Table Of Contents

Synergy Meaning

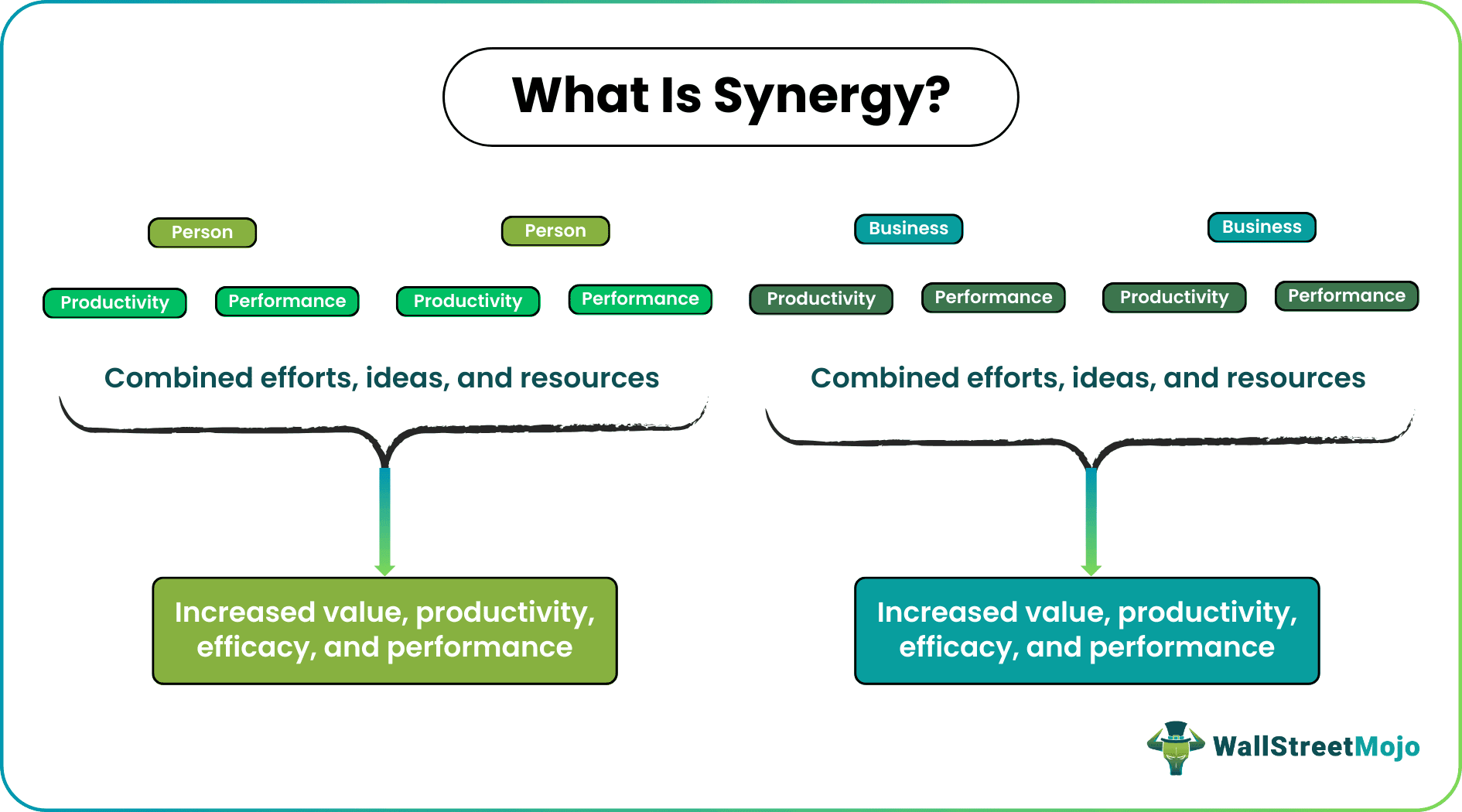

Synergy is a strategy where individuals or entities combine their efforts and resources to accomplish more collectively than they could individually. It eventually results in increased productivity, efficacy, and performance. Its best example is mergers and acquisitions, where the new company will provide more value than the two businesses independently.

The concept implies that collaborating on a task can lead to better decision-making and outcomes than working alone. In the business world, bringing together personnel, technology, and resources can result in higher revenues and lower expenses. For example, companies cross-sell each other's products to boost revenues or create multidisciplinary workgroups to increase productivity and quality.

Table of contents

- Synergy Meaning

- Synergy is a method in which individuals or organizations pool their resources and efforts to enhance value, productivity, efficacy, and performance more than they could individually.

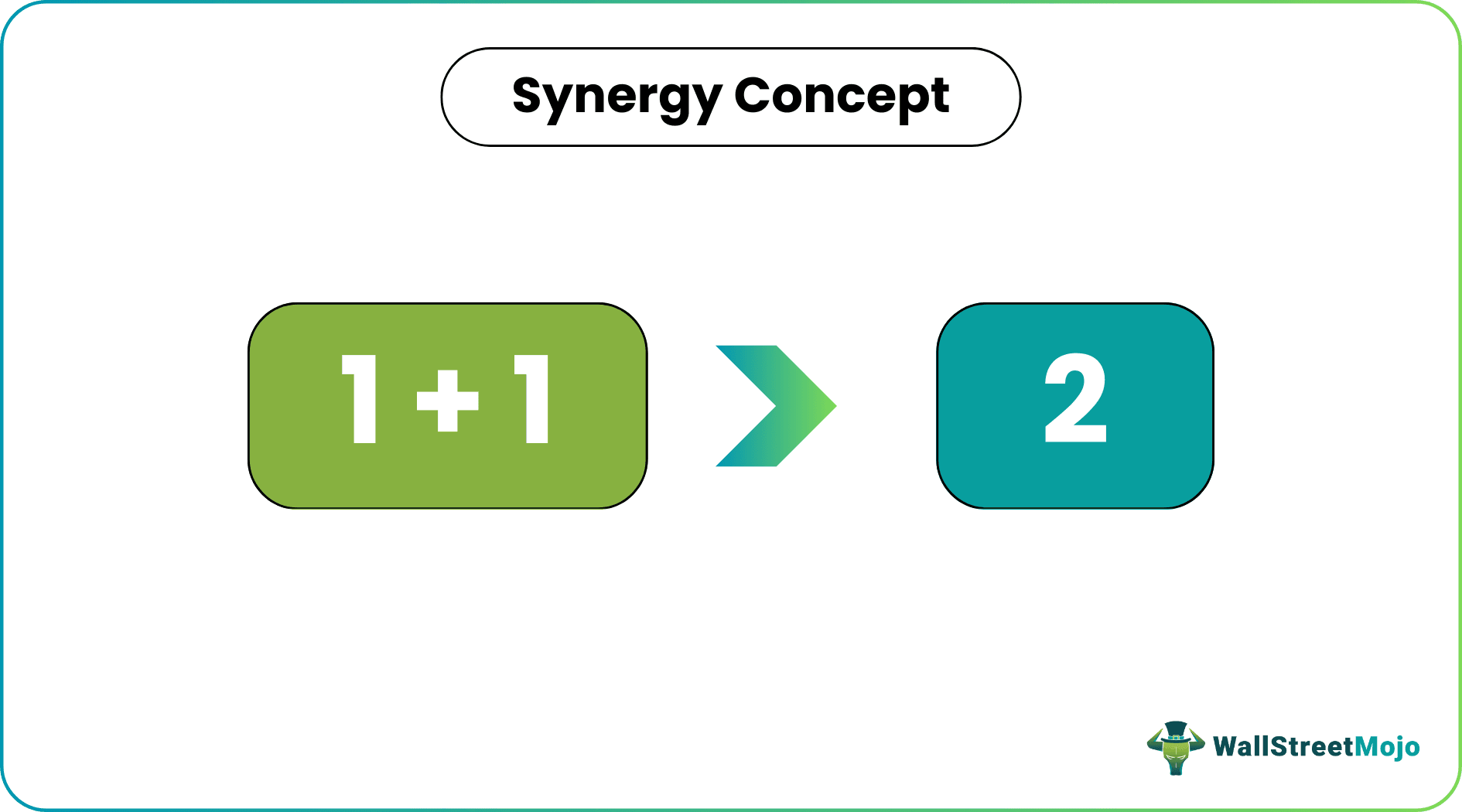

- While 1+1=2 in math, the idea suggests that 1+1 > 2. It means working together on a task can result in better decision-making and outcomes than working alone.

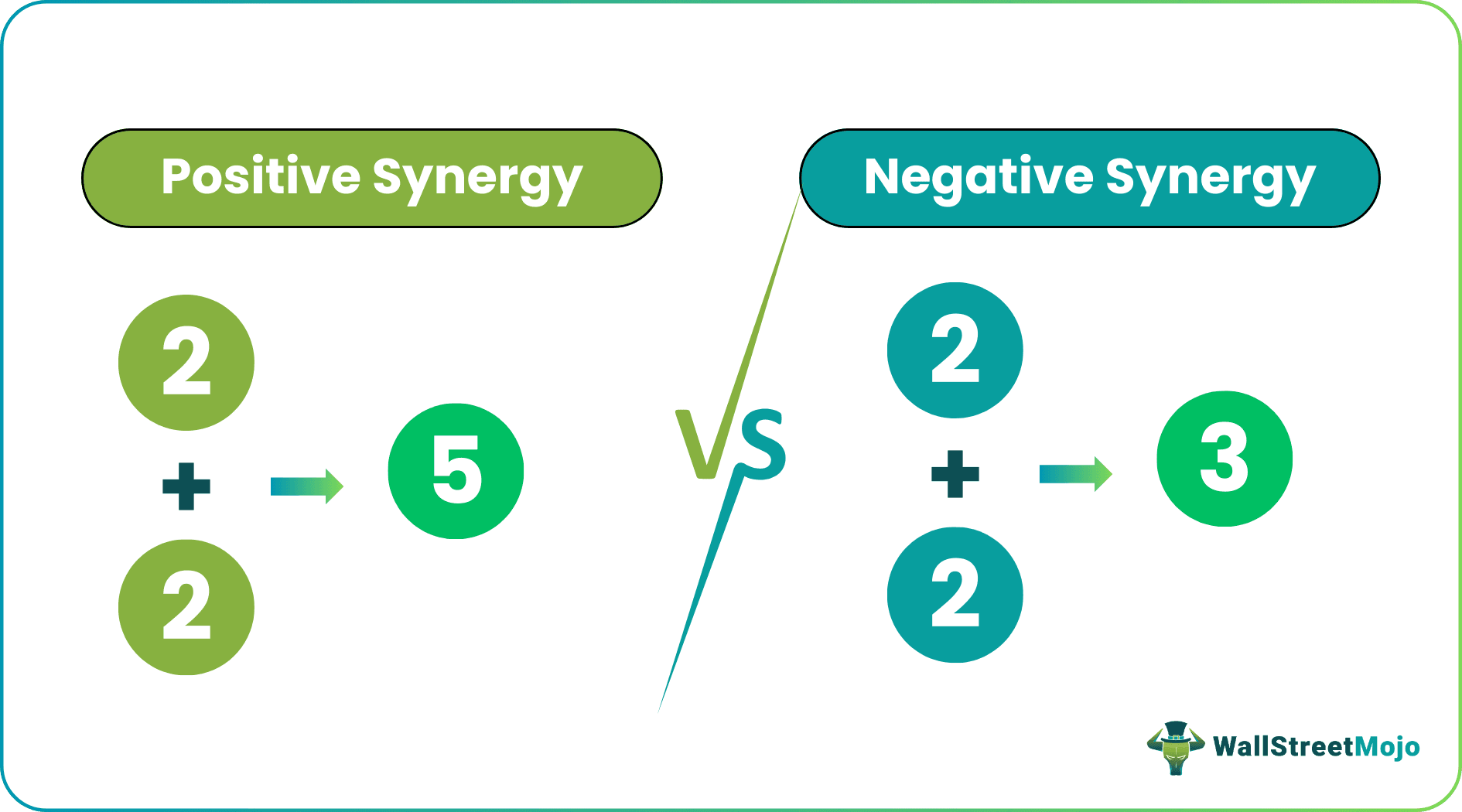

- It can be both positive and negative. If a group of people or businesses collaborates constructively to achieve a common goal, the result will be better (positive) than if they worked alone and vice versa.

- There are three sorts of synergies in the corporate sector - cost or operational, revenue, and financial.

Understanding Synergy

Synergy definition suggests two or more individuals or organizations collaborating to achieve a common goal. The combined entities may benefit from shared research and decision-making. Merger and acquisition (M&A) in the organizational setup are some of the most prominent examples of how it works. Factors impacting synergy measurement include the size of the group, the probability of the desired outcome, and time. While in mathematics 1+1=2, the concept advocates that 1+1 > 2.

For example, when two people combine their knowledge and insights to solve a problem, they offer different solutions. It is because there is someone on the opposite side to compliment or criticize the ideas, and hence the solution that emerges has no flaws. On the other hand, when working alone on an issue, the solution obtained may not be optimum.

Synergy In Business

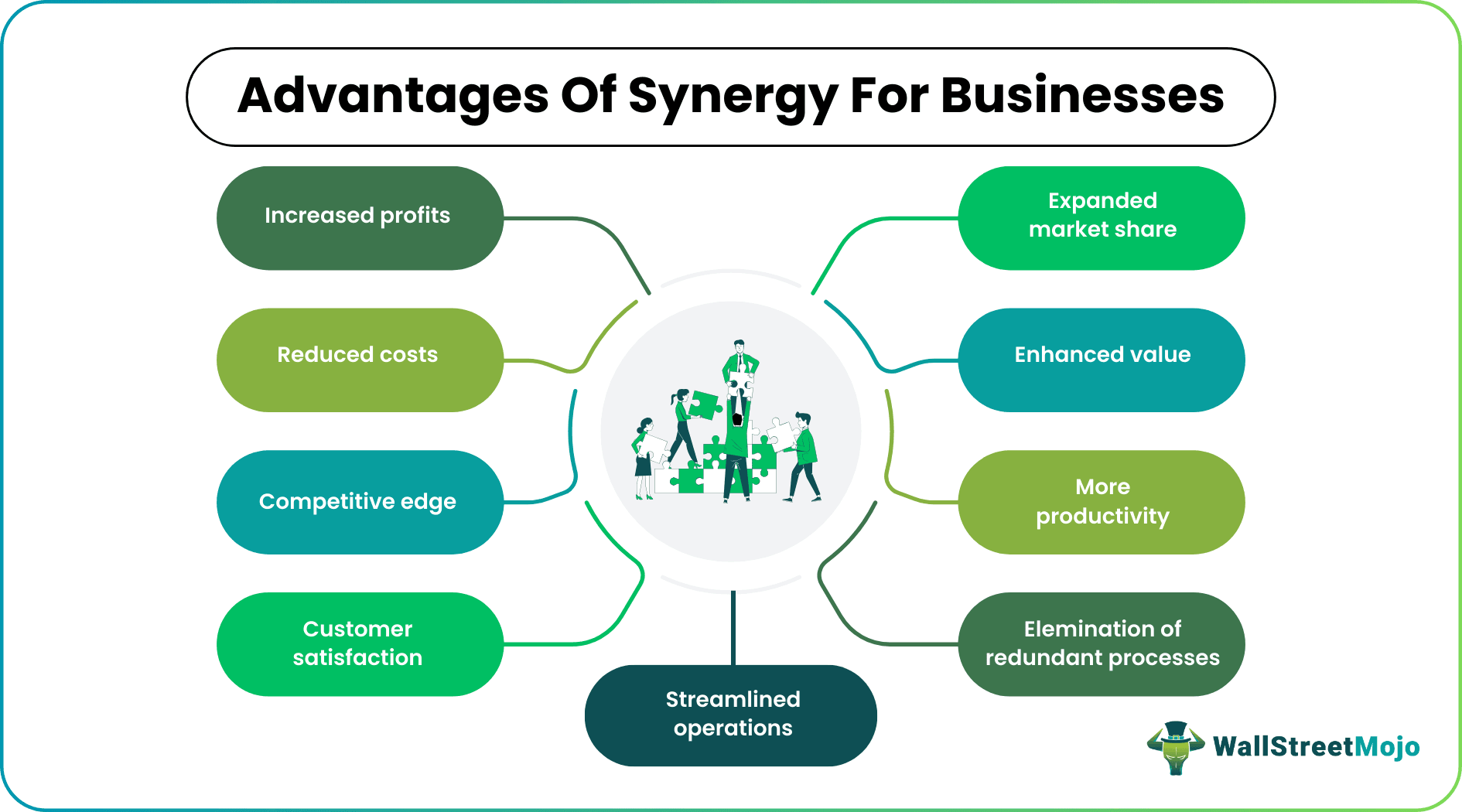

Businesses emphasize teamwork since collective efforts yield better results than individual efforts. Also, it has numerous advantages for enterprises, such as increased profits, reduced costs, competitive advantage, customer satisfaction, market share, etc. Furthermore, it assists in developing economies of scale.

The concept also exists in the feedback system, where businesses ask customers to share their experiences about a particular product or service. Customer reviews help companies learn what they are missing, allowing them to improve and perform even better.

Synergy M&A is one of the reasons that make businesses flourish and dominate the market. It allows the merging companies to generate more money as a single entity rather than as separate entities. Also, it aids in eliminating unnecessary procedures and the streamlining of operations, leading to significant cost savings.

It can be both positive and negative. If a group of persons or companies works together constructively to achieve a common goal, the outcome will be greater than if they have operated independently. Individuals working together to provide innovative ideas and businesses combining multiple products or markets is a sign of positive synergy. It, overall, results in operational efficiency, new opportunities, and better resource utilization.

On the other hand, if group members disagree or make collaboration a personal issue, the collective effort will yield zero returns. Negative synergy implies that combined efforts are less valuable than individual ones. Businesses may face this situation because of leadership structure and corporate culture, resulting in decreased production, poor quality, and resource underutilization. Other negative implications may include downsizing and divestiture.

Thus, collaborating as a team or merging as an entity is not synergy, while working collectively and thinking constructively is.

Examples

Let us look at some of the synergy examples to get an in-depth understanding of the concept:

Example #1

The e-commerce retailer ABC began operations on a limited scale, targeting primarily local customers. People started placing orders in the early stages of the company, and the business grew in popularity with clients.

Consumer reviews highlighted how they recommend the brand to their friends and family. As a result, the company launched a survey to see if people from other places would use their services. The results showed that existing consumers' word of mouth was effective. As a result, it decided to expand and begin shipping products beyond the local area.

However, due to the difficulty of handling the delivery, ABC partnered with the well-known logistics firm XYZ to ensure timely delivery. Thus, the two formed the best synergistic collaboration in the industry, resulting in massive profits.

Example #2

Rocket Lab, an aerospace company, recently merged with Vector Acquisition, a special purpose acquisition firm, and began trading on the NASDAQ. Through this merger, Rocket Lab went public and can bring significant space assets to the market. The deal and proceeds will also help Rocket Lab expand and strengthen its rocket and spacecraft business while allowing it to create a larger rocket, the Neutron.

Types of Synergy

Based on its application in business, synergy definition can be of three types, including cost or operational, revenue, and financial:

#1 - Cost Synergy

When two companies merge, the new entity can lower operational costs and eliminate unnecessary expenses. For example, if firms A and B unite, they can utilize each other's resources without owning them separately. As a result, they will both benefit financially from the collaboration.

#2 - Revenue Synergy

The merger or acquisition of firms may result in increased sales revenue compared to their separate operations. For example, suppose that firm X, worth $1 million, merges with company Y, valued at $500,000, and they cross-sell each other’s products. As a result of this deal, the turnover is likely to be $1.5 million. But the strategy makes the combined revenue exceed the individual sales of both companies, totaling more than $1.5 million.

#3 - Financial Synergy

It occurs where small businesses take up loans to start and grow. However, they need to repay more than they borrow, which may affect their financial situation. By applying the idea, they may unite with a mid-sized firm and operate as part of it rather than borrowing a large sum from lenders. In brief, the strategy provides more value to merged companies in terms of debt, tax, revenue, capital cost, and cash flow than their performances.

Frequently Asked Questions (FAQs)

Synergy is a process in which individuals or companies combine their resources and efforts to achieve more productivity, efficacy, and performance than they could alone. Mergers and acquisitions are the best example of this where the new company will provide more value than the two enterprises separately. Bringing people, technology, and resources together in a business can lead to more income and fewer costs.

Synergy can be both positive and negative. For example, if a group of individuals or enterprises work together to achieve a common objective, the outcome will be better (positive) than if they worked alone. Negative synergy suggests that if group members disagree or have a clash of ego, all the efforts will be less valuable than an individual effort.

The three types of synergy are:

- Cost: A merger of companies allows them to utilize each other's resources rather than investing in their own, thus reducing operational costs and removing unnecessary expenses.

- Revenue: Mergers and acquisitions enhance the new company's overall revenues through efforts like cross-selling rather than individual sales.

- Financial: It adds more value to combined organizations than their standalone performances, resulting in debt and tax benefits, higher revenue, lower capital cost, and better cash flow.

Recommended Articles

This has been a guide to what is Synergy and its Meaning. Here we discuss synergy in business, its types, along with examples. You can learn more about finance from the following articles –