Table Of Contents

Surcharge Meaning

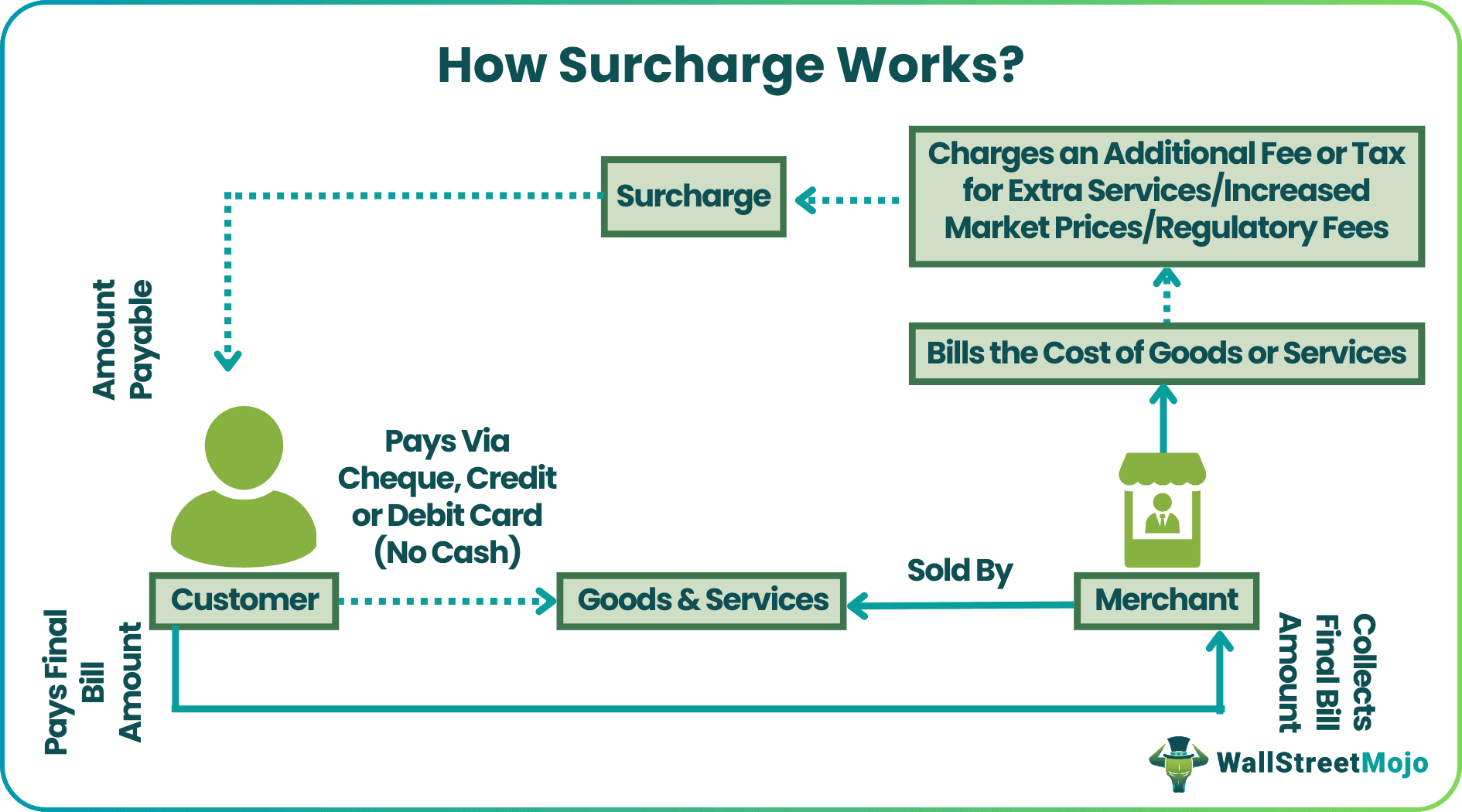

A surcharge is an extra fee or tax added to the customer's final bill for paying through check, credit, or debit card rather than cash. The additional sum reflects the extra services offered by the merchant, increased product costs, or government regulatory costs. It could be either a fixed amount or a percentage of the purchase amount.

This extra charge applies to various products and services, including medical care, telecommunications, and travel. The surcharge fee collected by enterprises is subsequently returned to the banks or authorities concerned. Even though businesses are free to add a specific amount to the final bill that customers must pay, some regulations prohibit enterprises from doing so.

Key Takeaways

- The surcharge refers to an extra fee or tax added on top of the final amount for the goods or services purchased by the customer, who pays for it through check or credit or debit card instead of cash.

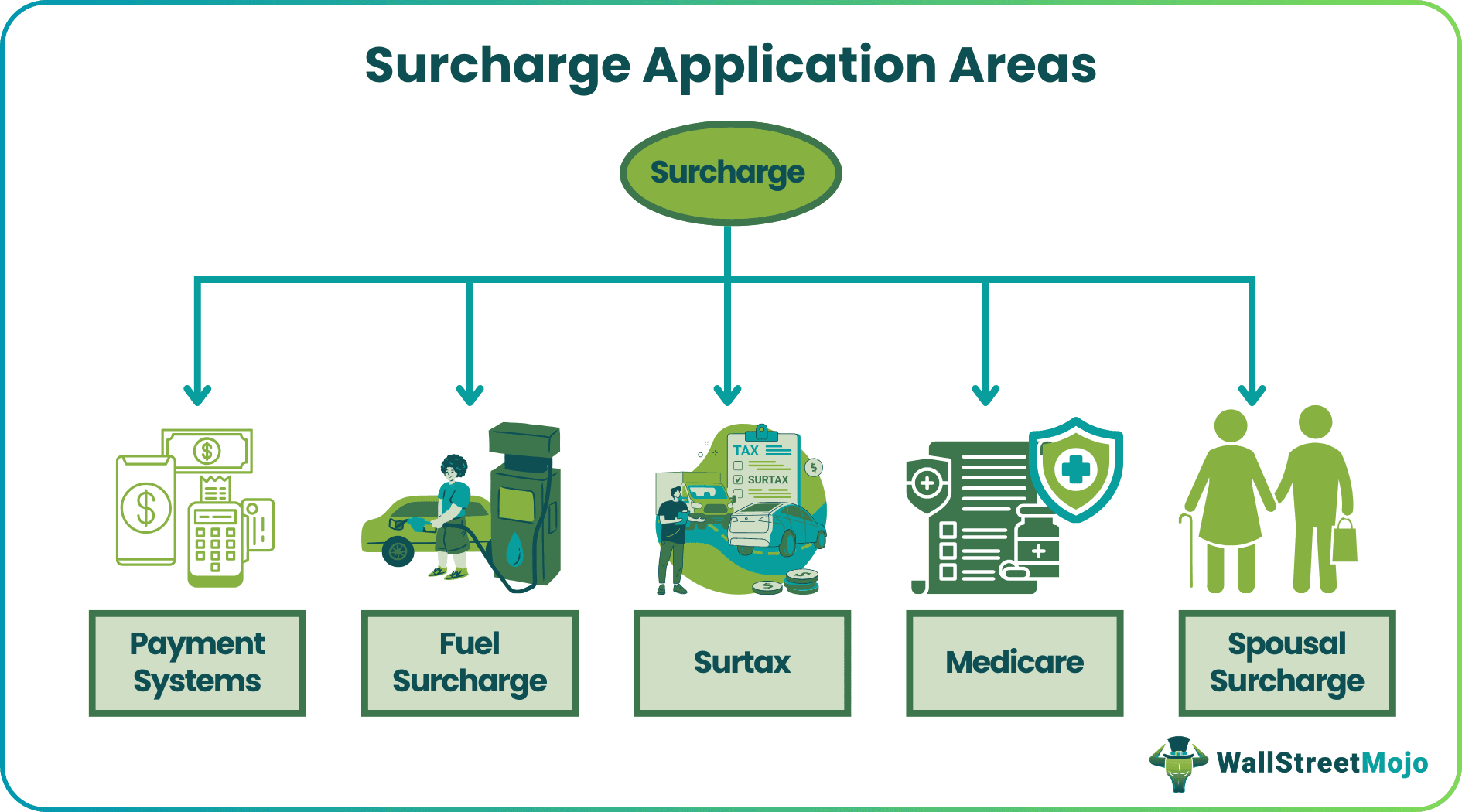

- The additional amount applies in various areas, including payment processing, Medicare, fuel consumption, spousal healthcare insurance, surtax, etc.

- It is different from cess in that the former is collected to serve various purposes, while the latter is meant for a specific purpose and is named after it, such as education cess.

How Does Surcharge Work?

Businesses often struggle with balancing the costs of providing services due to accepting payments via a payment platform. Sometimes there are gradual increases in the prices of products they offer or regulatory fees that the government imposes on respective industries. It brings us closer to the answer to what is a surcharge? To offset these additional and indirect costs, merchants charge customers extra fees or tax, known as a surcharging. It is in addition to the quoted price of the product or service purchased.

For example, in the case of a point-of-sale (POS) system, the processing fee is charged by the bank directly. Similarly, carriers assess additional fuel charges for transporting passengers or goods.

The practice of surcharging encourages consumers to turn to traditional payment methods, such as cash. With that said, it helps businesses avoid the indirect costs that they suffer. As already stated, merchants can charge additional fees or tax for selling goods or services but only to a certain extent. Different countries have different laws allowing or prohibiting merchants from practicing it.

Even though credit card surcharging allows businesses to pass on the processing fee to customers, unexpected situations like the COVID-19 pandemic make it challenging for them. The increasing reliance of people on credit or debit cards has fuelled the payment processing costs for businesses. In this situation, merchants must consider surcharging to support and manage their operations.

Application of Surcharge

It is applicable in various forms and for different purposes:

#1 - Payment Systems

When a customer pays for products at a retail shop, the shopkeeper swipes his or her credit or debit card. The POS system then automatically charges the additional fee on the payment. It is also referred to as the checkout fee and can be up to 4% for each transaction. It acts as the processing fee for the convenient payment method offered by the merchant to the customer. As it can lead to price discrimination by the retailers, many payment card companies restrict them from surcharging card transactions.

#2 - Fuel Consumption

The carriers charge an additional amount on the basic shipping or freight rates. Carriers like DHL, FedEx, and UPS collect a surcharge fee to cover the extra fuel costs, mainly because of the continuous fluctuation in the fuel prices. UPS has even an index-based surcharging system that undergoes weekly adjustments.

The U.S. On-Highway Diesel Fuel Prices data compiled by the U.S. Energy Information Administration specifies the weekly fuel price adjustment. The carriers use a standard calculator to calculate and pay the additional amount without worrying about the bottom lines.

#3 - Medicare Levy

In Australia, the Medicare Levy scheme requires taxpayers to contribute up to 2.5% of their taxable income for the medical requirements. The Medicare Levy Surcharge or MLS is an additional fee that patients or their family members would pay on top of the final medical bill amount, if:

- Neither they nor their spouses or children have the required level of healthcare coverage.

- Their earning is well-above the specified limits.

The main objective behind the introduction of the MLS is to encourage people to have proper medical coverage. It also ensures they have access to the private healthcare system and avail of medical benefits without paying anything extra.

#4 - Spousal Healthcare Insurance

Employees covered under healthcare insurance from their employers may wish to get the healthcare coverage provided by their spouses' employers. In this case, their spouses must pay a spousal surcharge to cover their partner under the chosen healthcare insurance plan. It is worth noting that this additional fee can be imposed on employees only if their spouses have other healthcare insurance alternatives available to them.

#5 - Surtax

The tax imposed on top of another tax is called a tax surcharging or surtax. While the income tax and sales tax paid by taxpayers to the government are for different purposes, the surtax is to fund specific government programs. The rule is simple - the higher the income, the more surtax is applicable and vice-versa.

Examples With Calculation

Consider the following examples to understand how and in what proportion surcharging applies:

Example #1

Christine bought groceries from a retail store and receives the bill of $154.50. However, when she calculated the total amount, it came to $150. The customer asked the merchant regarding the additional $4.5 charged in the bill. The shopkeeper explained that it was an additional fee of 3% imposed on customers for paying through credit or debit cards and not in cash. Christine made the calculation: 150 + (3% of $150) = $154.5. She paid the amount and left.

Example #2

This example reflects how a taxi driver can determine a fuel surcharge rate by considering the weekly adjustment of diesel fuel prices in the third week of May 2021. In doing so, it needs to consider three factors:

- The threshold amount, i.e., the minimum amount for the fuel surcharging to be applied. For example, $2.50.

- The actual price per gallon, which in this case is $3.249 (as depicted on the chart).

- The miles to be covered per gallon. For example, 5 miles.

Surcharge Rate Applicable Per Mile = (The actual price per gallon – The threshold amount)/The miles to be covered per gallon

= ($3.249-$2.50)/5 = 0.749/5

= 0.1498 = 0.15 (rounded off)

If the vehicle is to drive 50 miles, the surcharge fee levied by carriers on customers will be 0.15*50 = $7.50.

Difference Between Surcharge And Cess

People often confuse between surcharge rate and cess as both terms refer to a charge or tax on tax. While the former is for any purpose, the latter is for a particular purpose.

The term cess is added after the name of the purpose it would serve. For example, if it is for an education initiative, it will be called an education cess. Surcharging applies to a customer for exceeding the threshold amount.

As far as the calculation is concerned, cess applies to the taxable income. When the taxable income is applicable for a surcharge on income tax, surcharging will be done first to the tax payable, followed by cess. When an employee's income is subject to a surcharging and cess both, the former is added to the tax payable first, and then the cess is applied to it.