example #1

Mr. X took a shop on rent on which he is doing the business from Mr. Y. At the end of March -2019, Mr. X received an invoice of $ 50,000 from the landlord Mr. Y for the rent of the March month on March 31st, 2019. After a few days of receiving the invoice for the rent, i.e., on April 7th, 2019, Mr. X makes the same payment. Record the transactions in the T- account.

Solution:

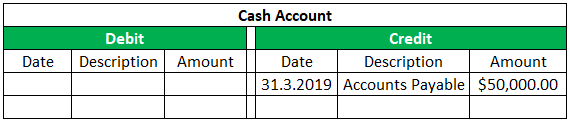

This transaction shows expenses incurred by the company and the creation of liability to pay off that expense. In this case, three accounts will be affected: the rent expense account Accounts payable account, and cash account. In the initial transaction, when the company gets the invoice for the rent payment, there will be a debit of $ 50,000 to the rent expense account and the corresponding credit will be to the accounts payable account.

After a few days, when the payment is made, the accounts payable liability will be eliminated by debiting that account with the corresponding credit to the cash account, leading to a decrease in the cash balance.

T–accounts will be as follows:

Rent Expense Account

Accounts Payable Account

Cash Account

Example #2

Mr. Y started the business. On April 19, he identified the following transactions. After reviewing the transactions, prepare the necessary journal entries and post them to the necessary T- Accounts.

Solution:

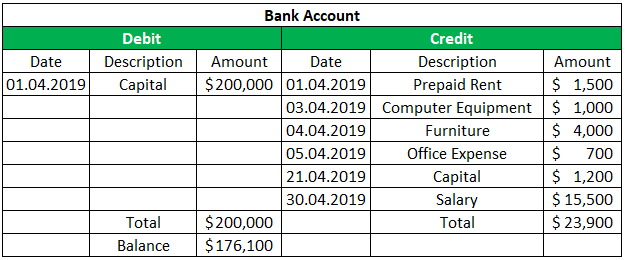

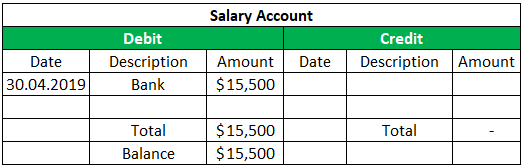

For the transactions during the month of April-2019, firstly, the journal entries are posted and based on which the T- Accounts are prepared as follows:

Journal Entry

Capital Account

Bank Account

Prepaid Rent Account

Computer Equipment Account

Furniture Account

Office Expense Account

Salary Account

Rent Account

Conclusion

T-account is very helpful to the user as it provides the guideline to the accountants regarding what is to be entered in the ledger for an adjusting balance of the accounts so that the amount of the revenue equals the amount of the expense. Thus, the T-account is used for the set of financial records that use double-entry bookkeeping. The accounts have the letter T format and are thus referred to as the T accounts. In the T- Accounts, the debit side always lies on the left side of the T outline, and the credit side always lies on the right side of the T outline.