Table Of Contents

What Is A Subscription Agreement?

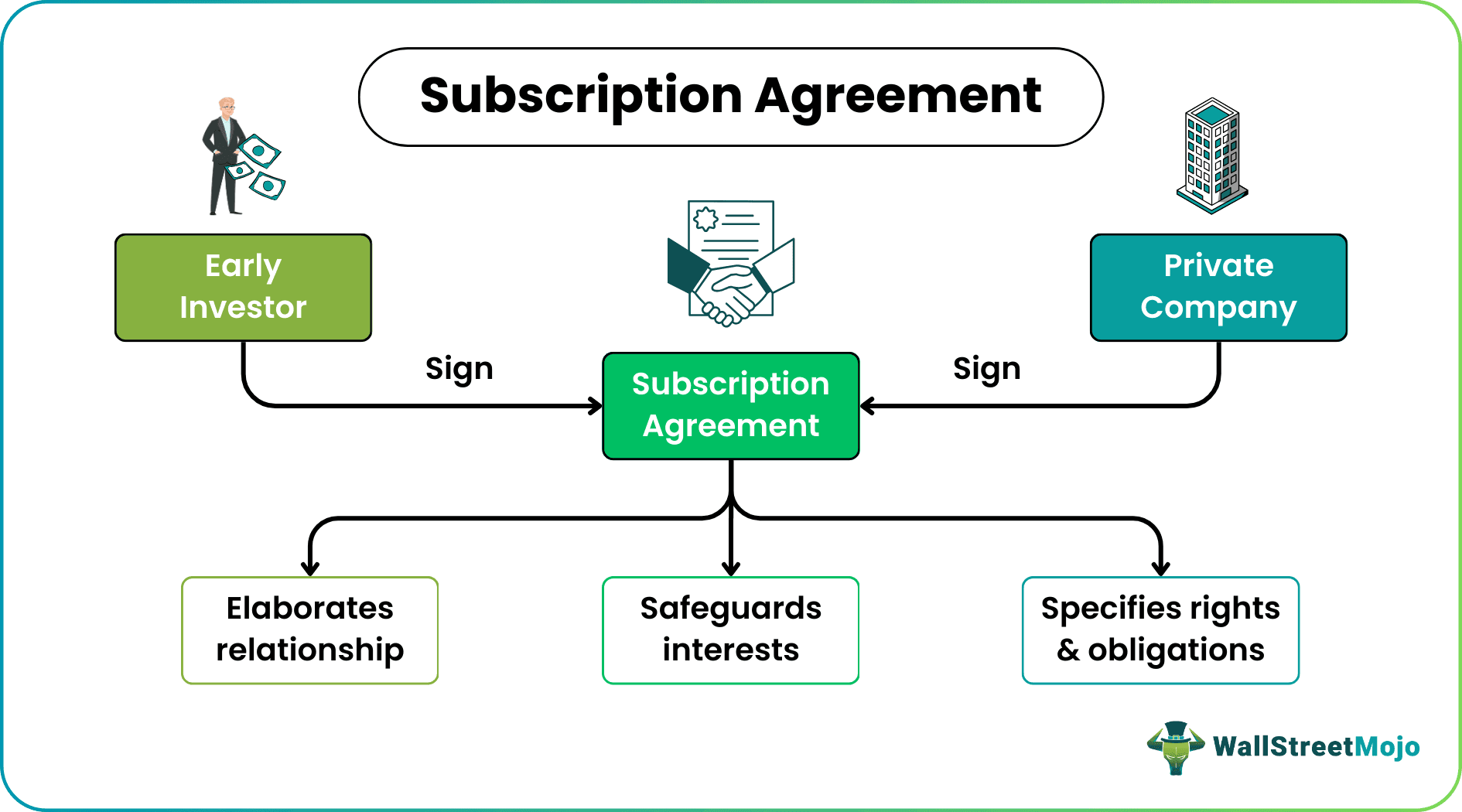

A subscription agreement assists private companies in selling shares without listing on a stock exchange. Instead, it is an agreement between a firm and an investor. It is a legal document that outlines terms and conditions. Company owners use this document to track the number of outstanding shares.

The agreement must comply with Securities and Exchange Commission (SEC) regulations in the US. As a result, these investors offer funds to become silent partners. Usually, these are one-time, lump-sum investments.

Table of contents

- What is a Subscription Agreement?

- The subscription agreement is a document signed by a company and an investor. A private investor purchases shares belonging to a limited company.

- In a share subscriber agreement, investors share only limited liability; the liability is limited to the amount invested in the company.

- But, after signing the share subscriber agreement, early investors have minimal rights. Liquidity is another major issue; If the silent investor wants to exit the partnership, someone must buy them out.

Examples

Let us look at some subscription agreement examples to understand the document better.

Example #1

Isaac is an investor; he is interested in buying shares of ABC Limited. ABC is not ready to register with SEC at the moment, though. But Isaac persists. Eventually, he enters a share subscriber agreement with the firm and becomes an investment partner.

The company sells 90 shares to Isaac—at a predetermined price. Isaac was able to persuade ABC Limited because they, too, needed funds. ABC plans to use the newly acquired funds for business operations.

Now the share subscriber agreement outlines obligations, offerings, and rights (of both parties). This way, there is transparency and clarity between parties.

Example #2

Advaxis, Inc. is a biotechnology company. In December 2022, Advaxis signed a subscriber and investment representation agreement with its CEO Kenneth A. Berlin. In addition to being the president, and CEO, Kenneth is also an investor.

Advaxis sold ten Series E Preferred Stocks—at a par value of $0.001 per share—$1,000 per share in cash. The share subscriber agreement contains customary representation, warranties, indemnification rights, and obligations.

Template

A sample of the subscription agreement template is as follows.

The following are the main components of the share subscriber agreement:

- Subscription

- Parties and purchaser details

- Applicable laws

- Counterparts

- Notices

- Procedures

- Transaction details

- Buyer rights

Frequently Asked Questions (FAQs)

It is an official document offered by a company to its customers. It explains subscription terms and conditions. It formalizes mutually agreed terms; both parties need to abide by the clauses mentioned in the document.

A share subscriber agreement allows investors to subscribe to buy new shares from a private company. It contains terms and conditions, details of payment, account details, etc. Share subscriber agreements comply with SEC Regulation D, specifically 506(B) and 506(C). The regulation allows different types of companies to attract investors without registering with the SEC.

When a company wants to raise capital and seek investors without listing itself on a stock exchange, the share subscriber agreement comes into play. Company owners use this document to track the number of outstanding shares.

Recommended Articles

This article has been a guide to what is Subscription Agreement. Here, we explain it with its template, examples, and comparison with shareholder agreement. You can learn more about it from the following articles -