Table Of Contents

What is Sweep Account?

A sweep account is a kind of bank or brokerage account. If the customer's account balance gets above the average limit set by the customers, the excess amount gets transferred to a high-interest-bearing money market account at the end of every business day. An auto sweep account minimizes the customer’s cash drag by investing in better immediate investment options.

Despite the better usage of excess cash, liquidity, and returns, this service is not always free, and considering the net returns from such accounts, it might not be a wise decision for everyone to opt for such an account. However, it is also an impressive option from the perspective of not letting the money sit idle in the bank account.

Table of contents

- What is Sweep Account?

- A sweep or auto sweep account is a type of bank or brokerage account where any excess balance above a predetermined limit set by the customer is automatically transferred to a high-interest-bearing money market account.

- The excess money in the account is automatically swept into the money market account for investment purposes.

- The financial advisor and the bank's customer predetermined the transferred funds. Furthermore, auto sweep accounts provide a higher return on investment than regular fixed deposit accounts.

How Does A Sweep Account Work?

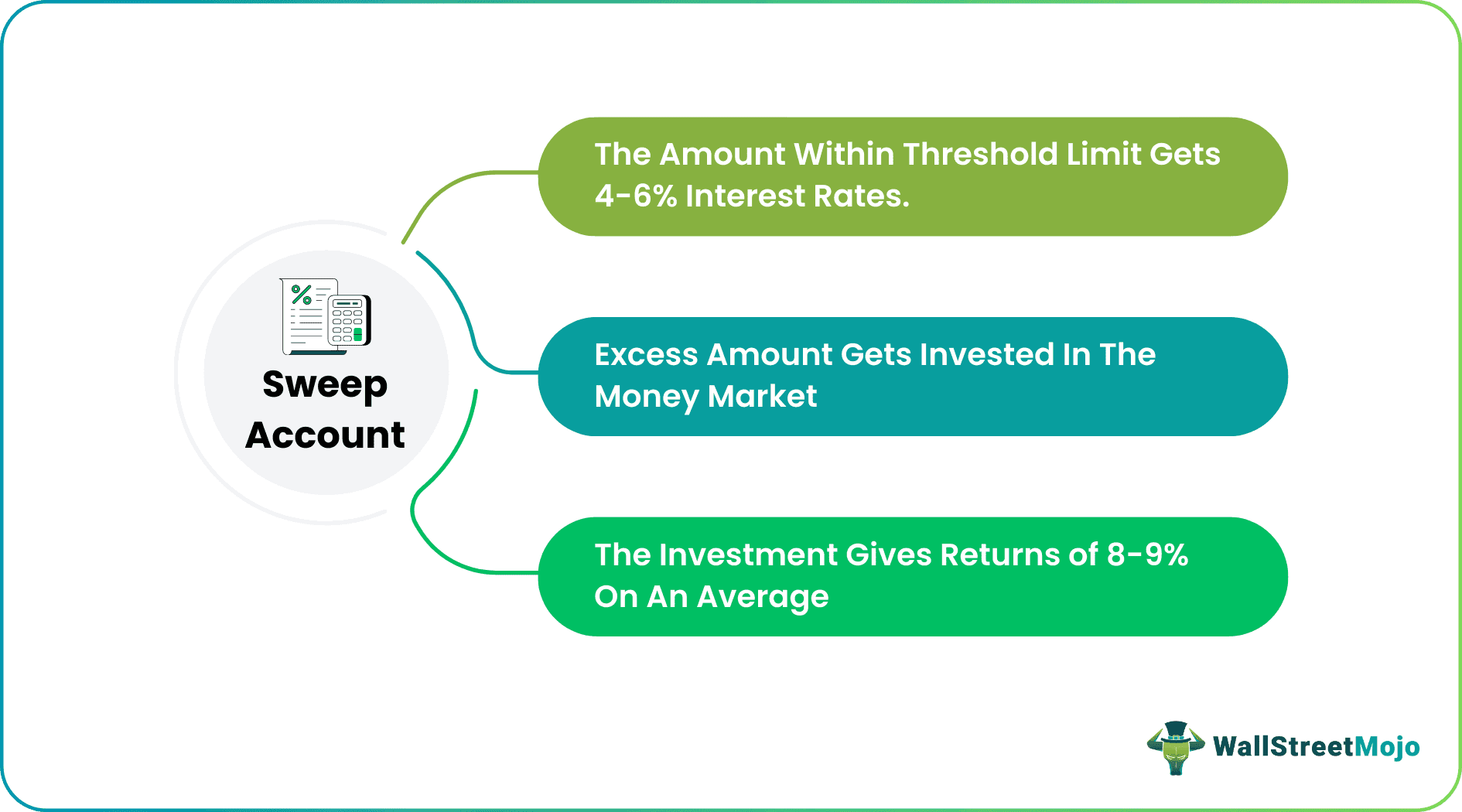

A sweep account is a type of bank or brokerage account that is designed to efficiently utilize the excess cash in the account. It has a cut-off or a threshold limit beyond which, the excess amount in the account is invested in investment options that would surely provide better returns than the savings account interest rate.

Banks provide the special facility of sweep account banking to customers by maintaining their accounts and as per the instruction given by the customers. They sweep the excess amount to the money market account and invest in the money market. The excess amount transferred to the sweep account can be easily liquidated. Customers can earn a return on their investments. The bank also provides a facility to the customers by giving them financial advice on where they can invest, or the customers can decide the same by themselves. Customers generally try to invest in the money market because the rate of return in this market is higher; also, the risk associated with the returns can be there, but if the customers take good financial advice, then they can do wonders with the excess money left over in their regular accounts which they are trying to invest in the money market.

The bankers will maintain the account, and as per the client’s requirement, the money automatically transfers to the account. Customers predetermine the average amount to be kept in the savings or current account, and any excess and excess is invested in the money market. The excess amount in the sweep account is also easily liquidated. Sometimes there can be a situation where the amount falls short in the main account, and at that time, the proceeds the customers earn from the investment in the money market can be used to maintain the accounts. The calculations and the adjustment should be made very carefully to maximize the utility of the mechanism of this special account type.

Banks provide special facilities to customers to ease their burden from complex investment situations. Still, the customers should understand this facility’s terms and conditions. The money market returns are no doubt higher than the regular savings account interest, but one must be very careful while investing in this type of account.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Features

These accounts are different than a regular savings or checking account in more than one way. The features that set them apart are discussed in detail below. Let us understand the features of a bank sweep account through the discussion below.

- These accounts automatically transfer the excess money into the sweep account to prepare it for the money market investment.

- The money that is being transferred is predetermined by the financial advisors and the bank's customers.

- This account helps the customer earn some return on investment, which is higher than the regular FD interest.

- It is also known as the auto sweep account.

- It is a smart way to regularize business people's daily cash flow balances.

Examples

Let us understand the concept of sweep account banking with the help of a couple of examples. These examples would give us an in-depth understanding of the significant details of the concept and its related factors.

Example #1

Mr. Russell opted for a sweep account facility with the bank. The savings account has a threshold limit of $ 5,000. The savings account interest was approx 2 % per annum. On 1st December 2019, he had $ 2,000 in his account, and on that, he has continued to earn a 2 % interest that year. On 1st January 2020, he deposited $ 2,000 to the bank, and now the fund in the account is $ 7,000. The extra amount from the threshold limit, i.e., $ 2,000, will be automatically invested in the money market. Mr. Russell can earn a higher return on his investment than the savings account.

Example #2

Despite the fact that these accounts provide better utilization of cash, the net returns might not be the best considering the overall performance. Moreover, a sizeable amount of banks and brokerages spread their clients’ cash balances way over Federal Deposit Insurance Corporation (FDIC) limits. Additionally, the cash is invested in a common account for a large volume of customers. This account is called an omnibus account. It makes it riskier for the customers as they stand to lose the whole amount if the institution falls.

It is also important to understand that the FDIC insurance is limited to $250,000 and an amount beyond that has to be invested on the investor’s own risk. Even for the insured amount, if the bank fails no amount can be claimed under the FDIC intrudes and takes control of the damage control.

Advantages

Let us understand the advantages of opting for an auto sweep account and efficiently using the excess cash in the account through the explanation below.

- This account transfers the excess fund automatically as per the client’s requirement.

- This account also helps the savings account maintain the threshold limit.

- In case the funds fall short in the savings account, the proceeds from the investment are automatically used to maintain the minimum requirement of the account balance.

- By this technique, the customer can earn a steady interest in their savings account, and the excess money is not idle in the accounts. It is further invested in the money market.

- The money invested through this account in any investment scheme can easily be liquidated when required.

Disadvantages

Despite significant advantages as mentioned above, there are a handful of factors that prove to be a hassle or an option that is not worth it in terms of returns for the investors. Let us discuss the disadvantages of bank sweep accounts through the points below.

- The disadvantage of this type of account is that the customer has to be very keen on investment. The risk involved in the money market is very high.

- The fees to maintain the account are usually high since the bank provides a very special facility to the customers.

- The customer should take financial advice before investing their hard-earned money in something like this because there can be a possibility of earning a lower return compared to the interest amount from the saving accounts.

- There is a huge penalty for breaking the account before completing its tenure.

Difference Between Sweep Account and Zero Balance Account

In the banking sector, a bank sweep account and a zero-balance account are widely discussed, marketed, and used. However, there are a few fundamental differences in their features, implications, and rates. Let us understand the differences through the comparison below.

- There is no minimum balance requirement in a zero-balance account, but in the case of a sweep account, there is a minimum balance requirement to continue the account.

- The function of the zero-balance account is to consolidate the cash balances of other accounts in a single entry for the clients. On the other hand, the sweep account helps to invest the excess money lying in the savings or current account of the customer to help them earn a higher return from the market.

- The zero-balance account disburses all the money from its account at the day end and thus makes the balance zero. At the same time, a minimum amount is required at any point in time in the case of the sweep account.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

To withdraw money from a sweep account, one can usually do so through their online banking account or by contacting their bank directly. The customer may be required to specify the amount they want to withdraw and the account they want the funds transferred.

Sweep accounts are generally considered safe, as banks and other financial institutions typically offer them with strong regulatory oversight. However, as with any investment or financial product, risks are involved, and it is important to understand the terms and conditions of your sweep account before investing.

An insured cash sweep account is a type of sweep account that is designed to provide investors with both liquidity and protection of their principal. These accounts are insured by the Federal Deposit Insurance Corporation (FDIC) up to certain limits, which helps to minimize the risk of loss in the event of bank failure. High-net-worth individuals and businesses often use insured cash sweep accounts to maximize the return on their cash while minimizing risk.

Recommended Articles

This article has been a guide to what is Sweep Account. Here we explain its features, advantages, disadvantages, examples and compared it with zero balance account. You may learn more about financing from the following articles –