Table Of Contents

What Is Subpart F Income?

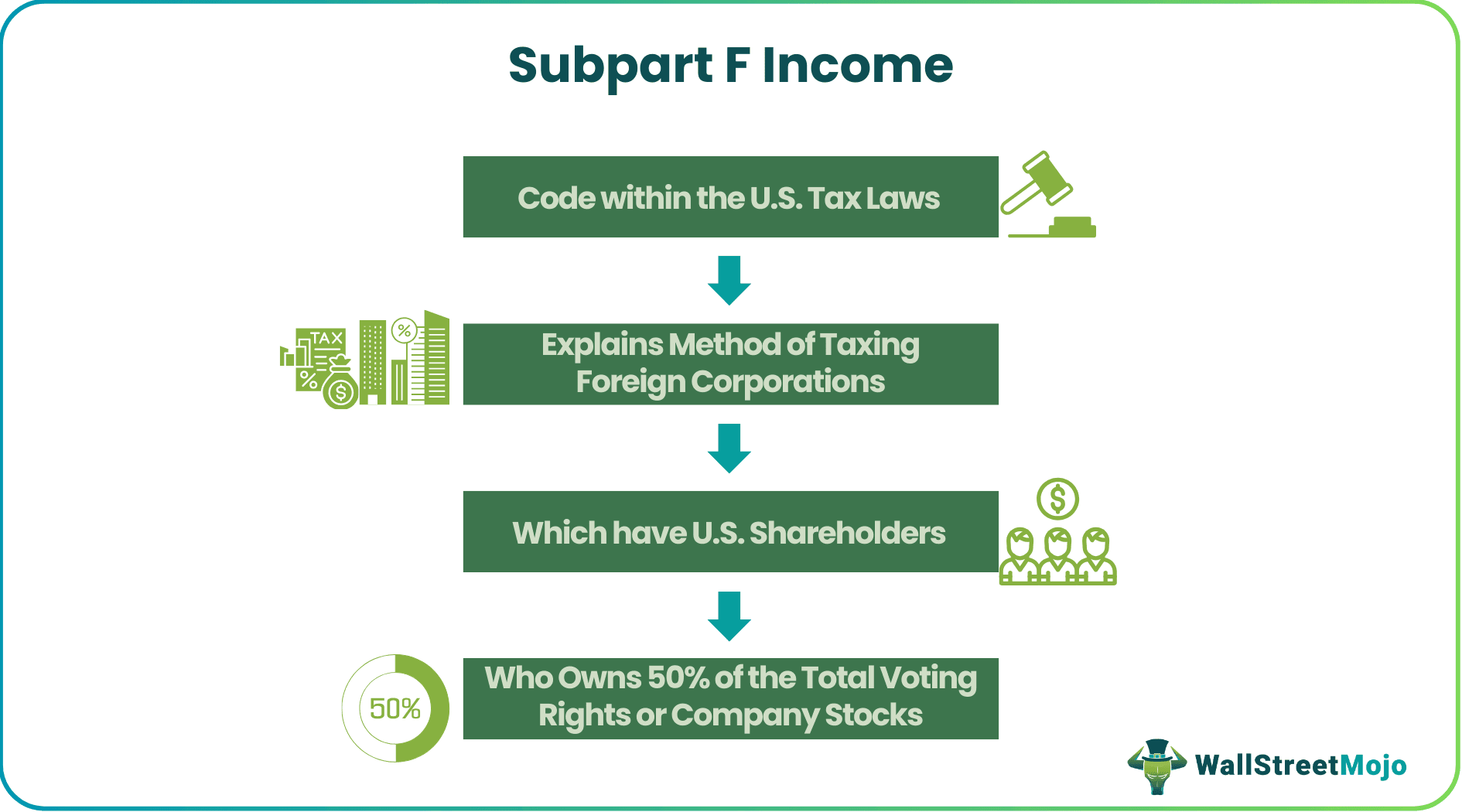

Subpart F income explains U.S tax law codes, including taxes applicable to controlled foreign companies (CFCs). CFCs are foreign corporations or business subsidiaries located abroad having U.S shareholders or taxpayers who own 50% of the total voting share or stocks and are thereby obligated to pay taxes.

Subpart F Income definition explains a type of deferred tax applicable to a CFC’s shareholders that is payable after they receive these dividends. CFCs’ registration and business operations are in a foreign jurisdiction, so these taxes are not directly applicable to foreign corporations. Still, they apply to the income earned from U.S. taxpayers' ownership of its shares or stocks.

Key Takeaways

- Subpart F Income definition explains a type of deferred tax on the income of shareholders of a controlled foreign corporation (CFC) after they have received these dividends.

- These rules were mentioned in the Revenue Act of 1962 for the first time, followed by various amendments. Further, the Tax Reforms Act of 1986 expanded the scope of foreign entities’ taxation by establishing subpart F.

- These tax codes apply to various types of revenues such as insurance income, foreign-based companies’ (FBC)

- oil-related income, investment of earnings in U.S. property, illegal bribes, and income from certain black-listed countries.

Subpart F Income Explained

Subpart F income tax rate explains that as U.S. companies continue to expand abroad, the government will collect taxes on their foreign activities and income generated. However, a major criterion for taxing CFCs is that 50% of its shareholders shall be U.S. taxpayers.

Subpart F taxes are applicable as deferred tax. It means that the tax is payable after the dividends are distributed back to the shareholders and not before. However, U.S tax laws require such U.S. shareholders to report this income before by counting the number of shares or stocks owned. It is known as subpart F income calculation on a pro-rata basis.

Stocks or shares ownership allows stakeholders to practice direct control over a foreign corporation while expanding business operations abroad. Thus, it is important to understand that these foreign corporations are not directly taxed by the U.S government but by resident sovereign governments.

The Internal Revenue Service (IRS) administers the U.S tax codes and, through subpart F. It regulates the U.S. entities and institutions that earn incomes from CFCs or own and control stocks in such corporations.

The CFC tax laws aimed to prevent tax evasion by corporations. As a result, many U.S. entities understated their taxable income or shifted their earnings and profits (E&P) to foreign jurisdictions.

Similarly, many U.S. corporations, especially the IT giants such as Apple, Facebook, etc., discovered tax havens. These companies set up subsidiaries in foreign jurisdictions with little or no taxes. Consequently, the extra income circulated back into the U.S. economy as passive earnings and profits (E&P) escaping the tax net.

Consequently, tax evasion led to an increase in the unequal distribution of income. Simultaneously, it led to the excessive money supply in various world economies pushing countries to introduce their CFC tax laws.

Revenue vs Income Explained in Video

How Is Subpart F Income Taxed?

The application of subpart F income tax rate on revenues from shareholdings came into effect in December 2017 and is chargeable on the following entities:

- Foreign Base Company Sales Income

- Foreign Base Company Services Income

- Foreign Base Company Income

- Foreign Personal Holding Company Income (FPHCI)

The U.S. federal tax laws, i.e., the Internal Revenue Code (IRC), define a U.S. person or entity. It includes a U.S. citizen or resident, a domestic partnership or corporation, and any non-foreign estate or trust.

Similarly, the U.S. tax laws nomenclature categorizes a CFC based on whether a U.S. person or entity owns more than 50% of the total voting power or the total value of the corporation’s stocks. Accordingly, it also taxes incomes from a CFC that have a U.S. shareholder owning 10% or more of the total voting power for all classes of stocks of any such foreign corporation.

Additionally, tax laws obligate a U.S. person owning 10% or more shares or stocks of a CFC to pay taxes under subpart F. Thus, in the case of partnerships, the number of shareholders can range between less than 10 to 100 people in CFCs, foreign partnerships, or trust.

The IRS also lays down specific anti-deferral rules mentioned within the U.S. tax codes. For example, it requires that the U.S. shareholders of a CFC report the undistributed earnings of foreign corporations. Additionally, they are liable to pay the taxes on the E&P earned or invested in any U.S. properties.

Examples

Let us now look at some examples to understand subpart F income meaning and applications comprehensively,

Example #1

For instance, ABC is an insurance company that provides insurance for a certain car company with global supply chains. It provides insurance and credit facilities for customers purchasing a car from this company. Thus, the income earned by branches of ABC Insurance and Credit Guarantee Ltd. company will not be directly taxable under the subpart F income tax codes. The income earned by its U.S. shareholders is taxable

Example #2

Apple Inc. established its Irish subsidiary holdings merely four years after its foundation. Although this Irish holding has no operations and employees in the top positions, it pays zero to very low taxes. This Irish company receives investments from its parent company Apple Inc. However, the U.S. tax applies to the earnings and profits (E&P) of the shareholders of these subsidiaries.

These Irish subsidiaries, categorized as CFCs, do not pay taxes in the country of their residence, i.e., to the Ireland Government, and claim no tax residence anywhere. A tax haven country cuts a deal with foreign corporations and entities that do not do business there.

Similarly, Apple’s affiliate companies tend to pay extremely low-income taxes. It does so by calculating income by special method and moving E&P from one jurisdiction to another.

Additionally, Apple routes 60% of the sales income of its consumer products through these offshore Irish subsidiaries to escape taxation and pocket huge profits. Simultaneously, these Irish companies hold foreign rights to Apple’s U.S.-based technology, earning huge profits from its sales.

Subpart F Income vs GILTI

Let us examine the differences between subpart F income and the global intangible low-taxed income or GILTI,

| Subpart F Income | GILTI |

|---|---|

| Subpart F Income is the method of taxation of incomes that CFCs generate wherein more than 50% of voting rights or stock ownership is with U.S. shareholders. | It refers to the incomes earned abroad by U.S. corporations or CFCs by shifting ownership of their intangible assets. Such as Intellectual property (IP) Rights from the U.S. to other low-tax jurisdictions. |

| The advantage of registering as a CFC under subpart F is income tax deferral and business expansion opportunities in lower tax jurisdictions. | The tax application aims to discourage U.S. corporations from moving these intangible assets to other zero or low-tax countries, i.e., corporate tax rates below 21%. |

| This tax is payable only after CFCs distribute dividends to U.S. shareholders. But the U.S. shareholder is obligated to report this income irrespective of its distribution. | The tax rate on GILTI is lower than regular U.S. corporate tax (21%) and ranges from 10.5% to 13.125%. |

| The Subpart F rules impose taxes on a U.S. shareholder of a CFC as if they received the share of income from the foreign corporation’s current E&P. | In the case of GILTI, a minimum tax is applicable on the profits of CFCs determinable through a complex calculation wherein up to 10% of returns earned from tangible assets are exempt. But the excess income is presumed to be the returns from investment into intangible assets such as IPR. |