Table Of Contents

What Is Subordinated Debt?

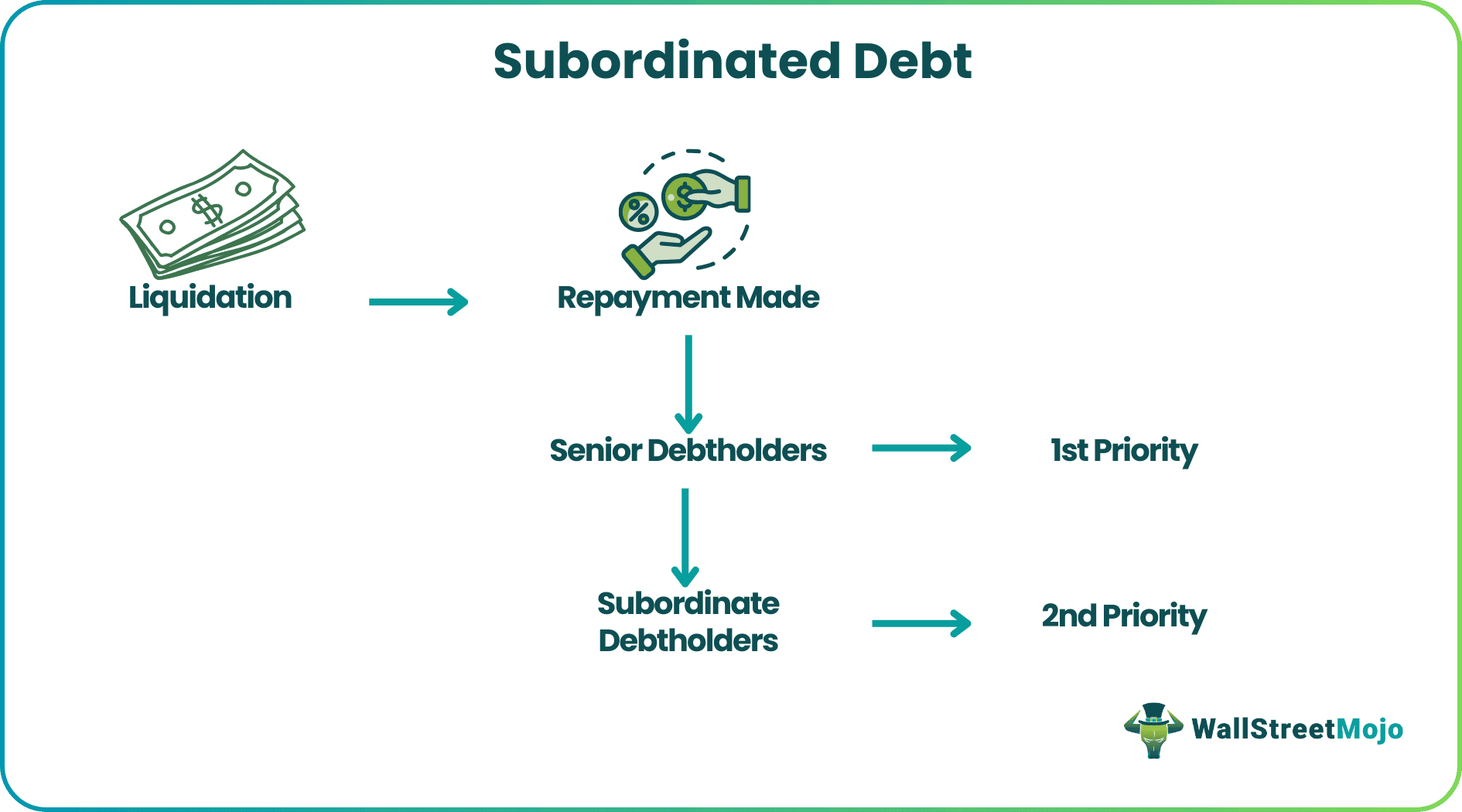

The subordinated debt is a kind of debt security that the government of corporations issue for the purpose of raising funds. It is different for other forms of debt due to their hierarchy of claim repayment during bankruptcy or liquidation.

In case of liquidation of a company, rankings are provided to various debts for the purpose o repayment, wherein the kind of debt which is ranked after all the senior debt and other corporate Debts and loans is known as subordinated debt and the borrowers of such kind of debt are larger corporations or business entities.

How Does Subordinated Debt Work?

A subordinated debt agreement is a kind of unsecured bond or loan whose priority for repayment during claims is below any other senior loans, For this reason, they are also called junior securities. If the borrower is not bale to pay bank the loan amount, then all other creditors will be paid first and then it will be the subordinated debtholders’ turn to receive their claims.

It is an interesting concept in the case of business. As the name suggests, the debt which is subject to subordination when the creditor’s default is called subordinated debt.

Since the lender has issued a subordinated loan, a subordinated debt balance sheet means first all the senior debts would be paid off in full from the assets and earnings of the company. After that, if anything is left, the banker or lender, would receive the money for this kind of debt.

As you can see, the subordinated loan is pretty risky.

Every bank or financial institution that offers a subordinated bond needs to be certain about the solvency and affluence of the company before issuing subordinated bonds.

Source: scotiabank.com

However, there’s one advantage.

Since subordinated bonds are a sort of debt, if a company defaults, the banks get the money for subordinated debts before the preferred and equity shareholders.

But still, it is better than the banks offering loans after a lot of due diligence and by looking into the cash flow, past years’ earnings, and the assets of the company with a subordinated debt balance sheet. The banks should also look at important ratios like debt-equity ratio, net profit ratio, current and quick ratio, etc.

However, it can prove to be a hugely profitable form of investment for investors who are ready to take high risk in exchange of a very lucrative return. But it is always important to do a thorough check regarding the creditworthiness of a borrower and be sure about their ability to pay back the loan on time. This will ensure a profitable investment in a stable and financially healthy company and potentially high returns.

Types

Now let us look at the various types of debts in the subordinate category and understand each of them in details.

- Mezzanine Debt – This is a type of financing through the subordinated debt agreement, where the basic characteristic of the debt is same a subordinated one. They often include subordinated loans with features similar to equity, thus, making it a subordinate loan in the capital structure of the company.

- Convertible subordinated debt – In this kind of debt instrument in the subordinated category, the investors get the option to convert or exchange their debt into equity form. The borrower issues common stocks as per a conversion ratio that is already predetermined.

- Callable debt – In this kind of debt in the subordinated category, the issuer has the right to redeem the debt before maturity. In this manner, the issuer gets a flexibility in managing its loans since its an obligation on the financial resources of the company.

- Fixed and floating – This refers to the interest rates, which can be either a constant one of change as per the market performance. In case of floating, the rate is tied to a benchmark, usually the LIBOR(London Interbank Offered Rate). It fluctuates as per changes in LIBOR.

- Subordinated notes – They are short term debt instruments that mature early and provides funds to the company during interim periods.

- Hybrid – Some of such loans in the subordinated debt instruments category have hybrid features, which usually combines the basic features of debt and equity, which provides a very unique risk and return profile to its investors.

Which Corporations Take Subordinated Debt?

Since banks or financial institutions know that the risk is higher in lending subordinated loans, they will not offer the subordinated debt to any small business. Yes, an exception can be there, but due to the risk factor and priority factor, it is futile to offer subordinated debt to corporations.

That’s why banks / financial institutions offer subordinated debt to large corporations.

Offering subordinated loans to large corporations allow them to be safe from all ends –

- First of all, large corporations have a big cash flow and non-current assets, which will allow the banks to get paid even for a subordinated loan.

- Secondly, large corporations have seen the low and high both and overcome the trials and turbulence of business to be making huge revenue and serving a huge network of customers. This allows them to be the right partner for the subordinated loan.

- Thirdly, large corporations have better solvency than small business owners. And they may also have better financial leverage than small business owners (it can’t be known just by looking at the size of the corporation, and that’s why it’s always important for the banks to do their own due diligence before offering the subordinated bond to the corporations).

- Finally, the chances of going bankrupt for large corporations are much lower than small businesses that have just been in business for a few years. As a result, large corporations would be the most appropriate borrower of subordinated debt.

Examples

Let’s take a complete example of subordinated debt instruments so that we can understand how it works.

Example #1

Y Corporation issues two types of bonds – G bond and S bond. Y is a large corporation and convinces the bank to provide both senior debt and subordinated debt. For senior debt, Y has issued a G bond, and for a subordinated bond, Y has issued an S bond. Unfortunately, Y incurs a huge loss and goes bankrupt.

Now Y Corporation has to be liquidated. Since G bond falls in the category of senior debt, it would be paid first before any other debt, preference shareholders, and equity shareholders.

However, for S bondholders, the liquidation may not be a good thing to happen because they would be given the last priority in paying off the subordinated loan. But there’s one good thing – S bondholders would get paid by the liquidation of Y Corporation before any preferred shareholders, and equity shareholders get paid.

Image Source: globenewswire.com

Also, please do have a look at this detailed guide on Subordination debt for more examples.

Example #2

Let’s say that you are a bank, and you have offered a subordinated debt to Company Y. After a certain period, Company Y went bankrupt. As a result, Company Y now wouldn’t be able to pay the money it has taken as a loan.

If you, as a bank, would have issued a subordinated bond, you won’t be able to claim on the company’s earnings or assets whatsoever.

Benefits

This particular question may lurk in your brain – why would someone /bank /financial institution/ promoter accept a subordinated arrangement of debt.

The answer is two-fold.

First of all, when a company feels that it needs more money in the form of capital, the company approaches the companies or banks that are in a cordial relationship with them. The business relationship is such that the approached companies can’t say ‘no’ to the former company.

Secondly, due to the cordial relationship, the approached companies offer a lower rate for the debts they are offering and also a subordinated arrangement for the debt payment. In this case, the rate of interest on the subordinated loan is much lower than the rate of interest any general investors would be ready to accept.

And that’s why subordinated loan holders accept this arrangement, and it can only happen for large corporations.

Even if there can be cordial relationships between large banks and small businesses, the large banks may not take huge risks by offering subordinated debt to small businesses just for cordial relationships.

Disadvantages

Some potential disadvantages of the concept are as follows:

- It has a high risk along with the high return that it provides to investors. Usually, they are not backed by any asset or collateral that the investor an claim in case of bankcrupcy or liquidation.

- They have a lower priority during repayment. This significantly impacts the amount and the time of receiving the claim. This risk is typically compensated by the issuer in the form of higher interest rate, which is again a pressure on the financial resource of the business.

- The market volatility significantly affects this type of debt if the interest rate is floating, resulting in changes in market value.

- It may have complex terms and conditions, which all investors may not be abe to understand clearly.

Thus, overall, the concept has both advantages and disadvantages which useful and may also prove risky at the same time.

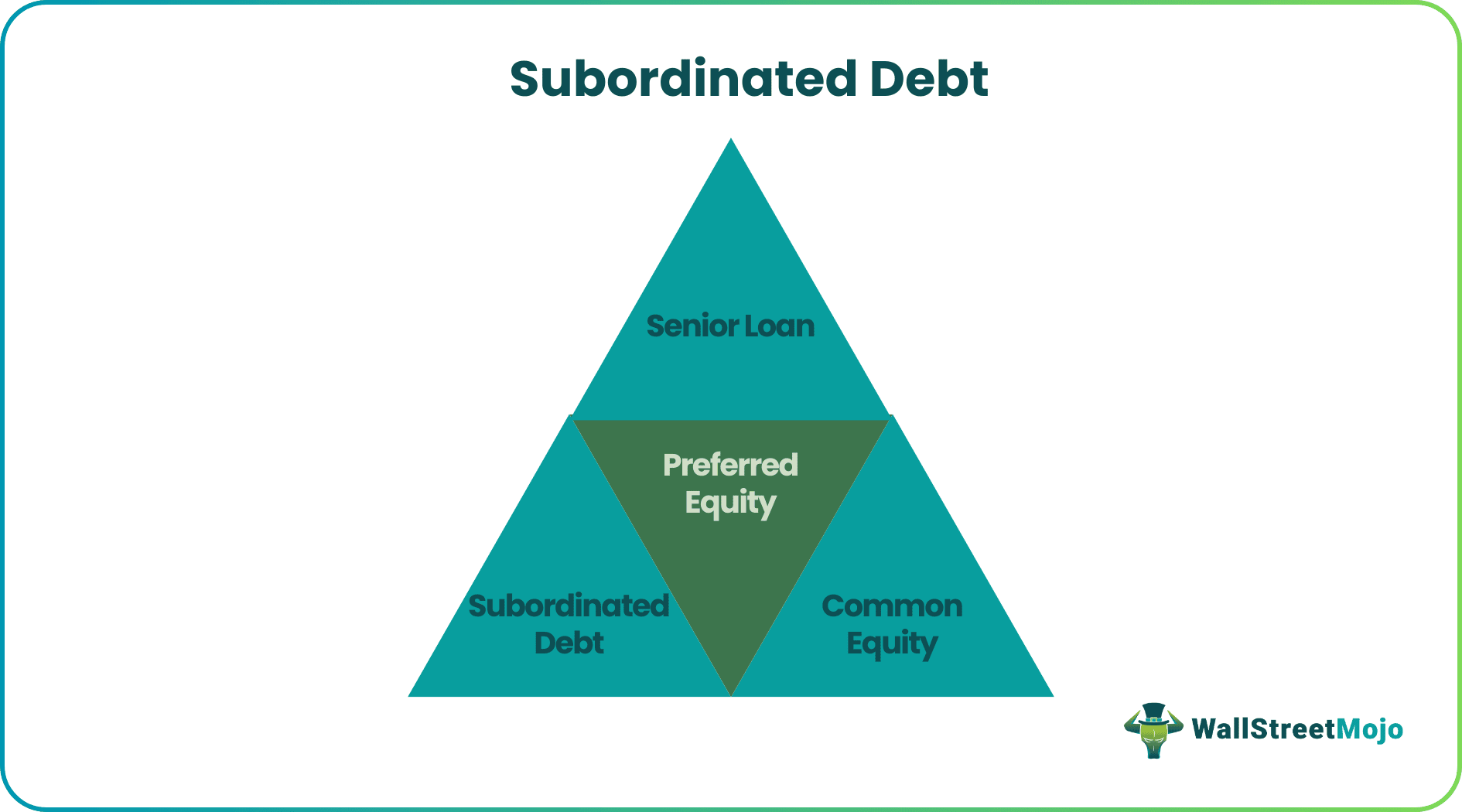

Subordinated Debt Vs Senior Debt

From the name, you can already say that the subordinated bond is the complete opposite of the unsubordinated debt.

But we need to know where the actual difference lies. Let’s have a look –

- Priority: In the case of the short or long term subordinated debt, all other debts are prioritized in terms of being paid in full before the subordinated debt would be paid. However, in the case of senior debt, before any junior debts are being paid, unsubordinated debt would be paid in full first. So in regards to unsubordinated debt, the priority completely changes in terms of payment.

- Risk factor: In the case of subordinated debt, the risk is much higher for the lender. On the other hand, in the case of senior debt, the risk of the lender is pretty low.

- Interest – The rate of interest in case of the former is higher compared to the latter because its risk is more. The investors in case of the latter is ready to accept lower rates in exchange of low return. Due to this reason. The former is more attractive to investors.

- Collateral – The former is generally unsecured without any backing, which makes it risky compared to the latter. But since the latter is secured with a collateral, which may be any valued asset, there is an additional layer of security that helps the investors in case the company defaults.

- Preference of investors – The investors too, always prefer the investment with lower risk, which again, of course depends on the risk-taking ability of the investor. In case the risk appetite is more, and higher return is expected, the short or long term subordinated debt gains more importance compared to the latter.

- Issuer’s preference – In this case, the situation becomes opposite as compared to the previous point. The issuer is profitable in case of the latter since lower interest rates leads to lower cost of financing.

Understanding these two differences will make you realize how subordinated debt and senior debt work.