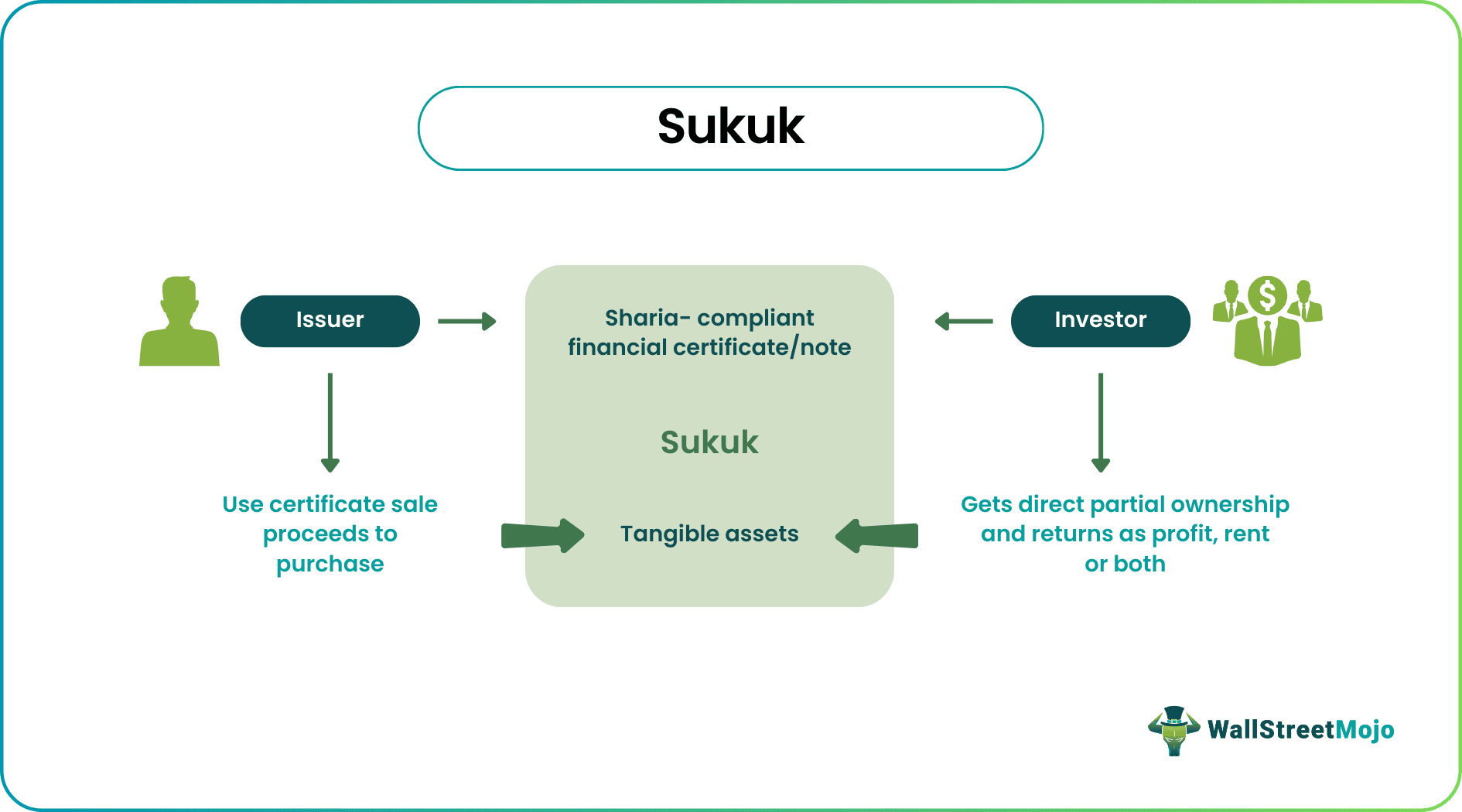

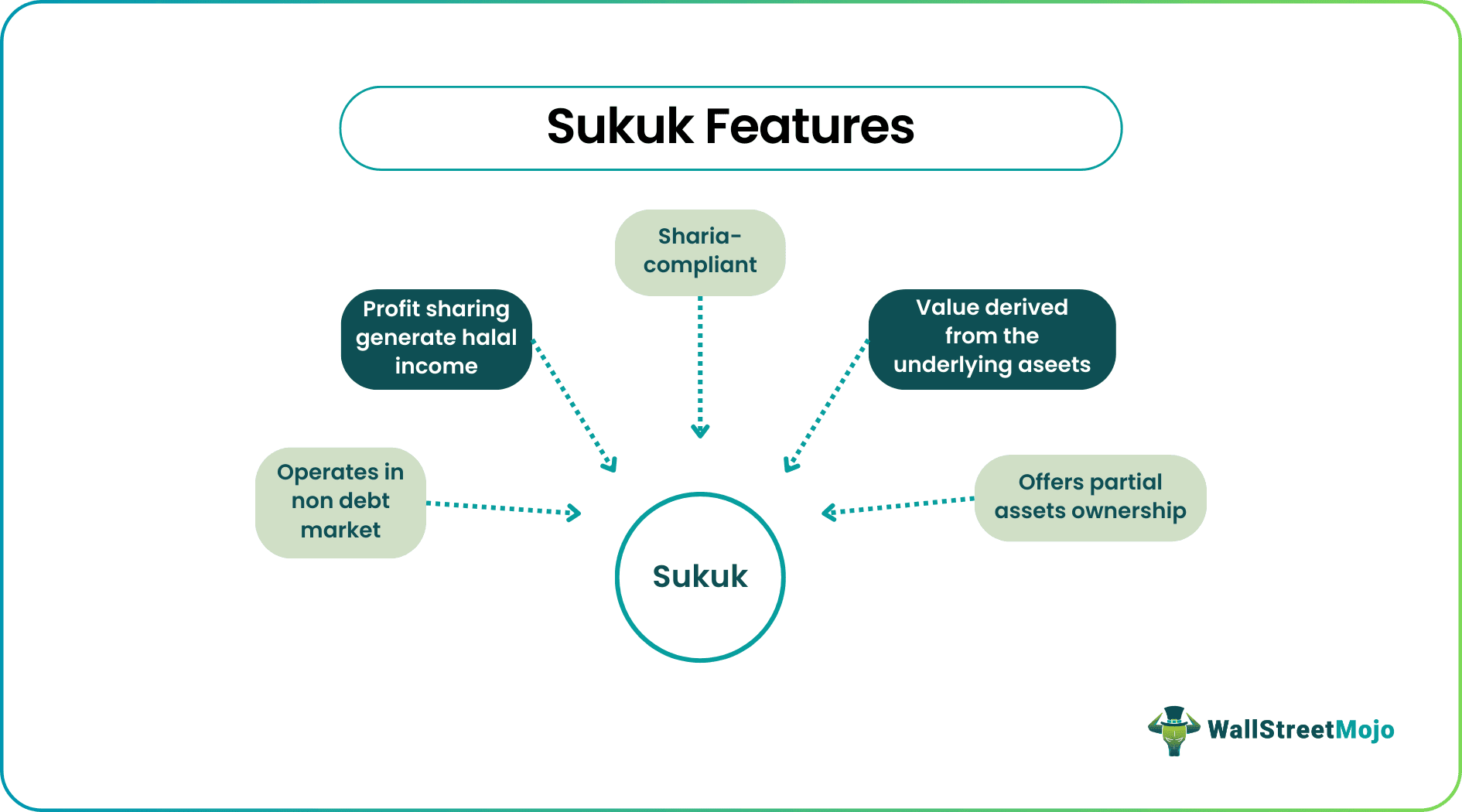

The word sukuk is often mistakenly substituted by Islamic bond, which is not an acceptable investment under Sharia law. When a sukuk is stated to be Sharia-compliant, it signifies that it follows the following rules:

- The profit earned only through commercial risk-taking and trade is the return on investment.

- No financial interests of any type are permitted.

- The assets in question must be halal.

When comparing sukuk with conventional bonds, there are many similarities and differences:

Similarities

- Investors will receive payouts

- Sold to investors with a set maturity period and can be used to raise funds for a variety of reasons

- Superior and safer investing alternatives to equities

- Issuers sell them, and they can be traded over the counter or on stock exchanges