Table Of Contents

Structured Investment Vehicle (SIV) Definition

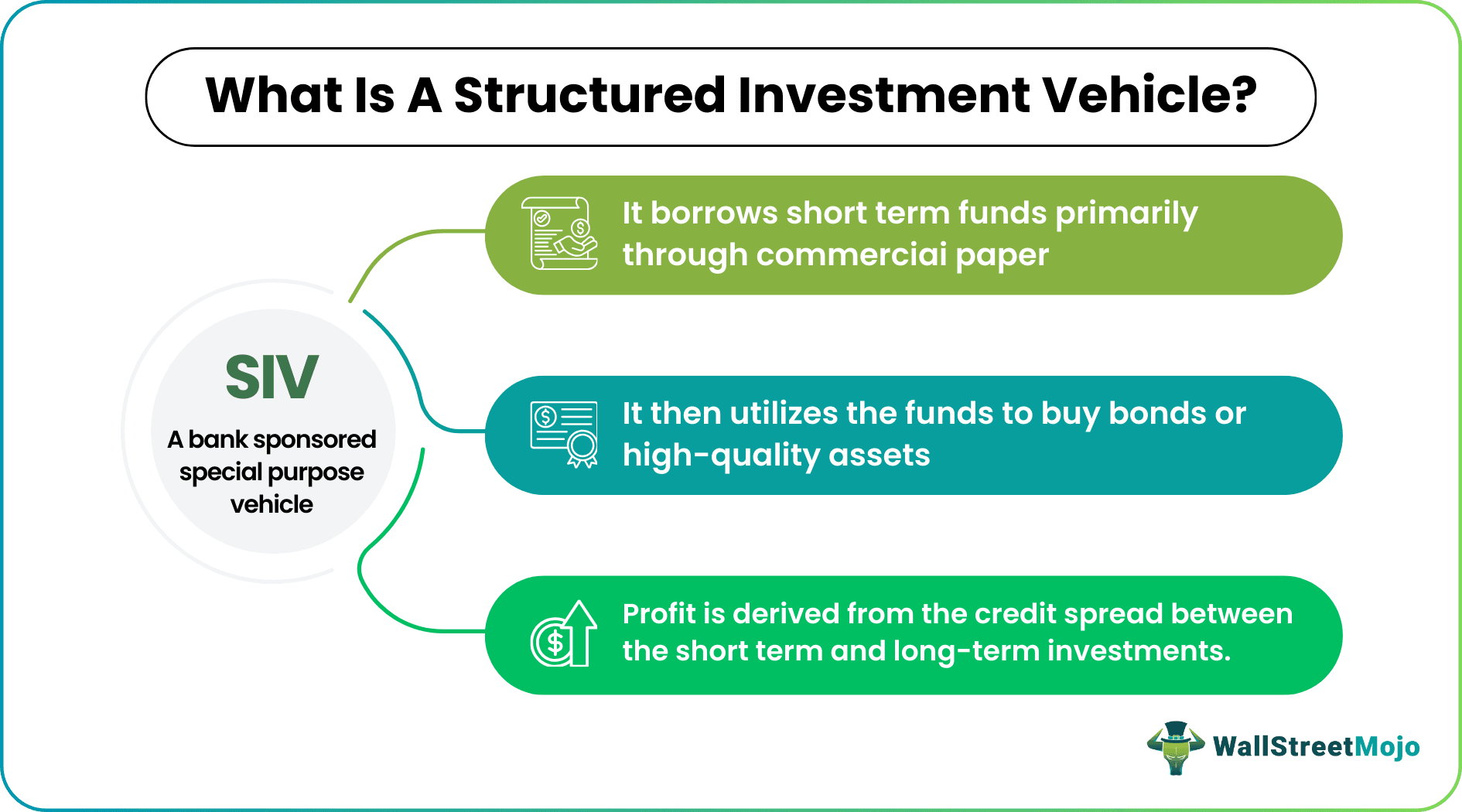

A structured investment vehicle is a fund that invests in long-term assets like mortgage-backed and asset-backed securities by taking out short-term loans through the issuance of commercial paper. Here, one earns the profit by the difference in credit spreads between short-term loans and long-term investments.

The key advantage is that investors can employ short-term, lower-rate liabilities using assets with greater rates of return. Financial companies frequently make off-balance sheet investments using these investment vehicles. However, by borrowing money and investing it in long-term assets, investors put themselves at risk by creating short-term liabilities.

Key Takeaways

- A structured investment vehicle (SIV) is a bank-sponsored special-purpose vehicle that borrows funds primarily through commercial paper.

- It then utilizes the funds to buy bonds or high-quality assets, thus lending them out similarly to how a bank would do.

- Aaa/AAA-rated asset-backed and mortgage-backed securities make up most of the bonds typically chosen by an SIV.

- The credit spread gap between short-term loans and long-term investments generates profit.

- In addition to relying on bank liquidity facilities, SIVs also use strong liquidity management strategies to manage their liquidity risk.

Structured Investment Vehicle Explained

Structured investment vehicles are investment instruments that use leverage. Hence, one can refer to it as a leveraged special purpose vehicle that invests in securities with a high rating. Medium-term notes and asset-backed commercial papers also fund it. SIVs are comparable to security arbitrage conduits in investing in top-rated securities. They are among the more complicated structured financing arrangements, although the way the transactions take place changes greatly from one to the other.

In contrast to securities arbitrage conduits, SIVs raise money from outside sources (third-party capital) and use it to buy short-term (commercial paper) and medium-term notes. They employ a robust liquidity management method in addition to relying on bank liquidity facilities to control their liquidity risk (i.e., liquid assets maintenance and bank facilities to cover the next two or three weeks of cumulative net cash outflows).

SIVs acquire residential mortgage-backed securities (RMBS), credit card receivable assets, etc., at higher returns (BBB average). It then organizes them into fragments of primarily higher-rated labels with lower returns (including a majority of AAA) to sell to investors. To build a profitable spread, one gives more weight to low-grade securities on the assets and high-grade securities on the liabilities side. SIVs attempt to function in neutral surroundings by hedging interest rates and the risk of currencies.

History

In 1988 and 1989, Nicholas Sossidis and Stephen Partridge-Hicks, two London-based bankers, launched the first SIVs for the Citi Group. They named them Alpha Finance Corp. and Beta Finance Corp. With each asset requiring 20% capital, regardless of the asset's credit rating, Alpha could only use maximum leverage of 5 times its capital.

Beta had up to 10 times capital leverage, but the basis for that leverage was the assets' risk weightings. The establishment of Alpha Finance was in reaction to the then-existing financial markets' turbulence. Investors were looking for a highly regarded vehicle that would provide a more consistent return on investment. Thus began the idea of SIV.

Examples of Structured Investment Vehicle

Take a look at these structured investment vehicle examples:

Example #1

Citi Corp. had agreed to buy the remaining SIV assets (2011) for their then-present fair value, which was about $17.4 billion, net of cash, down from $21.5 billion on September 30, 2008. The decrease was predominantly due to asset sales, maturities of $3.1 billion, and a decrease in the market value of $1.1 billion since the end of the third quarter of 2008.

In addition, these SIVs have been selling assets as part of a planned asset-reduction strategy to meet expiring debt obligations promptly. As a result, long-term assets had dropped from $87 billion at the end of July 2007 to $17 billion.

Example #2

Another structured investment vehicle example is the case of Standard Chartered, multinational banking, and financial services companies. It has invested in Whistlejacket structured investment vehicle (SIV) capital notes.

To deal with a decrease in the value of its assets, the SIV had given holders of capital notes the option to acquire "vertical" slices of its portfolio. But unfortunately, they had suffered a double blow due to the financial crisis. First, the crisis made it difficult for them to acquire funding, and the dramatic decline in the value of the securities they own has contributed to the move.

Although a good start, both examples point out that the financial crisis can lead to situations where SIP withdrawals happen.

SIV vs SPV

One can compare an SIV to a basic virtual non-bank financial organization that does not accept deposits. Instead of obtaining deposits from the general public, it borrows money from the money market by offering professional investors commercial paper (CP), medium-term notes (MTNs), and bonds that are public with short maturities (typically less than a year).

The abbreviation stands for special purpose vehicle. The phrase is known as a special purpose entity (SPE) in the U.S. Hence the terms "vehicle" and "market entity" are interchangeable. An SPV is essentially a business association of individuals or companies permitted to join the association. It is an organization that investors create for a particular, specific, and focused purpose. It can be formed to fulfill any legitimate goal. Therefore, No SPV may be established for an illegal purpose or to engage in actions against the rules of the law or public policy.

The major difference lies in their purpose. The goal of SIV is singularly reaping profits. But the purpose of SPV is to separate assets from the issuer by creating a legal entity.

Moreover, SPVs can help companies protect their intellectual properties by preventing competitors from accessing the developing technology through existing license deals. SIVs, however, restrict themselves to investments in securities.