Table Of Contents

What Is Systematic Risk?

Systematic risk is defined as the risk that is inherent to the entire market or the whole market segment as it affects the economy as a whole and cannot be diversified away; thus is also known as an “undiversifiable risk” or “market risk” or even “volatility risk.”

Systematic risk being non-diversifiable, impacts all sectors, stocks, businesses, etc., and, in essence, the entire economy. It helps one gauge the exposure by considering a holistic view of the risks inherent in the economy. The risk is calculated using beta, which is a metric that measures the sensitivity of the asset to market movements.

Systematic Risk Explained

The systematic risk is a fundamental concept in the field of finance which investors or finance analysts need to understand and identify. Since it is inherent in the broader market, it can affect any type of investment portfolio and is a crucial factor while taking important investment decisions.

The common factors that lead to such a risk are inflation, fluctuation in interest rates and currencies, economic recession due to natural or man made causes, any sudden natural disaster, etc. It is not possible to eliminate them but mitigation or control is possible to some extent.

Such risk is dangerous to the economy as the same, when rampant, may indicate a slowing economy, sluggish business warning of an impending recession. It has a wide-scale impact and repercussions, often spreading from one sector to another or even from one economy to another, for that matter, when they are interlinked.

However, to gauge and understand the risk inherent in any specific business or sector, one needs to study them in isolation, and systematic risk may not be able to help much in this regard.

Nevertheless, systematic risk factors does come a long way in helping one understand the exposure and the massive hit the portfolio can take in the event brought about by systematic or non-diversifiable risk. Thus, it becomes an essential tool for risk management. It has also served as the base for various valuation models like the Capital Asset Pricing Model (CAPM).

Types

The various types are listed as under:

- Interest-Rate Risk: It refers to the risk arising from the change of market interest rates and affects fixed income instruments like bonds.

- Market Risk: It refers to risk arising out of changes in the market price of securities that cause a significant fall in the event of a stock market correction

- Exchange Rate Risk: It appears out of changes in the value of currencies and affects corporations with substantial foreign exchange transaction exposure

- Political Risk: It is mainly due to political instability in any economy. It involves business decisions.

- Technological risk: This risk is associated with technological changes and upgradation taking place globally. This frequently disrupts business models and affect company performances.

Thus, the above are some important types of such risk and even though they cannot be eliminated, steps can be taken to calculate systematic risk and strategically design procedures that will help the business absorb such shocks and continue the operations without much disruption.

Formula

This type of risk is measured using beta, which calculates the sensitivity of the asset to fluctuations in the market. For this purpose, we need to determine the beta in the following way.

We need to collect the financial information of the past year years related to the asset for the purpose of analysis.

Then we also need to select a merket index that can be used as a benchmark over a significant period of time, like S&P 500, for US companies.

Then comes the step where we need to evaluate the returns. The returns will be calculated for both the asset as well as the market index. We assume Rm to the the market returns and Rp as the return on a particular asset.

Then, to calculate systematic risk, we calculate the covariance between the market index return and asset return. The term covariance identifies how the asset prices fluctuates in relation to changes in the market. We also calculate the variance that is the movement of the asset in relation to the mean.

Thus we calculate the beta as covariance divided by the variance as given below:

Beta = Covariance / Variance

Thus, through beta we can calculate the return on the asset with respect to market returns.

To learn further and become industry expert in Financial Modeling and Valuation techniques, enrol into the course bundle designed by WallStreetmojo, exclusively for those who want to expand their knowledge in this field and explore the intricacies of collection, analysis and forcasting the financial data for accurate decision making.

Example

Examples of finance systematic risk that would affect the whole economy as described under the various types are illustrated in the example below.

- Interest Rate Risk: Government reducing/increasing interest rates would affect securities valuation.

- Market Risk: A stock market correction would wipe out wealth created by fund managers and affect the whole company.

- Exchange Rate Risk: A devaluation of other countries’ currencies would make imports costlier.

- Political Risk: A government declaring war would lead to the withdrawal of foreign funds.

How To Reduce?

There are ways and means to reduce or control these finance systematic risk and design methods to reduce the exposure and impact of them in the client portfolios or business operations. Some strategies are given below.

- Asset allocation – It is necessary for management or financial planners to allocate the right mix of assets in the portfolio, be it for business or individual, that will not only help in achieving the financial goals within the stipulated time, but also have the ability to absorb risk to a greater extent.

- Investment in non-correlated assets – It is necessary to invest some part of funds in assets that are not directly correlated to the broader market. This means any unususal or heavy market fluctuation will not affect the stocks or assets in a big way. Such investments can protect portfolios and from market systematic risk factors even though the returns may be low.

- Regular investment in small amount – This helps reduce the impact of systematic risk because small amount of funds is invested at regular intervals in certain assets rather than investing in lump-sum. This reduces the overall effect of volatility in the investment.

- Long term planning – It is important to plan finances for long term, be it for individuals or businesses. Taking a long-term perspective helps mitigate the short-term fluctuations and make them less significant. This gives the portfolio a higher change to ride over the negative effects of the market. Therefore, management should always take a long-term view and devise investment and financial strategies accordingly.

- Gather information – Staying informed about the current market conditions is extremely important. This gives time to plan out methods to tackle market fluctuations or risks in a timely manner. It also given the time to put to use previous experience similar in nature. Awareness helps in understanding and identifying market trends and take decisions by adjusting the portfolios and assets accordingly.

- Professional advice – This also helps in important situations where the risk is not inherent to the business or sector only. Professionals like portfolio managers or financial advisors are experts in risk management and they have ideas and practical industry knowledge that help plan and devise strategies of risk management.

- Hedging – Hedging or designing methods using financial instruments like options or inverse exchange traded funds will lead to offsetting of losses when market declines mitigate systematic risk factors. They are however, complex strategies that need good understanding and knowledge.

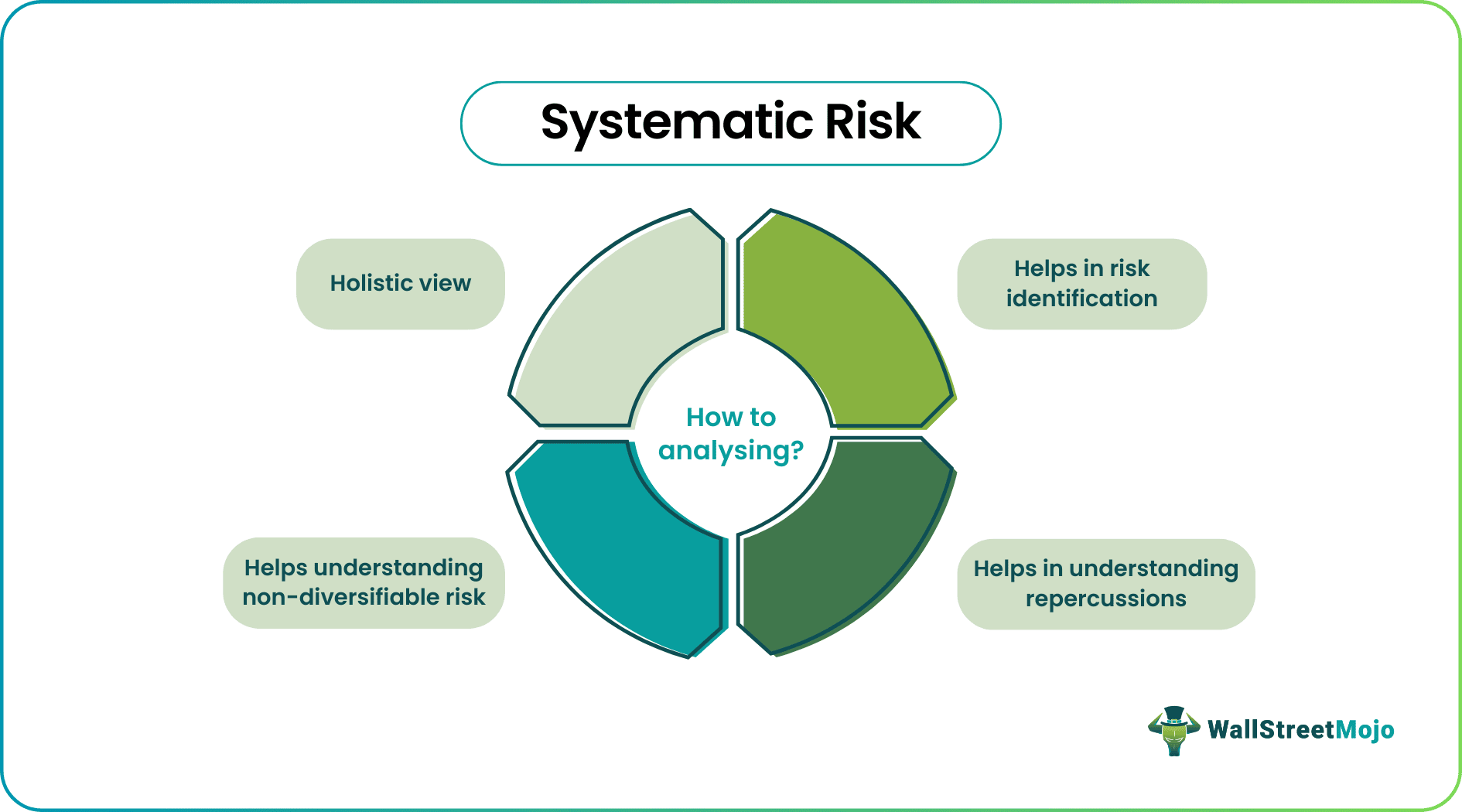

How Is Analyzing Systematic Risk Useful?

#1 - Holistic View

It would consider the entire economy, and the analyst would get a better picture as this provides a holistic view of the whole economy. It would serve as a proxy for the risk of the entire economy rather than having to find out the risk inherent in each sector in isolation.

#2 - Helps Understanding Non-Diversifiable Risk

By understanding the systematic risk that would affect the economy, the investor would tend to get an idea of how much his portfolio is exposed to non-diversifiable risk. In addition, by doing so, they would have a good feeling or understanding of the volatility that it would cause in the portfolio because of the impact of any such event that would affect the market as a whole.

#3 - Helps in Risk Identification

Risk diversification goes on to form the basis of insurance and also that of investment. However, the presence of systematic risk of portfolio affects everything at the same time. By undertaking a probabilistic approach of its impact on the risk profiling of the portfolio of the insurance companies, this approach helps to understand and identify risks better. Though systematic risk cannot be reduced by diversification, it does come a long way in understanding and identifying risks.

#4 - Helps in Understanding Repercussions

Since systematic risk affects the entire economy, it helps one understand the interlinkage and repercussions. For example, when the housing mortgage burst in 2007, the systematic risk became a nationwide phenomenon. This liquidity crunch affected the financial markets, which affected other economies and led to a steep fall in trade and investment globally.

Disadvantages

Some common disadvantages of the concept of systematic risk of portfolio are given below.

#1 - Mass Impact

Unlike sector-specific risks, such kinds of risks affect everyone. For example, businesses may slow down, the capital inflow may reduce, and job cuts. Hence such risks affect the entire economy and may lead to a global slowdown if the downside spreads to other countries.

#2 - Difficult to Study Sector-Specific Risk

It considers the whole of the economy. It would be difficult to assess the impact on various sectors, stocks, and businesses in an isolated manner. There may be sector-specific risks and factors that impact these businesses. Studying them in isolation rather than considering the holistic view is essential to understand the same better.

#3 - Scale of impact may be Different

Though the non-diversifiable risk is a systematic risk that impacts the whole economy, the scale of impact may differ across the business and sectors. Here it becomes essential to understand and study these sectors with a view different from that of the entire economy.

Although systematic risk impacts the entire economy, the scale and magnitude of the same may differ across sectors, and thus it becomes crucial to study them in isolation. The systematic risk may not give the analyst a complete picture in such a scenario. They may need to analyze sector-specific behavior and factors that affect the same.