Table Of Contents

What Are Sugar Futures?

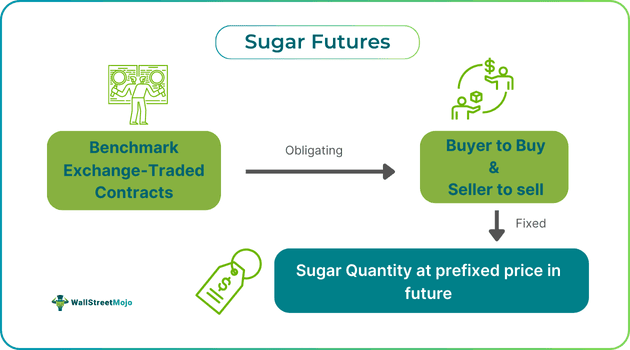

Sugar Futures refer to exchange-traded and standardized contracts that require the contract buyer to accept delivery of a fixed amount of sugar from the seller at a prefixed future date and price. They act to hedge prices for consumers and producers against market fluctuation, providing price security to participants in advance.

Traders, producers, and manufacturers mostly use it to handle financial risks related to sugar price fluctuation. Besides, it also offers speculative trading, giving investors avenues of profit from price movements without taking physical delivery of sugar. This makes them vital in commodity trading markets for impactful investment strategies.

Key Takeaways

- Sugar futures represent exchange-traded contracts obligating buyers to receive a fixed amount of sugar at a predetermined future date and price, providing price security in advance.

- Its types include New York No.11 and London No.5, both traded on ICE futures Europe.

- Its benefits include- offering financial stability, securing future costs, facilitating market participation, offering high liquidity, hedging against price fluctuations, enhancing cash flow, and providing profit opportunities.

- It comprises risks like losses and decreased value due to market volatility, margin calls, liquidity risks, expiry date risks, counterparty risks, sudden market shocks, and quality and storage challenges.

Sugar Futures Explained

The value assessment in finance emphasizes gauging the actual worth of a company or asset in the current period. It is crucial to identify the relevance of assets, products, services, businesses, investments, software, etc., at present. Some of the prominent methods for value analysis include the capital asset pricing model (CAPM), price-to-earnings ratio (PE ratio), fundamental analysis, net asset value (NAV), and dividend discount model (DDM).

The Financial Conduct Authority (FCA) has stated the following five pillars of value:

- Performance;

- Quality of service;

- Costs charged by the AFM;

- Comparable market rates;

- Comparable services;

- Economies of scale and

- Classes of units.

Business can take different forms, including operational, financial, and intangible valuations. In operational valuation, the company determines the level of efficiency in providing customer satisfaction and optimal utilization of assets and resources. Further, financial valuation speaks about the actual worth of a company's assets. Intangible value also includes the business's goodwill, brand value, and unique selling proposition.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Types

Futures of sugar have been crucial financial instruments of the global sugar market, having two major types serving different purposes in the trading realm. They are:

#1-New York No.11

New York Sugar No.11 represents the standardized benchmark concerning futures derived from raw sugar traded basically on ICE. It depicts the raw sugar price of Brazil and is broadly used by traders and producers globally. The size of the contract remains at 112000 pounds, making it reachable to various market participants. Here, the quoted prices are in cents per pound, representing the market volatility of sugar consumption and production.

#2-London No.5

London Sugar No.5 refers to white sugar traded on the ICE futures Europe exchange. Such sugar futures contracts become crucial for traders and investors dealing in refined sugar items having a standard size of contract as 50 metric tons. Its quoted prices are in US dollars per metric ton, serving different segments of the sugar market. London No.5 usually gets affected by changes in demand for and production levels of refined sugar in Europe.

Examples

Let's use a few examples to understand the topic.

Example #1

An online article published on July 9, 2024, discusses futures of raw sugar hitting a 20-month low, dipping to 18 cents per pound. Actually, the decline has been the lowest since October 2022. As per reports, the major decline in futures price became possible due to an estimated global excess for the 2024/25 season because of the oversupply of raw sugar in the market.

Nevertheless, the drop has not deterred bigger importers like China from taking advantage of the lower price, as evidenced by their buying of sugar at almost 18 cents per pound. On the other hand, the world's second-largest sugar producer, India, may delay exports until the latter half of 2025. Besides, sugar production in india has been predicted to reduce by 8%, having a total production estimate of 33.7 million metric tons during the 2023/24 marketing year.

Example #2

Let us assume that in the busy city of Old York, a company called Sugarcoaty produces sugar of premium quality. Its CEO, Samantha, predicts a hike in sugar demand because of a new trend in desserts. However, to safeguard from price fluctuation, she makes up her mind to invest in the sugar futures market.

Samantha calls her broker, Trump, for sugar futures trading, who then facilitates her buying of 500 sugar futures contracts at $0.50 per pound for receipt within 4 months. At the same time, another rival company, X, led by an expert CEO, predicts a price drop in sugar and sells 300 contracts at a short position at the same price. But with the delivery date approaching, the profit of Sugarcoaty soars with rising demand while business X experiences major losses because of their short position.

Benefits

Traders and investors can derive the following benefits from it:

- It allows producers to fix their prices, offering financial stability and safety against price decreases pre-harvest.

- They help buyers like manufacturers in securing costs related to future purchases, protecting against possible price rises.

- It facilitates wider market participation as its lower contract size makes it accessible to small and mid-sized companies.

- It has high liquidity provision, leading to easy exit and entry positions for traders in contrast with other commodities trading.

- They act as powerful hedging tools against price fluctuations in the sugar market, aiding in managing financial risks concerning volatile prices.

- Futures contracts enhance cash flow handling by offering predictable pricing, benefitting in terms of financial planning and budgeting.

- It gives many opportunities to traders for speculation, allowing them to gain from price trends in the absence of any need to take physical delivery of sugar.

Risks

There are certain risks associated with trading and investment in sugar futures:

- Market volatility often causes losses if sugar futures prices go unfavorable against a trader's position.

- If one trades it on margin, then it potentially increases the margin call, enhancing the loss risk as it needs extra funds to sustain positions.

- If traders fail to exit their positions at desired prices quickly, particularly in volatile markets, then liquidity risk arises.

- Usually, futures contracts contain expiry dates, resulting in risks of having to accept physical delivery of sugar if the expiry date is not managed properly.

- It has ingrained counterparty risks that might lead to losses in case the other party defaults on the contract.

- Unprecedented and sudden market shocks due to political instability or natural catastrophes may impact sugar prices negatively, disrupting trading.

- Quality and storage challenges may occur because inadequate storage conditions spoil the sugar pledged as security, decreasing its value.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.