Table Of Contents

What is a Surety Bond?

A surety bond is a contract that protects a creditor from non-performance or non-payment. It is an agreement between three parties—a third party assures the obligee that the principal will fulfill documented obligations.

This third party is known as a surety; the principal is the business entity that purchases the bond, and the obligee is the beneficiary. If the principal debtor dishonors the obligation, the third party pays compensation to the obligee. Surety bonds are mandatory for entering into contracts with government agencies, regulation departments, state courts, federal courts, and general contractors.

Key Takeaways

- A surety bond is a legal agreement that assures the obligee that the principal will complete the work. In case of failure, the surety will pay compensation to the oblige.

- Usually, the surety is an insurance company that issues bonds. Bonds are issued, once contractors meet the required conditions.

- The four different types of surety bonds include court, commercial, fidelity, and contract bonds.

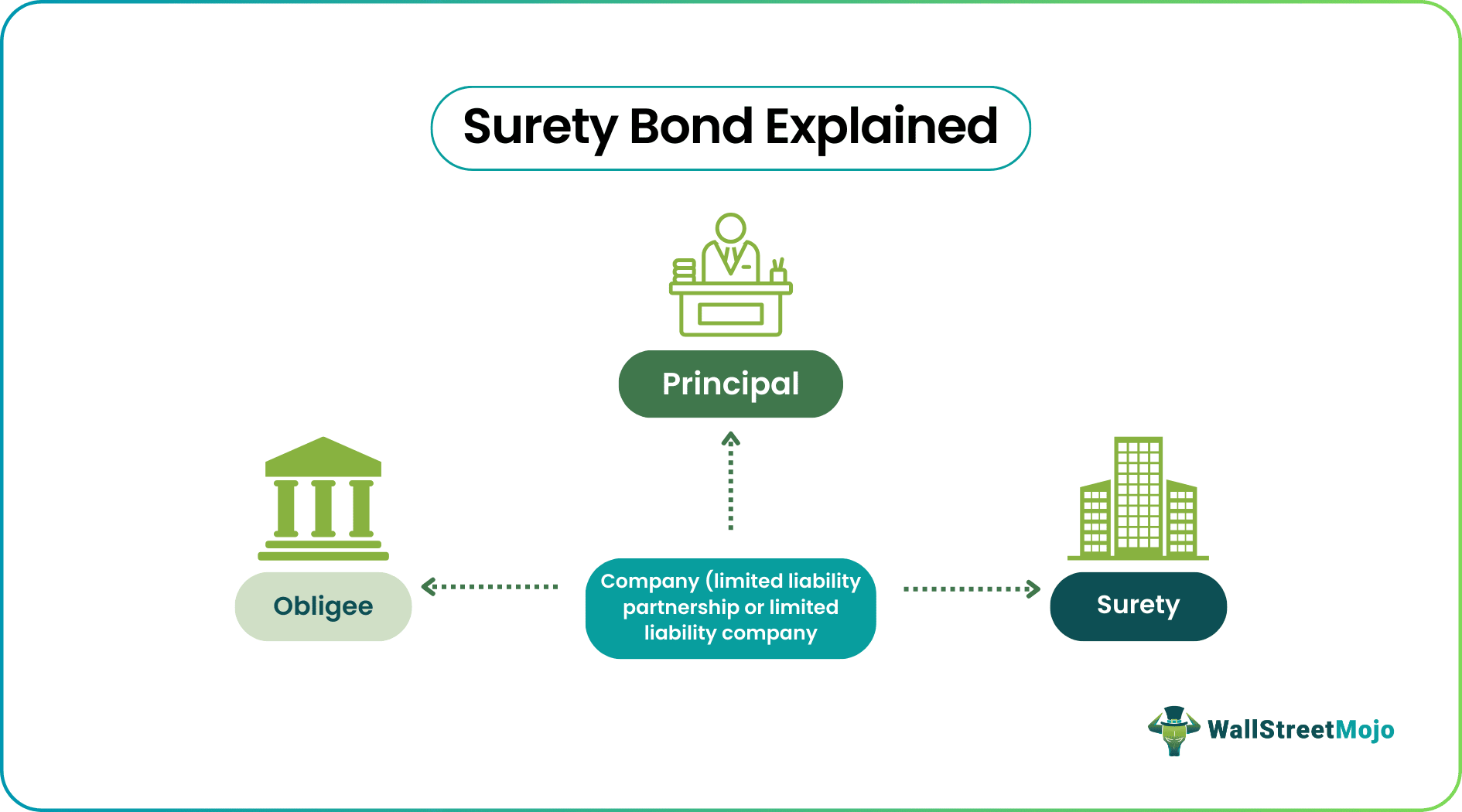

Surety Bonds Explained

A surety bond is a promise to complete a specific task—as per the contractor's terms. In order to ensure the completion of work, a bond is used as insurance. This provision safeguards an obligee in case the principal fails to comply with the agreed terms. An obligee is usually the government; the principal is a contractor or business owner. A surety acts as a middleman between the two parties—principal and obligee.

The principal requires a formal assurance from a surety; only then will the obligee proceed with the business activity. To acquire a surety bond (insurance) the principal must meet the following requirements:

- Sufficient funds for accomplishing the project.

- Adequate expertise—for the completion of the project.

- Positive corporate image.

- Well-managed business.

- Good reputation with banks.

- A proper line of credit.

The bond rider is the only legitimate method of updating surety documentation. The following changes can be made:

- Increase in the bond amount.

- Change in bond date.

- Change in bond terms.

- Error rectification in the original bond.

Parties to a Surety Bonds

A surety bond involved three parties:

- Obligee: It refers to the person or company protected by such a bond. This party is the beneficiary of the assurance.

- Principal: The principal is the person or company who has to fulfill the obligation (to accomplish a task or refrain from doing it). The principal purchases a surety bond to assure the obligee.

- Surety: It is an insurance company that backs a business contract. They issue bonds—a form of indemnification. Thus, the surety assures the obligee that the principal will successfully complete the documented obligations. If the principal fails, the surety compensates the obligee for the incurred losses.

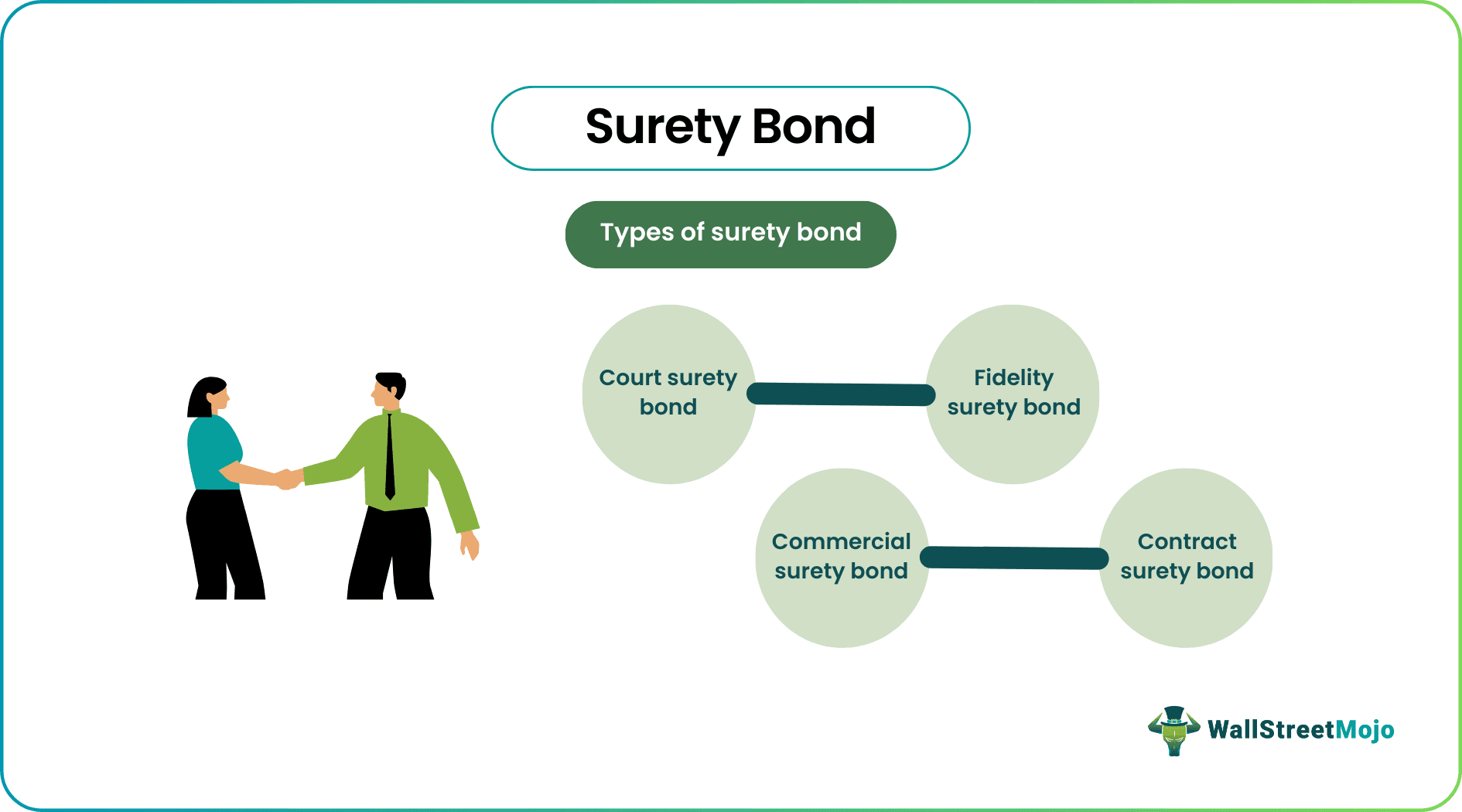

Types of Surety Bonds

Four prominent subtypes are as follows:

- Court Surety Bond: They are required before a civil court proceeding. The parties are financially liable if they fail to behave in accordance with the court’s orders.

- Commercial Surety Bond: These assurances are compulsory. Government bodies enforce these checks to ensure public welfare. It is a security measure against misrepresentation, fraud, and dishonesty.

For example, when new firms enter a particular industry that is sensitive to public health, they require a license to function—liquor shops.

- Contract Surety Bond: The surety assures that the contractor will fulfill construction according to agreed terms and conditions. The third party also makes sure that the obligee pays in time. Therefore, two surety bonds are issued.

- Fidelity Surety Bond: This assurance safeguards company owners against employees' defaults—theft, illegal actions, or mismanagement. They are a fundamental component of risk control.

Example

Now let us look at an example to understand the practical application.

Let us assume that a local USA authority (obligee) wants to construct an office building and hires XYZ contractor (principal) for the job. In accordance with local USA Authority regulations, it is mandatory for XYZ contractor to secure a construction performance bond.

This assurance guarantees the fulfillment of contract terms. Therefore, XYZ contractor buys a construction performance bond from a reliable third party. The third party or surety is usually an insurance company.

The guarantee protects the local USA authority. Even if XYZ contractor fails to satisfy the contractual terms, the obligee is compensated. In such a scenario, the surety company must pay the local USA authority, mitigating the incurred losses.