Table Of Contents

What Is A Subordinate Agreement?

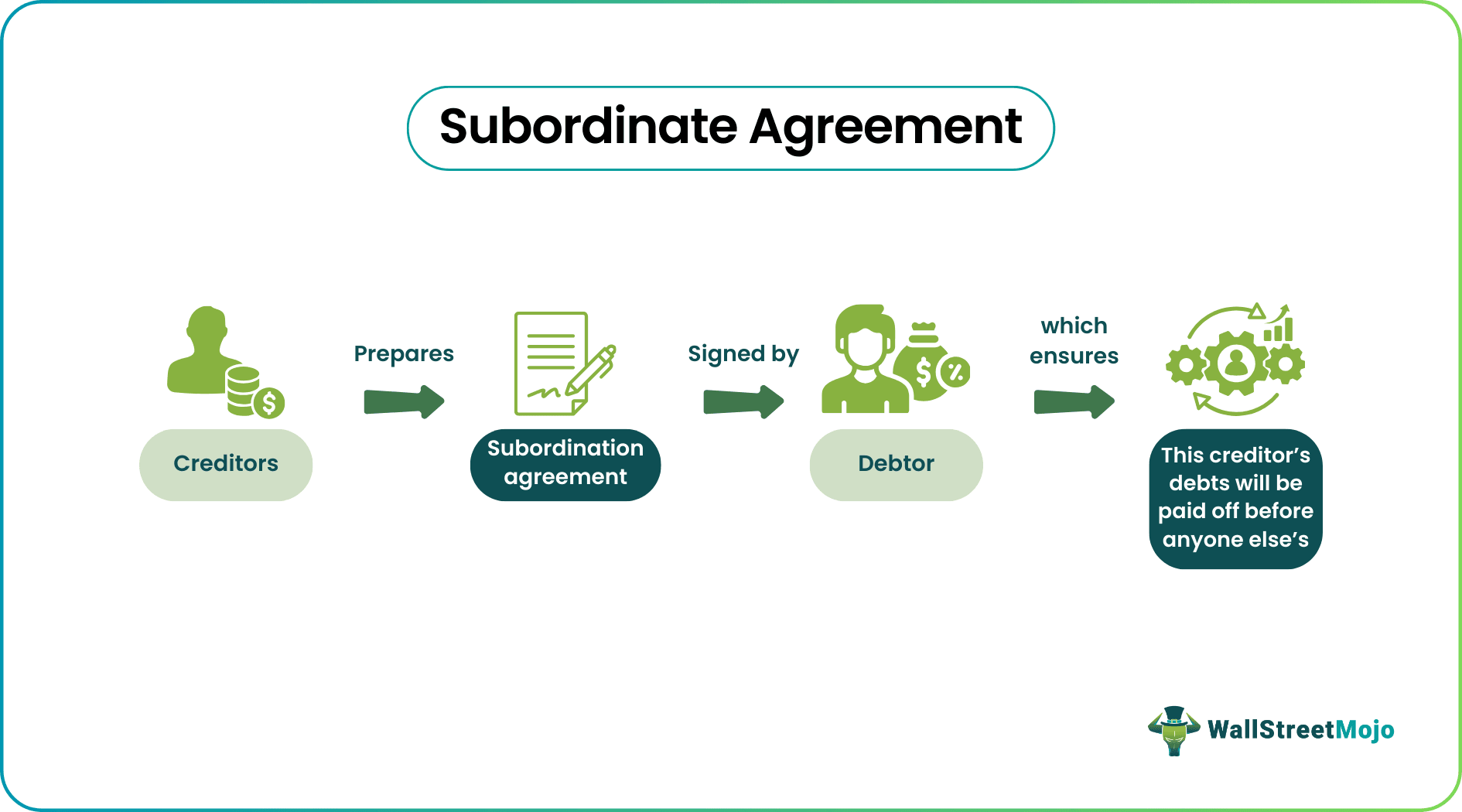

A subordination agreement is an agreement that a creditor drafts and a debtor must sign, which mentions that the debtor will pay off the creditor’s loan on a priority basis. The purpose of a subordination agreement is to rank the debts in order of priority concerning their payment.

This agreement is a common practice in the credit industry. If a borrower requires to refinance a loan, they may sign this agreement to assure the creditor that they will repay the particular creditor’s loan before anyone else’s. A new creditor benefits from this agreement as his repayment moves up the rank in the borrower’s priority list.

Key Takeaways

- A subordination agreement is a legal document between a creditor and a debtor that ensures that the debtor will repay the particular creditor’s loan before anyone else’s. This agreement is used to rank one debt over all other debts.

- This agreement is instrumental in ranking the loans in order of their priority. It is a frequent practice in the lending industry.

- In the real estate industry, when a borrower requires to refinance a loan, they sign this agreement to assure the lender that the borrower will repay their loan on priority. This agreement may give homeowners a lower interest on the property they purchase.

Subordinate Agreement Explained

A subordination agreement is an agreement that ranks loan repayments in order of their priority. A lender drafts this agreement, and the borrower signs it to ensure they repay the creditor’s loan before repaying any other loan. This agreement indicates that the creditor is not choosing a high-risk lending option. It prioritizes one debt over all the other debts. It is a fairly standard procedure in the lending industry.

In the real estate industry, refinancing is a method of repaying an old mortgage by getting a new one. A subordination agreement in real estate is a process through which a borrower can apply for a refinance. Conventional lenders refuse to refinance unless the debtor assures them that the debtor will repay their loan first.

This agreement requires the debtor to repay the superior debts first and only then proceed to repay the subordinate debts. If the borrower has no money left after repaying the superior debts, the subordinate lenders may receive less or no payment. However, the subordinate lenders usually sign this agreement only after ensuring the asset value is enough to cover all the debts.

Types

The subordination agreement types are as follows:

#1 - Executory Subordination Agreement

In this agreement, the subordinate party agrees that their interest payment will have a lower priority than another party’s security interest payment. It means that the borrower will pay the subordinate party’s interest after paying off another party’s interest. A party refusing to sign an executory subordination agreement can be considered a contract claim violation.

#2 - Automatic Subordination Agreement

In this agreement, multiple priority agreements take place simultaneously. Here, the subordination agreement is agreed upon and executed at the same time. For example, if a trust prioritizes living expenses, the first lien is the living cost. Its secondary lien, the subordinate, is education funding. Thus, the beneficiary pays for the living expenses first, and then the education funding is released.

Examples

Let us understand the subordination agreement with the following examples:

Example #1

Suppose a company named Little Works Ltd. had $10,00,000 as senior debt and $5,00,000 as subordinate debt. The company’s total asset was valued at $14,00,000. Little Works Ltd. filed for bankruptcy and entered the asset liquidation phase with $14,00,000 as its market value. In this scenario, the company paid its senior debtors in full, which is $10,00,000, from the total asset value.

Little Works Ltd. paid the remaining $4,00,000 from the entire asset value to the subordinate debtors. The company could not pay the remaining $1,00,000 debt as there was no money left for the company to pay. This is an example of a subordination agreement.

Example #2

Prospect Capital Corp, a New York-based company, has sued Morgan Lewis & Bockius LLP, a law firm in the United States. Prospect Capital Corp claimed that Morgan Lewis & Bockius LLP caused damage of at least $12 million for the financial services company due to a business loan it made.

The finance company argued that due to the law firm’s negligence, they were denied the right to pursue specific remedies against an alleged loan agreement breach. It claimed that Morgan Lewis did not inform them that a critical provision had been significantly narrowed to permit another bank to be paid first on a loan before prospect’s loan would be repaid. This is an example of a subordination agreement.

Subordination Agreement vs Intercreditor Agreement

The differences are as follows:

- Subordination Agreement: Creditors sign this agreement to rank the loans in order of their priority. This agreement mentions which debts must be paid back first compared to the other debts. According to the debt subordination agreement, the borrower must pay off the senior debts first and then repay the subordinate debts. It clarifies to the lenders which loan the borrower will repay in what order in the future.

- Intercreditor Agreement: This agreement contains the terms and conditions of collateral allotment if a loan defaults. Two or more creditors draft this agreement to ascertain the rules, priorities, and procedures they must follow if the joint borrower defaults on his repayment. In this agreement, both creditors are considered superior. Therefore, this agreement is valuable for the lenders as it keeps them away from any legal dispute in the future.

Frequently Asked Questions (FAQs)

Usually, first-mortgage lenders are only willing to refinance a loan if they are assured priority concerning repayment. In such a scenario, this agreement is helpful as it is the only way a borrower can refinance their loan. It also benefits the lender as they get the assurance that the borrower will repay their loan on a priority basis. Furthermore, through subordination agreements in real estate, the homeowners get a lower interest on their property. Therefore, it is a common practice in the lending industry.

The creditor prepares this agreement, and the debtors require to sign it. This agreement ensures that the said creditor will get back his loan amount before all the other creditors. Furthermore, this agreement indicates that this particular creditor is not taking a high risk. The purpose of a subordination agreement is for the lender to minimize the risk associated with the loan and mitigate potential losses if the borrower defaults.

Like all other legal documents, this agreement, too, requires notarization. A notary must sign and legally acknowledge this agreement. In addition, they must record the debt subordination agreement in the official records for it to be legally enforceable.